In the foreseeable future, digital wallets will be more widespread than physical ones — if it’s not already the case in some regions. No business can ignore this novel payment method, and the tourism sector is no exception. This article explores how digital wallets function and what value they bring at different stages of travel payment workflow.

What is a digital wallet?

A digital wallet, also known as an electronic or e-wallet, is any application that enables individuals and businesses to make transactions over computer networks using multiple payment options —- credit and debit cards, preloaded funds, cryptocurrencies, Buy Now Pay Later (BNPL), etc.

To ensure safety, e-wallets apply several layers of protection, such as data encryption, multi-factor authentication, and tokenization. The third means that the app replaces real payment details with a unique string of symbols (token), which have no sensitive information. This enables an account number to never be exposed, preventing data breaches.

Mobile wallet vs digital wallet

A mobile wallet or m-wallet is a specific type of digital wallet to be installed on smartphones, tablets, and wearable devices. It leverages additional features like biometric authentication (facial recognition, fingerprint scanning, etc.) and support for contactless payment methods such as

- near-field communication (NFC), which was pioneered by Google Pay;

- MST (Magnetic Secure Transition), exclusively owned by Samsung. It replicates a card swipe, enabling wireless payments via pre-chip terminals; and

- QR codes.

Most smartphone providers offer their proprietary m-wallets compatible exclusively with specific hardware, like Apple Pay for iOS devices and Samsung Wallet for Samsung phones and watches. But there are also universal, platform-agnostic options — for example, the PayPal app.

Types of digital wallets used in travel

Digital wallets in travel can be roughly grouped into three main categories.

Digital wallet apps. When speaking of digital wallets, especially mobile ones, we most often refer to B2C applications allowing end users to buy products and services online, make contactless payments via POS terminals, and transfer money between friends. Some solutions — for example, Apple Pay, Google Wallet, and Samsung Wallet — also store different items people usually hold in traditional wallets, like tickets, driver’s licenses, ID cards, gift cards, boarding passes, keys, and more.

Closed-loop wallets. Unlike universal, open-loop wallets, these options work only within a certain ecosystem. Popular examples are Uber Cash and Walmart Pay. As for travel, think about airlines offering branded e-wallets to preserve loyalty program cards, let travelers book flights, redeem rewards, pay for drinks and food onboard, and more. OTAs also often employ similar solutions, enabling customers to gather and manage rewards or get instant refunds. We’ll give you several examples of such wallets in travel later on.

B2B wallets. Designed to handle transactions between two businesses — for example, travel providers and suppliers — B2B wallets are not as common as B2C ones. Some platforms, like PayPal, offer both consumer and enterprise solutions.

Below, we’ll examine each type separately, putting the main focus on the first, most widespread category — end-user wallet apps.

Digital wallet apps

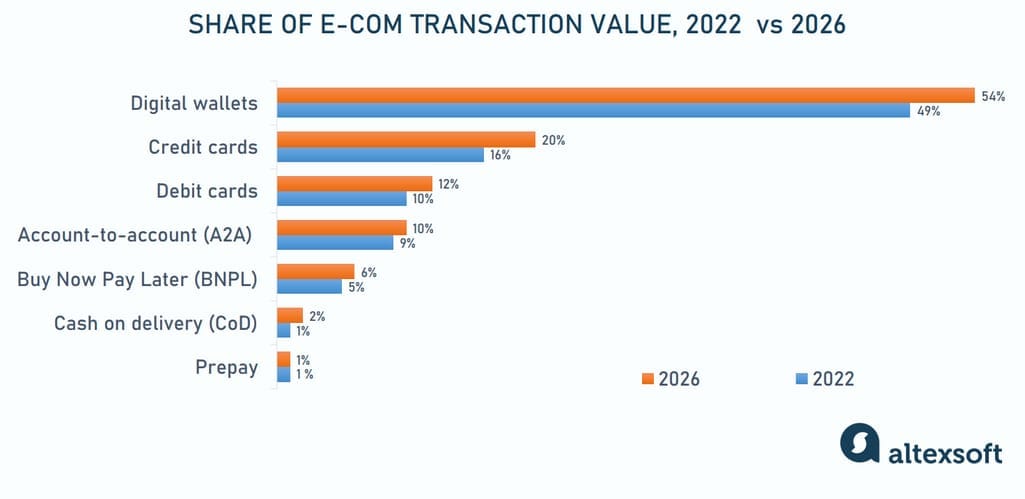

According to the Global Payment Report (GPR) 2023 by a fintech software provider, FIS Global, digital wallet apps have become the foremost payment method globally. Their share of transaction value hit 49 percent in 2022, promising to reach 54 percent in 2026. At the same time, they are among the leaders in the compound annual growth rate (CAGR), with an expected increase of 15 percent at points of sale (POSs) and of 12 percent in eСommerce by 2026.

