Written in conjunction with Hudson Crossing partners Max Rayner and Brian Clark

Nobody likes paying for things they don’t need. If something is included in the price but the buyer hasn’t asked for it, it’s a questionable benefit and possibly a detriment. When searching for hotel rooms, parents with young children may very much prefer to not have a fireplace or a high floor view, while honeymooners may be willing to pay to have both a fireplace and a view.

Airlines realized long ago that unbundling their product and allowing customers to buy valued ancillaries not only improved revenue and margins but actually improved customer satisfaction. Absent ancillaries, many carriers might never be profitable. Notably, this is not just a phenomenon with low and ultra-low cost carriers. Full service carriers have also joined the trend. Not long ago, Delta doubled down on experience attribute pricing by tying boarding priority (something many fliers care about) to specific purchased branded fares (~24% of its revenue comes from ancillaries).

Among hospitality distributors, Expedia has announced early results for its efforts to present an ABS shopping path where possible. According to an Hotel News Resource article by Expedia SVP Hari Nair, “Combined with Expedia Group’s machine-learning room recommendations, ABS has driven a 4.1% shift to more premium rooms and rates” even in its early trials with ABS.

Many hotels, though, still use an old shopping model. But maybe not for long. One of the hottest topics in hospitality today is attribute-based shopping. This is why we’ve teamed up with Hudson Crossing, a leading global advisor to travel and hospitality companies, to unravel what this concept entails and what benefits this approach gives hoteliers and hotel guests.

Hotel shopping today

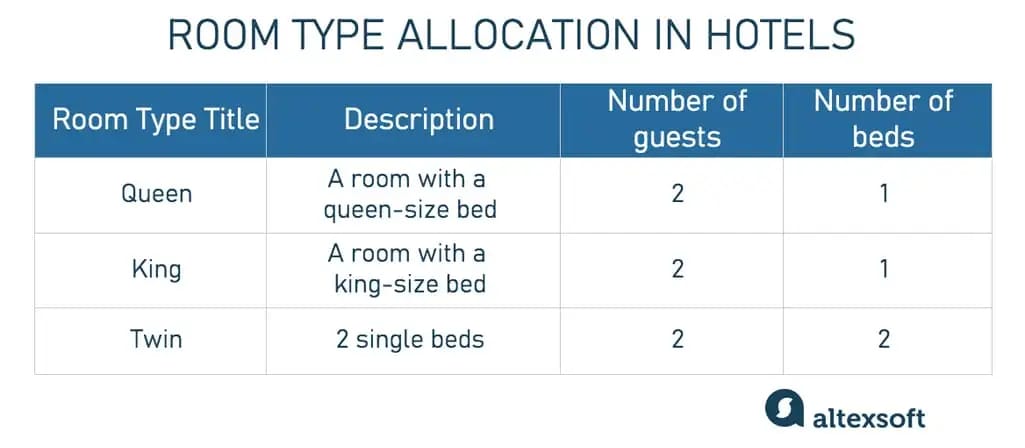

To understand how the current hotel room booking experience works, we need to first talk about how hotels control room inventory and pricing via combinations of Room Types and Rate Plans. These are essentially pre-built, low fidelity attribute packages. In the hotel’s systems, Room Types are often the lowest possible number of categories that capture high level variations among available accommodations. Typical room types are quite often based on the available bedding such as King, Two Queens, Queen or Twin but may include other attributes such high vs. low floor, premium vs. interior view, etc.

