Navigating the increasingly competitive hospitality sector landscape demands a thorough grasp of the vital performance indicators that demonstrate profitability. The Average Daily Rate (ADR) — one of the leading hotel KPIs for gauging performance and profit — has gained considerable importance for a reason.

Whether you're a hotelier aiming to optimize revenue or a tech enthusiast intrigued by the evolving dynamics of travel and hospitality, acquiring a comprehensive understanding of ADR will be helpful.

In this article, we delve into the ADR concept, explain its formula, and shed some light on its advantages and drawbacks. We also investigate predicting ADR through machine learning and strategies to enhance this KPI.

What is ADR?

ADR, in the hospitality industry, stands for the average daily rate. It is a hotel performance metric representing the average revenue earned for each room rented out in a hotel over a certain period. The metric includes all types of rooms and rates, whether discounted, group, or the best available ones.

For vacation rentals, ADR represents the average nightly income of a specific property. It's an individualized metric that can significantly vary based on property attributes, demand, and pricing tactics. This contrasts with hotels that calculate ADR across all occupied rooms, delivering a standard rate for the entire establishment.

Armed with insights from the ADR, revenue managers can anticipate the potential room rates for specific days of the week, defined months, or even entire seasons. By keeping an eye on ADR, observing its fluctuations, and establishing pricing objectives considering the ADR trends, both hotels and vacation rentals can enhance revenue and improve their overall profitability.

The ADR formula and how to calculate It

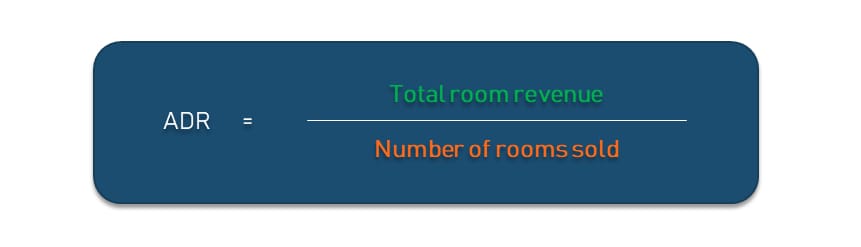

This is the formula for calculating hotel ADR.

In the formula

- the “total room revenue” represents the total income earned from the rooms sold on a given day and

- the “number of rooms sold” is the number of rooms rented out for that day. This figure excludes rooms that are out of order, used by staff, or are complimentary.

It's crucial to remember that ADR doesn't consider the total number of rooms available in the hotel.

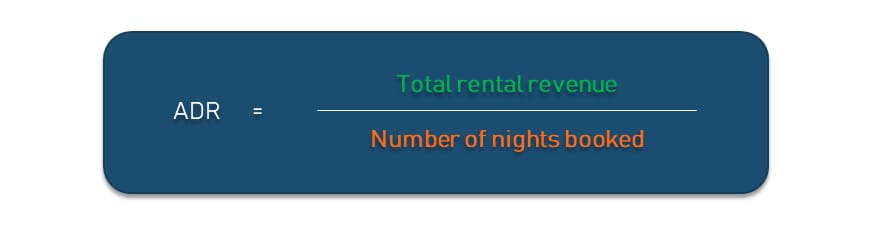

This is the formula for vacation rental ADR.

In this formula

- the “total rental revenue represents the total revenue earned from a reservation, including daily rates and cleaning fee and

- the “number of nights booked” is the sum of all individual nights that guests have stayed or will stay at the property.

Practical examples of ADR calculations

For a clearer understanding of how ADR works, here are two examples for both a hotel and a vacation rental business.

Example 1: Small boutique hotel. Imagine a small hotel with 10 rooms, which generates $800 in room revenue from selling 8 rooms in one night.

The ADR for this hotel is computed as follows:

ADR = $800 (Total Room Revenue) / 8 (Number of Rooms Sold) = $100.

Example 2: Vacation rental property. Let's consider a scenario for a vacation rental. Suppose you own a vacation home that was rented for seven days, and the total revenue from this reservation was $2100.

The ADR calculation would be:

ADR = $2,100 / 7 nights = $300 per night.

Regardless of the size or type of property, ADR serves as an insightful metric for assessing pricing performance.

