Historically, travel agencies mainly booked flights via global distribution systems or GDSs for short. These big middleman platforms accumulate schedules, fares, and inventory from carriers worldwide, letting resellers access all the air information in one place.

However, as new technologies, approaches, and formats emerge, GDSs are losing their monopoly. Today, online travel agencies (OTAs), travel management companies (TMCs), and other players can choose from and mix multiple sources of flight information—including direct connections with carriers. This article, created in partnership with TPConnects, an IATA-certified global travel content aggregation and distribution technology company, highlights things travel resellers should know when deciding how to tap into the air content.

Flight content landscape: types of distribution channels

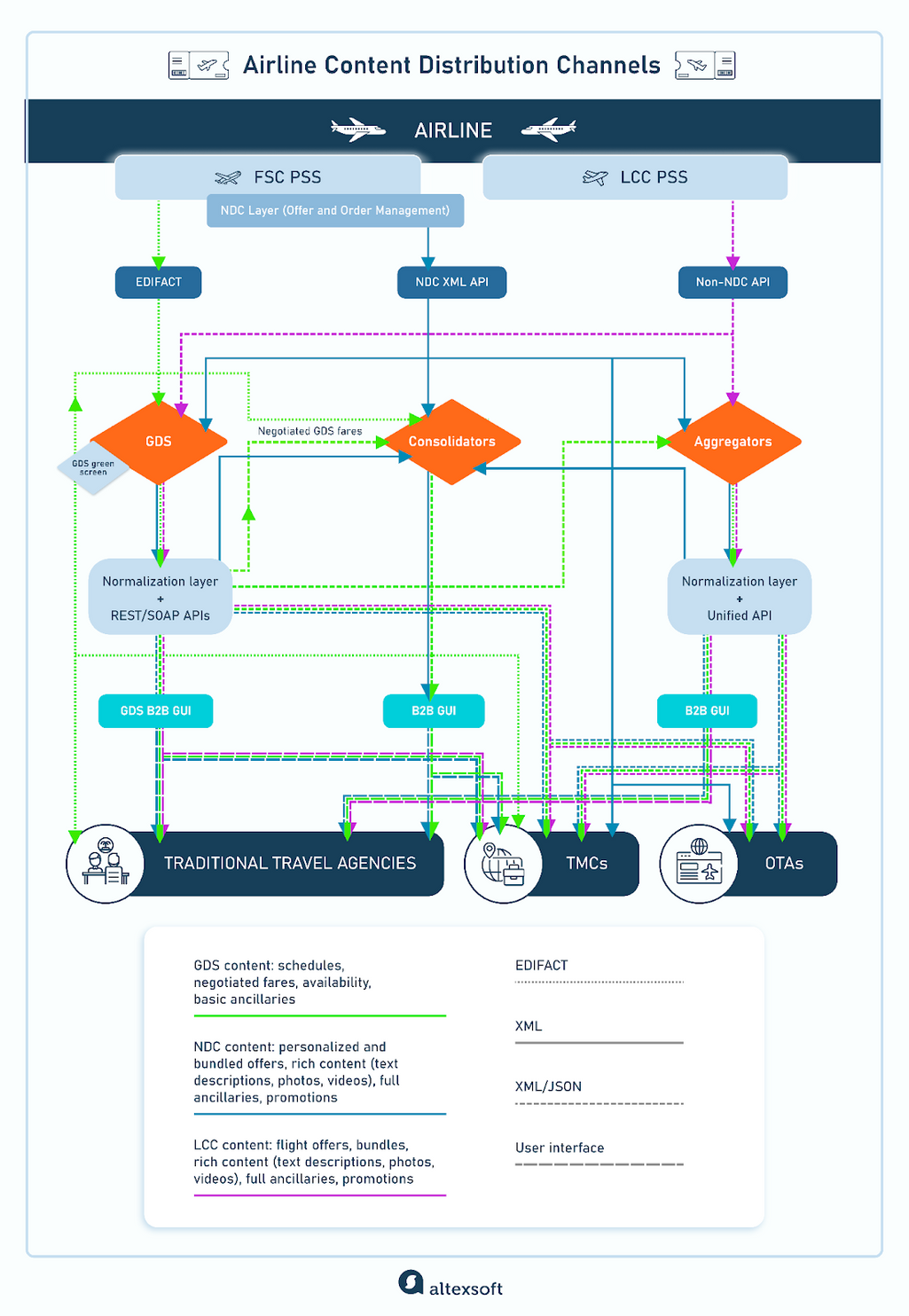

To understand what is happening in air distribution, let’s briefly explain three types of indirect distribution channels airlines use to sell flights.

