If you want to sell/advertise hotel rooms, you inevitably stumble over these three technical pitfalls:

How do you find hotel room APIs and what kind of providers are out there?

How do you find hotel content?

How do you map hotel room inventory?

These three will be in your face from the moment you crack open the door to enter the hospitality industry. Let’s try to get a handle on some of these stumble blocks in this article. And if you need more, go to our Tech Talks section to get answers to specific questions.

We’ll explore:

1. How hotel distribution works. To give a general idea of this tangled mess of connections and types of players.

2. GDS API. The APIs by key global distribution systems, the main players on the travel distribution market.

3. Wholesale APIs. Connectivity with key bed banks that purchase rooms in bulk.

4. Channel manager APIs. Connectivity with direct software vendors of hotels.

5. OTA APIs. Sourcing inventories of the largest online travel agencies.

6. Tech and mapping providers’ APIs. Additional options available through tech providers in the industry.

7. (Bonus) APIs for hotels. If you run a hotel, look for the best APIs, and somehow stumbled upon this article, check out the final section. We got you covered with the essentials there.

Let’s begin.

How hotel distribution works

The good news is the hotel distribution landscape is diverse and competitive, so you’ll be able to find at least some providers. The bad news, as always, there are trade-offs and providers may be slightly or even significantly different in terms of how they operate in the market.

And trying to understand how hotel distribution works gets a bit overwhelming as you dig into the business models, partnership approaches, comparing providers, and trying to decipher acronyms.

But here’s a pro tip:

All types of providers will allow you to find rooms, check availability, rates, and support with generally the same set of services! Kinda.

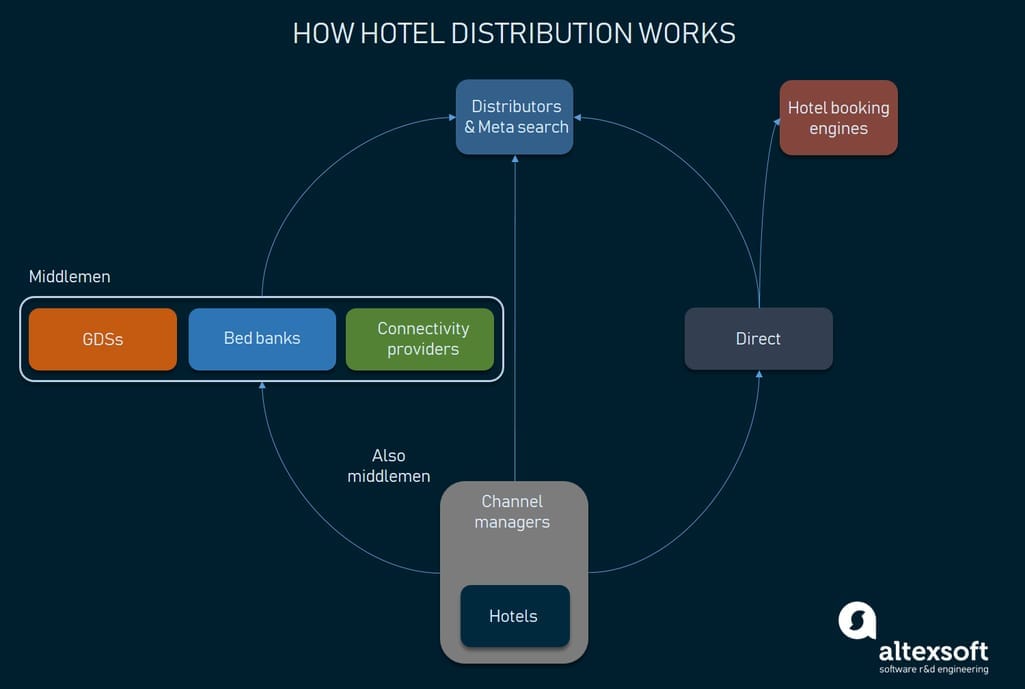

Here’s a simplified view: There are middlemen (bear with us, they are described below) that get rooms from hotels and further distribute them across agencies and other middlemen. And there are direct channels for hotels. If you look for hotel APIs for distribution, you need middlemen.

A little more complex view of the reality

About half of all hotel bookings happens indirectly, meaning that travelers book rooms at Booking.com, Expedia, Orbitz, and other online travel agencies (OTAs). So, where do these bookings come from? We’ll discuss the main types, their representatives, and try to understand the prospects of connecting to them.

It’s gonna be a long read. So, you may just glance over the coverage on the image to get an idea and then jump right in.

