This article is designed for those entering the travel space. Whether you want to learn how bed banks operate, understand how they fit into the hospitality ecosystem, or explore new opportunities in the distribution chain, you'll find insights into their role in travel sales.

What are bed banks?

Wholesalers, known as bed banks, are specialized B2B platforms that buy inventory from accommodation providers in bulk at a discounted price for specific dates and sell via their extensive network of travel retailers and intermediaries. This network includes online travel agencies (OTAs), travel management companies (TMCs), global distribution systems (GDSs), traditional travel agents, destination management companies (DMCs), tour operators, other bed banks, and airlines offering bundled travel packages to their customers.

So, bed banks serve as middlemen between travel suppliers (primarily hotels) and travel resellers. They help hotels maintain decent occupancy rates and provide travel companies with inventory for their end customers.

Major bed banks and their inventory

In addition to selling accommodation alone, bed banks often bundle inventory with transfers, car rentals, catering, or guided tours and attractions. Providers of these services are contracted in a similar way as hotel partners.

What is the history behind bed banks?

Although hotel room wholesalers have been around since the late 1960s, the modern concept of bed banks didn’t really take shape until much later.

Among the pioneers was Las Vegas Reservation Systems (LVRS), launched in 1990 by Tim Poster. The company purchased hotel rooms in bulk and sold them directly to consumers at highly discounted prices through the website. In 1993, Tom Breitling joined his close friend Poster to develop the business together.

At the end of the decade, the wholesaler, renamed Travelscape, worked with over 1,400 hotels in 240 cities worldwide and broadened its offerings to include airline, car rental, and cruise reservations. The company's success and innovative strategy were the reasons Expedia acquired it in 2000, and made it the cornerstone of its hotel distribution business.

One of the oldest major bed banks still in operation today is Hotelbeds. It was founded in Spain in 2001 as part of the UK travel company First Choice (now part of TUI Group) and spun off as an independent company in 2016. Next year, another forerunner, GTA, initially part of the British travel company Gullivers Travel Associates, joined Hotelbeds. Today, it is the flagship brand of the HBX Group, which includes another large bed bank, Bedsonline, and other tech-travel products.

Newer players enter the market, competing with long-established giants. For instance, WebBeds, launched in 2013, already overtook Hotelbeds in the number of properties—an impressive achievement given Hotelbeds’ decade-long head start. At the same time, Hotelbeds claims to be better in exclusive hotel partnerships—its entire portfolio of 300,000 properties is directly contracted, which means securing the best conditions. WebBeds lists over 500,000 chain and independent hotels, having direct deals with only 90,000+ of them.

In the early days, bed banks promoted their inventory through large printed brochures and processed bookings via email and fax. You’ll probably be surprised, but they still regularly publish brochures (including online) and can process reservations via email. Of course, it is now a minor communication channel. Let’s see how wholesalers work today.

