When a person books a flight, less than 15 minutes pass between their starting to fill in the search form and a booking confirmation appearing in their mailbox. From the airline side, it involves many events and systems to issue a ticket and make sure that the right person will board the plane. In this article, we describe the flight booking pipeline and explain the main processes supporting it.

Flight booking systems and concepts explained

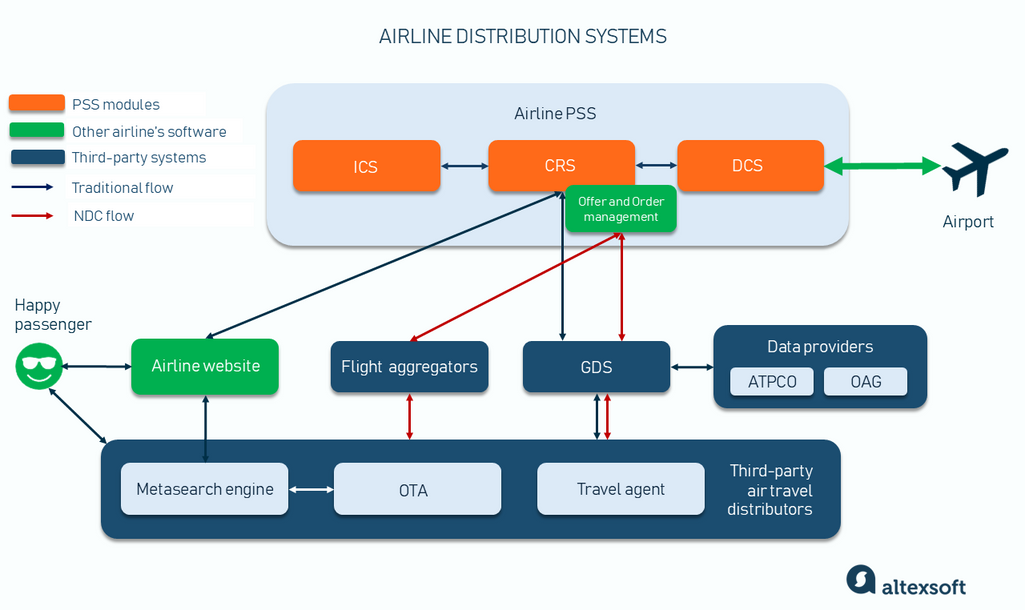

Let’s start at the very beginning. And in this case, it’s the way airlines distribute their tickets. There are several main types of players in this process:

- airlines,

- Global Distribution Systems (GDSs),

- flight data providers (ATPCO, OAG, and Cirium),

- flight aggregators,

- third-party travel retailers (OTAs, metasearch engines, TMCs, traditional agencies), and

- airports.

How airline distribution systems are connected

How do these players collaborate on the technical level? To answer this question, we need to introduce and briefly explain some key abbreviations related to flight booking. If you want to become better acquainted with the systems and concepts behind the three-letter short forms, just click on the link to the dedicated article.

What is PSS?

Read the main article: Airline Reservation Systems and Passenger Service Systems

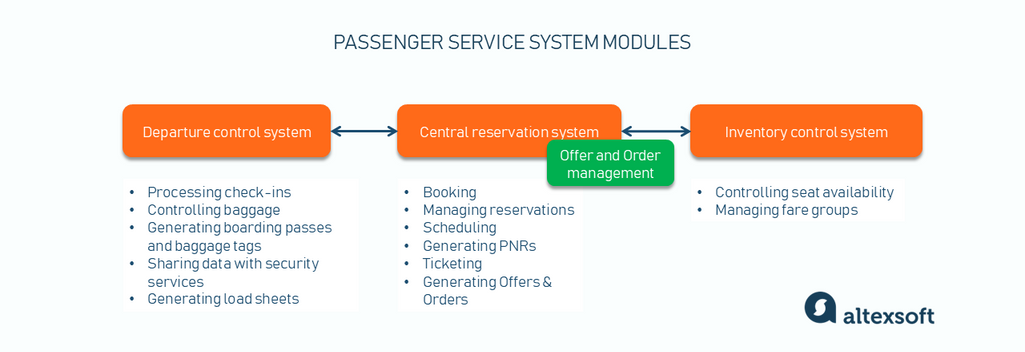

A passenger service system (PSS) is a suite of software modules supporting interactions between the carrier and its customers. Its key components are a central or airline reservation system (CRS), an inventory control system (ICS), and a departure control system (DCS.)