Comparison: ADR vs Occupancy Rate vs RevPAR

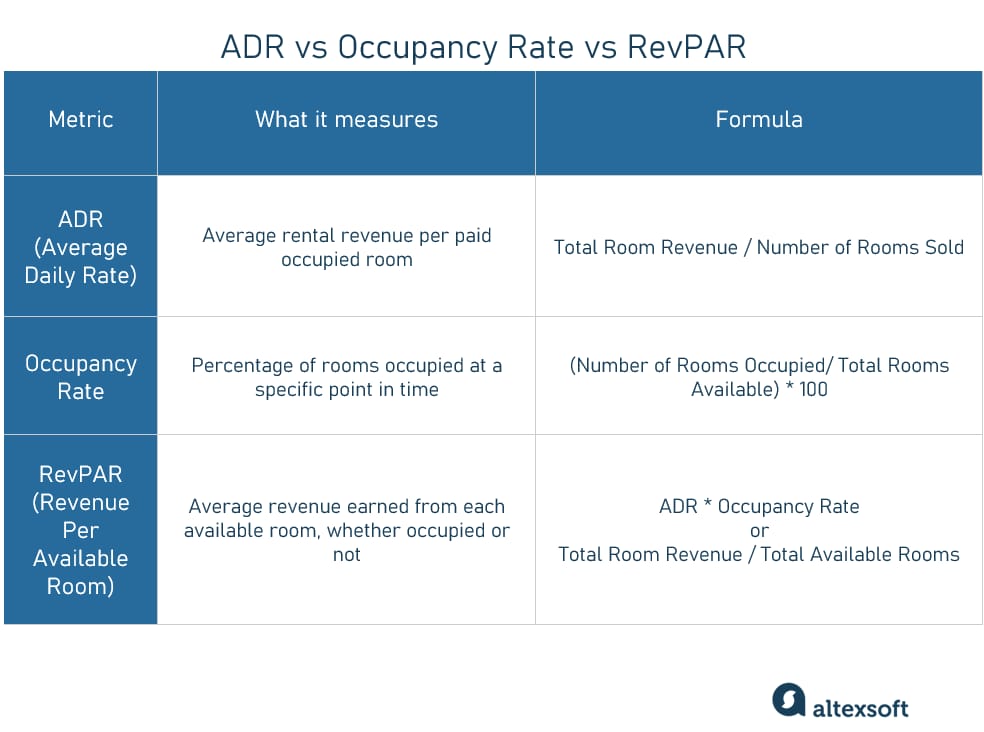

ADR, RevPAR, and occupancy rate are three pivotal metrics in the hotel industry, each providing unique insights into a hotel's performance. These indicators, when combined, present a comprehensive analysis of various business aspects. Let’s differentiate them to avoid confusion.

ADR, occupancy rate, and RevPAR compared.

As we said earlier, ADR measures the average revenue earned from each room sold during a specified period. Unlike the other metrics, ADR focuses solely on revenue from actual room sales, making it a vital KPI of a hotel's pricing strategy effectiveness.

The occupancy rate, on the other hand, denotes the percentage of rooms that were occupied during a specific time frame. While it's an effective metric to gauge a hotel's ability to sell rooms, it does not consider the revenue earned per room.

Learn more about occupancy rate prediction in our dedicated article.

RevPAR (Revenue Per Available Room) combines elements of both ADR and occupancy rate, offering a holistic perspective of a hotel's performance. It represents the average revenue derived from each available room — occupied or not — over a specific period. As such, RevPAR can reflect a hotel's ability to both fill its rooms and set effective pricing strategies.

Learn more about RevPAR in our dedicated article.

What ADR can tell you and what it can't

ADR is a highly valued metric in the hospitality industry, serving as a primary barometer of a hotel's room revenue performance. However, like any other technique, it comes with its own strengths and weaknesses. Recognizing what ADR can and cannot tell you is essential for leveraging this metric effectively and supplementing it with other performance indicators when necessary.

ADR benefits

The ADR provides various beneficial insights, from evaluating overall room or property revenue performance to informing competitive analysis and pricing strategy. Below you will find the key advantages of using the ADR metric.

Offers an overview of room revenue performance. As one of the analytical pillars, ADR provides a clear view of revenue performance. By tracking fluctuations in ADR over time, you can detect both subtle and drastic changes in revenue from property or room sales. This continuous monitoring can reveal valuable insights, such as identifying peak revenue-generating periods, recognizing the impact of specific events on revenue, or understanding the effects of a new pricing strategy.

Facilitates competitive analysis. Comparing your hotel's ADR with that of your competitors can bring significant market positioning insights to light. If your ADR is lower than what the market has, it might indicate that your property provides more value than you currently charge for. Conversely, a higher ADR could indicate a unique selling proposition that justifies a high rate or hints at the risk of pricing yourself out of the market. This information can guide strategic adjustments to your pricing model, helping you maintain a competitive edge.

