Imagine a toy business that wants to create a new action figure. While the company can research its competition to see what similar products are already on the market and what features they offer, this approach alone is insufficient. It might tell them what is currently popular but won't provide direct insights into what children actually want or why they prefer certain toys.

To truly understand their target audience, the company organizes a focus group with children. Participants are asked about their favorite toys, what they like or dislike about them, and what kind of new toys they would love. However, interviewing isn't enough. The purpose of the focus group is to let the individuals interact with each other and engage in a rich discussion.

By listening to the kids' conversations and observing their reactions, the toy company can gain valuable insights into what features to include in their new action figure, making it more appealing and successful.

This article will explain what focus groups are, the roles they include, the different types, and when they are used. We will also provide tips on how to run focus groups and address the challenges associated with them.

What is a focus group?

A focus group is a method of qualitative research that gathers data through group interaction. While quantitative research focuses on numerical data and statistical analysis, focus groups aim to understand the underlying reasons and motivations behind opinions and behaviors.

Focus group insights are interpreted as patterns and viewpoints instead of numbers or statistics. For example, your analytics show that the conversion rate from a landing page is 5 percent, while during the focus group, you can learn that the main call-to-action is not compelling to users, leading them to abandon the page.

One person's experiences can spark new perspectives in others. This collaborative dynamic leads to a chain reaction of ideas, where participants build upon each other's thoughts.

Focus groups differ from brainstorming sessions in that they are more structured and specifically target participants' perspectives on a particular topic rather than generating a wide range of ideas. Unlike interviews, which gather individual responses, focus groups encourage participants to influence each other, resulting in deeper, more nuanced insights.

Focus group roles

Let's discuss the distinct roles in focus groups.

Focus group roles

Participants are individuals who actively take part in the focus group discussion. They are selected based on specific criteria relevant to the research objectives, such as demographic characteristics or experience related to the topic.

Participants contribute their opinions, attitudes, and experiences, providing qualitative data that helps researchers understand diverse perspectives on the topic at hand. Later in the article, we’ll provide recommendations on selecting the right participants for your focus group.

A focus group usually consists of 4 to 12 participants. This number gives everyone a chance to speak and share their views while being large enough to offer a variety of opinions.

Smaller groups of 4-7 are better for in-depth discussions and sensitive topics. Eight to 10 participants are the standard for general consumer feedback. Larger groups of up to 12 individuals allow for broad market research and idea-generation sessions.

Moderators are responsible for guiding the focus group discussion and ensuring it stays on track. They encourage participation from all individuals and ask probing questions to delve deeper into relevant issues.

As a moderator, I recognize that each participant's experience can be highly valuable and always actively monitor the discussion to ensure everyone has the opportunity to contribute.

Moderators manage the group dynamics, fostering an environment where participants feel comfortable sharing their views without fear of judgment. They set clear ground rules at the beginning of the session and encourage respectful communication among participants.

Moderators may summarize key points and redirect conversations if needed. They follow a structured framework while remaining adaptable to the flow of conversation.

Observers do not actively participate in the discussion. They listen to it and pay attention to non-verbal cues like body language and facial expressions, group dynamics, and other contextual factors that may influence participant responses. They may also request the moderator to delve deeper into specific details.

Observers contribute to a more comprehensive understanding of how participants engage with the topic and each other.

Recorders, also known as note-takers, document the focus group proceedings. They record key quotes and, like observers, may take notes about participants' body language and group dynamics. Their documentation helps researchers validate findings and capture nuances that may not be immediately apparent during the session.

Note that, unlike participants and moderators, observers and recorders are optional roles in a focus group. Their presence can enhance the quality of data collected but is not necessary. By considering budget constraints and the depth of insights needed, researchers can determine whether to include observers and recorders.

