Whether you’re a leisure travel agent or a corporate TMC that deals with air tickets, you almost can’t avoid working with IATA’s Billing and Settlement Plan (BSP). In this post, we delve into the nuts and bolts of the BSP, unraveling everything you need to know – in plain English.

What is BSP?

The BSP (Billing and Settlement Plan) is a system that acts as an intermediary between travel agents and airlines, helping to manage the flow of money and data. It simplifies the selling, reporting, and remitting procedures of IATA-accredited travel agents.

Before the BSP appeared, airlines would pass tickets to each agency against bank guarantees and then gather multiple sales reports to track and receive their revenue. The settlement process was cumbersome and costly for both parties, resulting in inefficiencies, errors, and delays.

So in 1971, the International Air Transport Association (IATA) launched the BSP to simplify payouts and ticket issuance for travel resellers and money collection for airlines.

Today, the BSP serves as one point of contact instead of countless separate interactions. That enables a travel agency to make a single payout covering sales on multiple suppliers while carriers receive a consolidated settlement embracing all resellers (a Cash workflow).

In addition to simplifying payments, the BSP helps manage adjustments (debit and credit memos), supports reporting by compiling all sales data, and acts as an impartial go-between in case any disputes arise.

How does the BSP work?

Now, let’s look at the BSP payment workflows that travel agents can use to settle their transactions with airlines. Note that while these flows are very distinct, a single travel agency can use all of them depending on the situation.

Who are the key participants in the BSP flow?

All BSP ticketing/payment flows include multiple stages and have several key players involved. Before we explain the flows in detail, let’s briefly explain who is who.

GDS. A Global Distribution System or GDS is an intermediary that connects travel product providers (airlines, hotels, car rental companies, etc.) that publish their inventory, availability, schedules, and rates with travel agents and other resellers who want to book these products.

A concise overview of the main GDSs

IATA’s Data Processing Center (DPC). The DPC collects and validates ticketing sales transactions from the GDSs. It ensures that data is complete, no discrepancies creep in, and all the procedures are followed per IATA standards. Also, the DPC fcreates the billing reports that are sent to travel agents, airlines, and the clearing bank.

IATA’s clearing bank. A clearing bank collects all the travel agents’ remittances and settles the corresponding payments to airlines.

Both DPC and a clearing bank provide services to IATA on a contract basis.

BSP Cash payment flow

The Cash sales scenario is used by agencies operating on the merchant model. This means that the agent negotiates net rates from carriers and adds markups to form a final price. Then the agent, being a merchant of record, receives payments directly from customers and remits the amount due to the suppliers via the BSP.

Here’s the usual flow of travel agents booking air tickets through a GDS and settling payments via the BSP Cash payment option.

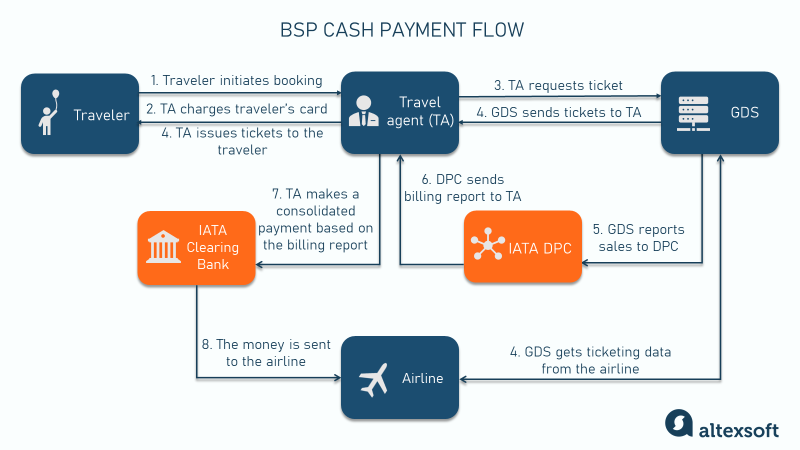

BSP Cash Payment flow

- The traveler initiates ticket booking through the travel agent.

