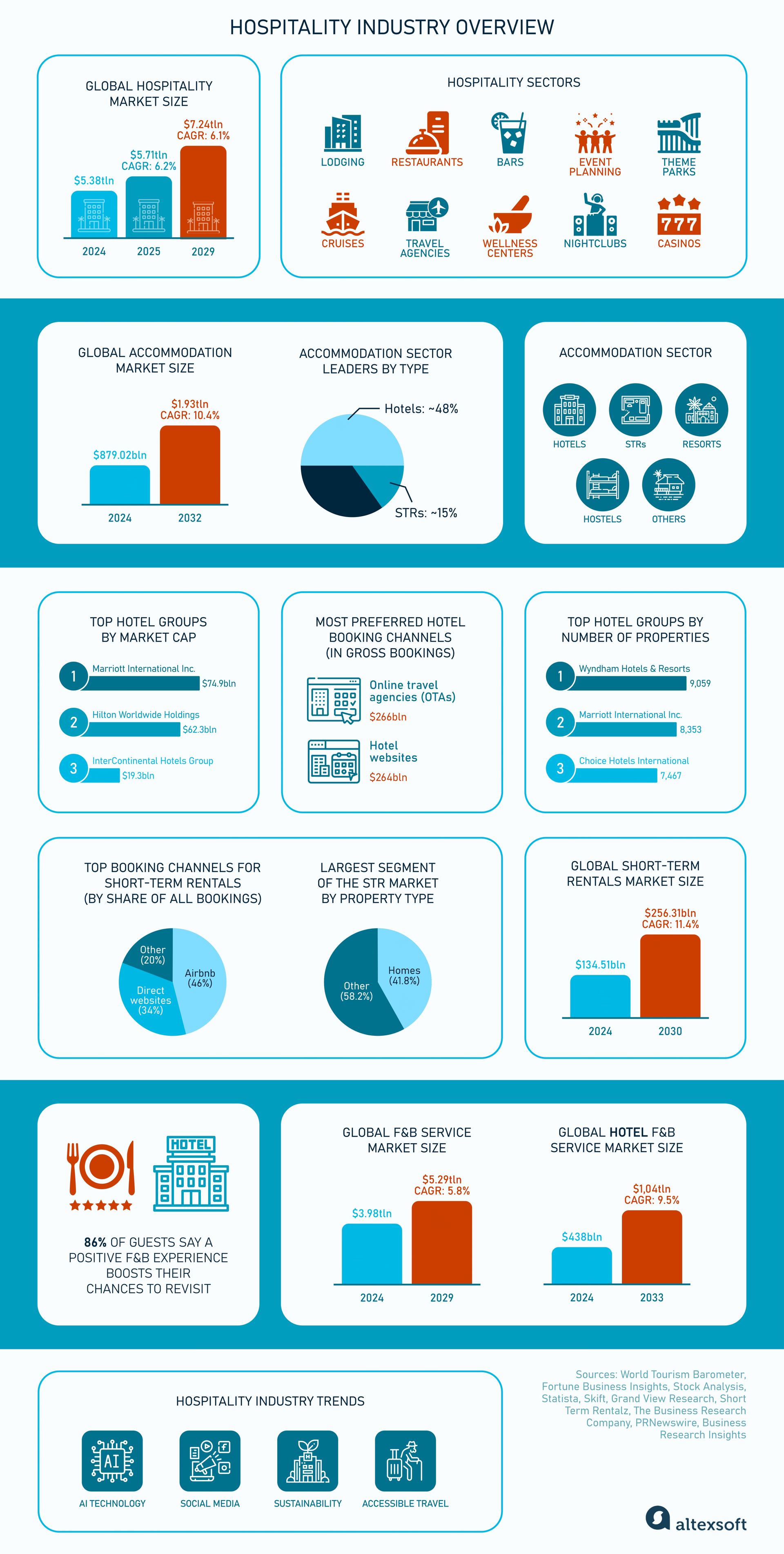

Our overview covers key aspects of hospitality, such as market size, employment figures, main sectors, and major trends influencing the industry.

Hospitality Industry Overview

What is hospitality?

Hospitality, in its broadest sense, refers to welcoming, accommodating, entertaining, and feeding travelers and local customers. The industry encompasses a wide range of service-oriented businesses, such as

- hotels, hostels, and resorts,

- restaurants and bars,

- event planning companies,

- theme parks,

- cruises,

- travel agencies,

- wellness centers,

- nightclubs,

- casinos, and more.

The Cambridge Business English Dictionary takes a narrower view, limiting hospitality to accommodations and food and beverage (F&B) sectors. This corresponds to the acronym HORECA (Hotel, Restaurant, and Café/Catering), which is used in Europe and some other regions to refer to businesses offering food, drink, and lodging services.

Further, we’ll follow this narrow understanding of hospitality, focusing on its core aspects—providing lodgings for temporary stays and serving foods prepared for immediate consumption. Both types of activities are often combined within the same entity (for example, a hotel or resort).

The state of hospitality, which is centered on creating welcoming and memorable experiences, largely depends on the broader travel and tourism industry.