Room type examples

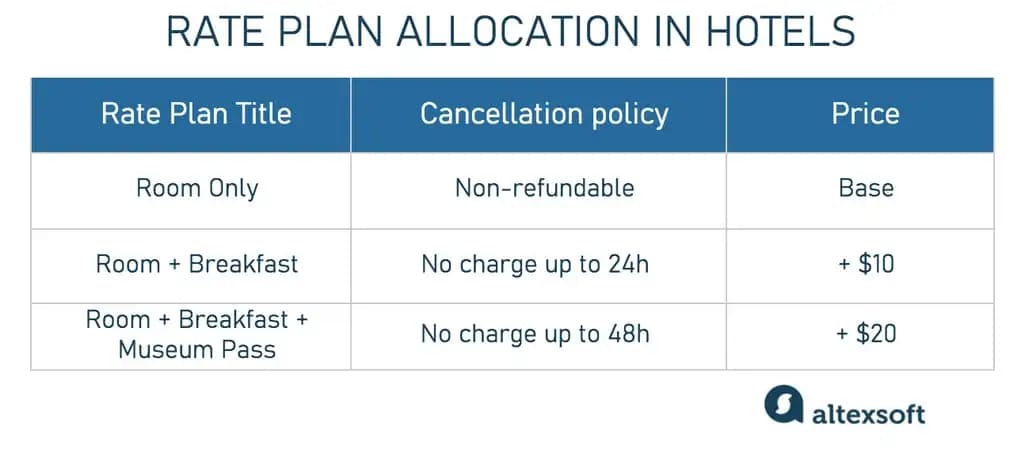

A Rate Plan represents essentially the practical terms and conditions that go with a booking. It can include different features like breakfast or WiFi access or unique terms of sale, for example, pay now/pay later and refundable or not.

Rate plan examples

Traditionally, when guests look up available rooms for their preferred dates on a hotel's website, the booking engine retrieves preset room types that fit their criteria and a selection of available rate plans. Quite often, brands lead with the lowest available nightly rate, followed by a choice of room types, and then a choice of available rate plans, but other approaches are possible. This is a simplistic approach that fails to optimize guest satisfaction (a guest may care deeply about a quiet interior room and proximity to elevators), and also fails to optimize profitable growth (guest studies consistently show a willingness to pay extra for valued ancillaries).

A marginally better approach might be Attribute Based Filtering (ABF). An ABF journey tends to start as above, but gives guests the option to apply faceted filters to tailor their preferences, thereby improving display of search results. While better than rigid pre-ordained choices, ABF is still limited by hotel systems that are fundamentally beholden to room types and rate plans, and fails to give the hotel a chance to maximize guest satisfaction while pricing and yielding attributes optimally. To do better, hoteliers need to unbundle both stay and non-stay attributes, and this is where attribute based shopping (ABS) comes in.

What is attribute-based shopping (ABS)?

Attribute-based shopping allows customers to shape their hotel experience and its price by choosing what attributes go into it. “We like to call it that as opposed to Attribute-Based Selling because “Shopping” focuses the value proposition on the customer rather than the seller,” says Max Rayner, Partner at Hudson Crossing and one of the industry’s earliest evangelists on ABS.

Let’s start by defining terms.