Global distribution systems (GDSs)

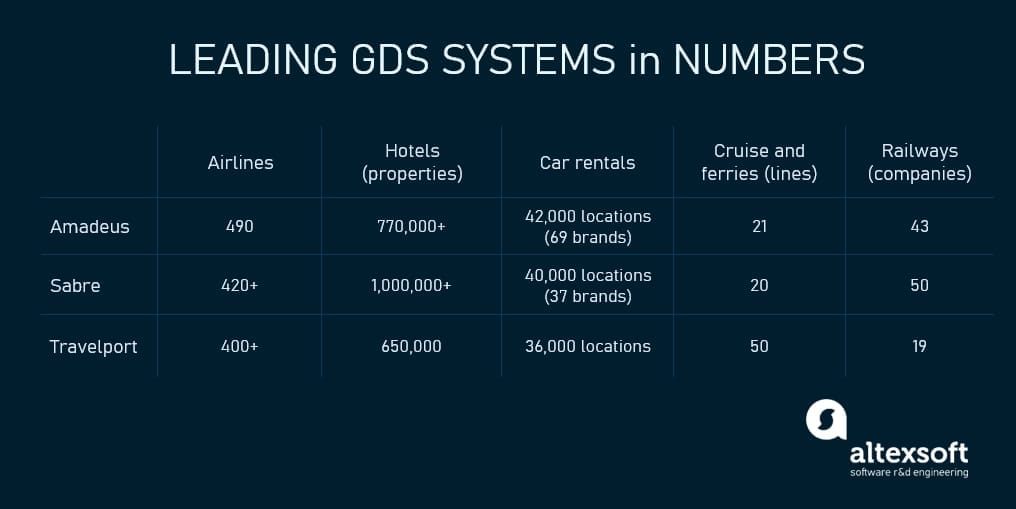

This is the oldest middlemen type. It originated from the airline industry and slowly tried to capture adjacent travel segments. Global distribution systems gather data from multiple sources, create their APIs, and distribute them across travel agents and OTAs. If you are familiar with airline APIs, you may know how big GDSs are in that market. However, in hospitality, they won’t be the first option to look at.

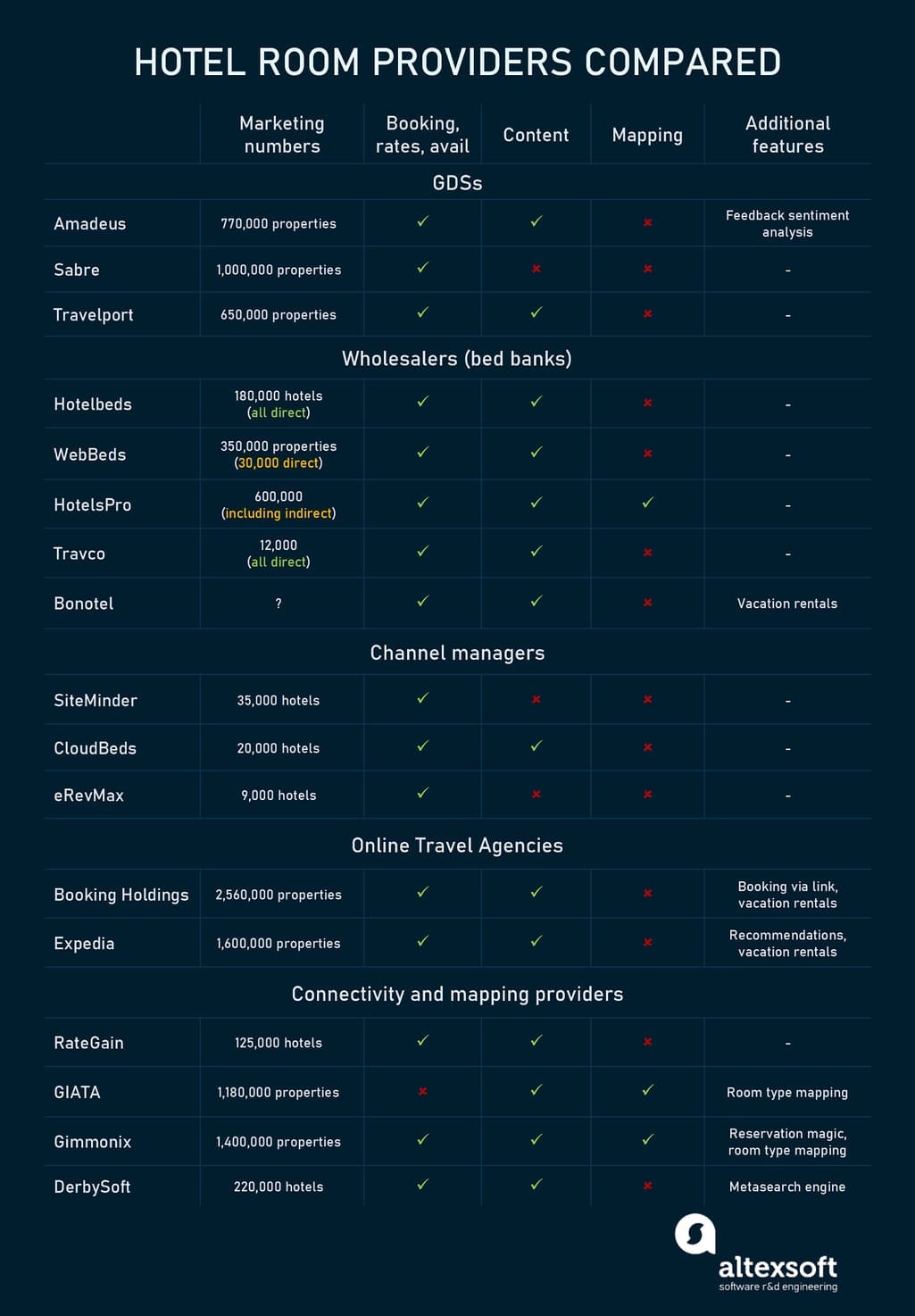

What’s cool about GDSs? They boast a large inventory of hotels and other travel services across the world. This means that on paper you can have a one-stop-shop experience with GDSs. Have a look at these stats from the three largest GDSs:

Impressive, right? But there’s a catch

Why GDSs are bad. Global distribution systems are inherently the monopolists of the air market. But this monopolist approach contaminates other segments they work with. Their customer service may not be answering your emails. And if it does, your requests can drown in the bureaucratic swamp. You’ll also likely experience problems with technology, supply, room availability, and content. Content, perhaps, is the main problem as you’re not likely to find much besides low-res hotel logos. And you won’t find vacation rentals here. Not the best option overall.