How is the share of electronic payments expected to change from 2022 to 2026? Source: Global Payment Report 2023

Digital wallet benefits: what is there for your travel business?

Based on a study by Juniper Research, by 2025, digital wallets will reap over 4.4 billion users. This large audience alone is a sufficient reason for OTAs and other travel businesses to enable the payment method on their platforms. But there are also several other important advantages brought by wallets.

Better customer experience. With digital wallets, customers don’t need to enter card details, bring a physical wallet when traveling, or manually exchange foreign currency. The convenience and speed of payments via this method, along with discounts and rewards offered by many wallet providers, largely contribute to a positive buying experience.

Low cost of adoption and use. Digital wallets are typically cheap to install and operate. Usually, they charge a percentage of each transaction from banks and other institutions that provide a certain payment option. That’s why many popular wallets — such as Apple Pay or Google Pay — are free for end customers and merchants (yet it’s not the case with PayPal, for example). Some wallets bypass traditional credit card rails, enabling lower transaction processing fees than card payments.

Enhanced security. Advanced security features like tokenization and biometric authentication ensure the safety of payment data, both at rest and in motion. (At the same time, mobile payments use public WiFi, and the device itself can be stolen, creating their own risks.)

Attracting unbanked or underbanked audiences. Mobile payments are preferable in regions lacking traditional financial institutions, with Morocco, Vietnam, Egypt, the Philippines, and Mexico topping the list of the most unbanked countries. There are also underbanked households that do have bank accounts but, for different reasons, prefer to rely on cash and alternative financial services. By adopting digital wallets, you let customers from such areas easily pay for travel services.

It’s worth noting that not all wallets foster the same set of benefits. It all depends on how exactly they deliver their services.

Wallet apps: how do they work?

There are three distinct groups of B2C wallet apps — pass-through, staged, and stored.

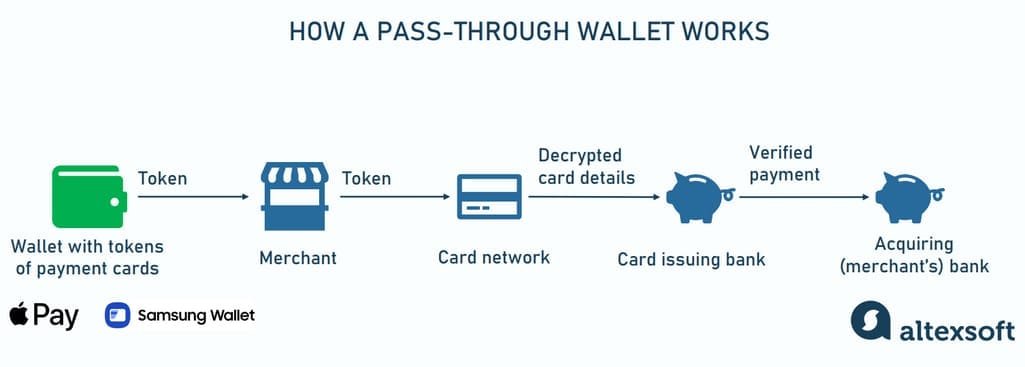

Pass-through wallets, commonly designed as mobile-first, keep tokens that link to your credit and debit cards instead of storing sensitive data or money directly. They don’t take part in moving funds. Once a transaction is initiated, such apps just pass encrypted information to a merchant — hence, the name.

Payment flow via a pass-through wallet

In the course of further payment processing, the token travels to a payment network to be decrypted and checked against the actual card or account information in the issuing bank. After verification, the payment gets approved and sent to a merchant’s acquiring bank. So, only the network and an issuing bank will know the actual card or account details.