Travel and tourism and hospitality statistics

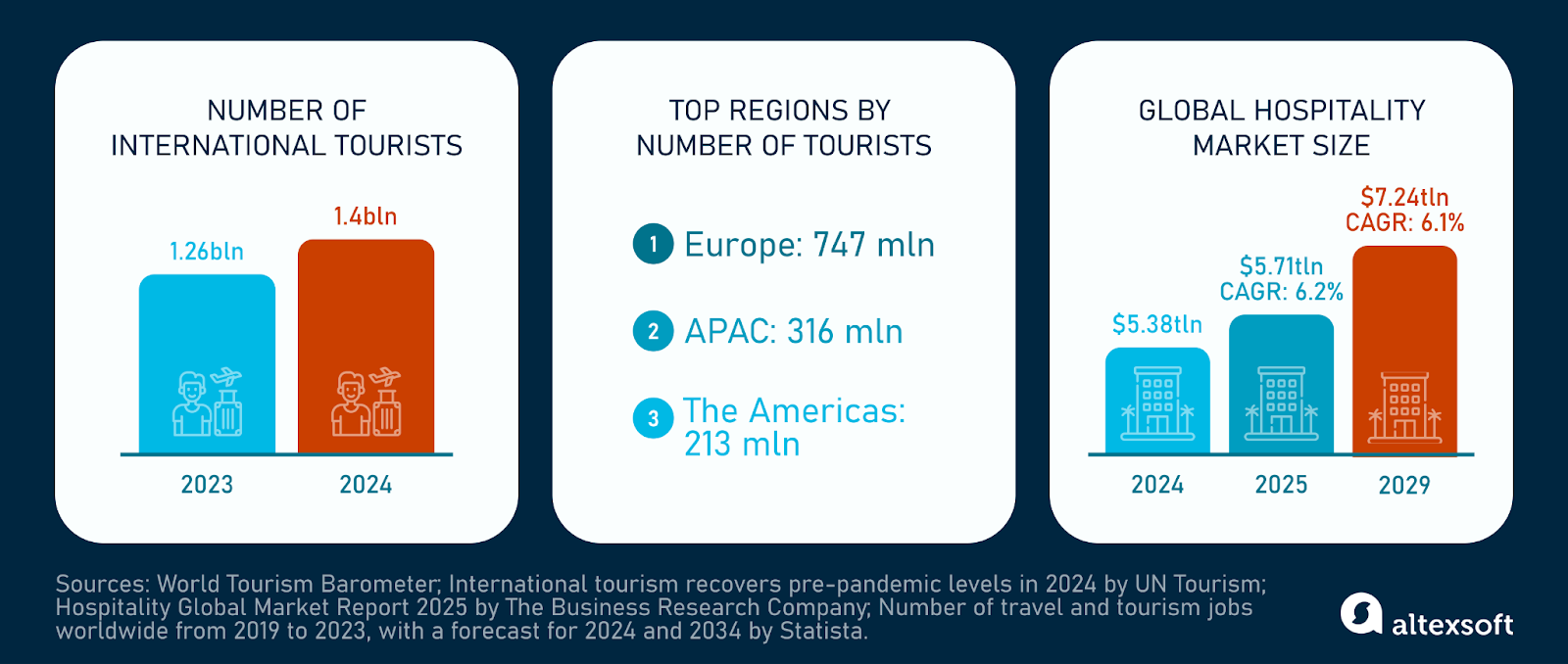

The World Tourism Barometer reports that 1.4 billion tourists traveled internationally in 2024—an increase of 140 million compared to 2023, reflecting an 11 percent growth. Europe was the world's top destination, welcoming 747 million international arrivals in 2024—a 5 percent increase from 2023. Asia and the Pacific experienced the highest growth, with arrivals climbing 33 percent to 316 million, an increase of 78 million. Meanwhile, the Americas recorded 213 million arrivals, reflecting a 7 percent rise over 2023.

Increasing global travel drives demand for accommodations, dining, and related services. Consequently, the hospitality market is on a steady upward trajectory. It is expected to grow from $5.38 trillion in 2024 to $5.71 trillion in 2025 at a CAGR of 6.2 percent and to $7.24 trillion in 2029 at a CAGR of 6.1 percent.