Who uses GDSs. In hospitality, they may be interesting for travel agencies that support multiple types of services (air, hotel, rentals, etc.) Another use case is corporate travel, as TMCs (travel management companies) are traditionally stuck with GDSs.

Now, let’s have a detailed look at the actual providers from the GDS side.

Amadeus API: basic hotel support

Amadeus is one of the oldest GDSs, that suggests two main types of connectivity: Self-Service APIs and Enterprise APIs.

Self-service APIs. These are standard REST/JSON APIs catering to a large variety of developers to test and use in production. They don’t require any special negotiation. You just register online and start using them. You can:

- Find hotels

- Check hotel rooms with availability, rates, and details

- Book hotel rooms

- Receive hotel ratings based on sentiment analysis of feedback with detailed breakdown by different services and characteristics (comfort, facilities, nearest points of interest, etc.)

With self-service APIs you get from 2,000 to 3,000 free requests per month for test purposes and from €0.015 ($0.017) to €0.03 ($0.034) per request for production environment. Hotel booking requests are free!

Enterprise APIs. These SOAP API services are aimed at larger businesses and if you are one, you should contact Amadeus directly and negotiate all conditions, including prices and request limits with them. Currently, the services include:

- Searching for both single and multiple hotels by their availability

- Booking

- Full hotel pricing details

Amadeus also has its reservation system iHotelier under its subsidiary brand TravelClick, which features connection to the main Amadeus APIs and other GDSs, including Sabre and Travelport.

Sabre API: limited content availability

Sabre is another giant GDS on the market. Unlike Amadeus, Sabre doesn’t divide its APIs into testing and enterprise use ones. All connections and rates must be negotiated directly with Sabre representatives. Sabre offers both SOAP and some REST APIs for:

- Hotel and availability search

- Hotel details and rates

- Booking, booking cancellations, and modifications

- Loyalty programs

As Sabre has SynXis, its own hotel reservation system, a number of APIs are designed specifically to communicate with this product. Although Sabre has hotel content, it may be somewhat limited compared to hotel-focused providers that we discuss below.

Travelport Universal API: both GDS and non-GDS hotels

Travelport is a large UK-based GDS that unites all its services into a single Universal API. Some of you may know that Travelport is a combination of multiple GDSs: Galileo, Apollo, and Worldspan. They supply the following services:

- Hotel and availability search

- Hotel details, rules, and rates

- Hotel booking

- Hotel content

- Additionally, you can get non-GDS deals from such suppliers as Agoda, Tourico (owned by Hotelbeds) and others

- Corporate discounts and negotiated rates

Let’s check other opportunities on the market.

Wholesalers or bed banks

In this business model, a wholesaler (bed bank) contracts with a hotel for a period of time to sell a bulk of its rooms for a fixed price. Sometimes, wholesalers do dynamic pricing, but this type of contract is uncommon. Then the nights are sold to travel agencies and OTAs. Hotels approach wholesalers to keep their rooms filled to capacity and resort to having special negotiated room rates, which isn’t always good for hotel revenue management, given that the price has to change with the demand. And with pre-negotiated rates for months, this isn’t possible.

What’s cool about bed banks? They are perhaps one of the two main sources of hotel rooms for any online travel agency. Some large wholesalers (or bed banks) like Hotelbeds strive to provide quality customer service, modern APIs, large inventory, etc.

Why bed banks are… bad. Hotels become increasingly more hesitant with wholesalers on the online-first markets. As the travel industry digitalizes and more travelers look for online booking, hotels start considering direct sales or sales via other providers capable of enabling dynamic pricing, dynamic content management, etc. Another problem with wholesalers is that every business on this market has at least some share of hotels that aren’t contracted directly, to the extent that just a tiny fraction of available hotels are direct partners.

Who uses bed banks. Well, basically everyone who does hotel distribution. They are really the first place to go to get hotel rooms, unless you are a startup that suggests personalized/smart/AI-driven accommodation search without full booking support. If you are, becoming a partner of some monster OTA like Booking.com may be easier.

Let’s have a look at the major bed banks. But keep in mind that we have a separate article about them. So, if you want to dive deeper check our bed banks overview.

Hotelbeds: the first place to go to for global coverage, now owns GTA and Tourico Holidays

Hotelbeds is the largest wholesale brand on the market. As their advertising says, they have 180k hotels in 185 destination countries. (A nerd’s note here, there are 195 countries in the world.) If you also look for Tourico Holidays or GTA wholesalers, Hotelbeds now owns them. So, it’s worth thinking about Hotelbeds first. Anyway, let’s have a look at what they offer.