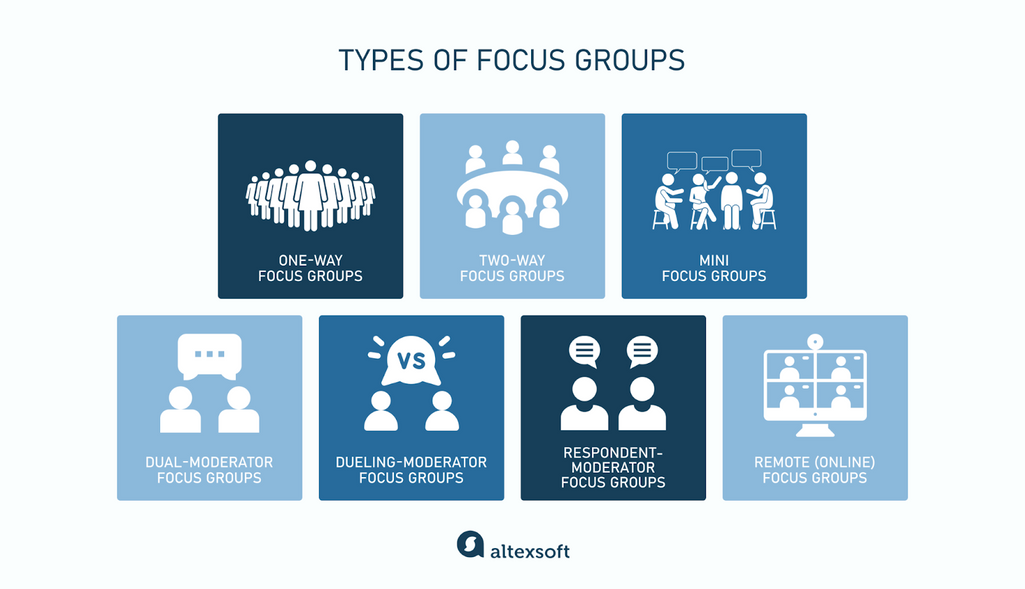

Types of focus groups

The various focus group formats suit different research objectives and participant dynamics.

Types of focus groups

One-way focus groups are the classic format where the moderator asks questions and leads the discussion while participants respond and interact with each other.

Two-way focus groups involve two separate groups, each with its own moderator. One acts as the primary while the other watches the discussions and interactions. As you can see, the role of an observer can be played not only by one person but a whole other group.

After the discussion, the second group may engage in their own discussion facilitated by their moderator, sharing observations and potentially drawing different conclusions based on what they saw and heard.

Mini focus groups comprise four or five participants and offer a more intimate setting. The smaller size fosters deeper discussions and is particularly suitable for exploring sensitive or complex topics since participants may feel more comfortable sharing personal views. Mini focus groups provide nuanced insights that might be less achievable in larger groups.

Variations like dyads (two participants with a moderator) and triads (three participants with a moderator) offer even more focused environments for deep exploration of specific topics or dynamics between individuals.

Dual-moderator focus groups involve two moderators working together. One takes the lead in asking questions and guiding the conversation, while the other ensures that all relevant topics are covered and participants stay focused and engaged. This format enhances the effectiveness of the focus group by dividing responsibilities.

Dueling-moderator focus groups include two moderators who take opposing viewpoints on the topic. By debating and challenging each other's positions, the moderators encourage participants to evaluate different sides of the issue and consider alternative opinions.

This format is effective for exploring controversial topics where multiple perspectives are valuable for comprehensive understanding and decision-making. It can uncover insights and solutions that may not arise in a single-perspective discussion.

Respondent-moderator focus groups assign one or more of the participants as moderators. This approach changes the dynamics of the group and allows different individuals to ask questions and guide the conversation. It helps avoid unintentional biases that a single moderator might bring and is useful for generating diverse reactions.

Remote (or online) focus groups allow people from different locations to participate without traveling and being present in one room. They enable a broader geographical reach and, in some cases, are used to ensure anonymity, encouraging more candid responses, especially when discussing sensitive topics.

One disadvantage here is that remote focus groups lack the depth of face-to-face interactions and do not provide an opportunity to read body language and communication tones thoroughly.