How airline content is distributed

Traditional/EDIFACT/GDS channels. Electronic Data Interchange for Administration, Commerce, and Transport, or EDIFACT, is a strictly formatted protocol that, for decades, was the only means of delivering flight content via third-party platforms. Developed in the pre-Internet era, it still dominates air distribution.

Most full-service carriers (FSCs) use EDIFACT to exchange information between their passenger service systems (PSSs) and GDSs. The problem is that EDIFACT messages can convey only basic information on flight products, such as schedules, fares, and availability. Global distribution systems use these data scraps to form offers they channel to resellers via SOAP or REST APIs in XML or JSON format. So, travel agencies don’t interact directly with EDIFACT — unless they use GDS terminals to book air.

NDC channels. NDC, short for New Distribution Capability, is an industry initiative introduced by IATA in 2012 to overcome the limitations of EDIFACT. The key idea behind it is to change how airlines communicate with resellers. Instead of short teletype messages, carriers rely on NDC-enabled APIs and XML schema to transfer rich content (pictures, videos, etc.) and ancillaries to third-party platforms.

With NDC, the indirect air distribution stops being GDS-centric since the carrier, not a GDS, creates the flight offer. The airline receives information on who’s reserving a seat on a third-party platform and can personalize its product for a particular passenger. Currently, over 70 airlines, according to IATA, leverage NDC content, with American Airlines, Lufthansa Group, United Airlines, Qantas, Emirates, and Qatar leading the pack. The list also includes several LCCs — such as Pegasus (Turkey), Vueling (Spain), Jeju Air (South Korea), Scoot (Singapore), and Spirit Airlines (the USA).

Read our articles on NDC in air travel and NDC technology implementation for airlines, or watch a brief NDC explainer to learn more.

How NDC boosts airline retailing

Other non-GDS channels. APIs used by airlines for indirect distribution are not necessarily NDC-enabled, as is usually the case with low-cost carriers (LCCs). Their initial business model suggests bypassing a GDS, which means they don’t have to solve the “EDIFACT problem.” Most LCCs sell their products on their websites or communicate with third-party platforms via APIs, typically built before NDC became an industry buzzword.

Read more about various travel APIs in our dedicated article.

An airline can offer different prices, conditions, and products depending on the distribution channel. Some FSCs removed certain offers from EDIFACT systems or set surcharges on GDS bookings. An example is Finnair, which sells domestic flights and a new corporate fare that includes luggage, seat selection, and the ability to change dates through its website or NDC only. In the same way, Air France and KLM made some of their cheapest deals NDC-exclusive.

We need to bear in mind that more and more airlines are moving their content to NDC. But at the same time, we’re not yet in the era where we’re 100 percent NDC.

“A travel agency will probably need content from GDS, NDC, and low-cost carriers,” Stephanos Kykkotis, Senior Product Manager at TPConnects, admits. “This is where questions arise: Do we need to maintain a connection with a GDS and then use an aggregator for NDC content? Or should we opt for an aggregator that provides both GDS and NDC offers via a single API? Or do we want to connect directly with an airline?”

The correct answers will depend on the particular case. We'll analyze various options to help you find the best fit, starting with the dilemma of how to interact with suppliers — directly or via a go-between.

How to connect: directly or via a middleman?

Setting direct API connections with airlines is a natural choice for big players who want to establish closer and more controlled relationships with suppliers. Yet, it also makes sense for smaller companies if they book most of their flights from just one or two carriers.

Among the obvious benefits of direct connections are

- independence from third-party platforms;

- access to the airline’s content via modem NDC or non-NDC APIs without restrictions imposed by EDIFACT. This means you’ll be able to book a wide range of ancillaries, get photos and detailed descriptions, and more; and

- cost savings through negotiated rates and incentives airlines can more willingly provide via direct channels — both NDC and non-NDC.

On the dark side, this scenario introduces a lot of overhead, and a travel agency must be large and tech-savvy enough to afford it.