Hotelbeds has three main API groups under the REST standard that support both JSON and XML exchange.

Booking API. Obviously, this set of APIs provides room booking capabilities, including:

- Flexible dates

- Availability check

- Booking, managing reservations, cancellations

Hotel Content API. The API provides all static hotel details that you should retrieve and update periodically:

- Locations, countries

- Rich content with descriptions, room facilities, bed types, and more

- Multilingual support

Cache API. Cache API is needed to cover large amounts of hotel data with rates, dates, etc., to analyze, compare prices, and also provide packaged travel. Here are some of its features:

- The cache updates up to once an hour

- You can download the entire snapshot of data

- It has client-side scan service to cover large amounts of data

Besides hospitality itself, Hotelbeds suggests similar APIs for activities and transfers.

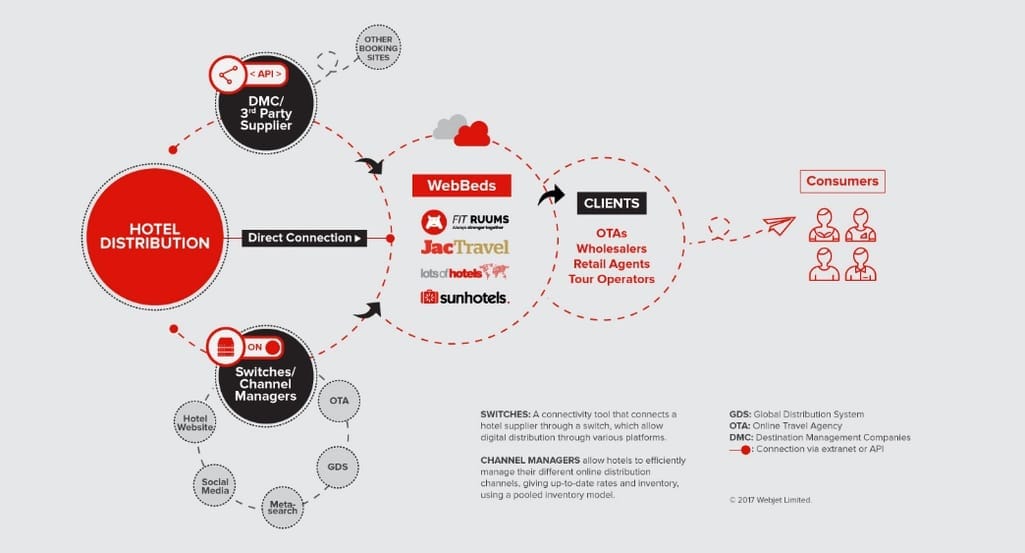

WebBeds by Webjet: the second place to go to and a great Asian coverage

The second largest bedbank is WebBeds owned by Webjet. It claims to have about 368,000 properties around the world in 14,000 destinations. But while Hotelbeds has directly contracted most of its properties, WebBeds has direct contracts with only 30,000. The rest is sourced from other places. Nonetheless, this is still a great result that became possible after the acquisition of Destinations of the World, a wholesaler with strong portfolio of contracts in Asia.

Generally, their brand list is quite impressive:

- JackTravel

- Sunhotels

- Lots of hotels

- Fit Ruums

- Destinations of the World (DOTW)

- Umrah Holidays

A representation of how hotel distribution works by WebBeds

In terms of API coverage, WebBeds suggests a relatively similar number of features:

- Hotel booking, managing reservations, and cancellations

- Rich content

- Resorts

- Transfer booking

- Multilingual support

- Both static and dynamic content

HPro Travel (HotelsPro): you’ll get content mapping in the bargain

HPro Travel (formerly HotelsPro) is another global wholesale provider that has connections (purportedly direct and indirect) with 1 million hotels in 205 countries (apparently, there’s more than one way to count it). Anyway, HPro Travel has two main APIs that you may be interested in.

Coral API. Coral is a large pool of both contracted and aggregated hotels from third-parties, even though HPro Travel promises wholesale prices across its entire inventory with a standard set of services. Coral uses RESTful APIs and doesn’t provide the SOAP option. Decide for yourself whether it works for you. What does Coral have?

- Hotel availability

- Single and multi-hotel search

- Hotel booking

- Business intelligence – a nice addition here to analyze your API activity

Okay, where’s content? It’s supported by another API.

Cosmos API. This one is pretty interesting as it’s sole focus is hotel content and content mapping.

Mapping is needed when you aggregate hotels from multiple sources, e.g. wholesalers, GDSs, larger OTAs and need to assign the same IDs and align all content pieces. Another major problem in mapping is to align room types as different suppliers define their rooms types differently. And if you’re an OTA, you want to have a coherent representation of those across your entire inventory.

If you’ve ever sourced hotel room inventories from multiple suppliers, you know what a headache it is to map all rooms and content. You usually can map 80 percent of the rooms, but that 20 percent is where you suffer. So, what does Cosmos deliver?