Assists in revenue management and pricing strategy. ADR is the critical data point when it comes to dynamic pricing calculations, as it informs the rate adjustments required to maximize room revenue. For instance, a steady increase in ADR could signal high demand, justifying a slight hike in property/room prices. Conversely, a decreasing ADR could be a trigger to implement promotional rates to stimulate demand and prevent revenue loss. By effectively responding to ADR trends, hoteliers and vacation rental managers can ensure they always get the most value from each sale.

Limitations of ADR

Despite its numerous benefits, it's essential to consider the limitations of ADR as well. Recognizing the shortcomings helps to ensure a more holistic understanding of a hotel's performance.

Does not consider ancillary revenue from other hotel services. ADR solely focuses on revenue from room sales, excluding other sources of income such as food and beverage, spa services, or event spaces, which can also significantly contribute to a hotel's overall revenue.

Doesn't account for the physical condition or the specific features of a hotel. ADR doesn't reflect the physical state of a hotel or its unique amenities. Two hotels with similar ADRs could offer vastly different guest experiences and value propositions based on their condition and features.

Vulnerable to distortion by outliers. ADR, as an average, can be skewed by extreme values or outliers. A single room sold at an unusually high or low rate significantly distorts the overall ADR, making it less reflective of typical room revenue.

ADR forecasting opportunities and challenges

Running an effective revenue management strategy requires optimized room pricing to boost sales and occupancy. This is where the power of machine learning comes into play, utilizing ADR for hotel price prediction tasks.

Discover how revenue management functions in hospitality in our video.

Before machine learning became prominent in the field, hotel managers had to rely on their intuition and experience to predict optimal room prices, which was time-consuming and prone to errors. However, introducing ML-powered predictive analytics has revolutionized this process.Machine learning employs sophisticated algorithms to anticipate future trends and accurately predict ADRs for hotels and vacation rentals. Armed with these predictions, you can proactively adjust your pricing strategy to ensure competitive rates for the inventory.

Using ADR as a strategic opportunity

Predicting ADR with machine learning provides an invaluable opportunity to foresee future room pricing trends and act strategically. While the prediction target varies depending on a hotel's goals and the type of data accessible, there are two primary steps to benchmark as part of maximizing profit.Establishing your own rate trends. Predicting ADR helps create accurate financial forecasts, inform decisions related to operational expenditures, and facilitate strategic planning. For example, if an anticipated ADR for a certain period is higher than usual, hotels might decide to boost marketing budgets to maximize room bookings and, thus, revenue. Additionally, predicted ADRs are a benchmark for evaluating financial performance against set objectives, allowing for necessary adjustments. By comparing actual ADR with predicted values, hotels can assess their pricing strategies' effectiveness, detect improvement areas, and adjust their competitive positioning if needed.

Comparing ADR against competitors. When it comes to competitive market insights, the goal becomes predicting the competitors' ADR and comparing it with your rates. This requires competitive pricing data, which is more difficult to collect, but the strategic advantage is worthwhile. By comparing your ADR levels against competitors or market averages, you can better understand your market position and set rates that attract customers while maintaining profitability.

For example, at AltexSoft, our team developed two algorithms to support Rakuten Travel, Japan's leading online booking platform that owns several hotels. The initial algorithm was designed to predict ADRs across competitor hotels, furnishing a comparative market perspective. Subsequently, a second algorithm was developed to forecast the occupancy rate for one of Rakuten's small family hotels, considering the differences between the predicted ADRs and the price set by the hotel itself. These sophisticated algorithms, in tandem, optimized revenue by facilitating more informed decisions on initial room pricing.

Alexander Konduforov, who served as a Data Science Competence Lead on this project, underscores the importance of competitor pricing knowledge: "By analyzing your competitors' rates, you can understand how much cheaper or more expensive or cheaper you are compared to them. This information helps you set prices to attract customers while ensuring that you remain profitable."

By focusing on both your hotel's ADR and that of your competitors, you can gain a holistic understanding of your market position. This dual tracking allows you to leverage ADR as a strategic tool for making data-driven decisions, optimizing occupancy rates, and enhancing profitability.

Sounds great, right? It definitely does, but utilizing machine learning for ADR prediction in the hotel industry presents various challenges.

Challenges to consider when predicting ADR

Embarking on the journey of ADR prediction introduces certain complexities, which we'll cover in this section.The intricacy of the ADR calculation. ADR is subject to many internal and external factors, just like other hotel pricing concepts. For machine learning models to predict ADR effectively, a comprehensive understanding of these variables is required in the data preparation stage.