Known for high security, pass-through wallets act essentially as extensions of credit and debit cards, so they are more widespread in regions with high card adoption, such as Europe and North America.

Major examples: Apple Pay, Samsung Wallet, Chase Mobile app

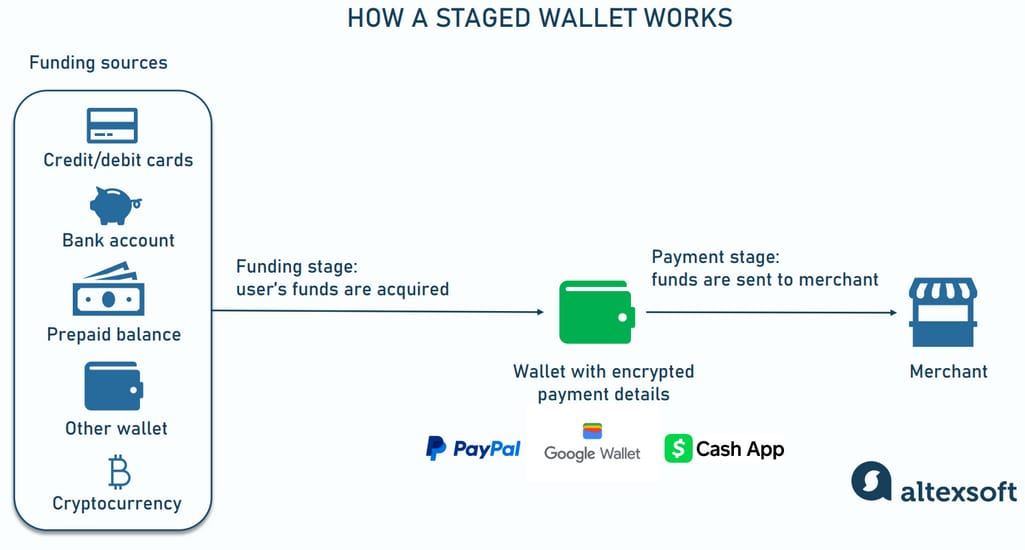

Staged wallets also house tokenized payment details but don’t transmit them anywhere. Instead, they perform transactions in two stages. At the funding stage, the wallet acquires money from a customer’s bank account, credit line, or other source. Then, at the payment stage, it sends funds to a merchant.

Payment flow with a staged wallet

In this scenario, a wallet provider can make additional fraud assessments. At the same time, a payment network or card issuer may know nothing about details of a particular transaction that are disclosed during operations with pass-through solutions.

Staged options often support peer-to-peer transfers and cryptocurrencies and allow for storing funds right in the wallet’s account.

Major examples: PayPal, Google Wallet (former Google Pay), Cash App (the US and UK only)

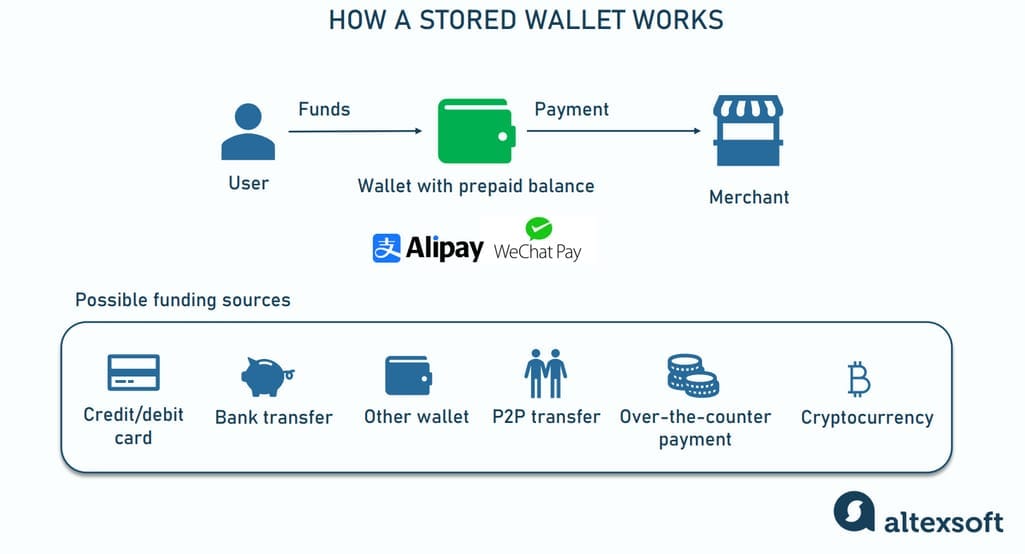

Stored digital wallets work as prepaid cards. Before making a transaction, a user must load money to a wallet’s balance from a bank account, debit or credit card, via peer-to-peer transfer, etc. The availability of funding sources differs across providers, depending on the location and targeted users. A merchant withdraws money directly from the wallet.

