Global spending on business trips is projected to reach $2 trillion by 2028, and organizations worldwide are looking for smarter ways to manage their travel budgets. Corporate cards have become a reliable solution for companies seeking to control expenses, enhance employee convenience, and gain real-time insights into spending patterns.

This article will explore how corporate cards simplify travel and expense (T&E) management, their key benefits, and what to consider when choosing one for your organization.

Looking for the right corporate travel management company to work with or the appropriate T&E management software to use? Explore our dedicated articles for expert advice.

What are corporate travel cards?

Corporate travel cards are payment cards companies issue to employees for business travel expenses like airfare, car rentals, client events, accommodation, and meals. While traditionally used for travel spending, some corporate travel programs allow staff to use these cards for office-related costs that may occur during business trips.

Unlike personal cards, which only carry the cardholder's name, corporate cards can have the employee’s, the organization’s, or a combination of both.

Not all companies qualify for corporate cards. Instead, they are typically issued to larger corporations that meet specific financial criteria, like a strong credit history and high annual revenue.

Key players in corporate card issuance and management

Corporate cards are issued by a single entity, typically a bank. However, other organizations, such as fintech companies, are involved in managing these cards.

Global card networks. Global card networks form the backbone of the payment industry. They include Visa, Mastercard, American Express (AmEx), Discover, UnionPay, and Japan Credit Bureau (JCB). These organizations process card transactions and set safety requirements — such as the Payment Card Industry Data Security Standards (PCI DSS) — to protect confidential information from theft.

National banks. National banks act as intermediaries between global card networks and businesses. They issue cards by collaborating with networks to offer branded corporate cards. They also tailor their cards’ features, such as rewards and credit terms, to suit local market needs.

Fintech companies. Fintech companies like Brex, Ramp, and Airwallex have disrupted traditional banking by offering corporate cards with features like real-time tracking and category restrictions. They also support integration with third-party accounting and expense management software.

Corporate expense management companies. Corporate expense management firms like Zoho Expense, Expensify, Payhawk, and Rydoo specialize in providing end-to-end solutions for managing business expenses. These companies often provide corporate cards as part of their broader service offerings. They partner with global card networks, banks, or fintech companies to issue cards.

How corporate travel cards help businesses manage travel expenses

Corporate travel cards provide several advantages for businesses, helping them manage business travel expenses.

Simplified bookings and payments. Corporate travel cards eliminate the need for employees to use personal funds for business travel. Instead, they can book flights, reserve hotels, and pay for meals using the card.

Streamlined expense tracking and categorization. Corporate card platforms automatically record transactions and categorize them into different expense buckets. This simplifies booking, enforces compliance with tax regulations, and offers businesses a detailed view of travel spending — all while saving time and reducing workloads.