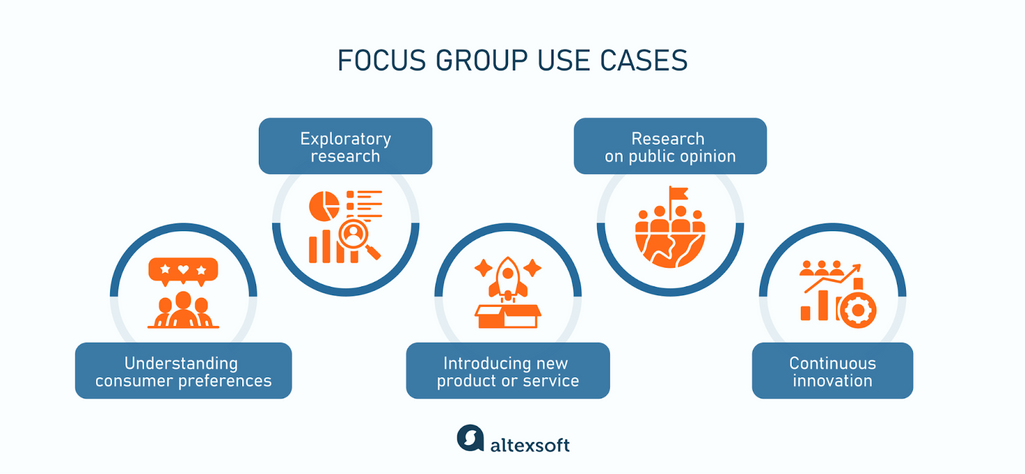

Focus group use cases

Focus groups can be used in various contexts to gather feedback from specific target audiences. Here are some of the most common use cases.

Focus group use cases

Understanding consumer preferences, habits, and motivations informs marketing strategies and product positioning. For instance, since 2021, Netflix has been reaching out to small groups of subscribers and asking them to provide feedback on original content before its public release. This allows Netflix to gauge the potential success of their new releases and gain insights into the preferences of their audience.

Exploratory research is conducted to understand problems where little or no previous knowledge or experience exists. Airbnb ran numerous focus groups with people with disabilities to introduce new accessibility features on the platform. This informed the development of new filters like wide entryways to accommodate a wheelchair, step-free room entries, and more.

Introducing a new product or service in focus groups involves gathering feedback from a representative sample of potential customers or users. This helps identify strengths and weaknesses before the product or service is finalized.

For example, Starbucks conducted a focus group to determine if customers would be willing to pay $25 to join a loyalty program and what benefits would justify this cost. They found out what types of discounts, rewards, and exclusivity features would appeal most to their customer base.

Focus groups can also be employed when the project is already "in production." They can provide valuable user feedback, identify areas for improvement, and help guide future updates and enhancements.

Research on public opinion provides valuable insights into populations’ behavior, attitudes, and societal trends, shaping the landscape of political discourse. It serves as a check on government actions and ensures the representation of public interests. This type of research also helps political parties gauge candidate viability and adjust campaign efforts accordingly.

For example, in 2009, Democratic pollster Peter Hart recruited a focus group to gather public opinion on President Obama's performance and the major issues he was handling at the time, including military decisions, healthcare reform, and the high unemployment rate. Hart invited five Democrats, three Republicans, and three independents to understand the primary concerns among various voter groups.

Continuous innovation in ever-evolving industries requires organizations to remain adaptable to changing market conditions, customer expectations, and technological advancements. For example, Pfizer constantly works closely with patient advocacy groups that educate the public and healthcare policymakers about specific conditions or patient issues. They perform the role of a focus group when providing input on new treatments, devices, or services to ensure they meet patient needs.

Whether used to understand customer preferences, test new ideas, or gauge societal attitudes, focus groups are invaluable tools in all industries.

Customer Research in Product Discovery

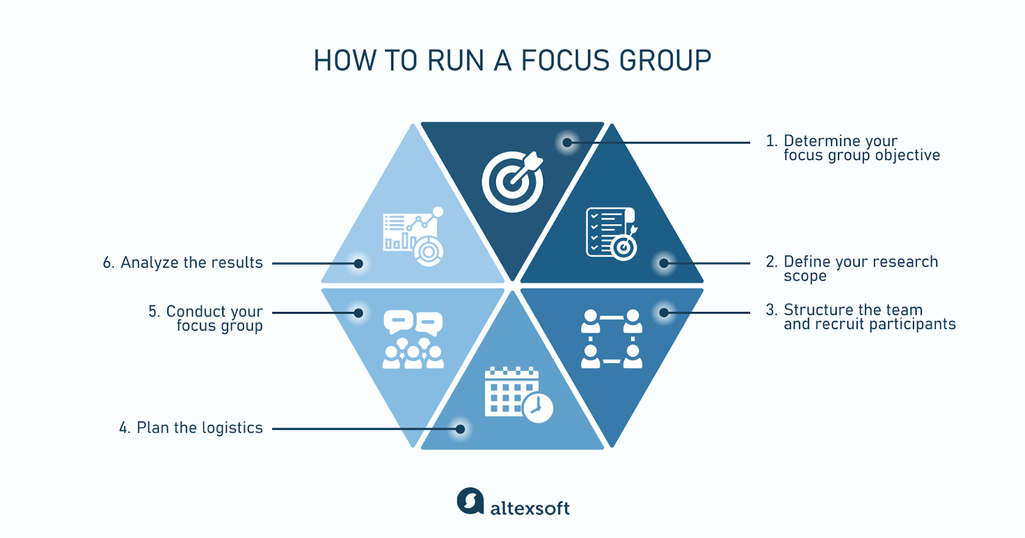

How to run a focus group

Conducting a focus group is more than just having people in the same place and talking to them. This research method requires careful planning and organization.

