By offering cheaper rates to passengers who book earlier, providing seat reservation at a higher price, and incorporating the now controversial practice of overbooking, Crandall’s AA claimed to generate an extra $500 million a year. The economic impact of yield management strategies utilized by American Airlines is apparent.

Today, revenue management specialists and systems work at most airlines to sell the right product to the right customer at the right moment at the right price on the right distribution channel. (Revenue management strategies in hotels are also common.) One of the critical components of revenue management is dynamic pricing. Let’s talk about the current methods of dynamic pricing and how the techniques are maturing to match the current airline distribution market.

What are dynamic and static pricing: evolution of flight pricing strategies

Traditionally and most commonly, airlines have been using static pricing. An airline creates its fare structure using a limited number of price points based on reservation booking designators (RBD) and then published through ATPCO. Each price point is developed for a specific customer segment and demand situation.Namely, there are price-sensitive passengers who are not locked in on a date or schedule and will pick the cheapest fare regardless of long layovers. Others must reach a destination on time and will pay any price to travel on a specific day. Considering such factors as time of flight and time of purchase, sales channel, and seat class, airlines create price points for different passenger segments.

This segmentation, though, remains fairly shallow. Without understanding the competitive landscape, market conditions, distribution of fares, and more complex data that can be received only through analytics, airlines can’t effectively segment passengers beyond the typical “business or leisure” scenario. This is especially important for low-cost carriers that need more sophisticated and creative solutions to stay competitive and profitable.

Today, thanks to data-driven capabilities and technology advancements, revenue management strategies for airlines have evolved to consider tons of various criteria in real time and deliver truly personalized pricing, which we know today as dynamic.

See our video on dynamic pricing which explains it visually

Dynamic pricing is a technique of pricing a product according to current market conditions. Prices change in real time based on timely data: Data about customer booking patterns, competitor prices, even weather and popular events can impact the product demand and require you to adjust prices to increase profits. This practice is most valuable to products that share these characteristics:

- products expire, meaning they lose their value at a certain point in time, and

- product capacity is limited and can’t be augmented to accommodate larger demand.

Both of these characteristics apply to flight fares, where high fixed costs (fuel, airport slots, ground handling) and low variable costs (the cost of carrying one more passenger) make the value of one flight seat extremely high. So, to drive the most revenue, airlines need to sell the greatest number of seats for the highest possible price. To learn what price that is, they need to understand nuances of passenger behavior and the market demand. That’s what dynamic pricing helps to achieve.

However, the current dynamic pricing model has a few limitations. Let’s review them and explain some solutions for improvement.

Current dynamic pricing limitations

You will notice that these problems are interdependent and there are common solutions to them since the industry is on the road to change how airlines create and price offers to customers.

Legacy revenue management technology

The four-decade long history of revenue management practices in airlines is both a gift and a curse. Ancient, rule-based software lags not only in technical finesse, but also in keeping up with new distribution trends.

The first problem is applying old approaches to solving one of the main tasks in RM -- demand forecasting. IT systems need to access many data sources and employ algorithms to pinpoint demand signals in real time, which requires some sophisticated data analytics and machine learning capabilities.

The second limitation stems from relying on traditional distribution models that keep airlines from using precious data from external sources. As long as airlines have limited control over the offer construction on indirect channels (GDSs and aggregators), they can’t deliver truly personalized experiences.

Fare compression

An airline’s ability to price flights is restricted by legacy distribution mechanisms. For once, airlines can offer a limited number of price points based on reservation booking designators (RBD) and when publishing them through ATPCO, they can update prices only in specific intervals. Consequently, prices are not adjusted in real time. This leads to other problems, like uncertain net revenue as airlines often file different fare products under the same RBD.

Little consideration for ancillary pricing

Ancillary revenues bring the industry around $55 billion a year and have been on the rise for the past ten years, being a huge part of low-cost carriers’ profits. Yet base flight products and ancillary products are managed in separate processes and through separate IT systems (revenue management and merchandising systems).