Understanding attributes and products

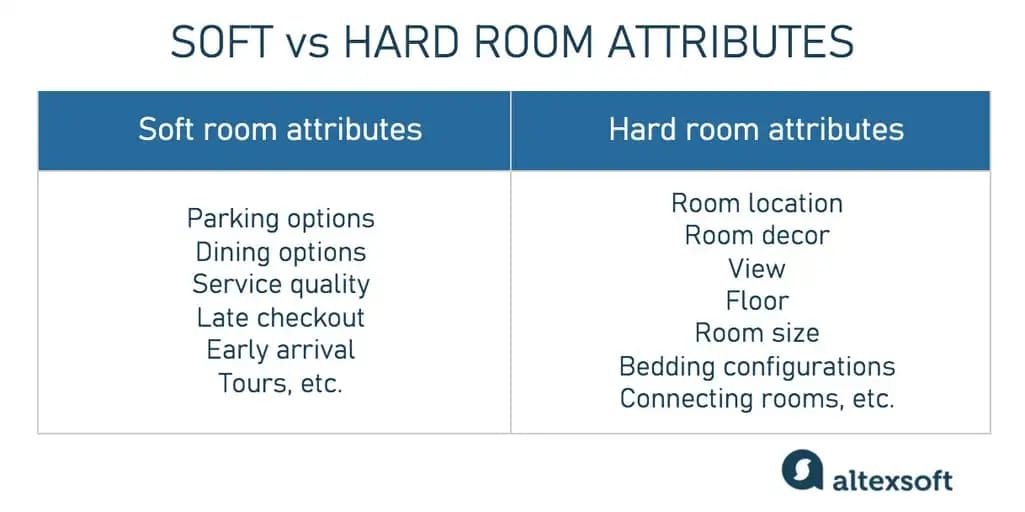

Attributes are characteristics of a guest’s stay. They can be hard, meaning that they can’t be moved or adjusted for a specific room, e.g., view, room size, floor, work desk availability, etc. But they can also be soft – attributes that can be sold regardless of the chosen room, e.g., terms and conditions, experiences, ancillaries, early check in, late checkout and other services.

Soft vs hard hotel room attributes

Another facet of ABS is the ability to make a stay optional, which allows a hotel to offer products to the people who are not staying at the hotel. So, while attributes are tied to a stay, products can be stay dependent or stay independent. As Max Rayner of Hudson Crossing puts it, “Late checkout is a stay dependent product (you can’t have it without a stay), while a tour or cabana access for a defined period is a non-stay dependent product.” A hotel might choose to sell meals, pool access, or other products independently, whether the customer booked a stay and has a folio open or not.

The journey to book an ABS hotel experience can come in seemingly different flavors, though they’re all anchored on delivering a bundle of valued attributes priced for optimal brand value and guest satisfaction.

One approach is to use machine learning to present high propensity, best fit bundles that already incorporate most probably desired attributes. This avoids the paradox of choice problem, while still allowing guests to then curate their choices if they want. Upscale brands eager to avoid comparisons to cheaper no service hotels will likely choose this path to avoid the impression they are nickel-and-diming guests. Instead of extensive a-la-carte pricing, such brands will present attractive options whose cost may well have been derived from optimizing individual and combined attribute prices, but which are presented as an overall cost.

Another more explicit approach relies on faceted search to present all available attributes and adds them to a cart, creating a unique combination to serve guest preferences. Instead of leading with a propensity-derived king room + breakfast prefab choice, guests can choose and pay for a room with a king-size bed, an ocean view, elevator proximity and club floor access, but no breakfast.

An important feature of ABS is that a hotel guarantees that everything a customer paid for will be available when they arrive without them having to make a separate request, which creates a set of distribution and operational challenges that need to be addressed to avoid disappointment.

Unsurprisingly, attribute-based shopping is a hot topic among hospitality industry professionals, with work underway both by technology vendors and industry groups. The American Hotel and Lodging Association (AHLA) and Hospitality Technology Next Generation (HTNG) are leading industry organizations that run workgroups on ABS, though there are no set standards yet nor universal best blueprints that can be applied for implementation.

How will attribute-based shopping work?