Accommodation sector

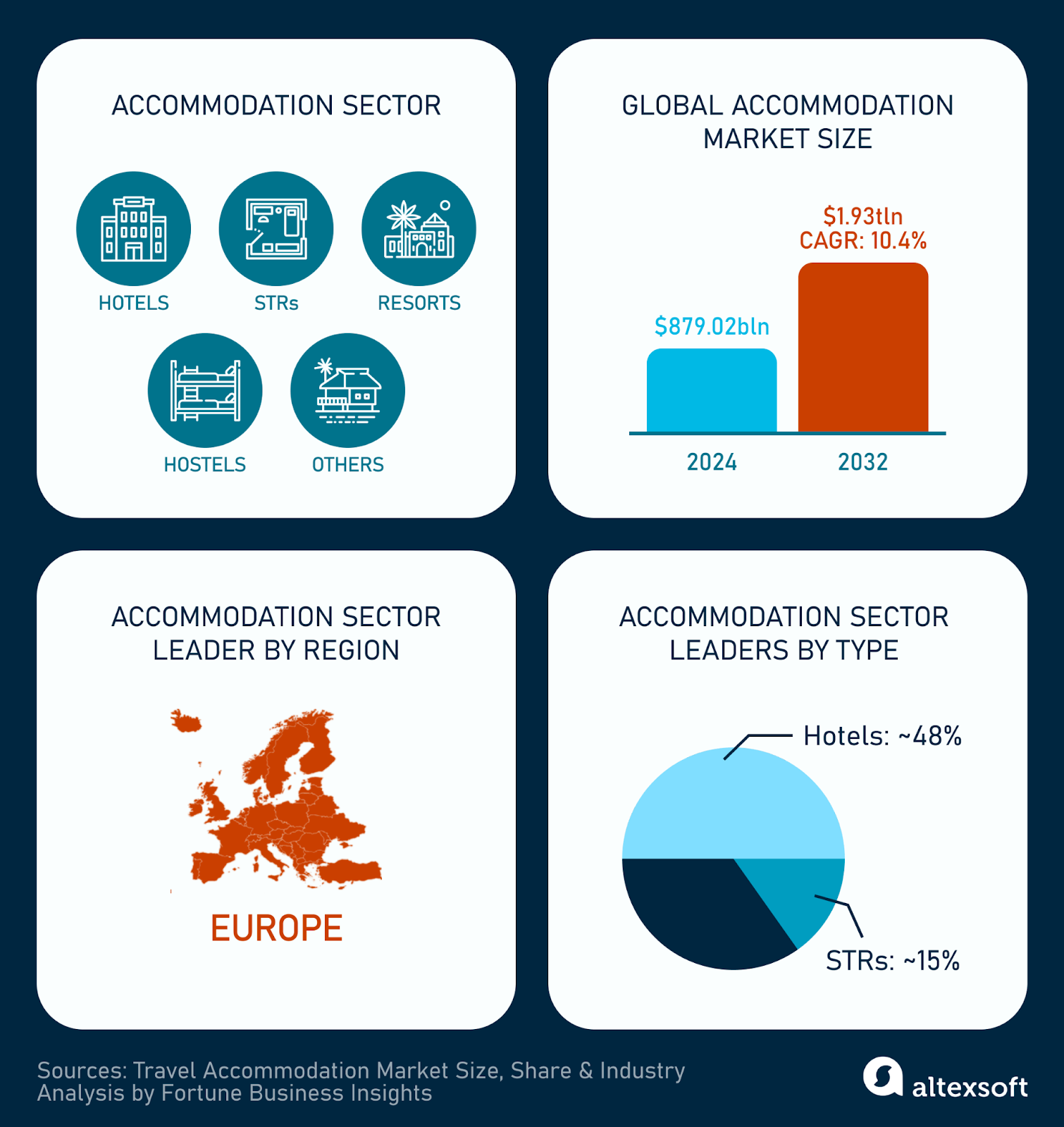

The accommodation sector of the hospitality industry includes all types of facilities that provide temporary lodging to guests. This covers hotels, resorts, hostels, vacation rentals, and other players.

Each type of accommodation caters to different customer needs, budgets, and preferences. For example, five-star hotels typically have full-service amenities such as restaurants, gyms, and conference rooms, while vacation rentals offer guests a home-like experience with longer stay options.

The accommodation sector statistics

The global travel accommodation market is expected to expand from $879.02 billion in 2024 to $1.93 trillion by 2032, reflecting a CAGR of 10.4 percent. In comparison, as mentioned before, the entire hospitality market is projected to increase at a CAGR of 6.1 percent.

The convenience of online booking platforms is one of the key factors leading to the growth of the accommodation sector. Travelers increasingly prefer booking lodgings online, as it allows for easy price comparison, real-time availability checks, and streamlined booking processes. Additionally, online platforms offer promotional discounts and special deals during holidays or special occasions.

Price-wise, the market can be divided into economy, mid-range, and luxury segments. Though the economy segment led the market in 2023, the mid-range segment is projected to grow, driven by travelers who prioritize comfort and convenience. This shift in consumer preferences is another key driver of the accommodation market growth.

From a regional perspective, Europe dominated the market in 2023, benefiting from tourism to iconic destinations such as the Eiffel Tower, Colosseum, Louvre, and Disneyland Paris.

By accommodation type, hotels lead the sector, representing about 48 percent of the market. Short-term rentals (STRs) hold the second spot with a share of over 15 percent. Further, we will focus on these two most popular types of lodging.

Hotels

A hotel is a commercial property designed to provide temporary accommodation to travelers. Hotels are classified into different categories based on the level of quality, service, and amenities offered. Star ratings indicate these categories and form traveler perceptions of what to expect from a hotel.

One- and two-star hotels offer basic, budget-friendly stays, while three-star hotels provide added comfort, featuring on-site dining and amenities. Four-star hotels are upscale with premium services like concierge and fitness centers. Five-star hotels represent luxury, offering top-tier service, fine dining, and high-end facilities.