Payment flow with a stored wallet

Stored wallets are especially popular in unbanked and underbanked countries since they enable people to deposit money without having a bank account.

Major examples: Apple Cash (US only), Alipay (China’s most popular e-wallet), WeChat Pay, Paytm Wallet (India’s largest platform for instant payments).

Which wallet type and which brands, in particular, should travel companies care about in the first place? It largely depends on where their target audiences are.

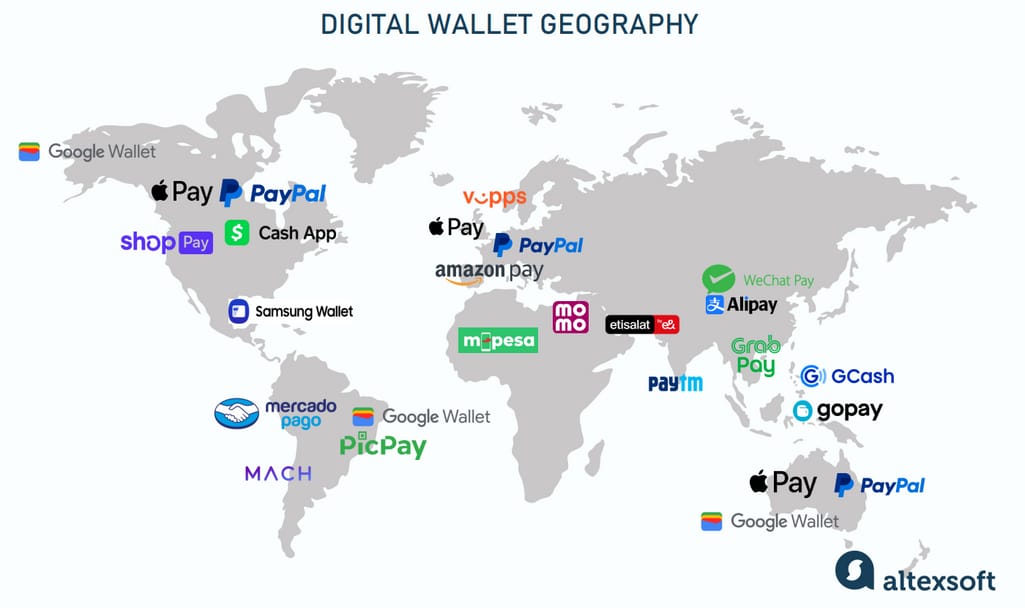

Digital wallet geography: Where are your customers?

The type of wallet — or how it works and whether it requires a user to have a bank account — impacts its adoption in different countries. Global players with the highest possible brand awareness, like Apple Pay or Samsung Wallet, may have little to no penetration in countries with limited access to traditional financial systems.

Besides payment flow, the device running a wallet app also matters. Android grabs 73 percent of the mobile OS market share, with its penetration especially high in India, Brazil, and Mexico. No wonder, in those countries, Android-centric tools beat Apple Pay. On the other hand, iOS leads in the US, Japan, Canada, Australia, and the UK — countries with higher standards of living, where people tend to earn and spend more.

With these considerations in mind, let’s take a broader look at the geography of wallet brands.

Most popular wallets across regions

The above-mentioned GPR survey shows that North America has been mostly served by three large brands — PayPal, Google Wallet, and Apple Pay. But recently, two other players, Shopify’s Shop Pay and Cash App Pay (both are staged wallets), have joined the leaders club, so they are worth considering by any business betting on the US or Canadian markets.

In Europe, PayPal plays first fiddle in Belgium, France, Germany, Italy, Spain, and the UK, with a tangible presence across other European countries. Other common international brands are Google Wallet, Apple Pay, and Amazon Pay. Local apps like Lydia in France, and Vipps MobilePay in Denmark and Norway also mustn’t be written off by those targeting a particular territory.

