Companies in the financial services industry must carefully assess software engineers for their technical skills and readiness to thrive under the sector’s unique constraints and requirements. This article explains how fintech companies evaluate candidates and what qualifications they look for, providing best practices for onboarding and integrating engineers in a highly regulated finance environment.

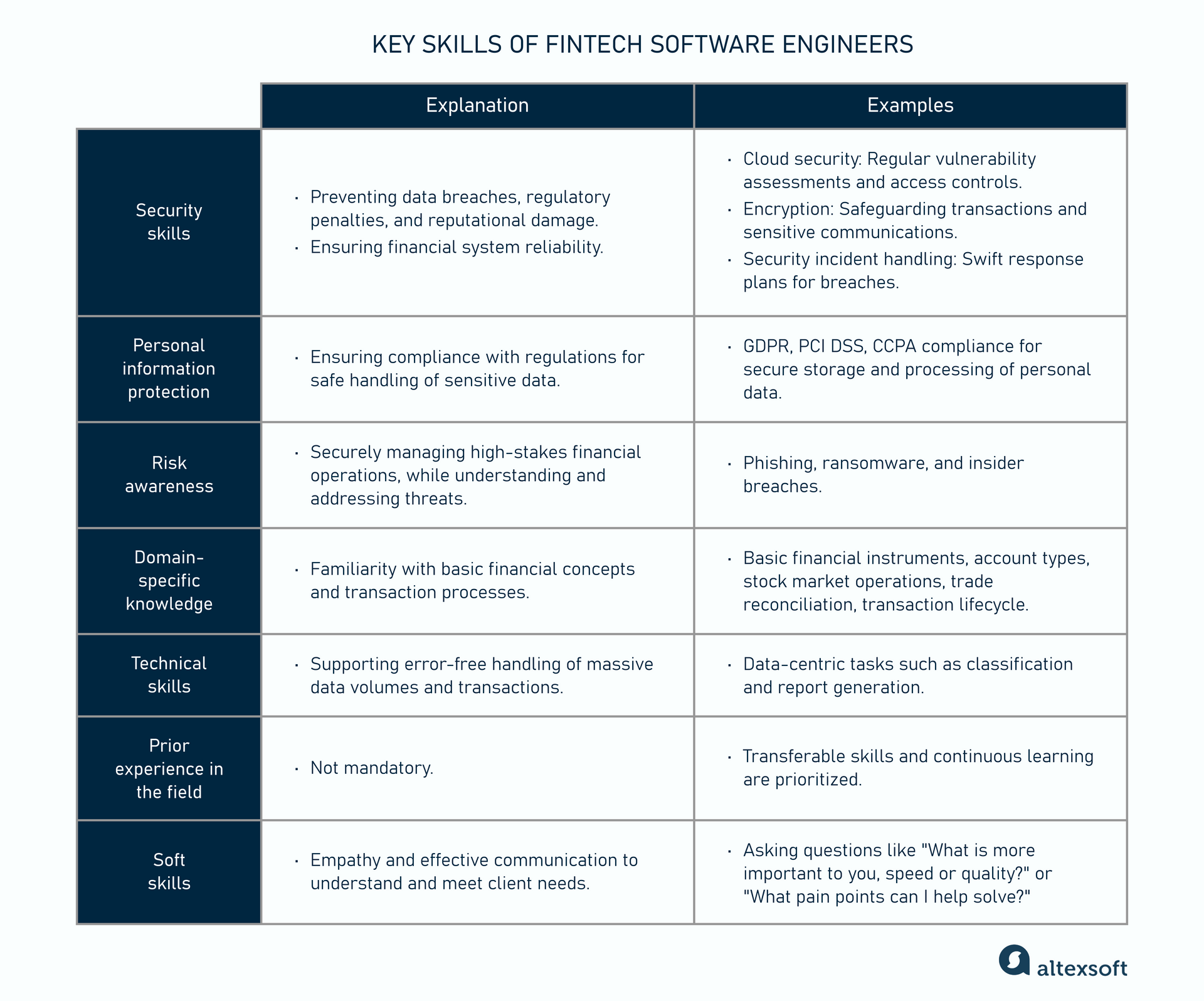

Key skills of fintech software engineers

Developers operate in a setting that requires a keen understanding of regulatory standards and a mindset for security-first development. Let’s discuss the common challenges in fintech hiring and the key skills expected from a candidate.