The PSS also comprises or integrates with a revenue management tool that analyzes historical data and sets pricing rules and an e-commerce platform (airline website) for flight and ancillary distribution. If an airline wants to sell products via NDC channels (we’ll talk about NDC later), it also needs a layer that supports offer and order management. Some PSSs, such as Navitair New Skies and Altea by Amadeus, come pre-equipped with the necessary NDC module.

What is CRS?

Read the main articles: Airline Reservation Systems and Passenger Service Systems, Central Reservation Systems for Hotels

A central reservation system, also called an airline or computer reservation system, serves as storage for flight-related information like schedules, fares and rules for each booking class, passenger name records (PNRs), e-tickets, etc. It’s also involved in managing booking requests and ticket issuing. Some airlines run their own CRS that may come as a part of the PSS. Yet, many carriers prefer to host and manage reservations on one of the GDSs.

In a broader sense, a CRS is a key technology of any travel organization that sells its inventory online, namely, hotels and airlines. It allows managers to control reservations across all distribution platforms.

What is PNR?

Read the main article: What is PNR?

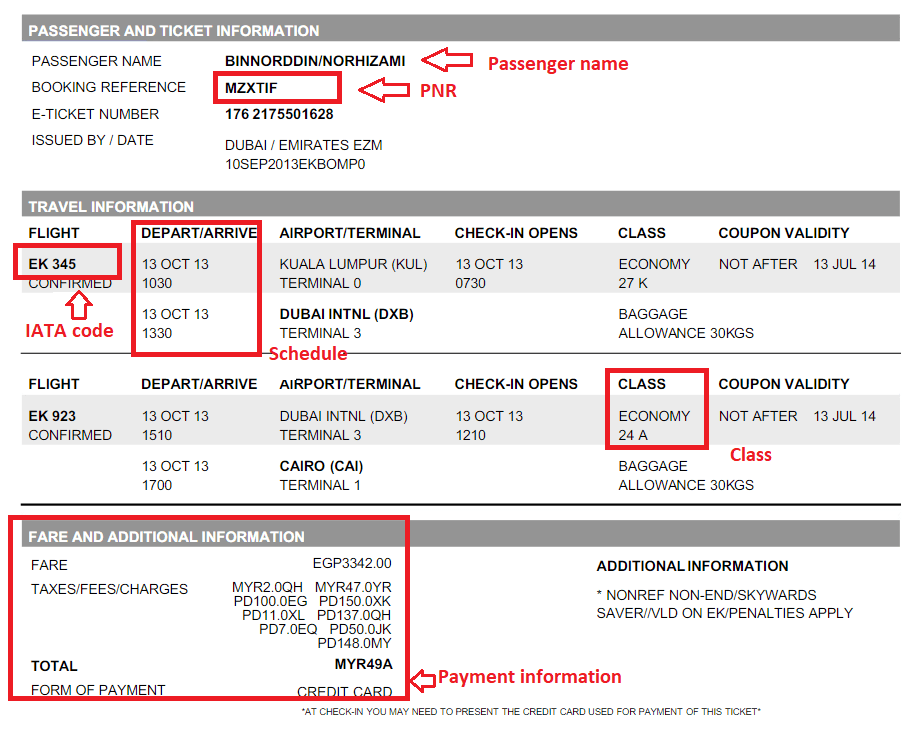

A passenger name record (PNR) or booking file is a digital document that contains information about a traveler or group of travelers and their itinerary. Each PNR has a unique code called a booking reference or record locator. Thanks to this number, the file can be easily found in the CRS database. A traveler purchasing a flight gets the code via email and can use it to access flight details or check in online.

PNRs also have electronic miscellaneous documents (EMDs) linked to them, which cover all ancillary services beyond the base fare and include fees for baggage, seat upgrades, lounge access, in-flight meals, and penalty fees for changes or cancellations.

PNR explained

What is GDS?