Hotels statistics

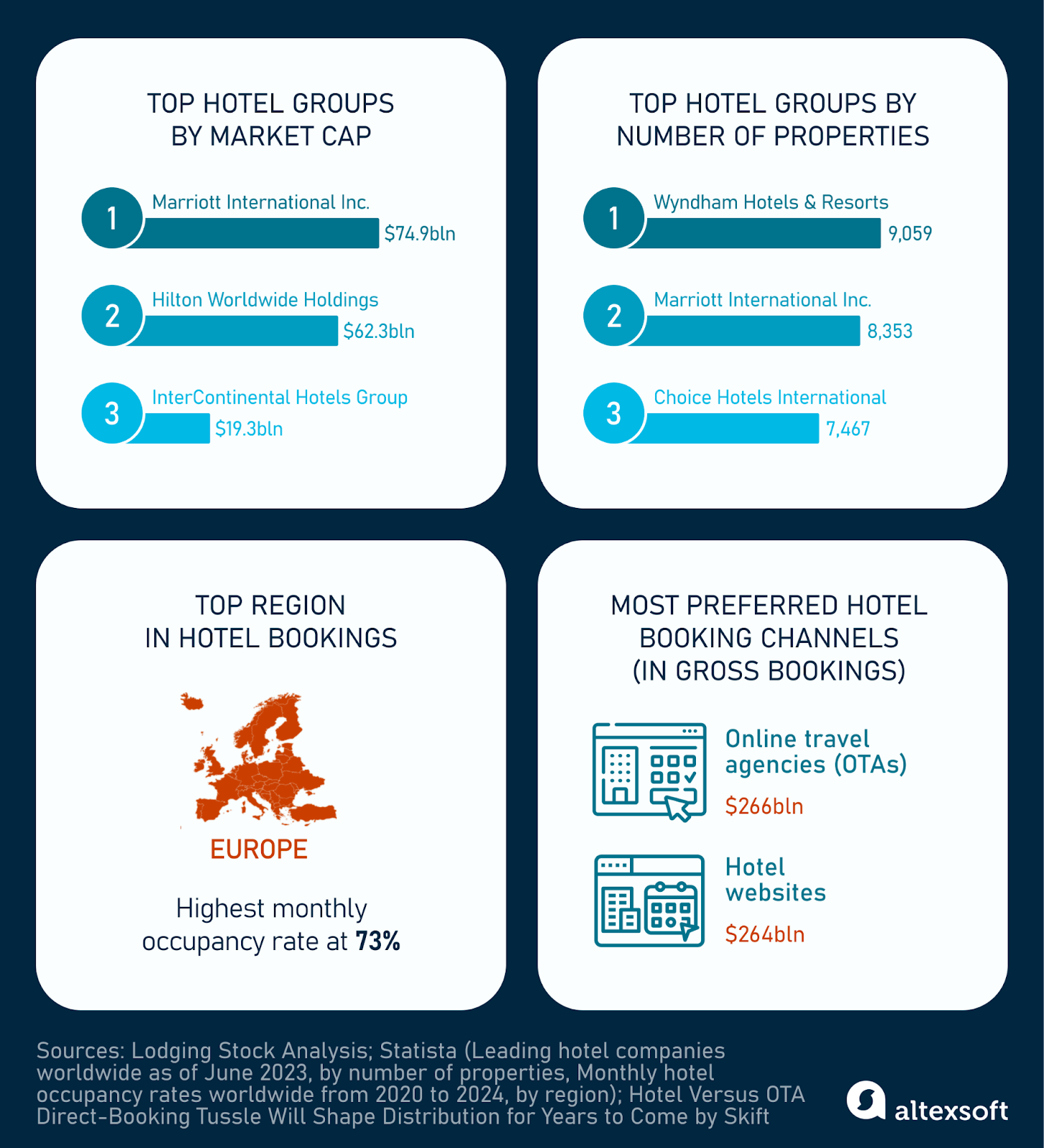

Several hotel groups dominate the industry. As of March 2025, Marriott International Inc. ranks first among lodging businesses by market cap (around $74.9 billion) and revenue ($6.62 billion).

Hilton Worldwide Holdings comes in second, valued at about $62.3 billion, with revenue of $4.75 billion. The third leader, InterContinental Hotels Group (IHG), lags significantly in terms of dollar value at around 19.3 billion. At the same time, the bronze medalist outpaces the runner-up with revenue of over $4.92 billion.

Top hotel groups compared

Another parameter for measuring the size of a hotel group is the number of properties. As of June 2023, Wyndham Hotels & Resorts topped the list, with 9,059 units in its worldwide portfolio. Marriott International Inc. and Choice Hotels International followed closely with 8,353 and 7,467 properties, respectively.

Alongside these industry giants, let’s also consider the region that leads in hotel bookings. In 2024, Europe had the highest monthly hotel occupancy rate at 73 percent. Hotels were also the preferred choice for 50 percent of European travelers, with vacation rentals being second on the list with 31 percent.

As for preferred booking channels, online travel agencies (OTAs) still have a slight advantage over hotel websites—$266 billion vs. $264 billion in gross bookings, respectively. Yet, by 2030, the situation is expected to turn in favor of direct bookings.

Short-term rentals

A short-term rental (STR) is a privately owned accommodation, such as a guest house, apartment, condo, or villa, rented out for a limited period, usually from a few days to a few weeks.

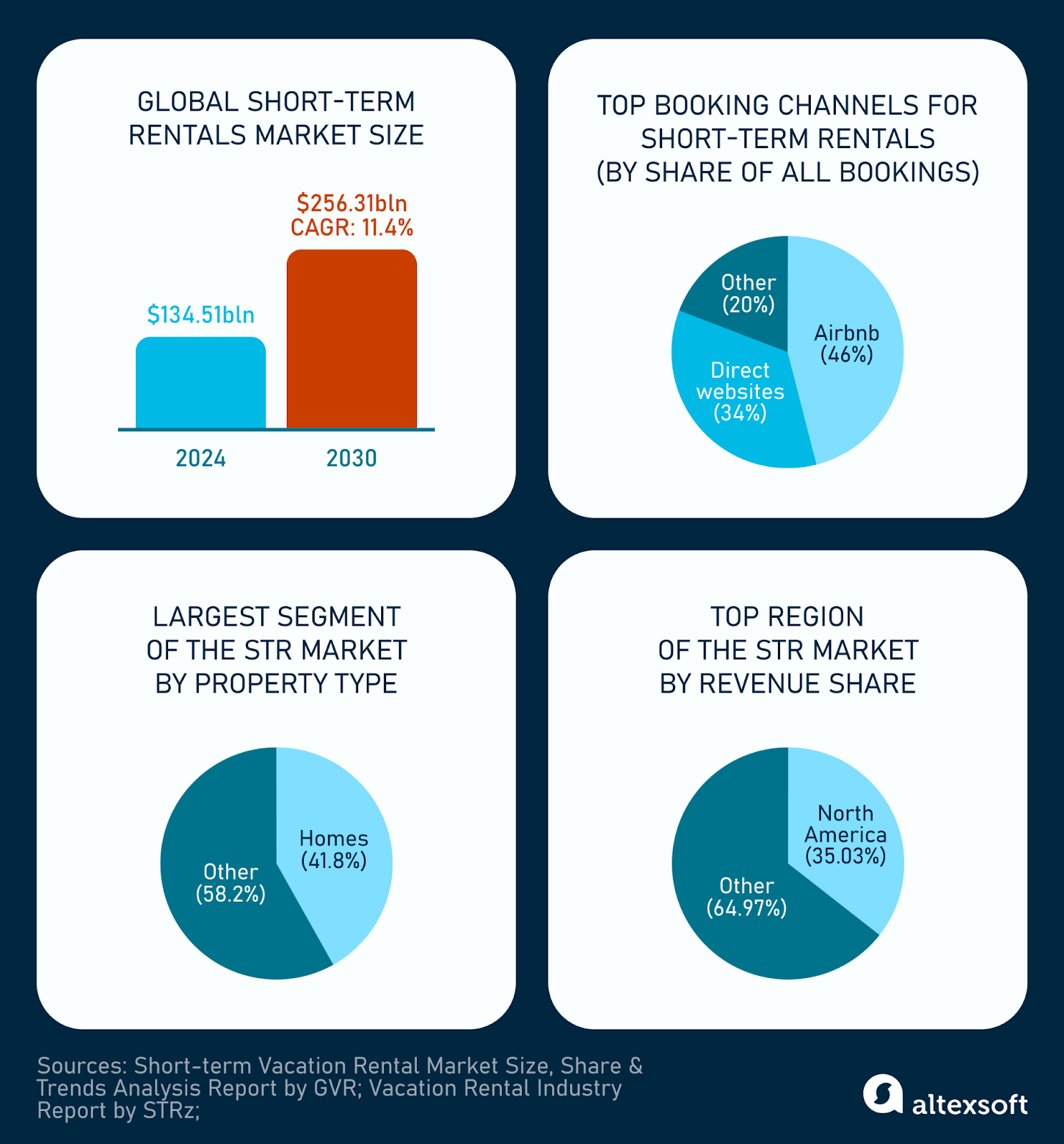

The global STR sector was valued at $134.51 billion in 2024. It is projected to grow faster than the accommodation market in general — at a CAGR of 11.4 percent from 2025 to 2030, reaching $256.31 billion.