So, extra baggage, seat selection, meals, Internet access, and many more services are priced statically and not accounted for in revenue management implementation. Customers receive the same price for the same product and the shopping process doesn’t consider contextual customer information. Basically, there’s no personalization.

Industry leaders such as IATA, ATPCO, Amadeus, Sabre, Lufthansa, and others are collaborating on solving the aforementioned problems and their research has culminated in the new airline distribution approach called continuous pricing. Let’s look at it in detail.

Understanding continuous pricing and Offer Management System

Continuous pricing is the process of dynamically adjusting fares in response to contextual signals. It can also be called total dynamic pricing. IATA calls it Dynamic Offers and it will likely become a new standard for offer construction and pricing. It will address other limitations and build on NDC and One Order standards to create holistic revenue management with improved demand forecast and personalized offers.

Namely, continuous pricing can introduce the following improvements.

Improved understanding of WTP. Currently, a customer’s willingness to pay remains mostly a mystery to airlines. It works on the assumption that passengers always make rational decisions that can be easily predicted, which is not true. A revenue manager often can’t anticipate or estimate what price suits what customer segment or even segment customers correctly. The most accurate way to do that is by employing machine learning solutions and AI algorithms. Which brings us to the next improvement.

Increased conversion. The more relevant offer a customer receives, the bigger chance they'll take it. This results not only in more sales, but also in more loyal customers who can 1) personalize their flight experience and 2) get cheaper tickets by stripping the price of extra services.

Holistic revenue management. Consistent offers bring more partnership opportunities, allowing airlines to incorporate more third-party ancillaries and interlining offerings.

Continuous pricing revolves around the idea for a new type of system -- Offer Management System (OMS) -- and a new definition for an offer. Here, an offer is a proposal to a customer from an airline for a set of products for a specific price. An airline offer will be composed of mandatory and optional items, which customers will be able to select or deselect.

Mandatory offer items include flight seats, in-flight services, conditions and restrictions, hotel rooms, interline connections. Optional items are ancillaries in bundles and a la carte and third-party content like insurance, rental cars, etc. These items bundled in one offer and priced according to specific context will improve customer experience and enable higher profitability.

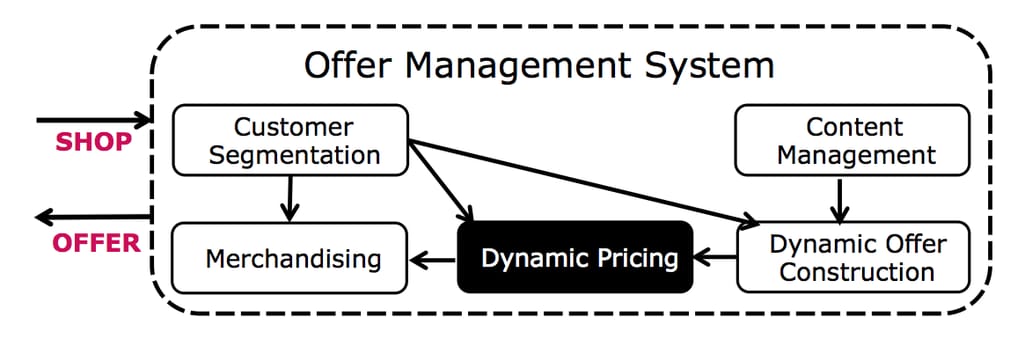

An Offer Management System consists of five modules:

- Content management -- the catalog of all items an airline can put in an offer.

- Customer segmentation -- customer behavior analytics and categorization.

- Dynamic offer construction -- models recommending relevant product sets, optionally augmented by recommender systems. Learn more about recommender systems from our videos.

- Dynamic pricing -- determining prices of constructed offers based on customer and contextual information.