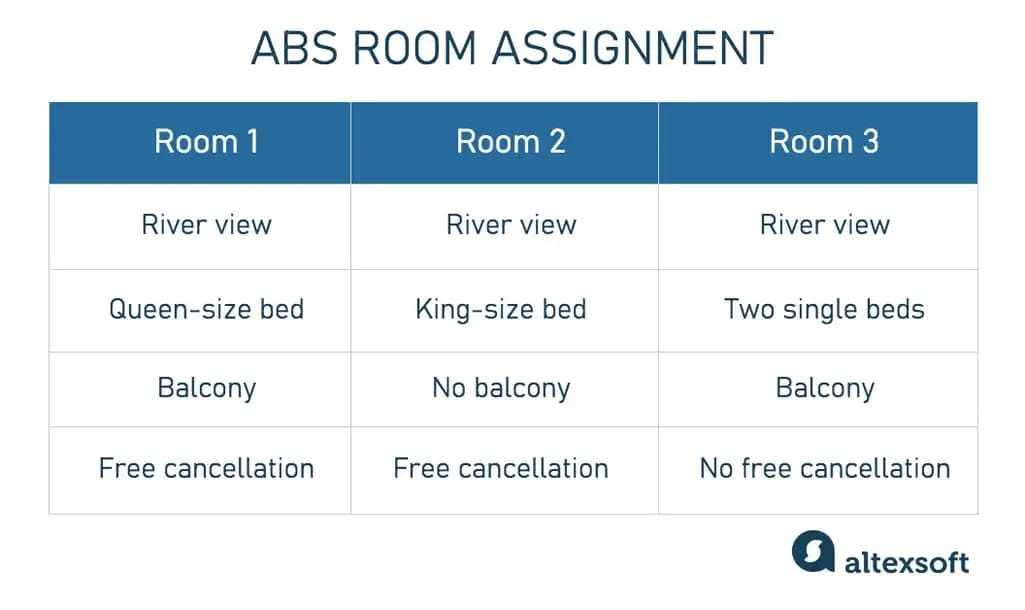

Say guest A wants to book a room with a river view but does not value/care about bed type. You have three such rooms. In the worst case traditional model, guest A will choose or be assigned to one of them randomly (say Room 2) and remove it from availability for those nights. Then couple B wants to book a room with a river view and a king-sized bed... But it’s already been blocked by the previous booking. So couple B will have to go to another hotel altogether, when in fact all guests could have been delighted and the hotel could have made more money.

Example of hotel inventory

In the attribute based shopping model, the system can tentatively assign guest A to Room 2, but as soon as the second guest appears, a dynamic algorithm will shift A to a different room, freeing Room 2 for couple B. So you end up with two rooms booked instead of one.

Benefits of attribute-based shopping

In the example above, since guest A only cared about a view but not about a balcony, while couple B really cared about a king sized bed, a view and (although not explicitly) a balcony, the brand not only gains a booking but has the chance to optimize pricing for both.

Improved loyalty benefits. One great option for brands with well managed loyalty programs is to tie availability of certain attributes to loyalty status. In other words,hoteliers can leverage the flexibility of ABS systems as a way to present certain attributes as distinct loyalty benefits instead of, or in addition to making them available for purchase (bundled or unbundled).

Increased revenue and profits. With ABS, hotels will enjoy higher revenue thanks to higher conversion (since they will be able to offer consumers better value), more cross-selling (since pricing will no longer be fixed to specific room types and rate plans), and dynamic room assignments, which captures more bookings overall.

Increased direct bookings. Hoteliers, who for years have tried to attract more direct customers, might finally have an invaluable advantage over OTAs. Assuming hoteliers will want greater control of their own inventory and deny ABS-shopping to OTAs, booking rooms directly via a hotel’s website will present greater flexibility, better value, and improved guest satisfaction.

Opportunity for upselling. Just as ABS financially benefits airlines, this model would incentivise customers to purchase services that they haven’t considered before. Once travelers make an initial emotional and financial commitment to a base price, it is well known that a “second wallet” opens up, presenting opportunities for ongoing experience-improvement calls to action.

Meeting guest expectations. One of the main features of ABS is that a guest doesn’t need to make special requests over the phone to a contact center or on arrival. Instead they can pick everything they need in advance and expect the room and experience to be exactly as they envisioned during booking.

Acquiring better data. Based on information about bookings, hoteliers will be able to identify the most demanded amenities and adjust their property design and selling strategies. Seeing which services guests value the most would provide hotels with a detailed understanding of customer preferences, so they can focus on the most meaningful services in the future.

Okay, all of this sounds good. But how can ABS be implemented? Let’s review some ideas and implementation scenarios.