“To build and maintain a lot of integrations, you need a quality engineering team,” Stephanos warns. “Also, you have to undergo a certification process with all these different airlines aiming to make sure their content is represented the way they want. It’s especially true for LCCs, who are very sensitive to how their products are distributed and try to preserve everywhere the same philosophy they have on their websites.”

A variety of API schemas, even within the NDC IATA Standard, make things even more difficult. GDSs and aggregators remove much of this complexity, providing content from hundreds of suppliers via one access point. They also typically handle airline certifications—agencies have to submit to this process only once to ensure the API connection with a middleman works properly.

Another issue solved by GDSs and aggregators is bringing all types of content from different sources to a harmonized, standard view and removing duplicate results.

“Say you want to book a flight from Dubai to Sydney,” Stephanos explains. “One source may return results with Sydney International Airport, while another calls the same place Sydney Airport without International. What we do in the background is standardize information so agencies receive the same names in the same format, no matter whether it’s GDS, NDC, or LCC content. It would be a huge effort for a travel agency to normalize data from multiple channels — so we take that off their hands.”

Considering all the factors mentioned above, it is no surprise that most resellers ended up partnering with an intermediary. They can get all air content from a single provider or set direct connections with several major airlines while reaching all others via a GDS, airline consolidator, or aggregator. Below, we’ll compare these three middlemen across several vital parameters.

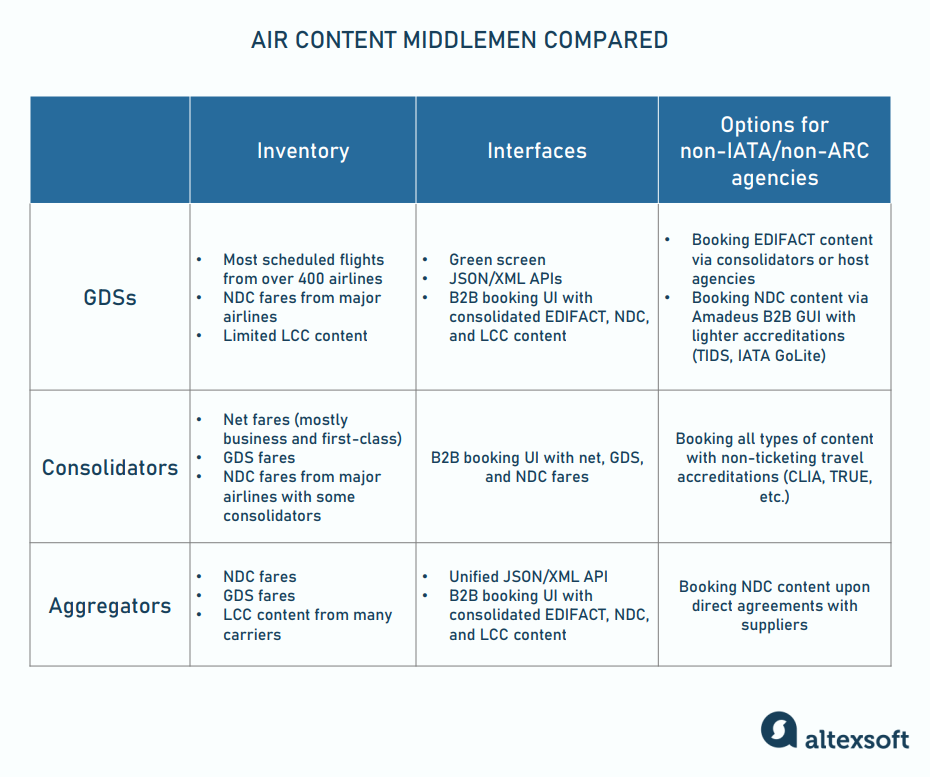

Air content middlemen compared

GDSs: mature players with global reach

Three global distribution systems—Sabre, Amadeus, and Travelport—play a pivotal role in air content distribution and are at the heart of the EDIFACT-based ecosystem. They preserve dominance over the air market due to their unprecedented reach and extensive suite of IT solutions for airlines, airports, and resellers (from passenger service systems and dynamic pricing tools to travel and expense management software and payment platforms).

Another big reason leisure OTAs and TMCs stick with global distribution systems is the incentives GDSs grant for air bookings. This money is subtracted from the fees airlines pay GDSs for using EDIFACT distribution channels.