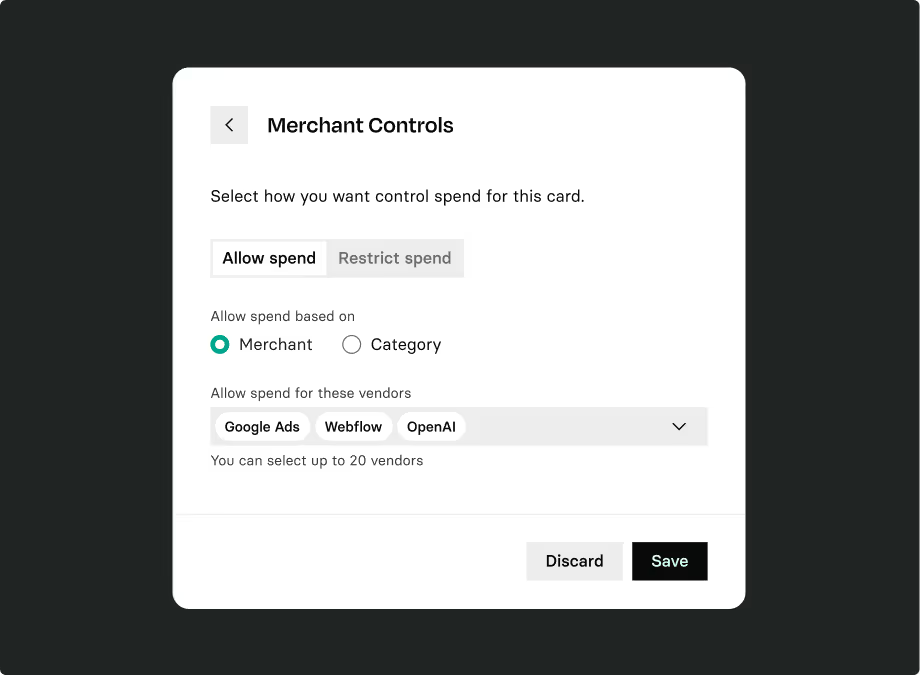

Enhanced financial control. Employers can set spending limits, restrict purchases to specific categories, and monitor card usage in real-time. For example, employers can configure a corporate travel card to allow only travel-related expenses with a $1,000 limit per trip. This ensures that employees use the card solely for business travel needs, which controls costs and prevents misuse.

Compliance and policy enforcement. Corporate travel cards can be configured to enforce company travel policies automatically. For example, restrictions can be placed on luxury hotels or first-class airline tickets, ensuring compliance with organizational guidelines.

How do corporate cards work?

Let’s explore how corporate cards work, starting with the initial application process.

Read our dedicated article for a deeper dive into the technical aspects of online payment processing.

Application and approval

The process starts with selecting a corporate card provider and applying for their card service. The application procedure involves the company submitting necessary documents, including financial statements and business registration details.

The card issuer checks to see if the company meets its eligibility criteria. If it does, the business is approved and accepted into the provider’s corporate card platform.

Card issuance and distribution

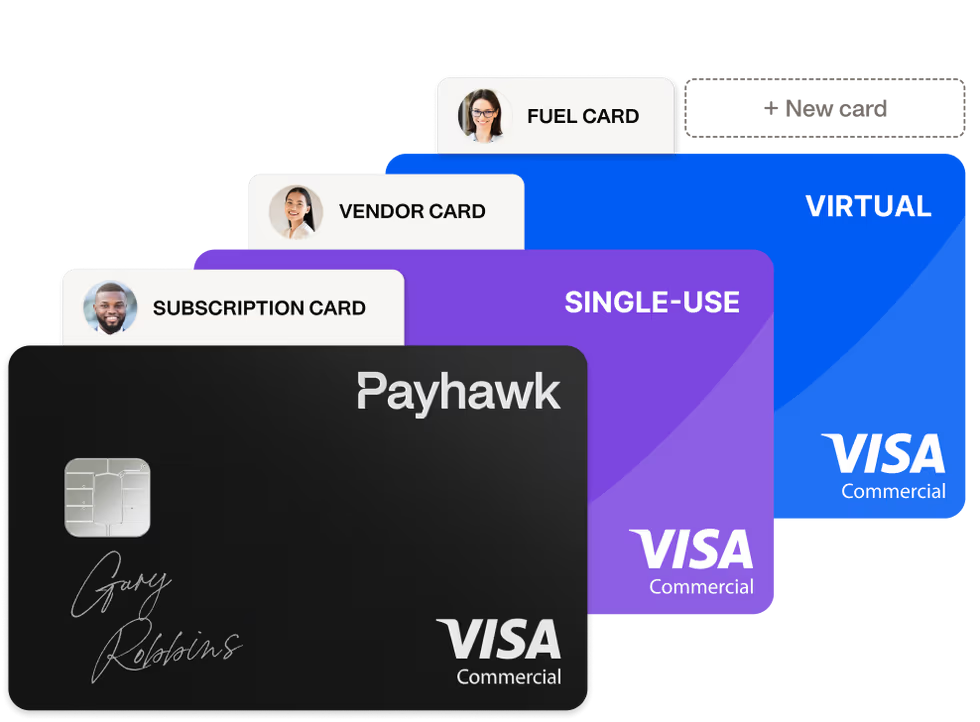

Once onboarded to the platform, the company — typically the finance team or designated administrators — can create as many cards as needed, tailoring them to specific individuals, departments, or purposes. Depending on the intended use and the provider's options, the cards may carry the name of the assigned employee, the department, or the company.

Before issuing the cards, businesses usually train employees on proper usage, business travel policies, and reporting requirements to prevent abuse.

Setting card limits and control

While creating the cards on the provider’s management platform, the employer configures the spending limits, allowed expense categories, and specific usage rules based on the company's travel and expense policies.