Stages of implementing Attribute-Based Shopping

ABS functionality can have different levels of sophistication in user presentation and technical development. Legacy property management systems (PMSs), central reservation systems (CRSs), and other hospitality tools were not built to support ABS. “The major CRS that’s farthest along ABS is Amadeus, and that is the reason IHG and Marriott have chosen Amadeus as their global CRS provider,” explains Max Rayner. Marriott is still at the planning stage while IHG has rolled out some ABS functionality, and is still in a test and learn phase. It is already clear, though, that just going through the effort to fully catalog all attributes is of great value. Even brands whose systems do not permit full ABS have reported significant gains from a better understanding of what each specific property can offer for sale.

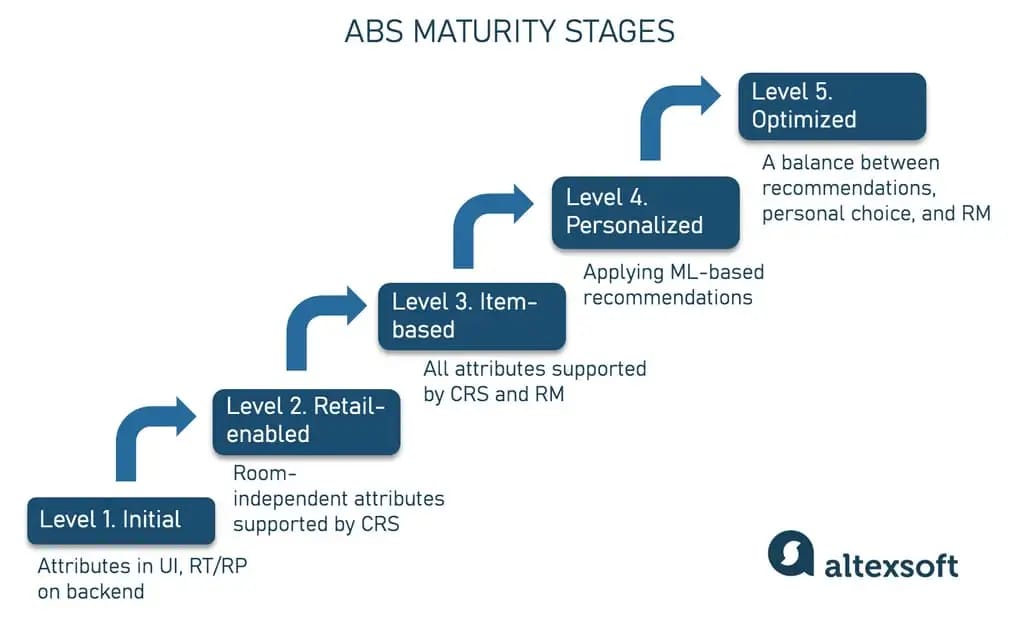

So how would ABS implementation work before the industry reaches full ABS maturity? According to Hudson Crossing, there are five levels of ABS capabilities.

ABS implementation stages

Level 1. Initial

At the beginning stage, a hotel might develop a UI for choosing attributes, but will price and sell attributes using the traditional RT/RP model. The clearest example of how ABS might work in such a case has been provided by GauVendi and ROOMDEX.

GauVendi is a hotel technology provider from Germany that developed and tested a leading ABS-ready system on 14 European properties. As Max Rayner explains it, “GauVendi acts as an overlay on top of a hotel’s CRS and/or PMS to mimic what the ABS UX should be.”