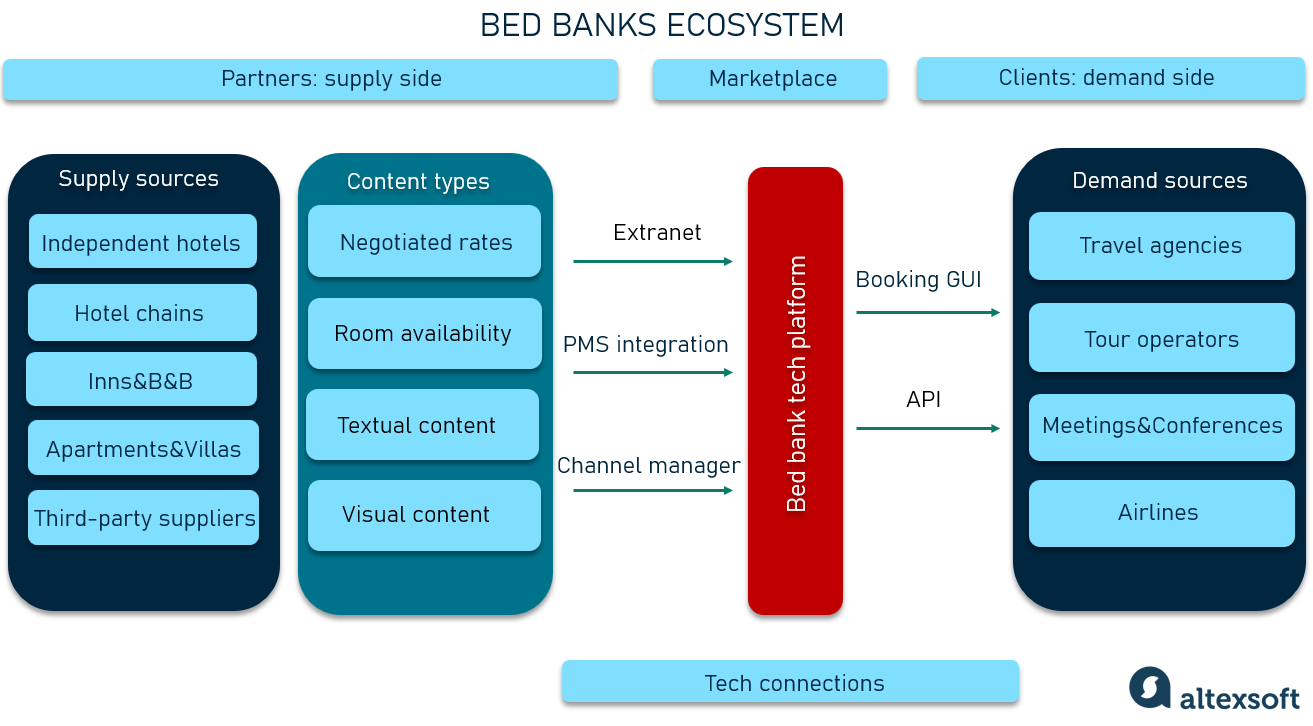

How do bed banks work?

Bed banks connect sources of supply and demand that would otherwise be unaware of or unable to access each other. They feature photos and detailed descriptions of locations, services, amenities, and room availability on their B2B platforms so the clients (travel sellers) can choose and book offers.

How bed banks work

Among inventory providers are hotel brands and independent hotels, inns, and alternative accommodations (guesthouses, villas, apartments, etc.). By signing a contract with a wholesaler, a hotel or other player agrees to allocate a certain portion of its properties at a negotiated rate and not distribute them elsewhere. In return, the bed bank takes responsibility for selling these rooms via its extensive distribution network. To give you an idea, GRNconnect has 35,000 agents registered, and WebBeds onboarded over 50,000.

Like any middleman, a wholesaler makes money by adding a markup to a net rate or negotiating a commission (we’ll look at the different scenarios later).

Besides contracting hotels, wholesalers also collaborate with third-party suppliers—local agents who represent multiple hotels within a specific region and have direct relationships with them.

Bed banks specialization

Some wholesalers, like Hotelbeds, GoGlobal, or Hotelstone, cover broad geographic regions and cater to various businesses. Others specialize in particular areas or travel partners. For example, Corean Hikari Global is one of Asia's most respectable bed banks, primarily partnering with properties in Japan, Singapore, Hong Kong, and Thailand.

Argentinian Mybeds concentrates on hotels in Latin America. UmrahHolidays International (UHI), a brand operated by WebBeds, is a local Saudi Arabian bed bank working directly with 1,000+ hotels in Makkah and nearby cities, and it traditionally focuses on religious tourism.

There’re wholesalers who work with specific types of suppliers. For instance, Bonotel onboards independent hotels for luxury travel, mainly around the US, and Restel Hotel, although partnering with a wide range of properties, has a separate platform, Domus Selecta, for gourmet and boutique hotels.

Tech connections with suppliers

Communication between a hotel and wholesaler can be done in two ways: manually via the extranet or automatically via direct connection with the property manager system (PMS) or channel manager.

Extranet. This is a wholesaler's admin panel where the hotel owner or manager can manually upload all information about the allotted inventory: availability, rates, photos, description, and other data. Some examples of such extranets are Hotelbeds Partner Portal and Tale Travel Extranet contracting tool.

When a reservation is made, the wholesaler sends the booking details, such as dates, guest names, and contact information, back to the hotel via email so that the property manager can update the data.

The extranet was the only way for suppliers to cooperate with wholesalers in the 1990s and early 2000s, but many independent hotels still use it today. It makes sense if the contract is for a fixed price or the rate changes rarely (say, once or twice a season).

PMS integration. Hotels can connect their PMS directly to the wholesaler’s B2B platform via API. This integration enables real-time data exchange on rates and availability, reducing the risk of overbookings and lost sales.

Channel manager. Major bed banks are integrated with tens of channel managers (e.g., SiteMinder, e-GDS, HotelRunner, etc.), so a hotel can rely on the familiar tool it already employs for distribution. For example, Hotelbeds partners with over 200 channel managers, while WebBeds leverages connections with over 80 channel managers and hotel switches.

Tech connections with resellers

Bed banks offer travel resellers access to their services through two primary channels: a booking platform and API integration.

Booking platforms. As we said, modern bed banks operate an online platform or marketplace where resellers can access a list of partner hotels and other products. These listings typically include descriptions, services, amenities, images, and real-time availability. Registered travel agents can easily search and book various services from a single interface.

Booking APIs. For more advanced data exchange, bed banks provide APIs that enable the agency to connect their apps and websites with the bed bank’s travel inventory and get access to

- static content (photos and descriptions),

- dynamic content (pricing and availability for hotels, activities, and transfers) and

- booking management functionality.