- Rich content

- Multilingual support

- Both dynamic and static content (the former is updated daily)

- Automatic mapping that eliminates information duplicates (a good thing)

Travco: Europe-focused wholesaler

Travco is an international hospitality business that originated in Egypt. It does almost everything travel: aviation, tours, and even hotel construction. And they have a wholesale branch that specializes mostly in Europe. While they don’t claim to have hundreds of thousands of hotels, Travco features direct contracts with more than 12,000 hotels. In terms of technology, they stick with good old XML:

- Hotel availability and reservation

- Rich content

- Multilingual support (9 languages)

- Packaged tours

- Exclusive contracted rates

Bonotel: exclusive luxury travel

Bonotel is not quite a wholesaler, but rather a tour operator that has wholesale offers. Another thing to keep in mind about them is that they don’t sell everything, only luxury hotels. So, their global inventory isn’t going to be large, but… well, pretty exclusive, if that’s what you’re looking for. Bonotel doesn’t have all those bells and whistles for content mapping, but it packs a basic set of services within XML-only API:

- Hotel availability, booking, and cancellation

- Hotel content, both static and dynamic

Additionally, Bonotel has a number of technology partners that are certified to use their API, so you feel free to contact them instead of the provider itself.

Let’s wind up with wholesalers for now, but as you’ve guessed there are many more of them. The first two of these are the largest. However, you may end up looking for local bedbanks, if you target some specific region.

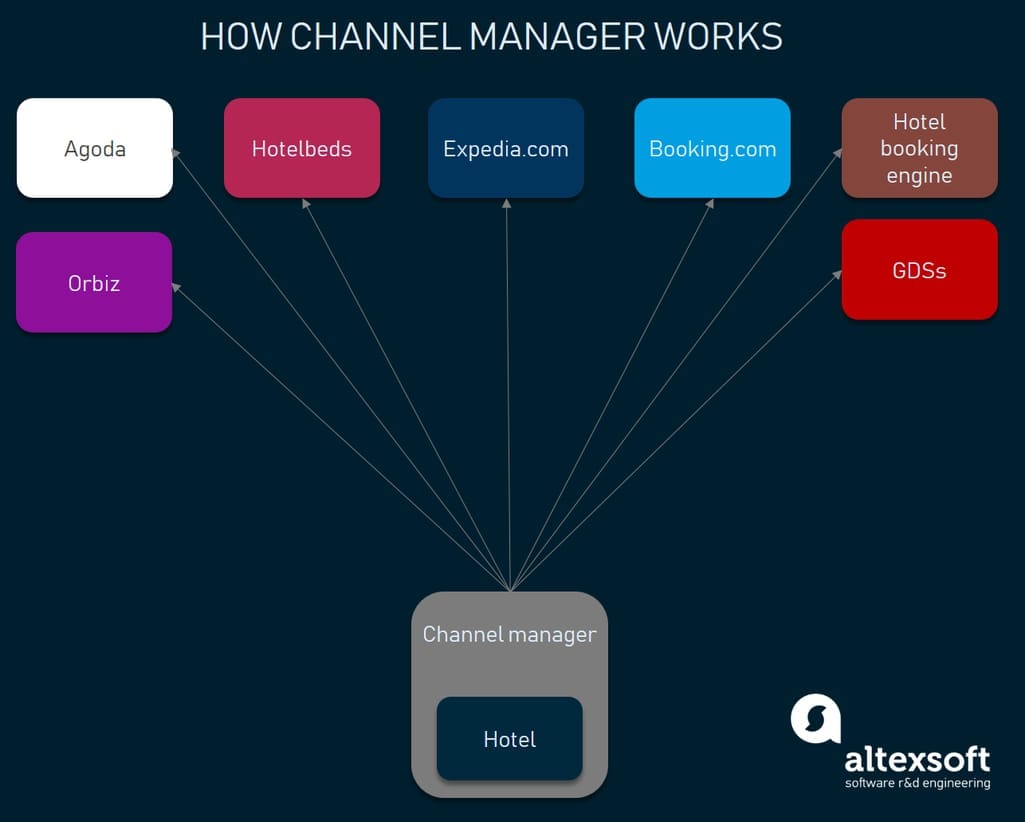

Channel managers

A channel manager is software that most hotels would use. It helps them distribute inventory and rates across multiple channels simultaneously via a single interface. For example, once a room is booked on Expedia, a channel manager automatically notifies other online travel agencies that this room is no longer available. This helps hotels avoid manual work with multiple channels and prevent overbooking.

Obviously, there are many more channels usually available

Interestingly, channel managers aren’t limited to online travel agencies like Booking or Expedia. They can also connect with bed banks, GDSs, and hotel direct booking engines. Larger channel managers give additional software environment for hotels, like property management systems, booking engines, and modules for them.

But why are we even talking about channel managers? Well, if you’re an OTA, they may be an option to connect with the hotels that a given channel manager works with.

What’s cool about channel managers? They are ultimately technological firms that work directly with the hotels. Usually, they have decent API support and you may expect that the rooms that you source haven’t traveled through multiple third-parties before they’ve gotten to you. Some channel managers started partnering with vacation rentals and urban homes to distribute say on Airbnb, which makes them significantly different from traditional GDSs and wholesalers. As you may know, wholesalers aren’t likely to contract your grandma who rents out her bungalow for the summer.

What’s bad about channel managers. Their clients are hotels, not distributors, even though it may look like both. This means you must have strong reasons to persuade channel managers to work with you. If some hotel or hotel chain that works with a given channel manager wants you to become their distribution partner, then you have a chance to connect. And finally, hotels can decide for themselves whether they want you to become their distribution channel.