Key skills of fintech software engineers

Security skills

Given the sensitivity of financial data, security is fundamental in fintech. Developers need certain skills to ensure systems offer robust protection against potential breaches.

Cloud security. This involves protecting data, applications, and infrastructure hosted in cloud environments through access controls and regular vulnerability assessments.

Security incident handling. Financial institutions need to act swiftly to minimize the impact of incidents on customers and operations while ensuring compliance. Engineers must know how to develop and execute plans to detect, respond to, and recover from security incidents such as breaches or cyberattacks.

Encryption. Using algorithms to convert data into a secure format ensures that only authorized users can decrypt and access it. Encryption protects financial transactions, customer information, and sensitive communications from interception and misuse.

“The candidate must be well-versed in cybersecurity practices and safety protocols,” Artem Batkivsky, a software engineer in a financial services company, explains. “Considering the high-risk nature of financial services, especially if given access to sensitive company networks, employees must uphold robust security frameworks.”

Personal information protection

Fintech companies manage vast amounts of sensitive customer and market data. Software engineers play a pivotal role in ensuring the secure handling of payment details, social security numbers, account credentials, and other sensitive information.

Data protection regulations exist to address the risks and concerns surrounding the collection, storage, and use of personal information. For example, the GDPR (General Data Protection Regulation), PCI DSS (Payment Card Industry Data Security Standard), CCPA (California Consumer Privacy Act), and other regulations demand strict compliance.

Being unaware of personal information protection principles can introduce vulnerabilities, leading to data breaches, regulatory fines, and loss of consumer confidence.

Risk awareness

The financial sector is a target for cybercriminals due to its valuable data and high-stakes operations. Threats such as phishing, ransomware, and insider breaches can lead to financial losses, regulatory penalties, and reputational damage. That’s why being risk-aware is critical for operating in a fintech environment.

A proactive approach to risk awareness involves regular practices, such as reminders to customers to use unique, strong passwords or threat simulations among employees.

A popular type of threat simulation is false emails designed to mimic real phishing attempts. The goal is to assess how well employees recognize and respond to such threats. They may identify suspicious elements and report the email or engage with it by clicking on the links or downloading attachments, which is the incorrect response.

While simulations and training programs are critical components of working in fintech, they cannot fully replace the foundational knowledge and risk awareness a candidate must possess before applying for the job.

Software engineers entering the fintech space must already have a baseline understanding of cybersecurity principles, compliance requirements, and risk management strategies to quickly adapt to the industry's high-stakes challenges.

Domain-specific knowledge

During the interview stage, candidates should be familiar with fundamental financial concepts. Here are some examples.

Basic financial instruments. Understand what stocks and bonds are, as well as their roles and distinctions.

Account types. Recognize the different types of bank accounts, such as checking and savings accounts in retail banking, and their primary uses.

Stock market operations. Have a general understanding of how the stock exchange and trading work.

Trade reconciliation. Know the basics of stock reconciliation—what happens after a stock is bought, where the funds go, and how ownership is transferred.

Transaction lifecycle. Be prepared to explain the process that takes place after a transaction, such as the purchase of a stock, including what it means for both the buyer and the seller.

For example, in an interview, a candidate must be able to explain what happens when someone buys a share of Microsoft stock, tracing the lifecycle of the transaction and where the investment goes. These questions ensure a basic understanding of the financial industry.

More complex financial concepts can be learned over time and are not typically required upfront.

Technical skills

Besides risk awareness, security practices, and basic domain-specific knowledge, software developers fundamentally operate as tech professionals, similar to those in other industries. Their primary focus remains on coding, problem-solving, and delivering technical solutions.

When software engineers join financial institutions, their identity as tech experts is preserved. They are not primarily seen as "financial services company employees" but rather as professionals contributing to technology-driven solutions in a finance context.

Artem shared an example: “Almost every company is a software company, even BMW. They produce machines for driving—but in the modern world, they are a software company first and vehicle producers second.”

Contrary to the perception that working in finance demands mastery of complex algorithms and advanced calculations, the reality is more pragmatic. Most software engineers focus on data-centric tasks such as classification and report generation. These responsibilities are straightforward and aim to ensure accurate and efficient data handling rather than delving into intricate financial models or software innovations.

“Usually, 80 percent of engineers work on business-as-usual operations. Financial services companies are mostly all about numbers—balances of their clients and transactions.” Artem Batkivsky explains. “Less than half of the engineering workforce engage in highly specialized work, such as developing sophisticated algorithms or advanced user interfaces.”