- The agent charges the traveler’s credit card.

- The agent requests a ticket from the GDS.

- The GDS gets ticketing data from the airline and sends it to the agent who issues a ticket to the traveler.

- The GDS reports the ticket sale to the DPC.

- The BSP issues a consolidated billing report (usually weekly, depending on the location), encompassing all ticket sales made by the agency during that period.

- The agent makes a consolidated payment to the IATA clearing bank based on the billing report.

- The BSP processes all agents’ payments and instructs the bank to distribute the appropriate amounts to the respective airlines. Typically, the airline receives the money 2 to 4 weeks after the ticket issue.

The BSP's preferred and most commonly used payment method is electronic funds transfer or direct debit.

Please note that the Cash form of payment is not available for the IATA GoLite accreditation option which doesn’t require any financial security. It’s only included in the GoStandard and GoGlobal plans that have the Remittance Holding Capacity (RHC) assigned to the agency (we’ll describe these accreditation types further).

The RHC is basically a threshold of Cash sales available to the agency. IATA establishes the RHC based either on the financial security provided by the agent or on the cash sales turnover of the busiest reporting periods. The maximum RHC you can count on would be no more than double the average sales amount.

The exact formula for RHC calculation and other related details can be found in the BSP Manual.

IATA will continuously monitor the agent’s cash sales and notify them when they reach 50, 75, and 100 percent of the RHC. Once this maximum amount is reached, the agent won’t be able to use the Cash option. In this case, they can sell tickets through the Card or EasyPay flows – or remit the amount due to reopen capacity.

BSP Customer Card payment flow

In the BSP Card flow, travel agents do not process any transactions themselves. Instead, they pass the client's card number and other relevant details to GDSs, who then report them to airlines which, in turn, withdraw money from customer cards.

In this case, the airline is the merchant of record, not the agent (that’s called the agency model).

The BSP Card option is mainly designed for smaller agencies that work on the agency model and lack the financial robustness to qualify for BSP Cash (the GoLite accreditation type). Also, it’s a handy solution when an agency exceeds its remittance holding capacity.

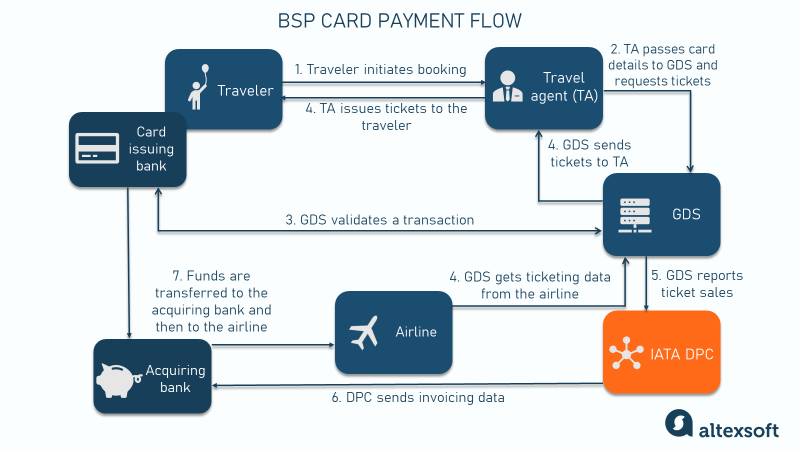

BSP Customer Card Payment flow

Here’s a step-by-step flow.

- The traveler initiates ticket booking through the travel agent.

- The agent forwards the traveler’s card details to the GDS and requests a ticket.

- The GDS validates the transaction with a card-issuing bank to ensure funds are available on the customer's account.

- Upon successful validation, the GDS sends ticketing data to the agent who issues the ticket to the traveler.

- The GDS reports the ticket sale to the DPC.

- The DPC sends transaction invoicing data to the acquiring bank.