- Merchandising -- applying merchandising techniques to affect the customer’s purchasing behavior.

Shopping requests are passed to an OMS and the final offers gets displayed for the customer Source: Dynamic pricing of airline offers, Fiig, Le Guen and Gauchet

Although transitioning to continuous pricing involves big changes, there are some opportunities airlines can explore today within their current architecture. Let’s overview them.

Transitioning to continuous pricing

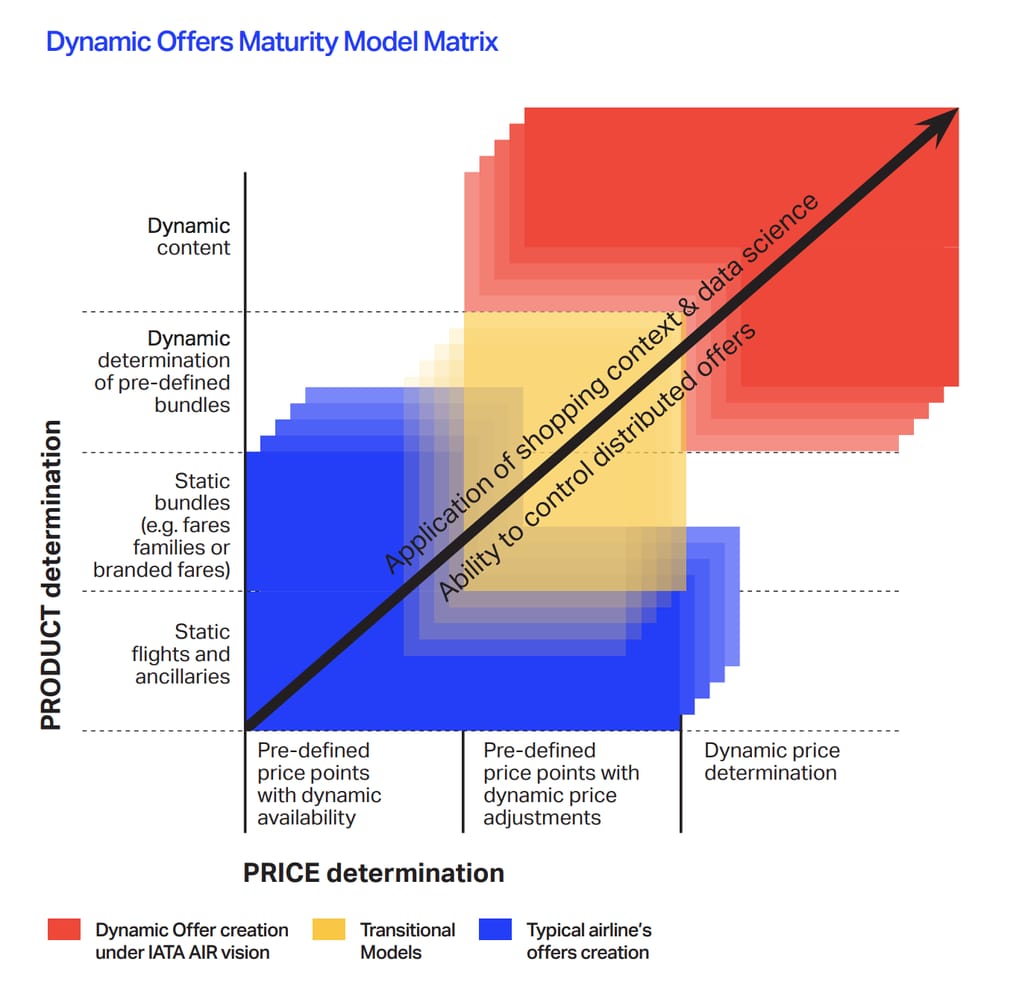

IATA identifies three levels of dynamic offers maturity.

The first level is where the industry is today. Flights and ancillaries are priced statically, price points are predefined with some dynamic availability and price adjustments involved.