It’s possible to assign different spending limits, categories, and rules to different employees or teams depending on their roles, responsibilities, or travel needs. For instance, a sales executive who travels frequently may have a higher spending limit and be allowed to expense flights, hotels, and client dinners. Meanwhile, a junior employee attending a local conference might have a lower spending limit that’s restricted to transport and meals.

Tracking transactions and verifying payments

Once employees start using corporate cards for approved expenses, transactions are tracked via the combined efforts of the issuer, the card network, and the business:

The issuer checks the transaction against the cardholder's credit limit, ensures sufficient funds are available, and validates that the purchase complies with company-approved spending rules.

The card network acts as the intermediary between the issuer and the merchant. It processes and routes the transaction securely.

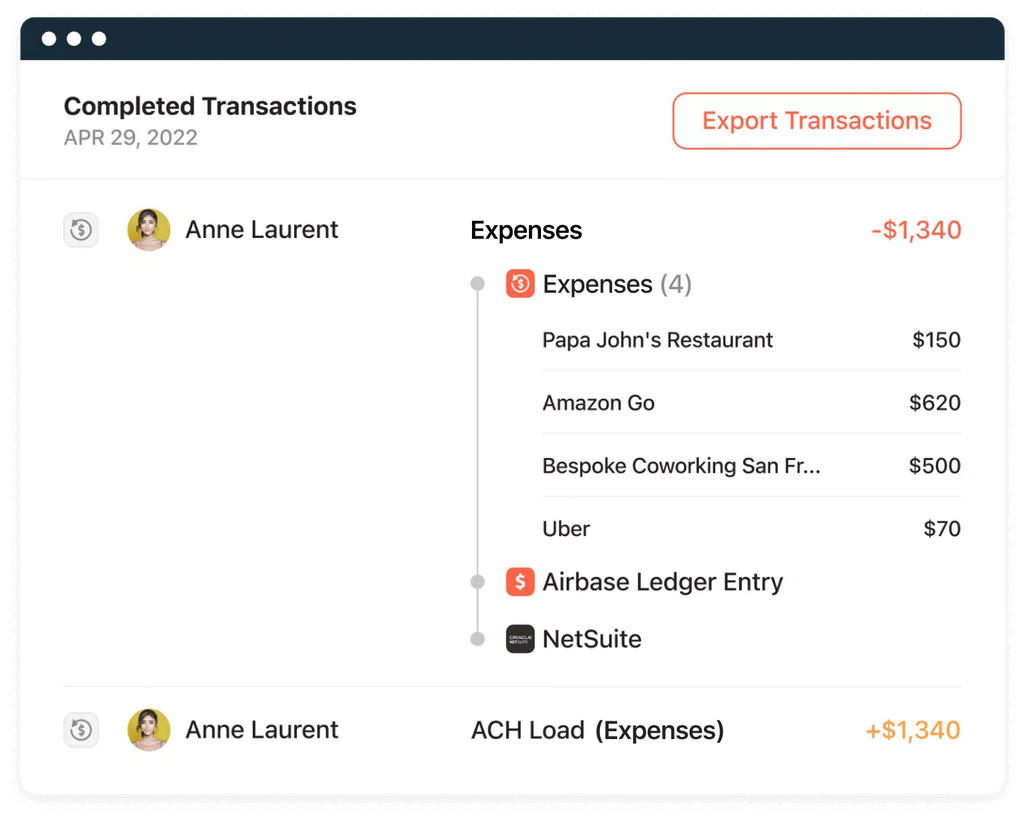

The business uses accounting management software integrated into the card platform to track and manage transactions that are approved by the issuer and processed by the network. Some systems automatically categorize expenses and flag transactions that violate company policies