Hotelbeds, GRNConnect, or HPro Travel, are examples of wholesalers publishing detailed API documentation, while many others share it on request.

Some companies, like All4Go, GRN Connect, and Go Global, additionally offer white-label solutions for agents without websites.

To learn about Hotelbeds API implementation, read our dedicated article.

Bed banks and payment flows

Bed bank operations involve complex payment processes which will vary depending on the agreements with suppliers and distributors. Let’s break down the key setups impacting wholesale cash flows.

Prepaid vs pay-on-consumption scenarios

Wholesalers can either purchase a block of rooms at bulk rates or follow the more flexible scenario called pay-on-consumption.

Prepaid guarantees. In this scenario, the hotel receives payment whether or not the inventory is sold, and such guarantees are usually tied to a fixed price. It is an attractive option for non-tech-savvy properties with owners prioritizing upfront revenue for financial stability. However, this approach can limit a hotel's potential profit. If demand unexpectedly surges, the pre-allocated rooms could have been sold at significantly higher rates, but the hotel has no control over prices under a prepaid contract.

This arrangement also carries serious financial risks for wholesalers, as unsold inventory results in direct losses. To mitigate this, bed banks often offer last-minute deals to OTAs or other resellers.

The prepaid scenario was prevalent in the 1990s and early 2000s. While bed banks still leverage it—especially for high-demand properties or exclusive inventory deals—contract terms have become more flexible. For example, wholesalers purchase only a portion of the allocated inventory while selling the rest under the pay-on-consumption terms. Besides, agreements typically specify release periods (30–60 days before check-in), when bed banks can return unsold rooms to the hotel without penalty.

Pay-on-consumption. Nowadays, accommodation providers increasingly seek greater control over pricing, driving a trend toward a pay-on-consumption approach, where payment is only made for rooms that are actually sold.

In this scenario, hotels typically offer wholesalers a fixed discount off the BAR rate (best available rate for a specific room type and date) instead of a locked-in price. This allows hotel revenue managers to dynamically price the contracted inventory depending on the actual demand. Price updates happen automatically if the bed bank’s platform is integrated with the hotel’s property management system (directly or via a channel manager). With pay-on-consumption, hotels don’t miss the opportunity to earn extra money while reducing financial risk for wholesalers—a win-win for everyone.

Merchant vs commission-based models

When an actual booking occurs, a bed bank can process the transaction itself (in other words, act as a merchant of record) or outsource this responsibility to a reseller. Most wholesalers support both options and choose between them depending on conditions.

Agency vs merchant model in travel

A bed bank is a merchant of record. In this setup, the bed bank applies a markup to a bulk rate (either fixed price or discounted BAR) and makes a final price available to a reseller operating on an agency model (also called commission-based.) Later, the wholesaler would pay an agent a commission for the sold inventory.

Example: a bed bank negotiates a cost of $80 per room from a hotel, then applies a markup of $20 and shows a retail price of $100. Upon booking, the bed bank processes the payment and returns a negotiated commission (for instance, $10) to the agency.

A bed bank is not a merchant of record. A wholesaler serves as a sheer intermediary between hotels and resellers operating on a merchant model.

Example: a bed bank says to an OTA, “I've made arrangements with the hotel. Here’s the room for $90 per night.” A travel agency marks up a rate exposed via a wholesaler and sells the room to a traveler for $100. A bed bank earns a $10 commission from a hotel for facilitating the booking.

A mixed setup. Being a registered merchant of record, a wholesaler can also earn part of the revenue as a commission. For example, long-standing hotel partners can be managed under the merchant model, while with new or less established properties—where demand is still uncertain—may be better to use a commission-based approach.

The commission-based model is also a good fit for inventory sold under pay-on-arrival conditions, where no prepayment is required.

Regardless of the scenario, all financial transactions involve a bed bank; the agency and the hotel do not pay each other directly. When do all parties get their money? It depends on multiple conditions and arrangements inside this multi-layer distribution structure. Final settlements can sometimes happen months after the booking occurs.

Cancellation policies

Bed bank cancellation policies are often, but not consistently, more severe than hotel policies. For example, a smaller UK wholesaler, Bedbank.com, deducts the full booking fee if a reservation is canceled less than 15 days before arrival. Bed banks may also charge an additional fee per person for administration costs incurred in case of booking changes. For instance, HPro Travel charges $17. Bonotel has a fee of $25 for any changes to an existing booking and $30 for refunds.

Bedbank-hotel relationships

Thanks to cooperation with wholesalers, hotels can count on a steady occupancy rate, even during periods of low demand. Besides, property owners do not need to maintain relationships with multiple travel companies; the bed banks serve as the primary point of contact.

Working with middlemen also enhances visibility for accommodation providers, especially independent ones. It allows the latter to compete with major brands without high marketing costs. Through intermediaries, these hotels gain access to offline travel agencies and customer segments—such as tour groups and conference attendees—that they might not otherwise reach.