People in Latin America largely rely on Mercado Pago Wallet from the LATAM’s biggest eCommerce marketplace, Mercado Libre. At the same time, the growing penetration of Android smartphones plays into the hands of global brands — Samsung Wallet and Google Wallet — that have a strong presence in Brazil and Mexico. Brazil is the only country where Google Wallet enabled QR-code payments. Still, many local wallets preserve leadership in the respective territories — like MACH Pay in Chile or PicPay in Brazil.

In Africa and the Middle East (MEA), the world’s most unbanked region, the adoption rate of m-wallets by far outpaces ownership of traditional bank accounts. In 2022, the region received around 68 percent of the global mobile transactions. Though not all of them were made via a wallet app, this statistic mirrors their significance and overall interest in alternative payment methods. Among the leading solutions are M-Pesa in Africa, MoMo from MTN, a major mobile network operator across the entire MEA, Etisalat Wallet in the UAE, and more.

Digital wallets became the leading eСommerce payment method in such countries of the Asia-Pacific (APAC) region as China, India, Indonesia, the Philippines, and Vietnam. The mainstream wallet in Southeast Asia is GrabPay, which covers the needs of unbanked and underbanked locals, amounting to 60 percent of the population. In China, around 90 percent of the online payment market belongs to Alipay and WeChat Pay. These two giants, along with PayPal, are popular across the entire APAC.

Some countries are dominated by national brands: MoMo in Vietnam, GoPay in Indonesia, GCash in the Philippines, and Paytm in India. Google Pay (now Google Wallet) also sees wide adoption in India, with 73 percent of online shoppers using this tool.

As for Australia, the most used wallets here are Apple Pay, PayPal, and Google Wallet

Geography is key but not the only factor to consider when choosing digital wallets to be integrated with your core system. What else should you keep in mind?

How to approach digital wallet selection and implementation

First things first: to decide on wallets, a travel business must be a merchant of record — an entity authorized to process transactions. Many companies in the tourism sector prefer to outsource this role: They just forward the cardholder data to suppliers and wait for commissions to be paid. Called an agent model, this scenario deprives you of control over your money and, subsequently, of the ability to make any choices regarding payment methods.

Adopting a merchant model, on the other hand, empowers you to manage financial processes at your own discretion. If you’re already a merchant of record, you most likely partner with one of the popular payment gateways. So, it’s the right place to start your digital wallet journey.

In case you’re only thinking over and planning the transition from agent to merchant model, read our article on travel payment integration for a bit of guidance.

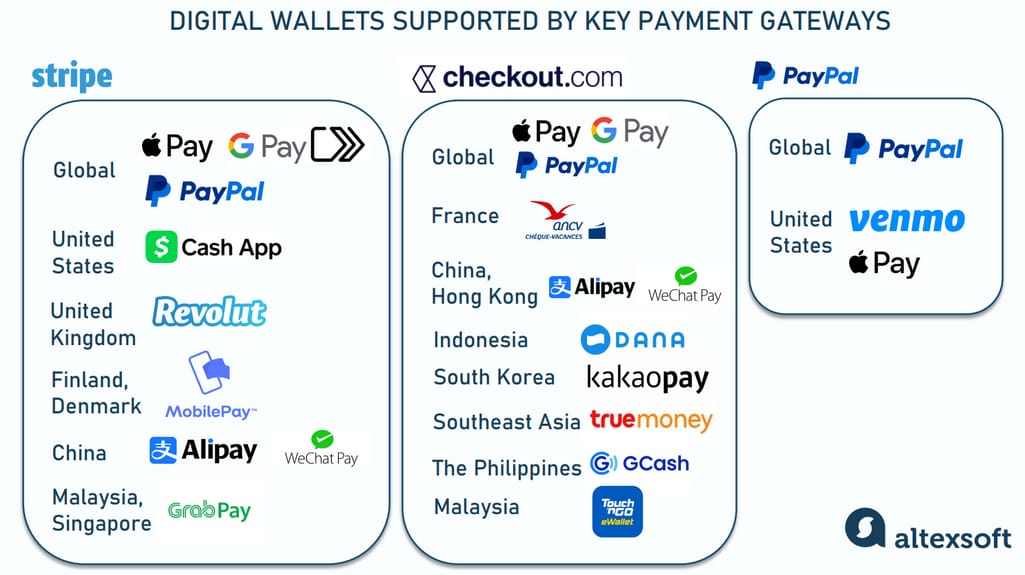

Check which digital wallets are available with your current payment gateway

Popular payment gateways are commonly pre-integrated with several global payment wallets and local options. The setup process depends on a particular method — sometimes, you can get started in minutes. Gateway providers give detailed information on how to activate a wallet or offer you assistance from their tech support.