Reconciliation of expenses

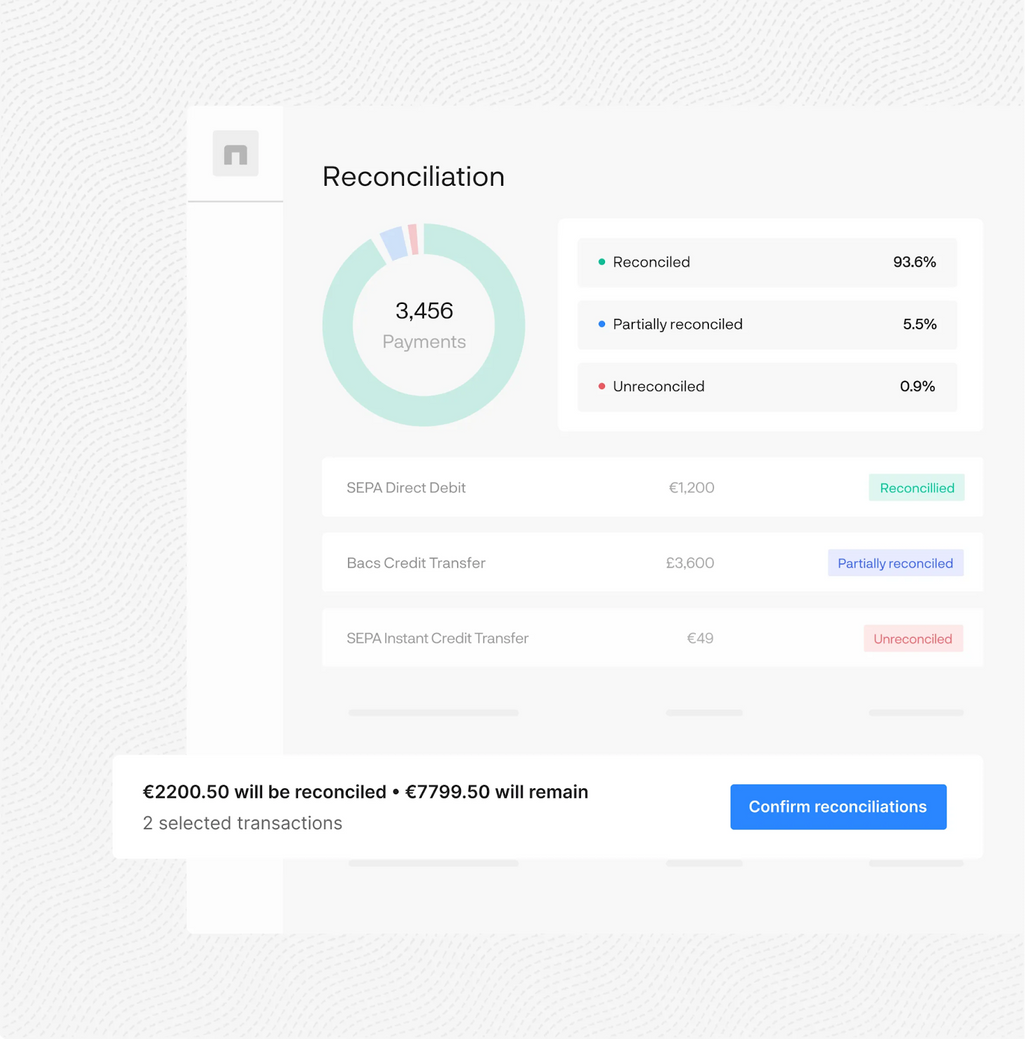

Finance teams reconcile the expenses by matching transactions with receipts and expense reports. Many corporate card platforms have expense management dashboards that match transactions with uploaded receipts and flag missing documentation or policy violations.

Payment reconciliation system. Source: Numeral

These platforms also provide reporting capabilities, allowing finance teams to generate detailed reports to evaluate spending patterns and department budgets.

Billing and settlement

Most corporate card providers consolidate all transactions into a single monthly statement, making it easier for the company to review, reconcile, and settle payments. The billing statement typically includes a breakdown of all expenses.

Payment terms vary by provider, but most corporate card programs require the company to settle the balance in full within a set timeframe, often 30 days. Some providers offer extended payment terms or installment options for larger balances, though this may come with additional fees or interest.

Factors to consider when choosing a corporate card for your business

There are various corporate travel card providers to choose from. Here are some criteria to consider when evaluating vendors.

Type of card

The first step in selecting a corporate card is understanding the type of card that suits your business. There are main options:

Debit cards that are linked directly to a bank account. When used, they immediately withdraw funds from the account.

Credit cards that allow businesses to borrow money up to a certain credit limit for making purchases. The company must repay the borrowed amount but can carry the balance month-to-month.

Prepaid cards that are loaded with money in advance, with their balance acting as the spending limit. They aren’t connected to a bank account and must be refilled once the money in them is exhausted.