Sabre vs Amadeus vs Travelport — what’s the difference?

Inventory

Each GDS gives travel agencies access to most scheduled flights from over 400 airlines worldwide, including some LCCs and hybrid carriers. In addition to bare seats, the traditional EDIFACT channels list branded fares and a limited number of ancillaries, such as prepaid baggage. Suppliers sell some additional services via GDSs using the electronic miscellaneous document (EMD)—a standard IATA form for collecting charges for products other than the flight itself.

Note, though, that, as we mentioned before, low-cost carriers are typically reluctant to sell tickets via traditional channels because of the high fees GDSs charge airlines for each booking. This approach simply doesn’t fit into the LCC business model, which revolves around cutting expenses to the extreme.

The differences between low-cost and full-service carriers explained

Though many budget carriers are present at least on one GDS, they often restrict access to their best deals. For example, in 2022, Ryanair signed a new agreement with Amadeus to reach more corporate customers. At the same time, the LCC refused to share its three cheapest fares via third-party channels.

NDC adoption

All three GDSs actively develop NDC channels alongside traditional ones. Today, Travelport onboards NDC content from 17 airlines and supports the same number of NDC capabilities which embrace all basic steps:

- flight and ancillary shopping;

- displaying a seat map;

- order creation, change, and cancelation; and

- payments with customer cards.

The GDS even allows booking additional ancillaries — like WiFi, meals, lounge access, and insurance.

Sabre has NDC connections with 16 carriers and maintains 23 proven capabilities, extending its functionality with

- offer personalization based on passenger type or loyalty programs,

- discounted benefits and promotions, and

- presenting content in local languages and currencies.

At the same time, NDC from Sabre has missed ancillary bookings so far.

Amadeus leads the pack advertising NDC connections with 27 airlines and 26 validated NDC capabilities, including shopping for all types of ancillaries, different payment methods, and extensive payment flow automation.

User interface

GDSs remain faithful to a legacy green-screen terminal with a command line for text inputs and outputs. To use this archaic interface, travel agents must know cryptic commands and codes, a complex technical skill that takes weeks or even months of training to obtain. Note that NDC offers will never appear in the GDS terminal since the legacy technology is incompatible with modern formats.

Alongside archaic green screens, each of the big three provides modern graphical user interfaces—Sabre Red 360, Amadeus Selling Platform Connect, and Travelport+—that consolidate air content in one place, presenting all types of offers (EDIFACT, LCC, and NDC) in a convenient, uniform manner. GUIs dramatically simplify the flight booking process. However, at the current stage, they don’t cover an end-to-end agency workflow. So, to complete and service EDIFACT reservations, you still need to understand the GDS language.

Watch our video about how flight booking via EDIFACT channels unfolds.

Flight booking steps and critical systems

API integration

OTAs, corporate booking platforms, and other resellers with websites can integrate GDS resources—content and functionality—via a set of APIs. Similar to B2B user interfaces, API connections allow for combining GDS, NDC, and LCC content in the same record. To accomplish bookings, your development team must implement a series of APIs, recreating several workflows.

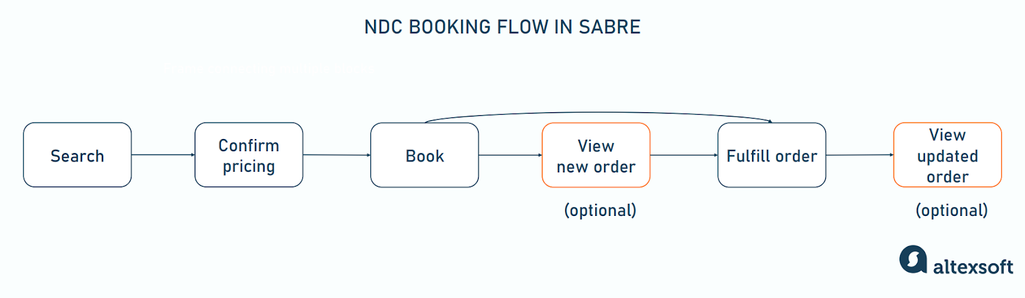

For example, Sabre provides Bargain Finder Mix API to shop for all types of offers. Then, to enable an NDC scenario, you must integrate with REST APIs from the Offer and Order suite so that your system calls them in a particular sequence. It takes six API requests to create and fulfill an NDC order and more to service it (cancel, change, reshop, etc.)