- The acquiring bank charges the issuing bank and settles the funds to the airline’s business account.

Note that in the BSP Card payment flow, card authorization is decoupled from the payment itself, i.e., the GDS authorizes the card, but the airline charges money. That's why the agency must ensure that the airline accepts cards as a payment method, including the сard brand in question (e.g., Visa, MasterCard, American Express, etc.).

If it’s agreed in the contract, airlines pay resellers commissions for their services after all the settlements are done. Alternatively, travel agents can charge customers a booking fee. However, that would mean developing a completely different payment flow that bypasses the BSP.

IATA EasyPay flow

IATA EasyPay is a pay-as-you-go e-wallet solution that works on a prepaid basis. Agents load money into their digital wallet accounts and then use these funds instead of credit cards or cash to buy tickets.

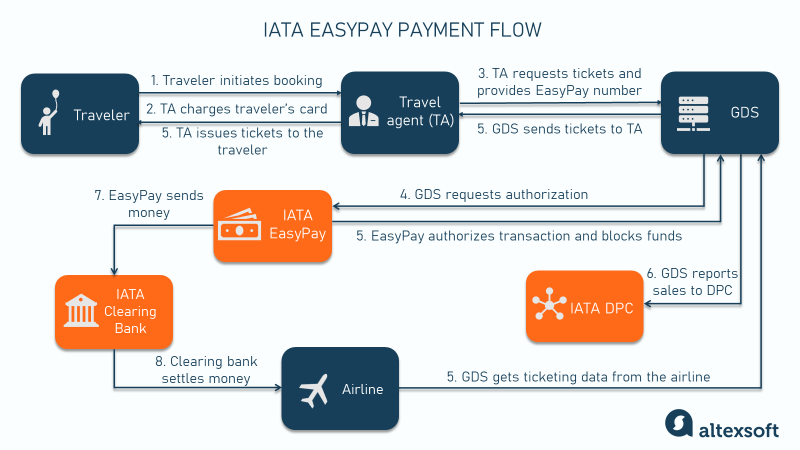

IATA EasyPay flow

- The traveler initiates ticket booking through the travel agent.

- The agent charges the traveler’s credit card.

- The agent requests a ticket from the GDS and shares their unique EasyPay number.

- The GDS requests authorization from the EasyPay system to ensure funds are available.

- Upon successful authorization, funds are blocked on the agent’s EasyPay account and the GDS sends the ticketing details to the agent who issues a ticket to the traveler.

- The GDS reports the ticket sale to the DPC.

- The payment from the EasyPay is sent to IATA’s clearing bank daily.

- The clearing bank settles the funds to the airline in 2 to 4 days.

IATA EasyPay is designed as a secure and fast payment option that complements more traditional BSP Cash and Customer Card methods. It’s a great solution for smaller agencies as they don’t need to provide large financial securities to IATA – and a handy option for airlines as it’s relatively cheap, fast, and fraud-free. However, its main weakness is that agents have no credit funds available and must limit their sales to the prepaid amount.

Read more about digital wallets in travel in our comprehensive overview or watch an explainer below.

Digital wallets in travel

So these are the three main payment options that travel agents can access when they get IATA accreditation.