Short-term rentals statistics

STRs have gained popularity through online booking platforms that connect property owners (hosts) with travelers seeking alternative accommodations beyond traditional hotels. Airbnb accounts for 46 percent of online reservations in the sector, with its revenue increased by 12.1 percent from $9.9 billion in 2023 to $11.1 billion in 2024.

The leading STR marketplace is followed by direct booking sites (nearly 34 percent). Together three largest middlemen (Airbnb, Vrbo, and Booking.com) and direct websites (such as Vacasa, TUI, and others) attract 95 percent of all STR reservations. At the same time, Google Vacation Rentals is emerging as a strong competitor, with its booking volume increasing by 72 percent in 2024.

Out of the entire STR market, homes represented the largest segment by property type, holding a 41.8 percent share in 2024. The availability of multiple bedrooms, fully equipped kitchens, and dedicated living areas makes homes a preferred alternative to hotels, particularly among families and group travelers.

Regionally, North America led the global short-term rental market in 2024, contributing 35 percent of the total revenue. The US market is expected to reach a revenue of $103.5 billion by 2030, growing at a CAGR of 10.5 percent.

Food and Beverage services

The Food and Beverage (F&B) sector in hospitality includes all dining and drink-related businesses, serving both travelers and locals. It embraces a wide range of establishments, such as restaurants, bars, cafés, coffee shops, and catering services.

Food and Beverage statistics

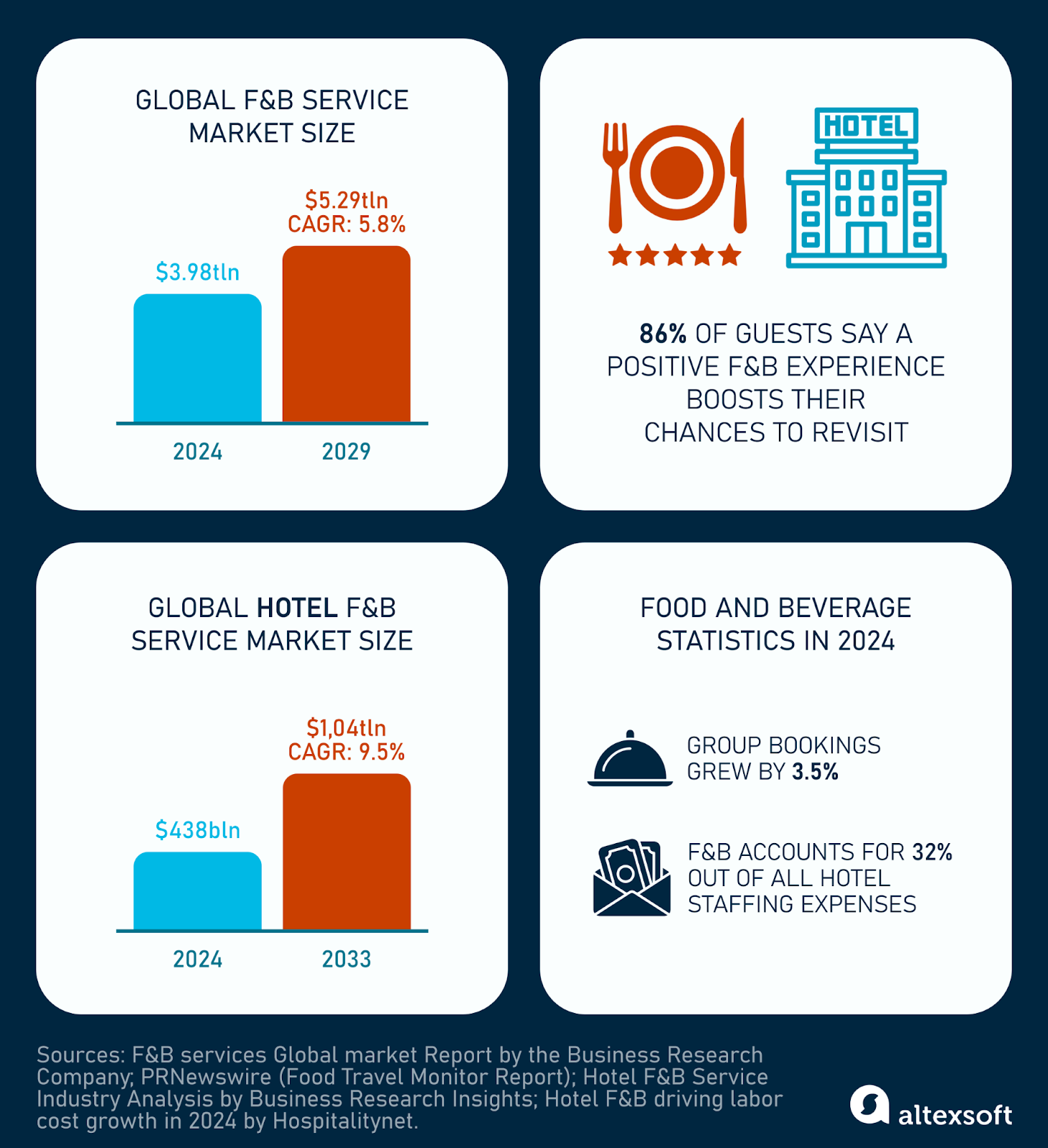

The global F&B market is expected to increase from $3.98 trillion in 2024 to $5.29 trillion in 2029 at a CAGR of 5.8 percent. This is driven by several factors, such as health-conscious dining, culinary innovation, technology integration in restaurants, contactless services, and the rising popularity of digital ordering and delivery.