How to run a focus group

In this section, we'll walk you through the preparation and discuss the essential aspects to keep in mind.

Determine your focus group objective

The first step sets the stage for everything that follows and involves identifying and articulating what you want to learn from the discussion. Are you looking to test a new product, discover consumer opinions, understand behavior patterns, or explore a new market segment?

Gather relevant background information about the topic, like market research reports, previous surveys, competitor analysis, and industry trends. Identify the key themes that you want to explore during the focus group.

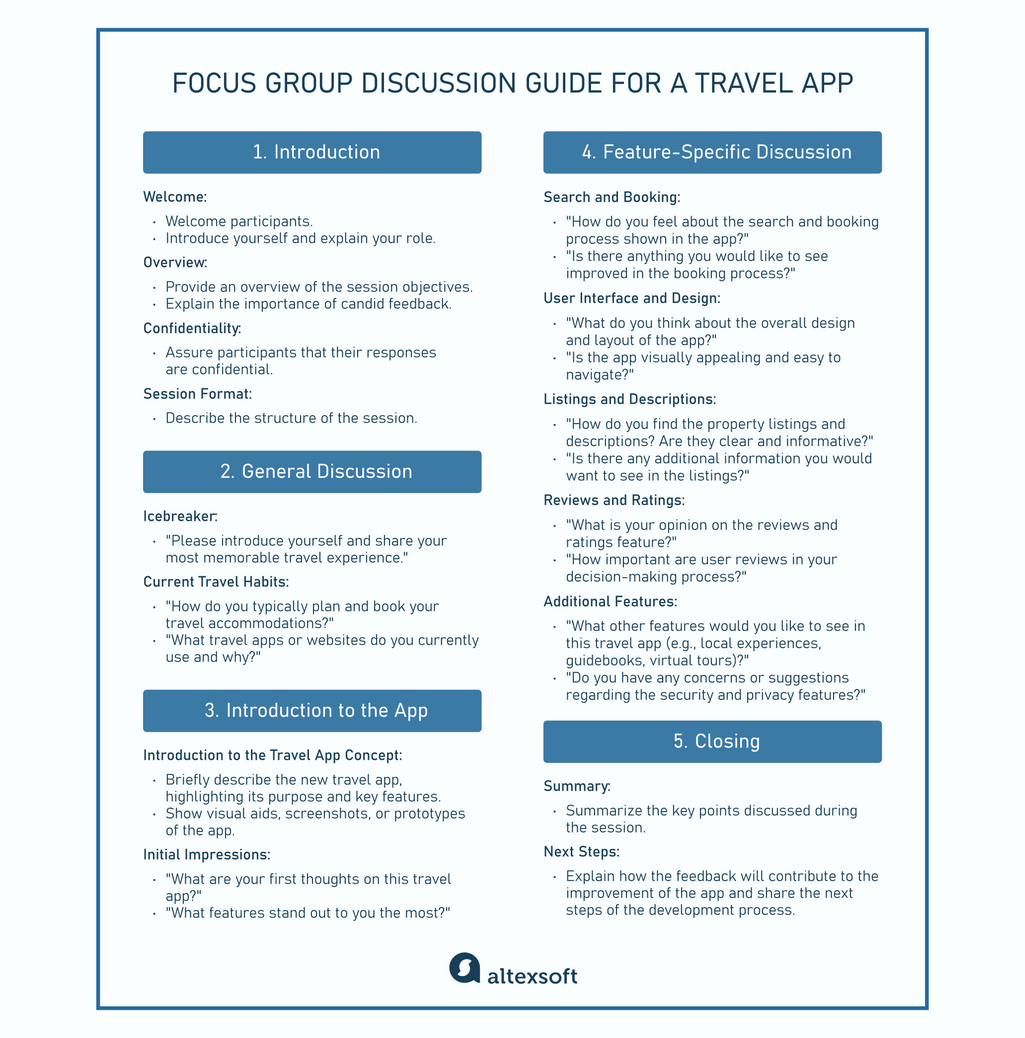

Define your research scope

Break down the broad objective into specific goals. For example, if you're testing a new product, your specific goals might include understanding user experience, identifying potential improvements, and gauging purchase intent.