The second level is the transitional stage. It’s not total dynamic pricing yet, but systems can choose the best-fitting fares among predefined bundles.

The final level is the desired continuous pricing. Both fares and offer content are defined on the go, data analytics and ML models are involved in decision making, and airlines have full control over how their data is displayed on GDSs, OTAs, and aggregators.

The ability to control your offers and accurately predict demand guides your dynamic offers maturity Source: IATA

ATPCO defines two steps for transitioning to more advanced dynamic pricing capabilities and eventually implementing dynamic offers.

Optimized pricing

To improve the ATPCO-filed fares, you can either increase the number of price points or make it unlimited. The framework for the first solution was developed by ATPCO under the name of Dual RBD. It sensibly divides RBDs into primary and secondary categories, allowing you to increase the number of options to 182 price points. The big advantage of this method is that no changes to schedule filing is necessary and system communication will happen the same way as before. However, you’ll have to change your fare structure in the inventory system.

So, the optimized pricing approach combines traditional static pricing with dynamic availability. It involves three changes to fare structures:

- Frequent fare updates, in which ATPCO offers solutions for automatic fare filing.

- Dynamic availability, in which product availability can be contextually adjusted.

- Additional RBD capabilities, in which the limit of 26 price points is increased.

To implement optimized pricing, follow the ATPCO implementation guide. Implement optimized pricing when you have too many price points under a single RBD. This approach can also be combined with adjusted pricing.

Adjusted pricing

The adjusted pricing approach involves the use of a dynamic pricing engine (DPE), which identifies and proposes the optimal price based on real-time data. There are two types of DPE solutions.

- DPE Predefined Price. An airline files its price points as usual and makes them available via request from a distribution channel. This approach makes sense if you want to provide private fares and present them on selected channels, for example, for customers of a travel management company (TMC).

- DPE Generated Price. This more advanced pricing method entails the use of a DPE that will define and distribute the fare at the time of shopping. To do that, airlines will have to use a separate distribution solution called the Airline Profile. Using the NDC standard, aggregators and travel agencies will be able to communicate with airlines’ DPEs. This system should be used when you want to react to market demands in real time, for example, to sell seats on an underperforming flight.

There are several methods to approach a DPE adoption.

Acquire a DPE from an NDC-enabled vendor such as PROS, OpenJaw, or Farelogix (the one Lufthansa has been working with on its continuous pricing solution). Faster implementation and being able to demo and review the tool before committing might be helpful when you’re just working out the logic of your dynamic pricing initiatives. Though some customization will always be needed, especially considering that the industry is still figuring out the best way to transition and your current systems have to be tightly interconnected with a new solution. So, a second option might be favorable as well.

Build a custom DPE by teaming up with a technology partner that can help you make these important decisions and create your fare rules from the ground up. Look for a vendor with data science expertise in the travel sector, especially in the area of price prediction and demand forecasting.

How close is the future?

Change comes slowly, but it does come. In 2021, airlines still majorly rely on traditional fare distribution, making poor forecasts, ignoring ancillaries, and struggling to update decade-old technology. But if you are ready to grow, look to the pioneers for encouragement.

The first adopter of a new distribution model was Lufthansa. After heavily investing in the NDC technology, the company started experimenting with dynamic offers on direct and indirect channels in 2020. Other big airlines like Air France-KLM and Singapore Airlines collaborated with Amadeus and Travelport to work on adoption as well. These examples indicate that the concept is no longer a theory or a proposition -- it will become an alternative or even a norm in the world of commercial aviation.

You don’t have to implement it overnight, but the support of industry regulators like IATA and ATPCO will help you make the important first steps.

Maryna is a passionate writer with a talent for simplifying complex topics for readers of all backgrounds. With 7 years of experience writing about travel technology, she is well-versed in the field. Outside of her professional writing, she enjoys reading, video games, and fashion.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.