The F&B sector plays a crucial role in generating revenue for hotels. From in-house restaurants to room service, F&B offerings enhance guest satisfaction and strengthen brand reputation. For example, 86 percent of guests stated that a positive F&B experience during their trip would increase the likelihood of them returning to that destination.

Recognizing its impact, let’s discuss F&B in the context of hotel services.

The global hotel F&B service market size was valued at around $438 billion in 2024. It is projected to reach $1,04 trillion by 2033, with an estimated CAGR of 9.5 percent from 2025 to 2033.

One of the growth drivers is the increase in group bookings (e.g., for weddings or business meetings) that include catering, banquets, and event dining. Group bookings rose by 3.5 percent in 2024.

At the same time, the sector expansion leads to higher labor costs. As a result, a larger share of hotel staffing expenses is now being allocated to the F&B department, reaching 32 percent.

MICE tourism as a hospitality driver

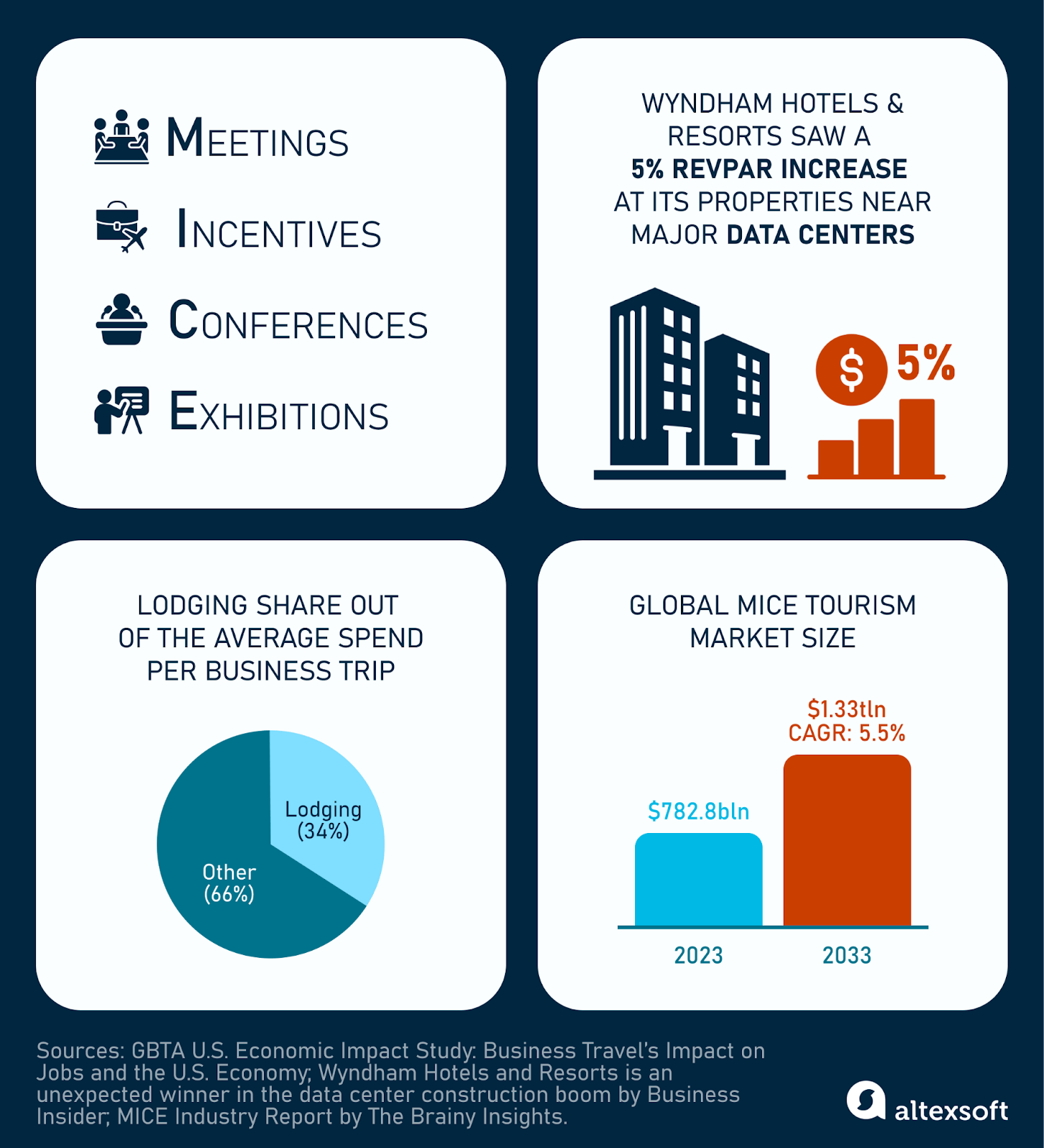

MICE stands for Meetings, Incentives, Conferences, and Exhibitions. It is a type of business travel where people take trips for professional or educational events.

MICE tourism statistics

MICE tourism plays a crucial role in driving revenue thoughout various segments of the hospitality industry. Business travelers attending MICE events require dining services and accommodations, directly boosting occupancy rates. According to the US Business Travel Study, the average spend per business trip is $632, with lodging accounting for the largest share at 34 percent ($214).

An example of business travel driving hotel revenue growth is Wyndham’s 5 percent increase in RevPAR at its properties near major data centers. While the company benefited from broader infrastructure and construction projects, hotels located near business hubs outperformed the rest of Wyndham's US portfolio.

The MICE tourism market was valued at $782.80 billion in 2023 and is projected to grow at a CAGR of 5.5 percent, reaching an estimated $1.33 trillion by 2033.

Read our full overview of MICE tourism, covering key players, destinations, trends, and economic impact.

Hospitality industry trends

The hospitality industry is constantly evolving, shaped by changing consumer preferences and technological advancements. As travelers seek innovative experiences, hospitality providers must adapt to keep up with trends and meet consumer demands.

AI technology

Artificial intelligence is revolutionizing the hospitality industry by transforming the way hotels and other businesses operate, enhancing guest experiences, and streamlining operations. From contactless check-in to predictive analytics optimizing pricing strategies, the integration of AI technologies is making a significant impact.