An example of a discussion guide

Create a discussion guide that includes a list of specific questions. The guide should balance structure and flexibility, allowing for spontaneous conversation while ensuring that critical areas are addressed.

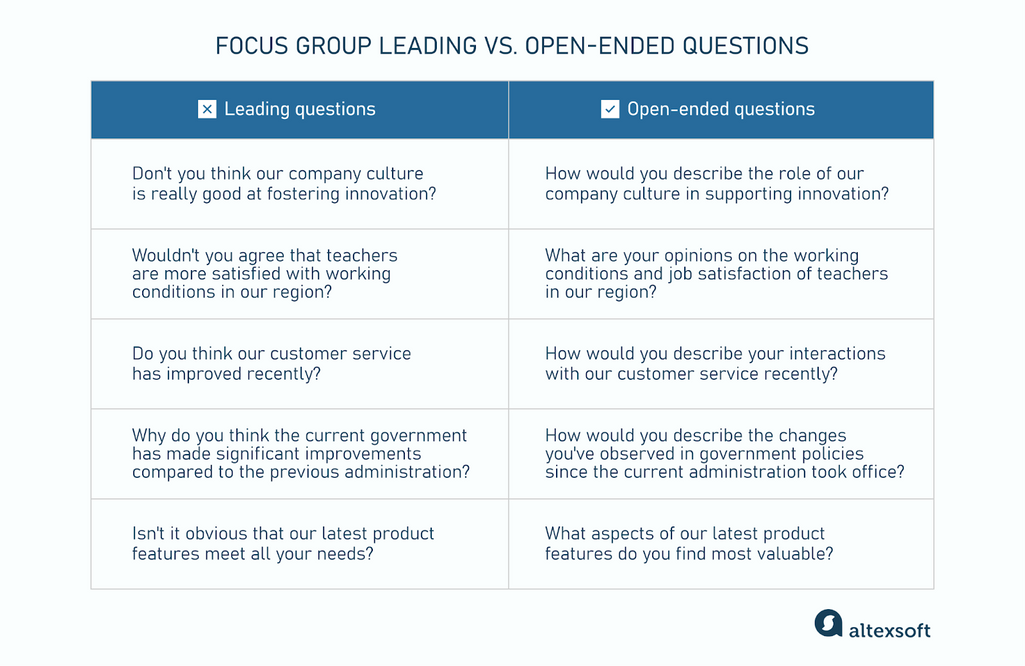

Examples of leading vs. open-ended questions

Pay special attention to the phrasing to avoid leading questions that can influence responses. Questions must be open-ended, meaning it’s impossible to answer them with a simple “yes” or “no.”

Structure the team

When choosing a moderator, look for someone with experience leading focus groups or strong interpersonal skills. They should be able to handle conflicts, probe for deeper insights, and ensure that all participants have a chance to speak.

If your research involves complex interactions, detailed behavior analysis, or a high volume of data, consider adding another moderator, an observer, or a recorder. They can take notes, help with questions, and watch participant behavior, allowing the main moderator to focus on leading the discussion. If the nature of your research involves exploring opposing standpoints, then you should have two dueling moderators, as we mentioned earlier.

Recruit the participants

There are several methods for finding focus group participants. They include reaching out to the existing customer base, using industry associations or word of mouth, partnering with focus group agencies, posting recruitment notices on social media platforms or community groups, and contacting universities or educational institutions.

Selecting the right participants for a focus group is crucial to obtaining valuable and relevant insights. The characteristics you choose for participants depend on the research objectives. The most important include:

- demographics (age, gender, income, education),

- geographics (location, climate),

- psychographics (lifestyle, values),

- behavioral characteristics (purchase behavior, product/service knowledge),

- experience and expertise (industry professionals, current vs. potential users), and

- cultural background (ethnicity and culture).

For example, if you plan to launch a new fitness app, you should select individuals whose lifestyles align with the app’s target audience. Look for people new to fitness, as well as those who have used such apps before, as they can provide ready insights into what they find valuable or lacking in existing apps. Also, include fitness instructors to gain professional insights.