Simplicity is key to success in financial institutions, particularly due to the need for high reliability and low tolerance for failure. Large financial organizations, such as banks and insurance companies, handle massive volumes of data and transactions, and they cannot afford surprises or failures in daily operations. To ensure success, they break down complex processes into simple, manageable tasks.

The ability to demystify our deliverables is what makes us successful.

By simplifying operations and focusing on small, understandable components, fintech companies reduce the risk of errors and increase the reliability of their systems.

Prior experience in the field

For developers, having experience working in the financial services industry is not key; it’s only an advantage.

Transferable skills are much more important than domain-specific experience. Many companies are open to hiring from other industries if candidates demonstrate strong abilities in coding, problem-solving, and effective communication.

Developers are evaluated on their ability to learn new skills quickly and stay updated with emerging technologies and practices. During interviews, companies pay attention to a candidate's learning muscles, recent projects or skills they’ve picked up, and how they integrate continuous learning into their routine.

Soft skills

The ability to express empathy is just as important as technical expertise in determining a candidate's success in the role. Effective communication skills are essential for translating technical requirements into business solutions and ensuring all stakeholders are aligned.

Developers who take the time to think about their clients' perspectives, even just a few minutes a day, are more likely to deliver the right solutions at the right time. With the rise of AI coding tools that make programming easier, the ability to empathize and understand client needs has become even more valuable, as technical skills are no longer the sole differentiator.

Developers must understand their client's needs and be able to ask insightful questions. For example, instead of simply delving into technical details, a specialist who proactively asks questions like "What is more important to you today, speed or quality?" or "What are your pain points that I can help solve?" shows a deeper understanding of the client's business goals and a willingness to align their work with those needs.

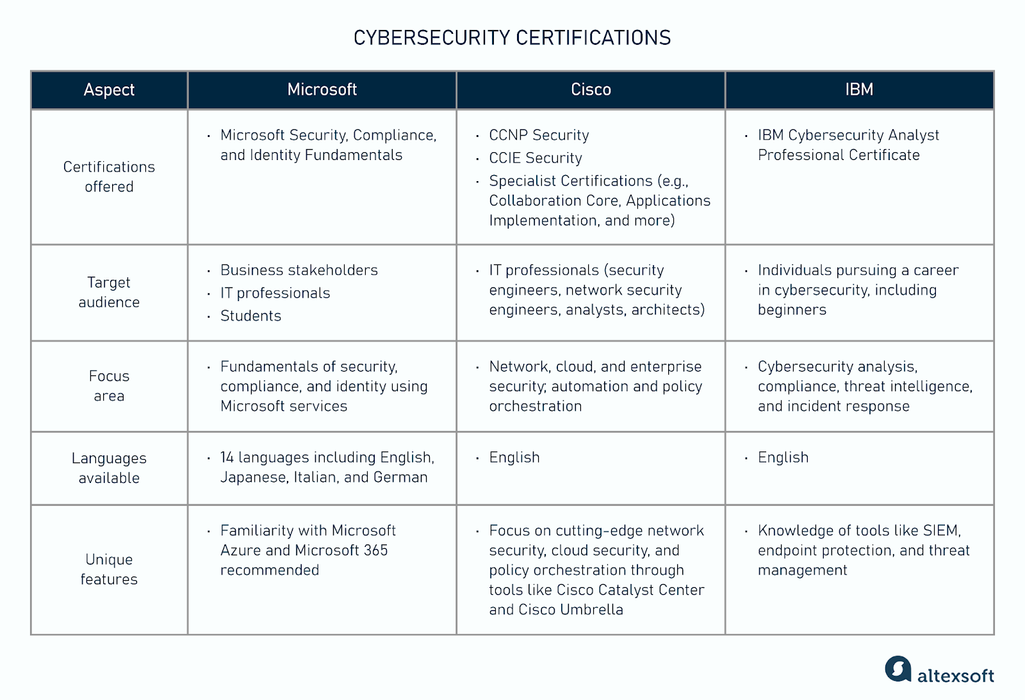

Cybersecurity certifications

Cybersecurity certifications help validate a candidate’s knowledge of security and compliance. However, they are not mandatory when hiring individual software engineers. That is because fintech companies add employees to their workforce, making it easier to integrate them into their security and risk management processes. For example, they run direct threat simulations and implement security protocols themselves, ensuring the individual complies with the company's standards.