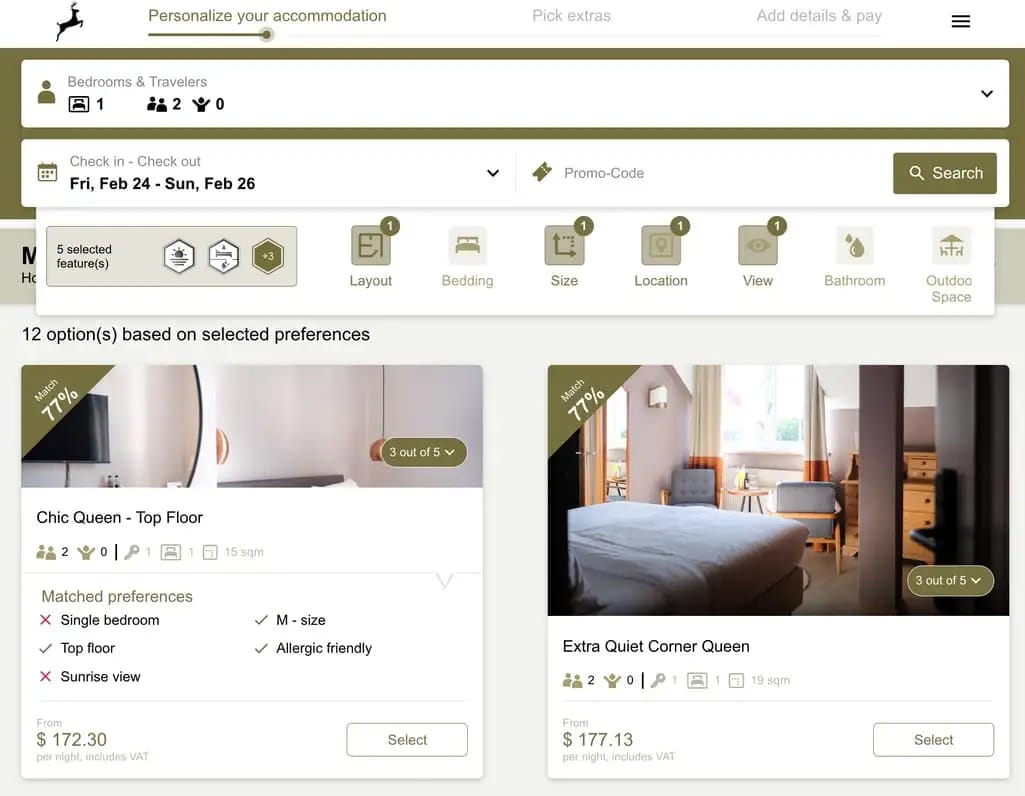

Search results show rooms with the best matches to chosen attributes. Source: GauVendi

Here a customer can choose among several attributes at the top and sees a price for each bundle. The engine looks for rooms that have at least some of the required attributes and provides the best fits for the customer.

This implementation doesn’t show the customer the price for each attribute, so hoteliers can prepare bundles of attributes for which they expect the most demand and provide a total price for each bundle.

ROOMDEX have also launched an elegant solution for ABS upselling, which is already yielding great results for hotels. ROOMDEX has indicated that “So far, all hotels using [ABS] are seeing a YoY increase in upselling revenue and all are seeing new revenue derived from the ability to upgrade to specific rooms - even within the same room type (possible through deep, room-level integration with the PMS). Users typically add multiple attributes to the cart and the number of transactions per month have increased by nearly 40%.”

Level 2. Retail enabled

At this stage, the hotel still relies on RT/RP bundling, but will apply ABS pricing on attributes and products besides just rooms. So a customer can only choose among the preset room types and rates, but they can put soft (i.e., room-independent) products like meals, WiFi passes, or late-checkout into the shopping cart.

This way, a hotel’s CRS only has to be aware of how certain attributes are individually priced, which requires minimal changes to the system. At the same time, here you can only apply traditional revenue management, compared to how this will be done at the next stage.

Level 3. Item-based

In this model, a CRS supports all attributes and applies item-based revenue management practices to them.

Revenue management is the practice of selling the room at the optimal price. Revenue managers in hotels aiming at selling the greatest number of rooms at the highest possible price will need to change their practices and strategies for the ABS model. “One key change,” Brian Clark details, “is to take the yielding and revenue optimization algorithms to the level of attributes.” So revenue managers will have to create pricing strategies not only for rooms, but also for each attribute.