Payment gateway integrations with digital wallets

Note that the same wallet can have different coverage across payment gateways. For example, PayPal integration with Apple Pay is available in the US only.

Decide on the list of direct integrations

Probably, your payment gateway doesn’t support all wallets you want to employ. That means you’ll have to build a separate connection. As a rule, wallet apps come with detailed API documentation that simplifies the integration. But anyway, it requires making an agreement with a wallet provider and involving developers to add the solution to your platform.

To save you time and effort, carefully choose options to integrate with. Consider such factors as

- flexibility — whether it’s platform-specific or universal,

- the global number of users,

- penetration rate in your target region,

- payment methods supported,

- multi-currency options,

- security measures,

- fees charged per transaction, and

- compatibility with your platform.

The table below compares several global players that, by default, ensure the highest level of protection and work with multiple currencies.

Global wallets compared

In most cases, the combination of global wallets and several local payment methods will guarantee the fullest coverage of your target market. For example, if you run your travel business in several European countries, it makes sense to add iDEAL for the Netherlands, Bancontact for Belgium, and Vipps MobilePay and Klarna for Scandinavia, while PayPal, Apple Pay, and Google Wallet will satisfy everyone else.

Closed-loop e-wallets in travel

All the options we discussed above belong to open-loop wallets that allow end customers to use a variety of payment methods and purchase goods and services from different businesses, no matter if they have direct partnerships with the wallet provider.

With such a great assortment of publicly available payment tools, some travel companies additionally run their internal, closed-loop solutions that work only with a particular brand and its partners.

Why adopt a closed-loop wallet

What makes businesses invest in one more payment system? Here are several key reasons.

Enhanced loyalty programs and cashback opportunities. A closed wallet creates an ideal platform to make the most of a frequent flyer or any other loyalty program. Users can easily earn and redeem loyalty points, take advantage of coupons and discounts, manage and utilize cashback, and, overall, keep track of their rewards. All these boost customer loyalty and engagement with your brand.

Expedited refunds. Another important function of closed wallets is addressing refunds. In case of trip cancelation, customers can instantly get their money back in the internal wallet and use it to purchase the next flight, stay, or other product while the provider saves on service fees. In the traditional scenario, a traveler may wait for weeks until a bank processes the payment and returns it to the corresponding credit card.

More repeat purchases. Refunds instantly available in the wallet encourage travelers to continue shopping with the same vendor. This situation fosters repeat purchases and allows businesses to keep repays within their ecosystem.

Access to customer data. Closed-loop wallets enable you to collect data and use it to gain insights into the behavior and preferences of your customers. This information, in turn, can fuel personalization activities to recommend products and tailor messages aligned with the interests of a particular customer.

To sum up, the key advantage of closed-loop wallets is that they boost customer experience and develop brand loyalty among clients.

Closed-loop wallet examples

Airlines and OTAs often provide branded e-wallets as a form of payment for their services that complete other methods — like regular credit cards, open-looped wallets, etc. The usual ways to refill the balance are refunds for canceled flights, rewards for purchases made with the supplier, and gift cards.

For example, Alaska Airlines’ e-wallet allows you to store and redeem discounts along with gift and credit certificates. They apply to purchases of flights operated by Alaska Airlines only. Credit certificates are issued when you cancel or change a nonrefundable ticket. All the remaining value can be spent on future travel for 12 months. Gift certificates do not expire.

LIFT, a South African low-cost carrier (LCC) serving domestic destinations, creates a secure e-wallet once a traveler makes the first booking. Linked to a customer profile, the tool collects refunds if you cancel a flight or the airfare price drops. This money can be used to buy tickets and flight extras or to upgrade to the LIFT Premium Loyalty Program.