Basically, they’ll have to enable your channel via their channel manager application.

Another problem is that the channel manager market is fragmented: Different hotels stick to different channel managers and integrating many of them may become a significant engineering task. A viable scenario would be integrating with one or multiple channel managers and also with some wholesalers to get broad hotel coverage.

But the biggest concern for you is that some channel managers don’t provide content. They’ll support you with availability and rates, but images and description are on you.

Who uses channel managers. Besides hotels, various online travel agencies and wholesalers are channel managers’ connectivity partners. Large OTAs like Booking.com have their own APIs dedicated to channel managers. If you are a smaller distributor, you may use APIs built by channel managers themselves. Another significant group of their partners is tech providers that integrate with channel managers or property management systems offering revenue management modules, room service software, etc.

We’ve chosen some of the largest channel manager providers, but keep in mind that there are many more out there.

SiteMinder: the main channel manager with booking engine and its own GDS

SiteMinder is used by about 35,000 hotels, homes, and vacation rentals. Yes, that’s more than some wholesalers can offer. However, if you’re an OTA, your product must pass their vetting procedure and gain certification. Keep in mind that there are multiple types of certifications depending on the functionality you’re looking for.

SiteMinder uses SOAP XML connection:

- Hotel room availability

- Hotel rates (with additional charges)

- Reservations, cancellations, modifications

According to SiteMinder, it’s one of those channel managers that require you to find hotel content on your own.

Cloudbeds: holistic API support

Cloudbeds is another large channel manager provider with about 20,000 hotels using it. Besides channel management itself Cloudbeds, offers a property management system and a booking engine. Its REST API supports JSON exchange format for:

- Room rates and availability

- Hotel content

- Hotel reservation

But their set of APIs goes way beyond that as it also caters to app developers who integrate their apps with booking engine and PMS systems.

eRevMax: tech provider with 9,000 hotels connected to RateTiger

eRevMax is a travel technology company that supports three products: a metasearch platform for agents, a hotel management dashboard, and a channel manager. We’re obviously interested in the third one. Their channel manager, RateTiger, connects to about 9,000 hotels and is famous for being used by Hotelbeds as its main source of discounted rooms.

eRevMax uses XML connections to support:

- Hotel room availability

- Rates in real time

- Reservations

We couldn’t find any proof that RateTiger allows you to source hotel content. Most likely, similar to SiteMinder, you’ll have to find hotel content somewhere else.

Online travel agencies

OTAs occupy the pinnacle of the distribution pyramid. And even though there are hundreds of assorted online travel agencies, everyone knows that the world of travel is dominated by the two largest players: Booking Holdings (Booking.com, Kayak, Agoda, Priceline, etc.) and Expedia Group (Expedia, Travelocity, Orbitz, HomeAway, etc.) Because of their size, these behemoths are capable of providing distribution support to smaller businesses (and, obviously, get a share of their markup).

Their dominant market position makes it unnecessary to use any other intermediaries. Hotel chains, cozy local hoteliers, home owners, and people with seaside bungalows willingly approach Booking and Expedia to distribute there, while the OTAs in turn suggest their own property management interfaces (extranets) for every hotelier to use. If a hotel leverages multiple channels, channel managers make sure to connect with Expedia and Booking.com platforms.

Actually, you may learn the inner workings of OTAs in our other long, long read. Or you can watch the video by our travel competence leader Andrey.

You should also subscribe to our channel. Now we do a lot of visual explaining of how the travel industry works

Should you connect to big OTAs?

Why connecting to big OTAs… may be cool. They have almost everything, really, except for properties, which work with Airbnb only. Remember 180k hotels at Hotelbeds? Well, Booking.com has more than 29 million listings. And also you get full content and reservation support.

What’s bad about OTAs as a connectivity partner. If you plan on building a traditional OTA, using affiliate programs of your main competitors may be a viable option in the beginning only, as your partners will be taking some share of your booking markup.

Who uses OTAs as connectivity partners. There’re many cases. If you’re a travel blogger, you can integrate a widget to let your readers book right from your blog and earn yourself a humble commission. If your value proposition is, say, finding personalized travel options or you’re some sort of sophisticated trip planner embracing flights, hotels, car rentals, experiences, etc., working with a big OTA may also be attractive. And finally, integrating OTA inventory is a common approach among travel providers that specialize in something else. For instance, JetBlue Hotels service is powered by Expedia.

Booking.com API: and also Agoda, Priceline, momondo, Cheapflights

Booking.com with approximately 2.5 million properties listed has an affiliate program that will allow you to use multiple types of services besides API. There are various widgets, banners, search boxes, all that sort of stuff. But the API is pretty powerful. It supports both XML and JSON exchange and provides the following capabilities:

- Live rates and availability

- Hotel content

- Room booking via both the Booking.com link and the API itself

In either case, you’ll have to show end-customers that your service is powered by Booking.com and integrating API-based reservations requires you to be PCI DSS-compliant.

Expedia Partner Solutions (EPS): and also Orbitz, Travelocity, trivago, Hotels.com, wotif, Hotwire, HomeAway, Vrbo

Expedia, the main rival of Booking Holdings, has more than 1,6 million properties across its subsidiaries, including over 765,000 properties on VRBO. Expedia has a pretty powerful RESTful API for hotel distribution and updates it with cool new features. So, what do they offer?