Who can use the BSP: IATA accreditations

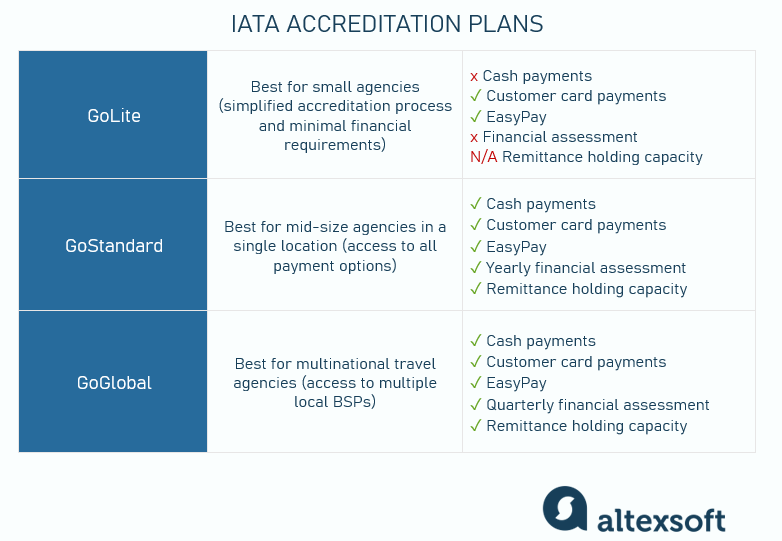

To join the BSP, a travel agency must become an IATA-accredited entity, meaning it meets specific professional standards and financial criteria. There are three accreditation tiers:

- GoLite – simplified accreditation process and requirements but no Cash payment flow available,

- GoStandard – a common model with access to all payment options for agents in a single location, and

- GoGlobal – for multinational travel agencies working with multiple local BSPs.

IATA accreditation models

Once certified, the agent gets access to the BSP and can sell tickets on behalf of airlines. While the BSP itself is free of charge for travel agents, getting IATA accreditation comes at a price (which varies depending on the tier). Certified agents also pay an annual fee to IATA.

Since its launch, the BSP has expanded worldwide, now serving nearly 400 airlines and thousands of agents in 183 countries and territories. Almost every country has its own local BSP system, though some are combined into a regional BSP. For example, BSP Central and West Africa covers twelve countries.

Note that the BSP isn’t available for travel agents registered in the US who use an alternative system – ARC. The Airline Reporting Corporation (ARC) is the organization that facilitates transactions between airlines and travel agents based in the US, Puerto Rico, the Virgin Islands, and American Samoa. Basically, it’s the US equivalent of the BSP. To access ARC services, you must first be ARC-accredited.

When you receive access to your local BSP, you get an IATA-appointed local BSP manager who provides guidance and information on how to use the services and tools – including BSPlink.

What is BSPlink?

BSPlink is essentially an electronic interface through which travel agents and airlines can access BSP services. This online platform allows you to

- track invoice status and remittance dates,

- generate reports (BSP Billing Reports and Statistics),

- manage ADM/ACMs and refunds,

- communicate with airlines and IATA, etc.

The Refund Application interface of BSPlink. Source: IATA Customer Portal

Agents can choose one of the two versions of BSPlink: The free-of-charge Efficient plan offers the basic functionality, while the Streamlined one is more feature-rich (for example, it includes online reports, document enquiry, and ticketing authority query) but comes at an additional cost. You can get more details about the pricing and capabilities in the Customer portal.

BSP alternatives

Today, the BSP is the industry standard. In 2023, it processed $225 billion in ticket sales with a 100 percent on-time settlement rate, offering security and convenience to both agents and airlines. Even in the NDC scenarios that exclude GDS, they often continue to use the BSP Cash payments because of efficient, standardized reporting and settlement services.

At the same time, the BSP has its limitations, such as the long settlement period for airlines. For agents, the drawback is that they can’t use the BSP to interact with non-member airlines – and that means most low-cost carriers. So what are the BSP alternatives?

Virtual credit cards. Virtual credit cards (VCCs) are a convenient, modern digital payment method that offers enhanced security, seamless reconciliation, and control over spending. At the same time, they come with high interchange fees charged by a card-issuing bank, so many airlines don’t want to deal with them as they are just too expensive.

A2A transfers. Account-to-account payment is the direct electronic transfer of funds from the buyer’s account to the seller’s account. For example, if the travel agent has a direct agreement with an airline, this is one of the possible settlement methods. It’s cheaper than processing cards, but there are still inefficiencies created in other processes.

Redirection to the airline’s website. Travel agents can also act like a metasearch engine and just provide flight details without processing payments. In this case, they display inventory, availability, and fare information and redirect travelers to the carrier’s own website for booking.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.