Among the internal factors are

- historical ADRs,

- operational costs,

- room types,

- occupancy rates,

- seasonal booking trends,

- special promotions and discounts, etc.

- competitors' ADRs,

- economic indicators,

- local and international events,

- inflation rates, and

- sociopolitical conditions, to name a few.

Data shortage and poor quality. The precision of ADR prediction hinges on the availability and quality of data, such as historical ADRs and occupancy data. In instances where significant data is missing or unreliable — such as a newly opened hotel with minimal historical data — the accuracy of machine learning models may be negatively impacted.

Alex Penades, Chief Marketing Officer at Avantio — a vacation rental software provider — emphasizes the importance of quality historical data for practical AI applications. He cautions, "However, such data might not be available in all areas or markets. Just like any other statistical databases, if the data is biased or incomplete, it can result in misleading or inaccurate conclusions when applying AI. Consequently, machine learning may become slower or deviate from the objective of accurate prediction."

Unique property variance in vacation rentals. The vacation rental industry is notably diverse, with individualized properties varying from traditional apartments to unique accommodations such as boats or repurposed buildings. This intrinsic diversity poses unique challenges for ADR prediction. Since for vacation rentals, ADR is a relatively new concept, with inconsistent historical data available, developing efficient ML models can be particularly challenging.

Alexia Zottu, Director of International Customer Care at Avantio, explains:

"The VR sector often boasts unique properties, where in many cases, there are no two alike. This drives the business model and management to be very different depending on the portfolio of properties, making it sometimes less intuitive for property managers to incorporate ADR in their KPIs."

Incorporating ADR in vacation rentals is vital as it gives a direct measure of income per booked room. However, it's not the sole indicator of financial health.

For instance, if a rental sees a rise in ADR but a significant dip in occupancy, the total revenue could still decline. A higher ADR doesn't guarantee increased revenue if bookings are infrequent. Thus, balancing a favorable ADR and a good occupancy rate is key.

But whatever challenges there are, utilizing machine learning techniques to predict ADR pays off big time. Let’s take a look at how things work under the hood.

How to predict ADR trends using machine learning

It’s not a secret that data forms the crux of any machine learning endeavor: Obtaining high-quality, relevant data is nonnegotiable for developing a robust ML-based ADR prediction model.For a more in-depth understanding of this topic and other essential concepts, we recommend reading our comprehensive article on data preparation for machine learning. If you prefer a more visual explanation, consider viewing our concise video on the same topic.

Data preparation for ML projects in 14 minutes

Data collection and preprocessing

For constructing ADR prediction models, you gather much booking information from trustworthy data sources such as follows.Hotel software, including Property Management Systems (PMSs), hotel websites with a direct booking module, and channel managers, stores detailed information about reservations and pricing, such as booking lead times, occupancy data, and the rates at which particular rooms or accommodations were reserved during a specific period.

Specialized hospitality data providers like PHP TRAVELS and Key Data consolidate various travel data types into a single platform.

OTAs such as Airbnb and Booking.com and metasearch engines like TripAdvisor can also supply valuable data on pricing, bookings, and lodging availability. Keep in mind, though, that it's crucial to adhere to legal guidelines to gather data from these sources.

Public datasets from platforms like Kaggle can offer supplementary booking information. But such datasets may have limitations in size and feature depth, potentially hindering the development of an effective model. Read our dedicated article for more information on the top public datasets for machine learning.

Once the data sources are chosen, the next step is to structure the dataset for your ADR prediction model.

The dataset usually contains variables such as historical ADRs, operational costs, room classifications, occupancy trends, competitor prices, and significant external influencers.

For example, when constructing a dataset for ADR prediction, in our AI project for Rakuten Travel, we used

- proprietary reservation data from the hotel's PMS (including ADRs, booking lead times, and reservation dates);

- reservations data from 80+ hotels in the same region;

- hotel attributes (location, property type, max capacity);

- room amenities;

- seasonal indicators (high season, low season); and

- external factors like holidays and vacations.