Learn more about revenue management in hotels from our video

Optimizing overall results also requires applying dynamic attribute pricing and dynamic room assignment. This requires an algorithm that will restack the whole hotel inventory whenever a new booking comes in, to satisfy every customer’s requirements without over-delivering and leaving some freedom for future bookings and operational “safety” margins.

Level 4. Personalized

At this stage, the system will be able to make context-sensitive attribute recommendations using machine learning.

Recommender engines powered by machine learning drive today’s personalization. Applied at YouTube, Netflix, and Amazon, they are also employed by hotel brands and OTAs to sift through thousands of offers and provide the best match to customer needs in the context of specific stays.

According to Max Rayner, “The same exact person booking mid-week for one vs. booking on a weekend for a family may have very different preferences and be ‘moved’ by the offer of different attributes.”

While recommender systems are already actively used in hospitality, they provide a solution to one of ABS’ potential problems. When presented with a wide selection of attributes, customers can become overwhelmed and experience decision paralysis. An ML-based system can predict what a customer will enjoy and offer relevant attribute combinations that fit their needs, making the choice faster and easier. Loyalty programs and CRMs will also learn to understand customer preferences from their shopping experiences.

At the same time, guest options for manual customizations will remain.

Level 5. Optimized

Finally, Hudson Crossing sees the ultimate ABS maturity as a balance between a recommender system, a person’s individual choices, and revenue management suggestions.

In this ideal implementation of ABS, a guest is presented with recommendations based on ML data with the best balanced pricing, all of which can be easily calculated and adjusted when a person makes their own choices.

As you may have noticed, here we talked mainly about booking on direct channels. So if ABS works with OTA distribution, how does it do that?

Attribute-based shopping and OTAs

Online travel agencies are an integral part of today’s hotel distribution but will they be able to offer ABS?

First of all, ABS works on the CRS level, so only OTAs that connect directly to hotel CRSs will be able to do that. Since many websites pull their data from a variety of sources, they likely won’t have access to real-time attribute pricing and availability.

Second, since ABS presents hotels with an opportunity to rise above OTAs, they likely wouldn’t want to make it available to OTAs. As Max Rayner puts it, “The key idea here is that driving more direct bookings and encouraging loyalty membership are strategic imperatives for hotels, and one of the most obvious opportunities to differentiate is to offer excellent ABS on direct channels but deny ABS to OTAs. This would allow hotels to have a clear, unique selling proposition for their direct channels.”

More on the nature of relationships between OTAs and hotels – in this video

Leading OTAs understand the potential impact of direct-channel only ABS, and have been exploring how to “unbundle” hotel experiences on their own to mitigate ABS’ potential impacts. However, even if OTAs succeed in improving how they present options to customers, delivering on all but the most trivial attributes is only possible with a seamless connection to hotel systems.

Challenges of ABS implementation

Attribute-based shopping has great potential and many industry leaders believe that it’s the future of hotel booking. But we need to recognize some of the challenges that will inevitably surface with such a big shift. Let’s go through them and consider possible solutions.

Lack of ABS-specific technology

There are currently no platforms that fully support ABS implementation and this is the greatest barrier to adoption. Not only must the CRS be ABS-ready, but also the PMS, RMS, customer relationship tools, and more. Besides, the fragmentation of hospitality technology as well as its legacy nature makes it really hard to introduce any changes when they do come. While bigger brands are testing the new ABS model with technology partners, it will take some time until such tech is fully ready for everyone to implement.

Fortunately some of the most progressive technology providers are moving in this direction (Amadeus and Above Property with item-oriented ABS data models, Sabre SynXis with its recently unveiled Retail Studio, and IDeaS with R&D that looks ahead to ABS revenue management).