Last but not least, the bed banks usually intervene to resolve disputes between partners and clients. Major wholesalers have extensive and experienced multilingual support teams that work 24/7 and offices in key locations.

In a way, bed banks are to hotels what GDSs are to airlines—an important centralized distribution channel without the oligopoly position of GDSs.

Rate disparity risks

When a wholesaler exposes a discounted rate to a travel reseller, there could be an unpleasant collision. Some bad actors in this complex distribution chain may undercut agreed-upon retail pricing and advertise lower rates online. For example, inventory expected to be bundled into a package sometimes turns out to be “split” and sold at a significantly reduced price on the customer-facing OTA platforms.

This leads to a breach of rate parity agreements. Rate parity in hospitality means maintaining the same price for the same room type across all public distribution channels, such as the hotel's website, OTAs, and GDSs. Rate parity is an industrial rule; its violation harms the hotel's reputation and relations with partners.

Any discrepancies between booking channels immediately become apparent on the Internet due to meta search engines such as Google Hotel Ads, Kayak, and Trivago, which hunt for all available options and organize them in ranked lists.

However, since the hotel doesn’t have direct contracts with OTAs that purchase from wholesalers, it has little control over the negotiated rate leakages.

To avoid trouble, accommodation providers can apply the following strategies.

Carefully review contracts with wholesalers and distribution partners to include specific rate parity clauses, ensuring that the intermediary cannot offer rates directly to consumers.

Conduct regular audits of pricing practices among distribution partners to ensure compliance with contractual obligations.

Leverage monitoring tools to enforce pricing consistency across all channels. Rate shopping tools help collect and analyze your and competitors' prices, demand, and occupancy data.

Major reputable wholesalers are interested in maintaining price integrity. Their standard terms and conditions often include the rule prohibiting an agency from showing a price breakdown of the services in a package. Some of them, like Hotelbeds and WebBeds, provide their own monitoring instruments. Also, bed banks have resources to combat rogue, third-party, non-contracted OTAs that sell discounted rates initially intended for other channels.

Bed bank–travel agencies relationships

Let's take a look at the advantages travel agencies get by working with wholesalers.

A wide selection of hotel inventory and packages at low rates. This allows resellers to offer travelers attractive prices in tens of destinations.

Quality assurance. As intermediaries, wholesalers take on quality assurance: they scrutinize partner hotels down to industry standards for fire, health, and safety. Travel agencies simply do not have the same technical capabilities and resources.

Access to hard-to-reach and niche markets. For example, China's DidaTravel has comprehensive coverage in the Asia-Pacific region for over 100 independent hotels, plus regional and local hotel chains. The British Vertical Travel Group's specialty is luxury hotels in Greece, Cyprus, and the Canary Islands.

Local expertise. It is not only about accommodation but also various services, such as tours with local guides, sports events, theatre and museum tickets, etc. Wholesalers know the local markets or know people who do.

Flexible financial policies. Due to their scale, wholesalers can manage money more freely and provide credit lines to established, reliable partner agencies with a strong payment history. Sometimes, it means allowing post-stay billing.

Incentives. Some wholesalers, such as Bedsonline, GRN Connect, and TBO, have reward programs for agents: you get points for each booking and can exchange them for hotel vouchers, airline miles, etc.

Future of bed banks

Once irreplaceable travel intermediaries, nowadays, bed banks face several challenges as the industry adapts to shifting trends.

First of all, it’s small and medium-sized businesses, both on the supply and demand sides, that rely most on wholesalers’ services. The issue for bed banks is that traditional independently run and modestly scaled tour operators and travel agencies are declining worldwide. The COVID-19 pandemic only accelerated this process.

The number of brick-and-mortar travel agencies in the US has decreased dramatically, and the UK has seen a similar downturn: the number of UK travel agencies has dropped by nearly 18 percent in the past few years from over 4,200 travel agency shops in March 2019 to just 3,500 by June 2023.

Another factor is the global "branding" of the hotel industry, with an increasing share of hotel rooms belonging to major chains rather than independent properties. Today, large brands account for 70 percent of US hotel inventory. These giants increasingly bypass traditional B2B wholesalers, selling their inventory via direct channels or large OTAs like Booking.com and Expedia.

However, bed banks are evolving to stay relevant. Some are now positioning themselves as OTAs in their own right, offering a dual value proposition. This shift allows them to maintain a strong enough position in the ever-changing travel distribution landscape.

Olga is a tech journalist at AltexSoft, specializing in travel technologies. With over 25 years of experience in journalism, she began her career writing travel articles for glossy magazines before advancing to editor-in-chief of a specialized media outlet focused on science and travel. Her diverse background also includes roles as a QA specialist and tech writer.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.