Chatbots and virtual assistants, powered by generative AI, in particular, are becoming a trend as they can effectively assist customers with timely answers and tailored recommendations, match guests with properties, build personalized itineraries, and automate many other operations.

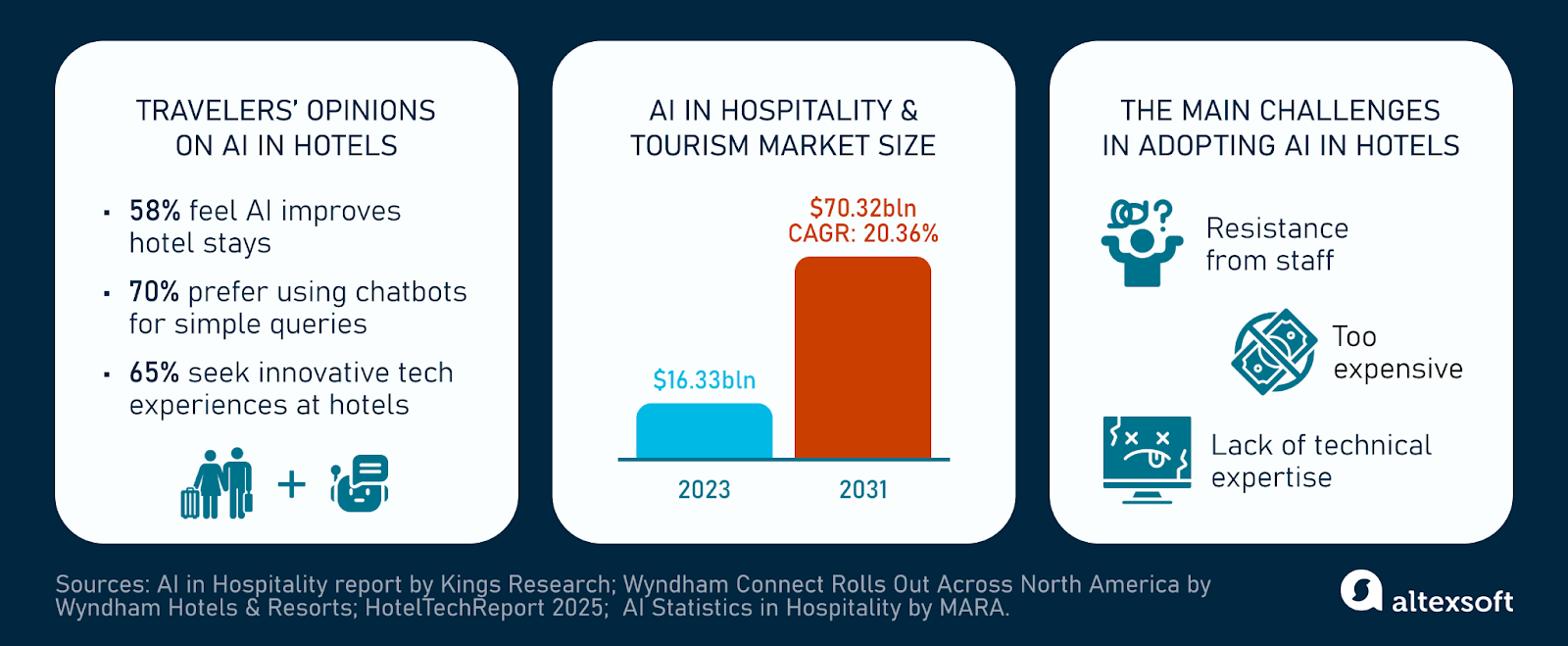

AI in hospitality statistics

The AI in hospitality and tourism market size is expected to grow from $16.33 billion in 2023 to $70.32 billion in 2031 at a CAGR of 20.36 percent, fueled by increasing demand for contactless and personalized guest interactions.

With this, the chatbots and travel bots segment is expected to experience a CAGR of 26.28 percent from 2023 to 2031. An example of a hotel chatbot is Wyndham Connect by Wyndham Hotels & Resorts. It responds to common guest questions and verifies information to speed up check-ins.

Read our article about AI in short-term rentals to learn more about its potential and key use cases.

Here are some takeaways from the HotelTechReport 2025 that underscore travelers’ increasing preference for AI technology.

- 58 percent feel AI improves hotel stays.

- 70 percent prefer using chatbots for simple queries.

- 65 percent expect hotel technology to exceed what they have at home, seeking innovative and impressive tech experiences.

However, even with AI transforming the hospitality industry and driving major investments, many hoteliers still remain hesitant to fully embrace the technology. According to MARA’s survey, when asked about the main challenges their hotel encounters in implementing AI, 30 percent responded with “resistance from staff,” and 59 percent said “the lack of technical expertise” was the issue. In another survey by the same company, 30 percent said that adopting AI tools was “too expensive” for their business.

Social media

Social media has become an essential tool in the hospitality industry, influencing traveler decisions and shaping brand perception. Platforms like Instagram, Facebook, and TikTok serve as digital showcases, allowing travelers to share their experiences and businesses to highlight their unique offerings to a global audience.

According to Big 7 Media, 61 percent of people have booked a specific hotel after encountering it on their Instagram feed. Younger travelers, in particular, rely heavily on social media for trip planning, with 53 percent of millennials turning to Instagram for vacation inspiration.

Reviews and ratings also play a crucial role in hospitality, as evidenced by TripAdvisor’s studies showing that 82 percent of travelers consider reviews an important factor in accommodation choice, and 79 percent would select a hotel with a higher rating when given the option.

Given this reliance on digital validation, hotels are increasingly investing in influencer partnerships, user-generated content, and online reputation management to remain competitive.

Sustainability

Sustainability has become a trend among travelers as more people are seeking eco-friendly accommodations and experiences. This shift in consumer behavior is largely driven by increasing awareness of environmental issues, such as climate change, resource depletion, and pollution.

The rising trend of sustainable travel is pushing hospitality businesses to meet the expectations of today's conscious consumers while contributing to a more eco-friendly future.