Charge cards are similar to credit cards, but the balance must be paid off each month — or each billing cycle. They often have higher spending limits but are more expensive.

Also, consider whether you need individual employee cards or department-specific cards. Each type serves different purposes, so assess your spending patterns and choose accordingly.

Expense management features

A solid corporate card provider should simplify expense management for a business and its employees. Look for systems that offer real-time expense tracking, automatic categorization, mobile receipt capture with OCR technology, automated approval workflows, instant receipt matching, and integration with your accounting software.

For instance, a card that automatically categorizes a purchase at Delta as "Travel" and matches it with an uploaded receipt saves considerable time.

Global acceptance and fees

If your business operates globally or requires frequent international travel, ensure the corporate card works seamlessly across borders. It’s also important to consider these fees:

- Foreign transaction fees: Some cards charge up to 3 percent per transaction, while others have no foreign fees.

- Currency conversion rates: Some issuers offer better rates than others

- Annual fees: Some cards have high annual charges but offer superior rewards and benefits, while others waive the fee entirely.

- Late payment penalties: Charge cards often come with hefty late fees if balances are not settled on time.

For instance, a large corporation with US and European operations might choose a card that offers multi-currency accounts and strong global coverage, even if their charges are high. On the other hand, a startup with tight budgets may prefer a vendor with low/no fees.

Rewards and perks

Corporate cards often come with rewards programs and perks like cashback on business purchases, travel insurance, and travel rewards (cards with airline miles, hotel discounts, or airport lounge access). These perks can maximize ROI and make the cards worth it in the long run.

Customer support

Strong customer support is a must for resolving issues like fraudulent charges, card loss, or technical glitches. Ensure the issuer provides round-the-clock support, especially if you operate across time zones. Larger organizations may benefit from a dedicated representative who understands their specific needs.

Integration capabilities

A corporate card platform that seamlessly connects with your existing tools and provides APIs for custom integrations can save significant time and reduce manual efforts. Look for providers that offer compatibility with popular accounting software like QuickBooks, Xero, or SAP and expense management platforms such as Expensify, Concur, or Zoho Expense to ensure smooth expense tracking and reconciliation.

Some corporate card issuers like Ramp provide direct integrations with specific banks, which gives businesses access to higher credit limits.

Corporate travel card alternatives

Corporate travel cards are a go-to solution businesses use to manage T&E expenses. However, their strict eligibility requirements and high fees make them unsuitable for all companies, meaning alternatives are required, especially for SMEs or startups.

Corporate cards vs business credit cards

Unlike corporate cards, which are tailored to large companies, business credit cards cater to institutions of all sizes and are commonly used by small businesses or sole proprietors. They are also easier to obtain than corporate cards and have no stringent requirements.

Corporate cards provide more granular control over travel expenses than business cards, as employers can set individual spending limits for each employee based on their role or travel needs. Business cards don’t provide this level of control, making them less effective for managing travel expenses at scale.

For instance, a company can issue a corporate card to an employee traveling for a conference, set the spending limit to $1,500, and restrict the card to only work at travel-related vendors. In contrast, a business credit card might have a general credit limit of $5,000 but cannot restrict where and how the card is used, meaning the employee can cover personal and travel expenses.

Corporate cards vs personal cards

In some organizations, employees use their personal cards to pay for travel trips and related costs. In such scenarios, the staff has to track all receipts and submit them to the relevant department, e.g., finance, for reimbursement. This method mixes personal and business transactions, complicating expense tracking.

Personal cards are a practical option for smaller businesses or infrequent travelers where issuing corporate cards isn’t cost-effective. However, the employee is liable for charges until reimbursed.

Corporate cards vs virtual cards

Virtual cards are digital cards created for one-time online transactions. They have unique card numbers, expiration dates, and CVVs.

While corporate cards provide great spending control, virtual cards provide even more control. They can be generated for one-time use, meaning they become invalid after use. For example, if a business traveler needs to book a last-minute flight, the finance team can issue a virtual card for that purpose alone, with the card becoming unusable after that.

However, virtual cards aren’t universally accepted and are created for online payments. A corporate card, or any physical one, would be needed for in-person payments like last-minute hotel bookings at the front desk. Virtual cards aren't suitable for on-the-ground travel activities.

With a software engineering background, Nefe demystifies technology-specific topics—such as web development, cloud computing, and data science—for readers of all levels.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.