The largest LCC, Ryanair, also has a Wallet to deposit refunds travelers can spend on new bookings. In case of flight disruptions, you may choose to withdraw money to your original payment method, e.g., credit card.

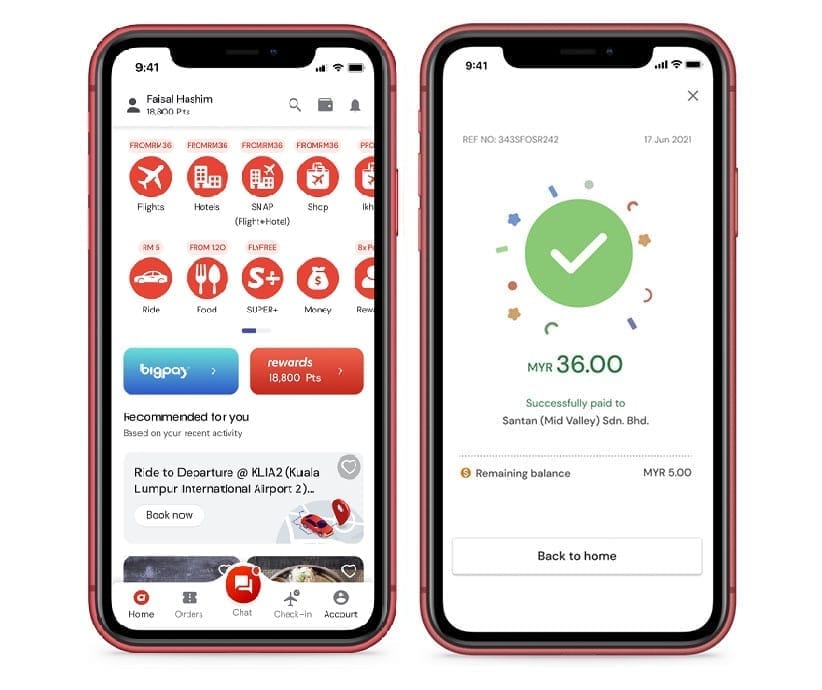

AirAsia, a Malaysian multinational budget carrier, runs a closed-loop wallet called AirAsia pocket as a feature within the company’s mobile app. Upon activation, it empowers you to earn loyalty points, get 10-percent flight discounts, and multiply rewards tenfold on purchasing AirAsia food on weekends.

AirAsia pocket interface. Source: AirAsia

Rewards & Wallet from Booking.com enables users to receive travel bonuses with each purchase and redeem them for different services — stays, airline tickets, car rentals, attractions, taxis, and insurance. Note, though, that this payment method is applicable only to selected accommodations and flights.

B2B wallets in travel

The previous two types of e-wallets cover the first consumer-facing leg of a transaction. When it comes to settlements between travel resellers and suppliers, other tools enter the scene. Among traditional B2B payment methods are checks, bank transfers, and corporate debit and credit cards.

Read our article on how virtual credit cards facilitate B2B transactions in travel.

B2B wallets are relatively new instruments to keep, manage, and quickly transfer funds in preferred currencies. They typically work with funds predeposited on a virtual account or with prepaid cards but sometimes offer credit lines as well. Among the features inherent in these novel digital solutions are expense tracking, setting spending limits, instant payment notifications, and the ability to create sub-wallets for different agents.

To provide a better understanding of what B2B wallets are, we’ll explore three travel-specific platforms.

B2B wallets in travel compared

Amadeus B2B Wallet: Juggling EARN and SAVE virtual cards

Amadeus B2B Wallet provides you with a safeguarded account (“wallet”) you need to fund before using. On your request, the platform generates virtual cards and loads them with money from your balance to pay suppliers — for example, hotels or airlines. You can choose between two types of prepaid cards.

The Visa SAVE helps you minimize or even avoid surcharges added by many low-cost carriers and some full-service carriers (FSCs). It supports three currencies (USD, GBP, and EUR) and applies to any category of business globally. The MasterCard EARN, in turn, receives rebates on certain purchases. Note that though it can be created in 8 currencies, you may use it to pay travel and hospitality companies only.

You can restrict card use to a certain timeframe or spending limit. On transaction completion, the tool compiles booking and payment data in a single report to simplify reconciliation.