Here’s a clear distinction: Individual contractors fall directly under the company’s processes, while vendor-provided workers are managed independently by the vendor. When fintech companies partner with vendors, the approach differs. Vendors are responsible for managing their own headcount and implementing their own security measures. As a result, the financial institution counts on the vendor’s cybersecurity certifications, like those from Microsoft, Cisco, or IBM. You can learn the details of each in the table below.

A general overview of security certifications by Microsoft, Cisco, and IBM

ISO certifications also play a significant role in ensuring trust and accountability. ISO 27001 is the most widely recognized standard for Information Security Management Systems (ISMS) and is relevant for companies of all sizes and industries.

The certification includes a framework for managing data security risks and helps organizations become proactive in identifying and addressing cyber threats and vulnerabilities. For instance, AltexSoft has successfully completed its training and is ISO 27001 certified.

Certifications provide validation that the vendor’s processes align with industry standards and follow structured security frameworks. However, there are still cases when companies might not require certifications from vendors. It depends on the project’s value and the level of risk tolerance.

In smaller projects, where the billing amounts are modest, certifications may not be a requirement. Instead, companies focus on factors like project cost, speed, and vendor reviews. Ultimately, it’s up to the client to determine whether certifications are a priority.

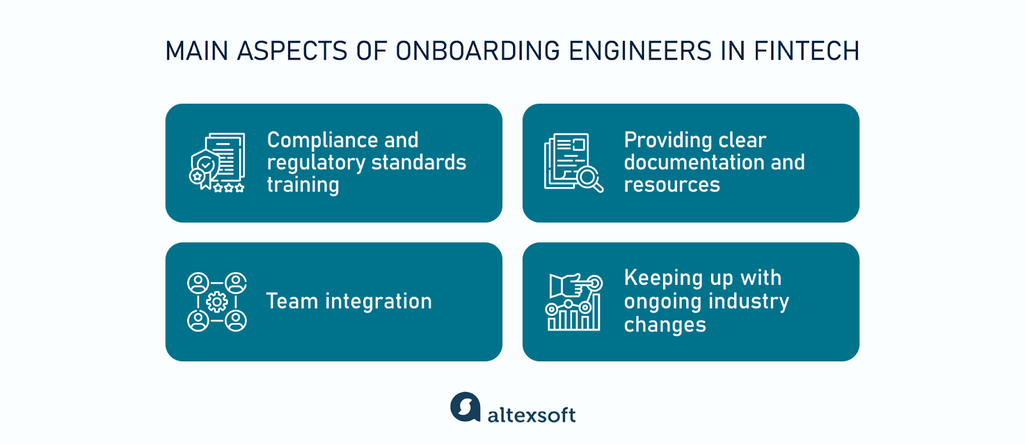

Onboarding software engineers in fintech

The goal of onboarding is not only to equip new hires with the knowledge they need to comply with company standards and industry regulations but also to foster a collaborative mindset and continuous growth within this specialized field.

Main aspects of onboarding engineers in fintech

Training on compliance and regulatory standards. “When a financial services company hires someone, whether directly or through a vendor contract, they provide training in financial literacy, cybersecurity awareness, and risk management. This onboarding process is standardized and ensures that employees are aligned with the organization’s protocols and industry expectations,” Artem Batkivsky explains.

However, we’d like to remind you that candidates are expected to have a basic understanding of these topics.

Clear documentation and resources. Provide comprehensive documentation, such as coding standards and security protocols, so engineers have quick access to critical information. Encourage feedback from new hires to identify areas of improvement and tailor the experience to better meet the needs of future hires.

Team integration. Even though “engineers typically have minimal day-to-day interaction with legal or HR departments,” as Artem says, onboarding should include introductions to all key teams to help engineers understand the bigger picture and ensure product alignment with regulatory standards and business goals.

Establishing relationships with other departments also makes it easier for engineers to seek guidance, clarify requirements, and address challenges as they arise.

Keeping up with ongoing industry changes. Onboarding is also an opportunity to set the stage for continuous learning in a fast-evolving industry. Fintech regulations change frequently, and keeping up-to-date is crucial. For example, anti-money laundering (AML) regulations are frequently updated worldwide to address new types of financial crimes.

To keep engineers current, provide access to ongoing training opportunities, such as workshops, industry conferences, online courses, and periodic compliance refreshers. This way, engineers remain informed about any changes that affect their work and are prepared to implement the latest innovations and best practices.