NDC primary flow. Source: Sabre Dev Studio

Booking and servicing EDIFACT and LCC content requires building separate processes with a number of additional APIs.

API integration with other GDSs is somewhat nuanced but generally very similar to that with Sabre. Apart from the technical side, it involves complex business negotiations and cumbersome certification to confirm that your shopping flows work as expected. From our experience, the entire endeavor may take months or even a year, from the first contact with a GDS to the moment you can finally book flights.

Read articles on Sabre API integration and Amadeus API Integration based on our hands-on experience with leading GDSs for more details.

Options for non-IATA/non-ARC agencies

Independent resellers without IATA or ARC accreditation can book air with GDSs using the credentials of an approved host travel agency or air consolidator. Amadeus even provides a dedicated airline consolidation service, enabling startups and small non-IATA agencies to integrate flight booking APIs and sell air tickets without investing in expensive training and licensing.

Amadeus also allows agencies to make NDC reservations via Selling Platform Connect using lighter types of IATA certifications — such as free-of-charge TIDS (Travel Industry Designator Service) and IATA GoLite, a simplified accreditation version for smaller companies.

Airline consolidators: bargain shops for corporate travels

Like GDSs, air consolidators appeared in the pre-Internet era and ran most of their business through legacy EDIFACT channels. They negotiate bulk prices with an airline, add markups, and let travel agencies access these discounted deals in GDS systems using a consolidator’s credentials. In contrast to published fares, net fares from wholesalers are not exposed publicly online. That’s why such offers are often called private.

Inventory and NDC adoption

For airlines, a wholesaler is a no-cost way to distribute products they consider challenging to sell — such as business and first-class seats on some international flights. This inventory is especially in demand with corporate travelers who can purchase a business trip for half price.

At the same time, deals offloaded via consolidators come with certain restrictions, like high cancelation fees or the inability to exchange and refund a ticket.

Besides EDIFACT-based offers, some consolidators incorporated NDC fares into their B2B booking engines, using a mix of integrations with NDC-enabled GDS channels, flight aggregators, and airlines. For example, Sky Bird Travel &Tours provides access to NDC deals from 14 airlines, Picasso Travel sells NDC from 20 carriers, while DownTown Travel established NDC-enabled direct connections with 14 airlines. Many wholesalers also train agents and advisors to ensure they understand what NDC is and how to service NDC deals.

User interface and API integration

Consolidators allow travel agents to book net fares and other EDIFACT and NDC inventory through easy-to-use B2B booking engines that require no knowledge of GDS commands. Remember that GUIs from GDSs still sometimes switch to screens with cryptic language.

Unlike GDSs and flight aggregators, these players rarely make their API documentation publicly available. One exception is Mondee, one of the largest air consolidators in North America, which has open API description and integration guidelines. However, in most cases, you need to contact a consolidator to learn the conditions of API access and whether it’s possible at all.

Options for non-IATA/non-ARC agencies

Consolidators are preferred partners for agencies with lighter, non-ticketing forms of travel accreditation (CLIA, TRUE, etc) that want to sell airline tickets. As mentioned, wholesalers share their GDS credentials with resellers, allowing them to book net fares and other inventory. So, travel companies (whether they work on the merchant or agency model) can skip the expensive and time-consuming certification process with IATA/ARC and GDSs.

Flight aggregators: NDC-centric newcomers with modern technologies

Flight aggregators are modern cloud-based platforms that accumulate air content from various sources, including GDSs, consolidators, NDC-enabled airlines, and LCCs. Compared to global distribution systems and consolidators, these players are faster, more flexible, and more agile in adapting to changes. Unlike GDSs, which charge content providers (airlines) and incentivize resellers, aggregators make travel agencies pay a fee for each transaction. For carriers, distribution services are free.

Inventory and NDC adoption

While GDSs were built around EDIFACT, aggregators emerged as mediums for NDC offers. They focus on setting direct NDC connections with airlines and complement this inventory with traditional content from at least one of the major global distribution systems.