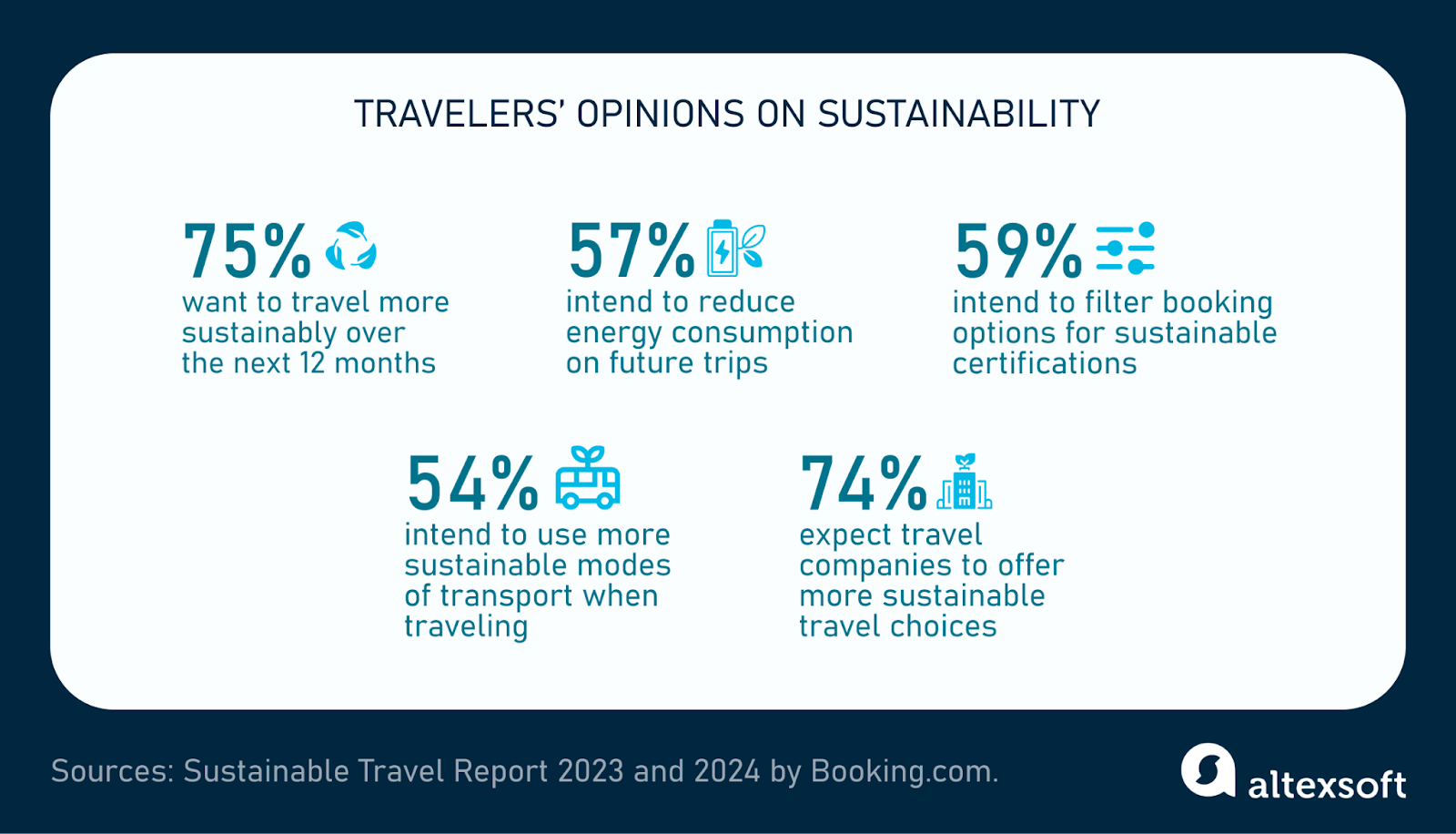

Travelers' opinions on sustainability options

Here are some insights from Booking.com's report on sustainable travel in 2024 that demonstrate the growing demand for sustainable travel options.

- 75 percent of global travelers say that they want to travel more sustainably over the next 12 months.

- 57 percent intend to reduce energy consumption on future trips.

- 54 percent intend to use more sustainable modes of transport when traveling in the future.

Guests are increasingly seeking accommodations that prioritize environmental responsibility, making sustainability a competitive advantage. In 2023, 74 percent of travelers expected travel companies to offer more sustainable travel choices, and 59 percent even intended to filter their options for those with a sustainable certification the next time they book.

Accessible travel

Accessible travel refers to experiences, accommodations, and services that are fully usable and welcoming to everyone, including individuals with disabilities, seniors, and those with special needs.

This encompasses physical features like wheelchair-accessible rooms, ramps, and adaptive bathroom fixtures. Airbnb hosts can specify various accessibility features in their listings, such as step-free entrances, wide doorways, and accessible bathrooms. Guests can then filter search results to find accommodations that meet their specific needs.

Major events (e.g., music festivals, business conventions, or sports events) attract a massive influx of visitors from around the world. This surge in travelers places significant demands on a destination’s infrastructure, transportation, and hospitality. To ensure an inclusive travel experience, destinations must invest in accessibility upgrades.

For example, Brisbane is planning to enhance accessibility ahead of the 2032 Olympic and Paralympic Games. As the host city, it’s going to implement features such as dedicated parking, access ramps, lifts, widened footpaths, accessible toilets, and changeroom facilities, creating a more inclusive environment for all visitors.

Digital accessibility is also part of the travel experience, such as websites and apps that are compatible with screen readers, easy to navigate, and designed with clear, inclusive language. Hilton adopted the Website Content Accessibility Guidelines 2.1 Level AA to ensure a user-friendly experience and accessibility to guests who use assistive technology on online platforms.

Linda is a tech journalist at AltexSoft, specializing in travel technologies. With a focus on this evolving industry, she analyzes and reports on the technologies and latest tech that influence the world of travel. Beyond the professional domain, Linda's passion for writing extends to novels, screenplays, and even poetry.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.