Read the main article: How to Choose a GDS?

A Global Distribution System (GDS) is a computer network operating as a middleman between travel agents and numerous travel service providers. The three main GDSs to know about are Amadeus, Sabre, and Travelport.

A global distribution system aggregates flight information from the following sources:

- the Airline Tariff Publishing Company (ATPCO), which is the key vendor of fare-related content. Carriers cooperating with ATPCO can update their prices four times per day for domestic US and Canada flights and once per day for international flights;

- the Official Aviation Guide for Airways (OAG) and Cirium, which store flight schedules; and

- numerous airline CRSs, holding data on available seats and ancillaries.

Based on schedules, fares, and availability, the GDS creates offers and sends them to the OTAs, travel management companies (TMCs), and other travel platforms at their request. Travel agents connect to GDS content via manual terminals or B2B booking interfaces.

What is NDC?

Read the main articles: New Distribution Capability in Air Travel, NDC for Airlines: Key Providers and Implementation Scenario

The majority of flights are distributed through the mediation of GDSs, which force all the above-mentioned systems to exchange data via the archaic EDIFACT protocol. As a result, airlines can’t collect detailed information about passengers, nor can they provide feature-rich content and a wide range of ancillaries (like in-flight meals or excess baggage options) to their customers. On the other hand, they have to pay extra fees for GDS services.

New Distribution Capability (NDC) standard was introduced by the International Air Transport Association (IATA) in the hope of replacing the existing scenario. It allows travel systems to share data with each other via standard travel APIs, using the content-friendly XML protocol.

NDC enables carriers to access customer information, personalize user experience, and sell ancillaries and seats, bypassing most of the third parties. Today, dozens of airlines and IT companies have adopted NDC capability, but GDS is still the main distributor in the industry.

What is a flight aggregator?

Though NDC was initially designed for direct communications between airlines and OTAs, in practice, it appeared to be too complex for both parties to establish multiple bilateral connections. This problem propelled the growth of flight aggregators — relatively new players that source both GDS and NDC content, as well as offers from low-cost carriers (LCCs) and private fares from consolidators. So, instead of building API integration with each NDC-enabled airline, OTAs, TMCs, and other resellers can access all types of airline content via a single unified API provided by an aggregator.

By the way, GDSs can also be viewed as flight aggregators, especially considering that they’re actively developing NDC connections with airlines — alongside existing legacy channels.

Flight booking process steps

With some basics covered, let’s closely look at what happens between the moment of reservation via a travel platform and baggage reclaim at the destination airport.

The whole process of this traveler/airline interaction can be divided into several major steps:

- flight search,

- flight booking,

- ancillary booking,

- using frequent flyer miles and points,

- payment processing,

- ticketing,

- check-in and boarding, and

- baggage handling and reclaim.

In case you need to save time, watch our video where we describe all the steps of traditional flight booking.

Above, we described the traditional scenario. NDC has made some adjustments to it — after the search and before the ticketing steps, it will have specific stages called NDC Shop, NDC Order, and NDC Pay.

Flight search

Today, a traveler can find a flight directly on an airline website or via indirect channels — OTAs, like Expedia, Orbitz, Travelocity, or Priceline, or metasearch engines like Kayak or Skyscanner. Depending on the type of retailer, the search process will slightly differ in terms of technologies and results.

Via airline website. The website sends a search request directly to the airline’s CRS and then displays the list of available flights to the user, skipping the whole GDS part.

Yet, more often than not, travelers want to compare fares from different carriers or need to book a complex itinerary operated by more than one airline. Obviously, they will opt for third-party platforms that aggregate offers relevant to a passenger’s query from multiple sources.

Via OTAs. Online travel agencies get flight information from

- GDSs,

- air consolidators, which negotiate with carriers for bulk or net fares and then resell them to travel distributors, and

- partner airlines.

To maximize revenue, travel platforms use smart booking engines that filter and prioritize airfare deals according to predefined business and pricing rules. Watch our video explaining how this software benefits OTAs.

Via metasearch engines. Metasearch engines sift through deals across multiple OTAs, full-service carriers, and low-cost carriers which typically don’t distribute their inventory via GDSs. As a result, the visitors will get the widest possible range of flights available in the market.