New players can provide cheaper air inventory than GDSs. As we said, many airlines withdrew their best deals from EDIFACT or added surcharges for legacy reservations. For example, Lufthansa Group has a $26.50 surcharge for booking with Sabre, $24.50 — with Travelport, and $19 — with Amadeus. The leading aviation company charges about $8.70 if you use NDC-enabled GDS channels. At the same time, you pay no extra for products captured via direct NDC connections with Lufthansa Group’s airlines.

Besides that, aggregators onboard more LCCs since no-frill carriers bear no expense for distribution services.

User interface

The most straightforward way to get content from an aggregator is via its B2B user interface, which usually looks very similar to an airline website and doesn’t require any training in mastering cryptic commands. The UI allows a travel agent to compare prices for the same flight from GDS and NDC channels and book a better option to maximize revenue.

The onboarding process takes, on average, a couple of weeks. “Our team provides a demo to the travel agency, and if they’re interested, we sign a contract,” explains Stephanos, a typical routine in the example of TPConnects. “After that, it’s pretty much plug and play. If the travel agency has office ID credentials with an airline or IATA number, we configure it on the UI, and they can start selling.”

API integration

A travel agency running its own booking website can power it with a unified aggregator API. ‘Unified’ here means that you can connect to all types of air content and recreate an end-to-end booking and servicing flow via a single point of access. Deals from different sources will come in a standardized form as all inconsistencies and duplications are addressed behind the scenes.

“Travel agencies will need a development team to integrate their platform with a unified API, but there will be essentially one connection,” Stephanos reveals.“Once an integration is done, there will be a certification process with an aggregator to make sure that a recommended workflow is followed and credentials are configured. Yet, it will definitely be much faster than with GDSs or if you connect with many airlines.”

Options for non-IATA/non-ARC agencies

Most full-service carriers work exclusively with IATA/ARC-accredited players and settle their sales via BSP/ARC systems only, which is an industry-wide standard to pay airlines. Yet, some suppliers agree to distribute fares to non-IATA agencies via NDC channels. Also, independent resellers can buy from LCCs. “What the aggregator has to do in this case is to enable the agency to pay with a credit card because the payment is made on the spot and doesn’t go through BSP/ARC,” Stephanos says.

Read our article on using virtual credit cards in travel or watch a video about this B2B payment method.

Virtual credit cards in payments explained

What else to consider?

There are a couple of other important things to learn about when integrating air content and before striking a deal with a middleman.

Booking servicing

Booking a flight is only one part of the agency workflow—not the largest or most complex one. Servicing the reservation can be much more challenging. This includes voiding (canceling a ticket purchase free of charge within a certain period of time), adding and changing passenger data, showing a seat map, rebooking, refunding, and more.

One of the challenges posed by modern air merchandising is servicing NDC fares. Some carriers automate almost every step, while others require a reseller to call them to modify a ticket or make a refund. The same can be said about NDC-enabled mediators, which differ significantly in servicing capabilities.

“Some aggregators might be offering part of the servicing but not the entire thing,” Stephanos admits. Sо it’s always good to look at their list of capabilities. We put a lot of emphasis on servicing, which is especially important for business travelers. If you want to exchange or refund a flight, it takes a button click. It’s not that straightforward with GDSs, for example.”

You may check the Airline Maturity Index (ARM) registry to learn what NDC functionality airlines, sellers, and system providers already support. Note, though, that not all players bother certifying everything with IATA. Besides that, the registry only confirms the presence of a particular feature but doesn’t evaluate its quality. So, reaching out to a potential partner and getting first-hand information always makes sense.

Negotiating deals with airlines

Integrating air content—directly or via a middleman—is a technical aspect of merchandising. But you can add value to this physical connection by striking exclusive business deals with carriers. To encourage NDC bookings, airlines tend to offer discounted fares or incentive agreements to travel agencies — no matter whether it’s a direct connection or there is a middleman in the mix.

For example, American Airlines rewards agencies that purchase NDC with 10-percent commissions. Previously, the leading US carrier tried to punish resellers for their unwillingness to modernize by removing the best deals from GDS channels. Recently, AA has focused on carrots rather than sticks as a primary motivational tool, and other carriers may eventually follow the example.

With 25 years of experience, Liudmyla is a seasoned editor and IT journalist. Over the last five years, she has focused on travel tech, travel payments, and the advancements in NDC implementation.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.