The wallet comes pre-connected with Amadeus Selling Platform Connect. Other platforms can integrate with the tool’s functionality using XML web services.

IATA EasyPay: a low-cost payment method for small and mid-sized travel agencies

IATA EasyPay is a closed-loop proprietary e-wallet created as a faster, more secure, and low-cost alternative to traditional cash payments accepted by IATA’s mediator, Billing and Settlement Plan (BSP.). Any IATA-accredited travel agent can take advantage of this tool to purchase airline tickets.

How does the e-wallet work? An agent creates an EasyPay account in a local currency via the IATA Customer Portal and tops it up through a bank transfer. Each transaction gets a unique 16-digit code to be used instead of credit card details in any global distribution system (GDS.) The wallet blocks the money for a particular booking and then sends it to the airline over the IATA clearing rails.

International Air Transport Association (IATA) explained

EasyPay does not require financial guarantees to cover non-payment as it’s all pre-paid. Agencies with a Remittance Holding Capacity can use EasyCash to continue issuing tickets when they have reached the maximum allowed amount within a billing period.

“EasyPay allows smaller travel agencies to issue tickets,” explains Paul van Alfen, Travel Payment Strategist and Managing Director at Up in the Air, a travel payment consultancy company. “And for the airlines, it’s actually a relatively cheap and cash-flow-friendly way to accept bookings. Since the money is already in the wallet account, the payment is guaranteed, there’s no fraud, and the funds move relatively quickly.”

EasyPay allows smaller travel agencies to issue tickets. And for the airlines, it is actually a relatively cheap and cash-flow-friendly way to accept bookings.

At the same time, the wallet doesn’t provide any credit line. “The prepaid part blocks out large travel agencies since they can’t prefund all purchases,” Paul adds.

Outpayce B2B Wallet: flexibility and guaranteed chargeback refunds for large players

B2B Wallet from Outpayce, a payment company owned by Amadeus, works with 5 issuing banks, 43 currencies, and 3 card schemes — Visa, MasterCard, and UATP (Universal Air Travel Plan). It generates transaction-specific virtual cards, enabling you to choose from 14 card types, depending on a particular use case. Specifically, Outpayce Wallet MasterCard protects chargebacks, ensuring you get your money back if a supplier goes bankrupt.

It’s worth noting that a travel agency must meet certain criteria — like handling a large amount of transactions annually — to partner with Outpayce. In other words, you have to be big to take advantage of this wallet.

Digital wallets as must-haves to retain customers

Digital wallets, specifically consumer-facing ones, are on the increase, and both travel suppliers and resellers should adequately respond to this trend. The ability to accept alternative payment methods simplifies the path to purchase and dramatically expedites transactions. But all players — airlines, hotels, OTAs — should carefully consider what tools meet their business needs and will enhance customer experience in the target markets.

While most large travel companies already work with global wallets like Apple Pay, Google Wallet, and PayPal, experts advise going local and support this recommendation with real-life success stories.

Finnair became the first airline to introduce in-flight purchases with Alipay. As you already know, this wallet is extremely popular among Chinese travelers abroad, and the airline didn’t miss the opportunity to benefit from the growing tourist flow between Asia and Northern Europe. A year later, this solution led to a 100-percent increase in onboard sales.

If the trip originates from China or Hong Kong, a customer can also use Alipay or WeChat Pay for shopping on the airline’s website and mobile app. Finnair also leverages Apple Pay, Google Pay, and several local European payment methods available if a journey starts in a corresponding country.

Hotels lag behind other travel businesses in terms of digital wallet adoption. Yet, large chains have already seen the value of partnerships with wallet providers, which is not limited to adding one more payment option. For example, Hyatt collaborates with Apple to let guests store electronic keys in Apple Wallet. Now, Hyatte’s customers can unlock rooms and other hotel properties with iPhones or Apple Watch devices.

Whether the wallet is local or global, B2C or B2B, the primary consideration is to ensure that the tool facilitates the booking process rather than hampers it. The solution should satisfy three critical requirements: simple to use, secure, and reliable. A weird checkout process, risks of data leaks, or a lack of transparency when paying suppliers makes a new payment method a pain, not a pleasure.

With 25 years of experience, Liudmyla is a seasoned editor and IT journalist. Over the last five years, she has focused on travel tech, travel payments, and the advancements in NDC implementation.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.