On the dark side, a classical metasearch engine comes without booking functionality. Instead, it redirects travelers to a partner platform to make the next logical step.

Flight booking

While OTAs and metasearch engines are the preferred option at the search stage, the majority of travelers go to airline websites when it comes to booking. There are two main reasons for this.

First, purchasing seats directly from the airline makes it simpler, even from a technical perspective, to change the reservation or cancel the flight. Second, travelers have access to a broader selection of ancillaries than OTAs typically provide.

No matter the source of booking, the airline CRS has to check if the flight product in question is still available for reservation. Then, it replies to the travel retailer with the status code HK (“holding confirmed”.) The alternative answer is UN, meaning that the carrier is unable to satisfy the request.

Another task of the CRS at this step is to create a PNR. In the course of booking, a retailer — be it an OTA or airline website — collects personal data such as a passenger's name and contacts and redirects it to the CRS. Once all mandatory details are gathered, the system generates a PNR number that works as an electronic address for the file in the database.

Ancillary booking

Ancillary revenue remains a major source of airline revenue, especially for low-cost carriers. Examples of additional services include seat selection, excess baggage, extra legroom, and in-flight meals.

A traveler typically chooses ancillaries within the course of flight reservations. However, if purchasing the journey directly from the airline, extras can be added later. Passengers may access their bookings via the carrier’s website and make changes to them using the PNR number.

In any scenario, the information on wanted ancillaries gets to the CRS in the form of special service request (SSR) codes introduced by IATA. Each code contains four characters and is associated with a particular extra.

Some examples of SSRs are:

- EXST — for extra seat,

- KSML — for kosher meal,

- LSML — for low-salt meal, and

- PETC — for animals in the cabin.

Not all ancillaries have unique SSR codes, so they are defined as OTHS (others). Some airlines use specific codes to complement or even replace the IATA system. For instance, Qatar Airways offers falcon transportation under the SSR-like code FALC.

To confirm an ancillary booking, a CRS checks if the service is provided on the particular flight and, as with the flight booking, returns the status code HK (“yes!”) or UN (“no!”). The information on ancillaries is added to the PNR (even if the carrier declined the request.)

Using frequent flyer miles and points

Members of a frequent-flyer or airline loyalty program can use earned miles or points accumulated from previous flights to purchase extra services from airlines. These points can be exchanged for discounts or benefits, like upgrading to business class. To earn customer loyalty, CRSs reserve a particular number of places for frequent flyers.

Passengers can either log in via their accounts while purchasing tickets from an airline website or get a frequent flyer number to book from a third party.

Payment processing

Intention to fly must be eventually backed by money. In other words, passengers have to pay the fare for use of a seat plus taxes and the cost of ancillaries (if any.)

The financial operations on the airline websitecan be performed via payment gateways — third-party services that not only process transactions but also ensure data safety. Yet, if GDSs and OTAs are involved, things become far more complicated. In this case, money flows through IATA’s payment processing mechanism called the Billing and Settlement Plan (BSP) or its US analogue, Airline Reporting Corporation (ARC.)

Once the payment is confirmed, the traveler receives a flight itinerary and PNR number via email. That’s enough to track the flight status, cancel the trip or even, in the case of direct booking, modify the future journey and add ancillaries.

NDC booking flow

The NDC has changed the traditional flow of flight booking. As of this writing, more than 10 percent of travel agent sales now come via NDC channels, and 77 airlines, including major players like American Airlines and British Airways, have adopted NDC to some extent.

Let’s explore how the NDC introduces a modern, more flexible flight booking process.

NDC shopping

In the NDC shopping phase, a traveler visits a travel agency website and inputs search details. The agency can send this information to the airline

- directly via NDC-enabled bilateral API integration,

- via a flight aggregator,

- via NDC channels by GDSs.

Unlike the traditional flow, where GDSs form final proposals for travelers, NDC gives control over air products back to carriers letting them sell flights and ancillaries via OTAs and TMCs the same way they do on their websites.

NDC has created enormous opportunity for airlines to evolve their products and services to be more customer centric. With support from across the value chain, airlines can now take the next steps towards becoming true modern retailers centered on the customer experience.