- Live rates and availability

- Rich content (500,000 accommodations)

- Booking, cancellations, and modifications

- Recommendations (finding alternative properties nearby)

You can check other affiliate programs by OTAs. Ctrip, the largest Asian distributor and Skyscanner owner, has affiliate proposals as well.

Connectivity and mapping providers

And the final group of providers that we’re going to talk about are tech businesses that do… well, you name it. Some specifically focus on aggregating as many hotel sources as possible and distributing them using APIs, some focus on content services. Generally, they fall under the term connectivity providers.

Besides connecting suppliers and distributors, you may find in this group hotel and content mapping.

So, what’s cool about connectivity providers? They give you very specific services and sometimes let you access the widest pools of hotels and content. Eventually, you can apply to them to augment your existing inventory with more deals or to map your inventory to avoid duplicates, errors, or missing content.

What’s bad about connectivity providers? As any work with middlemen, it comes at a price. Another problem is that connectivity businesses can aggregate deals from other aggregators and, generally, not all hotels are happy when they aren’t in full control of their inventories.

Who uses connectivity providers. They may be helpful both to distributors and hotels. Distributors receive broader connectivity, while hotels can also leverage the mapping services to check if all content and rooms across all channels are up to date.

RateGain: now owns DHISCO Switch

RateGain is an Indian travel technology business. They sell a whole set of useful tools to hoteliers and distribution players. But regardless of how interesting it all is, let’s focus on their recent acquisition. In 2018, RateGain bought DHISCO Switch. If you’re a hotel industry old-timer, you’ve likely heard of these guys. DHISCO has been doing hotel distribution since 1989 by connecting hotels’ central reservation systems with Sabre GDS. In 1996, they started connecting with OTAs. Today, RateGain albeit rivaled by other players, has a connection to 125,000 hotels to distribute across OTAs, GDSs, and meta search engines.

What do they offer today?

Switch. The core XML-based exchange supports all booking operations by connecting directly to hotel central reservation systems.

Shop. The shop service is used to push rates, policies, room types, amenities, while also supplying price breakdown.

Content. That’s pretty much self-explanatory. The cool thing is that DHISCO strives to connect directly with content management systems at hotels.

That’s Dhisco’s logo in the middle

GIATA: largest hotel mapping database

GIATA is another old-timer in the hotel market, operating since 1996. The company’s product is a sort of Yellow Pages with its own content IDs (multicodes) assigned to each piece of information. Currently, GIATA claims to have up to 1.18 million properties mapped. To read more about hotel mapping check our separate article.

You can source hotel data from GIATA using their XML REST API:

- Addresses and geocodes

- Phones numbers

- Booking codes

- GDS/CRS codes

- Images and texts (including multilingual content)

- Ratings

- Nearby airports

A relatively new feature is room type mapping that was presented in March 2019. It aligns different room types from different suppliers to coherently distribute them. Good stuff, given that hotels like inventing unique names for their room types.

Gimmonix: distribution, mapping, and rate magic

Gimmonix is a relatively young business from Israel, founded in 2010. Their core product, Travolutionary works in a similar way to DHISCO Switch. It aggregates hotel deals from about 80 hotels with 1.4 million properties and from about 150 suppliers and then distributes them across OTAs using a single API. But there are more cool features you should consider. Let’s briefly discuss their products:

Travolutionary. Their main product is focused on distribution, but also has some additional interesting features:

- Hotel search and booking

- Pre-integrated 30 payment gateways

- Real time data

- Support for different currencies

- Integrated fraud detection

- Meta search support to compare deals

Mapping.Works. The mapping service allows OTAs and – surprisingly – hotels to cover hotel- and room-level mapping. OTAs can standardize the content they receive from different sources; while hotels can check if their content is correctly mapped and displayed at distributor platforms. Mapping.Works is worth checking if you use multiple sources to form your hotel inventory. If you use Travolutionary as the only source, it has built-in mapping already. Unlike GIATA that uses its own multicodes assigned to hotels and their content, Gimmonix has built a machine learning algorithm that automatically maps both on hotel and room levels.

Reservation.Works. The reservation service automatically checks the same room offers across different suppliers and tries to find the best deal in terms of distributor margin at the moment a traveler books this room using your service. It also can automatically cancel and re-book a room after booking is completed, given that it finds a better deal for this room and the cancellation policy allows for it.

DerbySoft: connectivity, meta search, and content

DerbySoft is a US-based connectivity business that aggregates about 220 thousand hotel deals and distributes them, having more than 400 integrated partners on both sides of the chain, meaning suppliers and distributors combined.

Side note here: If you’re wondering where we get these numbers – its right from the companies’ websites! Most of these businesses are private, so we have to trust their marketing numbers. Some public companies like Booking Holdings and Expedia expose inventory sizes in their annual reports, which has appearance of being more trustworthy than landing pages, but these are the only options we have.

Let’s get back to DerbySoft. The company, similar to Gimmonix, has three products available via JSON RESTful API.