It's a good practice to add different categories of people from the innovation adoption cycle. This way, you will learn how to enhance the excitement of early adopters and spark the interest in those skeptical and resistant to trying your product.

Determine the characteristics of the participants that align with your research goals. It’s best to choose individuals who already have experience in the topic of discussion and are personally interested in attending.

The participants often receive monetary compensation for their time or other incentives like gift cards, samples of products or services being discussed, or access to research findings. In other cases, they might participate voluntarily out of interest or are experts in a field who join focus groups as part of their job responsibilities.

Choose the time and place

Schedule the session, typically lasting 45-90 minutes, at a convenient time for participants. If longer, include breaks to maintain attention. Choose a comfortable, accessible location with adequate space and facilities. For remote groups, select a reliable virtual meeting platform and ensure all participants have the necessary technology to join.

Confirm the session time and date with participants well in advance. Remind them a day before the session to ensure attendance. It is a good practice to invite more participants than needed, for example, 10-12 for a focus group size of 8-10. This ensures that the group remains within the desired range even if some fail to attend.

Provide participants with all necessary information about the focus group, including its purpose, benefits, and confidentiality levels. Obtain written consent, especially if recording the session. If participants have to read something beforehand, provide these materials well in advance.

Conduct your focus group

Now, it's the time you’ve been preparing for. Before the participants arrive, ensure everything functions correctly, such as recording devices or the online meeting platform. Also, check that all materials, including discussion guides, participant information sheets, and consent forms, are ready.

The moderator begins the session by welcoming participants, introducing the purpose of the focus group, explaining how the session will be conducted, and how feedback will be used.

We recommend starting with general questions before probing specifics. At the end, summarize the discussion and thank participants for their contributions.

Analyze and report the results

Once the focus group session is complete, the critical task of data analysis and reporting begins. The facilitators debrief by exchanging their initial impressions, key takeaways, surprising insights, and thoughts on the overall group dynamics. If the session wasn't recorded, it is important to debrief immediately to ensure the nuances and details of the discussion are captured accurately while they are top of mind for facilitators.

Look for recurring themes, agreements, and disagreements among participants. Identify patterns in responses and note any significant deviations or unique perspectives. Pay special attention to trends that align with or challenge your initial hypotheses.

Finally, create the summary report in which you present the main findings organized by themes or topics. Use direct quotes from participants to illustrate key points and add depth.

Focus group challenges and limitations

Focus groups have certain challenges and limitations that must be considered.

Focus group challenges

Group dynamics can influence the quality of insights obtained. Dominant participants may overshadow quieter voices, leading to biased or incomplete feedback. Moderators must encourage quieter participants to share their views and set ground rules to ensure all voices are heard.

Discussing sensitive or personal topics in front of others may be challenging for some individuals. Ensure confidentiality and create a safe, trust-promoting environment. Clearly communicate the anonymity of responses and the importance of open, honest dialogue.

Fair representation is not always easy to achieve with small sample sizes that do not fully capture diverse perspectives or behaviors. You should carefully select participants who reflect the target audience's demographics and viewpoints. If this is still not possible, try adding a few more participants or consider conducting multiple focus groups.

Social desirability bias occurs when participants provide responses that align with social norms or expectations rather than expressing genuine opinions. To mitigate this issue, foster a non-judgmental environment where participants feel comfortable expressing themselves. Use neutral phrasing in questions to encourage honest responses.

Scheduling difficulties may arise as it is hard to coordinate a common date and time for all participants to meet. Offer multiple session times and use scheduling tools to find common availability. Consider online focus groups as an alternative to accommodate participants from different locations, but keep in mind that they come with the cons we mentioned earlier—the lack of face-to-face interactions and the inability to read body language fully.

Discrepancies between stated and actual behavior mean that what participants say does not accurately mirror their real-life actions. To uncover misalignments, moderators must encourage participants to reflect on their responses and ask probing questions.

Analyzing results requires skilled interpretation. Qualitative data (opinions, attitudes, and perceptions) is inherently subjective. The interpretation of this data can be influenced by the analyst's personal biases and preconceived notions. To ensure objectivity, employ researchers who are experienced in qualitative analysis.

Addressing these challenges will help you harness the full potential of qualitative research to uncover authentic insights and inform strategic decisions.