NDC ordering

Once a traveler selects options and clicks "Buy Now," the offer transitions into an order created by the airline’s offer and order management system, which connects its PSS with NDC distribution channels. Such systems also typically come with continuous pricing and bundling capabilities. The order captures ongoing changes like adding and deleting products, altering or canceling flights, and so on.

NDC payment

The final step is NDC payment, where the traveler pays for the flight products and completes the order. While, in the traditional flow, transactions are processed via ARC or BSP systems, the NDC scenario lets the airline decide on payment methods. It can choose to work with BSP/ARC or accept virtual credit cards, bank transfers, and other B2B forms of payment directly from the travel agency.

Learn about corporate travel cards and how businesses use them to handle employees' travel and expense (T&E) management.

Ticketing

Ticketing and booking are two separate processes. Booking just holds the seat on the plane. Ticketing means that the seat is paid for, and the passenger has the right to take it during the flight. There is a certain time lag between these steps, even if a traveler pays for the trip immediately, as most OTAs and LCCs require. It usually takes up to three working days to verify payment details and finalize money transmission.

To issue an e-ticket — or individual electronic receipts linked to the PNR — the company must be certified by IATA or ARC. Not all air travel retailers can afford this. Instead, they ticket flights via accredited partners — like big OTAs, airline consolidators, or host travel agencies.

What if a trip consists of several flights operated by different airlines? In such cases, carriers strike a special commercial agreement called interlining and issue a single ticket covering all segments of the itinerary. Also, the Super PNR is created to link pieces of the journey in one record.

In any case, the e-ticket with the passenger name and related PNR number is finally emailed to the traveler. If for some reason, the booking can’t be ticketed, the travel supplier has to offer an alternative flight or pay a full refund.

Check-in and boarding

Here, we deal with the airline’s DCS, or departure control system. This module of the PSS is connected to the CRS and airport devices like self-check-in kiosks, airport agents’ software, baggage drop, and even immigration control. The DCS processes all check-in and boarding-related procedures, which start with ticket validation. This system is also responsible for entering customs and border security reservations, as well as aircraft weight optimization and cargo handling.

During check-in, a traveler must provide their PNR and name so that the system can match it with ones stored in the CRS and assign a seat. This procedure slightly differs online and offline.

Online check-in. Online check-in usually becomes available 48 hours before the flight, but it depends upon the airline. A traveler enters details from an e-ticket at an airline website or an app and gets access to an aircraft seat map to choose a particular seat. If a user doesn’t select it, the system randomly assigns a free one and issues an electronic boarding pass. The same principle works for check-in kiosks.

Airport check-in. In this scenario, a person brings an e-ticket to the airport agent at the check-in counter so that they can enter the details and reserve a seat on a seat map.

After check-in, the departure control system generates a boarding pass that finally entitles passengers to get on a plane. The pass can be printed off or downloaded to a mobile phone. The document contains a QR code that works as a unique link to the traveler’s flight information. As the passenger proceeds to the airplane, a QR code is scanned, and the PNR status changes from “checked-in” to “boarded” and, finally, to “flown.”

Baggage handling and reclaim

A plane has landed at the destination point, and it seems like this is the end of a journey – unless a passenger’s baggage is lost. To avoid this, the airline’s DCS generates and prints out bag tags with ten-digit numeric codes, also represented as a barcode. The airport’s baggage handling system scans these barcodes to sort and track the baggage.

Though the rate of missed or delayed baggage is very low (less than 0.5 percent), in case passengers find themselves among this unhappy minority, a baggage barcode will serve as a key identifier that they must share with the airline they fly on.

A few more words on flight booking

Since there are no ticket agents anymore and you don’t need to call them to reserve a paper ticket, today’s flight booking pipeline is considered to be simpler than before. But still, a single booking requires a number of different operations, all bound to one another. Most of these processes remain overcomplicated by numerous connections to different services, systems, and distribution channels. As innovations are adopted by both airports and airlines quite slowly, there still are GDSs and multiple airline flight booking APIs to ensure seat, ancillary, and fare distribution.

With a software engineering background, Nefe demystifies technology-specific topics—such as web development, cloud computing, and data science—for readers of all levels.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.