Popular machine learning models to predict ADR

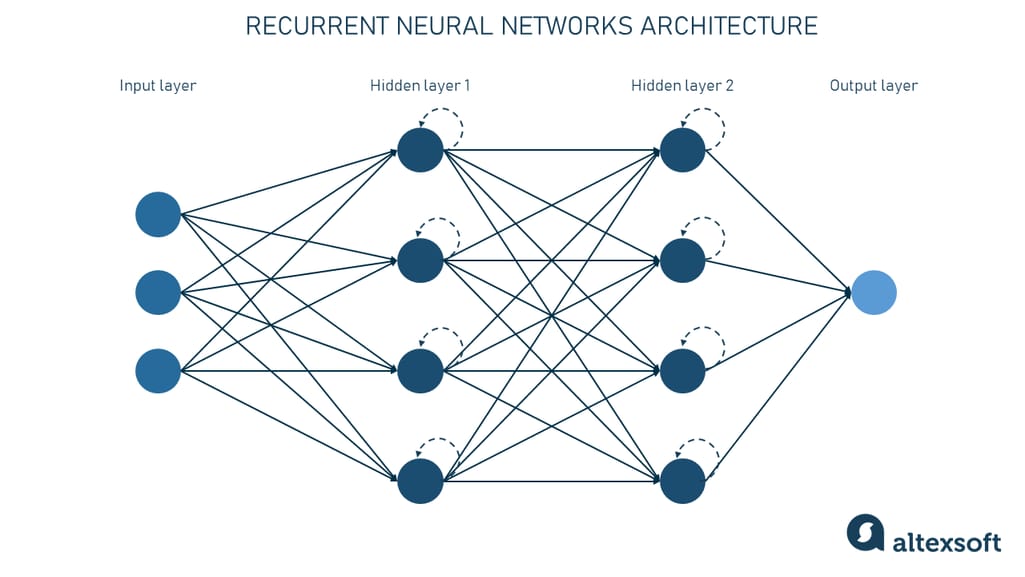

When predicting ADR, various machine learning models can be deployed, but some have proven particularly effective due to their unique abilities and attributes. Here, we'll explore two such models — Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) networks — and their application to ADR prediction.Recurrent Neural Networks (RNNs) are a specialized category of deep neural networks designed to remember previous outputs and integrate them into current computations. This characteristic distinguishes them from traditional neural networks, which typically process each input and output as separate entities.

Recurrent neural network architecture.

This neural network type possesses an internal memory, visualized as several copies of a neural network with interconnected loops. Each network's copy passes a message to the succeeding copy. The decision-making process incorporates both the current input and the learned output from preceding inputs.RNNs excel in time-series forecasting, which involves recognizing intricate sequential patterns and long-term dependencies in data. This makes them ideally suited for predicting temporal changes in ADRs.

Similar to other neural networks, RNNs demand a substantial amount of data to ensure accurate predictions. So if you're working with a massive dataset and need a model to generalize effectively across all data, opting for neural networks like RNNs is a logical step.

However, standard RNNs are limited by the vanishing gradient problem. This is where the influence of inputs from earlier in the sequence fades over time, hindering the model's performance when handling longer sequences.

Long Short Term Memory networks extend the concept of RNNs by addressing the vanishing gradients problem. In essence, LSTMs employ a cell structure that selectively retains or discards data as the model processes information. This allows the network to maintain relevant data from the early stages of the sequence, thereby providing more accurate predictions over time.

Each LSTM cell features three primary components or gates.

- The input gate determines which new values in the data should be updated in the cell state.

- The forget gate decides which data points are unnecessary and can be discarded.

- The output gate regulates which processed information should be used as output.

Basically, both RNNs and LSTMs work well for predicting ADRs, given their ability to handle sequential data effectively. However, the choice of model would depend on the specific requirements of the task, the length of the sequences involved, and the volume of data available.

In some cases, you may opt for simpler models like XGBoost, and there are several reasons why. Simpler models may be more suitable when computational resources are limited or when there's a need for faster model training and predictions. They can also be easier to understand and explain, which can be crucial in specific business contexts. Therefore, while complex models like RNNs and LSTMs have their virtues, consider the power of simpler models in the right circumstances.

Model deployment, testing, and validation

Once the model has been trained, it is evaluated using previously unseen data. This stage is vital for confirming the model's forecasting capabilities and addressing any issues that may have been spotted during training. Machine learning metrics such as Root Mean Square Error (RMSE) and Mean Absolute Percentage Error (MAPE) are frequently employed to assess the model's performance and precision in predicting ADRs.By repeatedly testing and refining the model, it is ensured that the most significant features and patterns are captured, leading to enhanced accuracy in predictions. You may discover that you need more data or features during this stage, prompting another round of data gathering and preprocessing. Ongoing improvement is necessary to maintain the model's relevance and accuracy in line with changing market conditions.

It's worth noting that the goal is not solely to develop a predictive model but to create a trustworthy and efficient instrument that can assist you in making strategic decisions, optimizing pricing tactics, and, ultimately, boosting profitability.