Go. Their main connectivity product, it connects directly to the hotels’ central reservation systems (CRSs) and property management systems (PMSs) to further distribute rooms on OTAs. The API supports:

- Room shopping (looking for rooms)

- Availability

- Booking, cancellations, modifications

Click. Click is a meta search engine that helps hotels market their offers at respective businesses.

Max. Max is a content suite that features 500+ different hotel attributes. It doesn’t have all those mapping capabilities to match DerbySoft content with other providers. But it will support you with standardized images, descriptions, room types, etc.

APIs for hotels and accommodation owners

Okay, if you’re here, you’re looking for the main APIs that hotel owners can use. This isn’t the main focus of the article. But we’ll give a set of the most basic things that you, as a hotelier or accommodation owner should know about.

Google Hotels API: Search/Metasearch engine integration

Google Hotel Ads is technically a metasearch engine, similar to Kayak or Skyscanner. But unlike dedicated platforms, Google Hotels is available right through the search engine page and activates once a user starts looking for accommodation. It shows prices on the map, has a dates and locations filter, and sometimes can even act as an OTA if a hotelier were to decide to enable the Book on Google feature. Google Hotels is a part of the Google Travel platform, which is also the part of the secret evil plan to seize the travel distribution. Here’s our video about that.

If you’re a hotelier, you can’t ignore Google (as a matter of fact, if you’re just a human you can’t ignore Google either)

So, Google Hotels API is an addition to their interface for manual work. If you’re running multiple campaigns and need some automation, check their REST-ful API. It has:

- Bidding, you can submit you ads bids

- Hotel prices and availability

- Submitting you hotel content

- And Book on Google feature integration.

Additionally, Google helps hoteliers with data insights about campaigns.

Tripadvisor API: the tool of social proof

Tripadvisor is… Well, you know what they are. Tripadvisor content API mostly caters to distributors and metasearch engines. It can provide location IDs, names, addresses, coordinates. But hotels that strive for direct booking can place on their booking websites:

- Ratings and awards

- Reviews

- Price levels

Tripadvisor is a must for social proof, so you may consider integrating with them as well.

Airbnb API: for professional hosts

Airbnb API exists for those accommodation owners who don’t rent out their apartments while they’re gone for vacation. It’s a tool for people who are professional Airbnb hosts and distribute their property across multiple channels and using channel managers to rule them all instead of using several extranets at a time. The API supports:

- Authenticating to existing Airbnb accounts

- Update content

- Update rates and availability

As of this writing, Airbnb isn’t accepting new API access requests and is struggling with the pandemic consequences that heavily hit both Airbnb and its hosts. But let’s keep our hopes up.

Guesty: vacation rentals channel manager/property management for Airbnb hosts

Guesty is a fresh Y-Combinator-driven startup that raised about $35 million. As Airbnb has introduced urban short-term rentals to the market, Guesty made a channel manager for it (and a whole bunch of other things targeting owners of small homes). Now they cooperate with Airbnb – also a Y-Combinator alumni – and other channels, like HomeAway.

Their JSON API is created for home owners to expose their channel manager and property management functionality to third parties.

Their API exposes:

- Listings and their details

- Availability

- Reservation

- Guests data

- Tasks

- Billing

So, if you’re using Guesty as you channel manager, the API allows for integrating custom software.

Expedia Connectivity API: direct connection without extranet

Expedia again. Besides EPS designed for distributors they have Connectivity APIs for hotels and property management vendors. So, you can push your hotel data directly to the entire portfolio of Expedia brands, bypassing the extranet, and even bypassing a 3rd party channel manager if you have a household one. What can you do with this XML interface?

- Send availability and rates updates

- Get in near real time notifications about all events (new, modified, cancelled reservations)

- Retrieve a booking and confirmation number (across all Expedia brands)

- Send room types and rate plans updates

- Send and update images, policies, fee rules

- Update deposit policies

It’s actually quite generous of Expedia to directly support hoteliers with this rich API connectivity. Booking Holdings, for instance, don’t have that. They do have their own set connectivity of APIs, but they are catered towards tech providers only, mostly channel managers. And if you're a hotel, which wants to automate interactions with Booking brands, you have to do it through your channel manager.

Final recommendations

Let’s wind up with some final thoughts and bits of advice.

Align your business model with your key hotel providers. Connecting a small booking personalization tool to channel managers is nonsense, as is trying to build a classic accommodation-focused OTA with GDS inventories. Consider what you need most and start researching those partners who excel at it.

If you use multiple APIs, you’ll end up needing a mapping solution. Think of that in advance and consider, who’s going to be your dream mapping partner. Maybe you can solve a mapping problem yourself.

Trust test environments, not landing pages. Frankly, our engineers haven’t worked with all businesses that we described here. So, it’s hard to tell in all these cases what’s really under the hoods of all those APIs, especially in terms of your individual business problem. Make sure you spend time it takes to run test requests and see what kinds of responses you get before signing up for any of those tools.

Interested in travel APIs? Check our other pieces on the topic:

Main travel and booking APIs

Hotel mapping providers

Bed banks (wholesalers)

Flight and air booking APIs

Rail APIs

Airport transfers APIs and solutions

NDC connections and APIs

Low-cost booking APIs

Car rental APIs

Tours and attractions APIs

Channel management in hotels APIs

Custom channel management in hotels APIs

Public transportation APIs

Restaurant and table reservation APIs