Lack of accurate data

Deciding on what attributes to include and how to bundle them must come from understanding customer behavior and demand for those attributes. Unfortunately, not all hotels today operate on data analytics and have data management to properly collect and use it. And even if they did collect data for the past decade, much of it is not detailed enough to apply to ABS.

Uncertain customer reaction

How will customers react to the idea of attribute-based shopping? Will they be thrown off by the new functionality or even feel that now the hotel wants them to pay for something that used to be included in the price? And what if they start booking only the base fare without any attributes, thus lowering hotel revenues?

Well, we have reason to hope that it won’t be the case.

First, the airline example allows us to conclude differently. “In airline sales there are years and years of clear evidence that the attribute sales are the key difference between airlines with good results and those without,” shares Brian Clark.

Second, a recent survey held by StayNTouch and NYU provided some valuable insight. They surveyed 1,000 US travelers and learned that over 60 percent of them see value in the customization features via ABS and a large portion of travelers (63 percent of travelers who pay $251 or more per night and 48 percent of those who pay between $151 and $250 per night) are willing to pay more for preferred room features.

Additionally, shoppers who used the GauVendi interface understood and chose the ABS path without prompting, resulting in 17.4 percent of bookings through the ABS path, about the same number as those who chose the prefab “most popular” option.

In other words, all available evidence suggests that customers would enjoy and understand the new level of personalization, and more importantly find value in paying for desired features.

Comparison complexity

If guests can no longer differentiate hotels by room types and price rates, how can they compare one hotel to another? Over 90 percent of travelers use metasearch websites to compare rates, will they no longer be able to do that with ABS? You can’t compare a “Standard Two Beds” with a “A room with a garden view, a balcony, and a queen bed.” And even if two hotels both use ABS, they may map and price their attributes differently, so there will never be a true apples-to-apples comparison.

However, it is wrong-headed to conclude that the ABS model would unduly complicate search and booking. Hotels should not aspire to be undifferentiated commodities. Even bargain hunters can be targeted with lower cost ABS bundles. Airlines learned that lesson when they allowed the experience to become indistinguishable from one to the next and suffered greatly as a result. ABS provides an opportunity for creativity and differentiation, and therefore to achieve positive channel shifts (and for the best brands, share shift).

More importantly, for the most profitable, most frequent guests, ABS provides an opportunity to maximize lifetime value. Highly profitable luxury guests and corporate road warriors have definite ideas about what they want and expect all their needs will be met. For groups and corporate contracts, ABS also increases options that hotel sales can present to travel managers, allowing sales to balance between cost and attractive options.

What now? How to prepare for ABS

If you’re a hotelier that believes in ABS but doesn’t see what they can do today to prepare for the change, we have a recommendation – start collecting data on attributes.

To apply ABS, you will need to identify the value of each attribute and price it accordingly. As Max Rayner points out, “Getting a complete, sustainable, evergreen data set on all attributes (and the collections of attributes that can be sold as products) has to be the starting point.”

So start by collecting information on what your guests request and how often, monitor their preferences (for example by tracking searches on websites and apps), and be proactive in getting their feedback on extra items. Start analyzing the probability of what each guest might prefer, categorize those amenities into bundles, and record their implicit preferences (from what they buy) and explicit preferences (from what they ask for). Test, change, repeat, until you can accurately value your products.

Even if this is the only thing you do, you will massively benefit from understanding customer segments, behavior patterns, and learn to better monetize assets.

For hoteliers and technology providers who want to go deeper, both Hudson Crossing and AltexSoft can help. Hudson Crossing has been developing sophisticated models to estimate ABS benefits for years and has collaborated with AltexSoft in identifying some of the custom developments that will enable ABS success, such as dynamic room assignment and other integrations.

Maryna is a passionate writer with a talent for simplifying complex topics for readers of all backgrounds. With 7 years of experience writing about travel technology, she is well-versed in the field. Outside of her professional writing, she enjoys reading, video games, and fashion.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.