Inventory management always involves deciding on further actions: Which items should you replenish? When? In what quantity? To answer these and other questions, you can rely on your gut feeling, ask the astrologist – or scrutinize the related metrics and make your decisions based on data. Spoiler: We recommend the last option.

It’s evident that to manage your inventory (as well as other business aspects) effectively, you have to measure and analyze the processes inside your company. So today we look at the main stock-related KPIs that can show you the actual state of affairs, highlight areas for improvement, and help you choose the best course of action.

What are inventory KPIs?

Inventory KPIs are quantifiable metrics that measure the performance of inventory-related activities such as procurement, sales, order processing, warehousing operations, etc. They also highlight other important connected aspects like customer demand and satisfaction, company expenses, and so on.

Tracking these KPIs gives inventory managers better visibility of the supply chain and an understanding of the market in general. Analyzing inventory KPIs and their dynamics helps decision-makers optimize stock-related processes, reduce costs, and ultimately improve the business’s bottom line.

Setting and monitoring inventory KPIs must be an integral part of your overall inventory management activities if you operate in such industries as retail, eCommerce, B2B wholesale, manufacturing, and so on.

In our overview, we’ll stick to the generally accepted categorization that divides inventory KPIs into 3 groups:

- sales KPIs,

- operational KPIs, and

- receiving KPIs.

Top inventory management KPIs

We can’t describe all the inventory KPIs that exist out there, so we’ll focus on the most popular and actionable ones. We’ll also suggest a few tips on how to approach inventory-related business intelligence. So let’s dive in.

Sales KPIs: inventory turnover ratio, days sales in inventory, sell-through rate, and others

The inventory-related KPIs we describe below can help you evaluate your sales processes and stock performance.

Inventory turnover ratio (ITR)

Inventory turnover ratio (also known as inventory turnover rate, stock turn, or inventory turn) is the number of times a company sells and replenishes its stock over a specific period (usually one year). To calculate it, divide the cost of goods sold (COGS) by the average inventory value.

You can also measure the turnover ratio in units, not in money values. Then the formula will look like this:

Inventory Turnover = Number of units sold / Average number of units in stock

If you use the first formula, you’ll have to find COGS and average inventory first. To calculate COGS, you have to add inventory value at the beginning of the period to total purchases during the period and subtract inventory value at the end of the period.

COGS = Beginning inventory + Purchases – Ending inventory

To calculate average inventory, you have to add inventory value at the beginning of the period and inventory value at the end of the period and divide the sum by two. We'll get back to this metric and break it down in more detail further on.

Average Inventory = (Beginning inventory + Ending inventory) : 2

What does it show? The inventory turnover ratio basically shows how fast – or how efficiently – you sell your stock and turn it into revenue. In general, a high ITR value is a sign of strong sales and healthy cash flow, while a low ITR can indicate low sales or excessive inventory. Too much stock held isn’t good because it ties up cash and increases overhead and holding costs.

How to approach it? Typically, companies strive for ITR growth as it’s a sign of higher sales and increased revenue, but a too high ITR value can sometimes mean that you don’t have enough inventory to satisfy customer demand and have a risk of stockouts.

Important to understand. An optimal ITR value greatly depends on what you sell. For example, a good ITR for retailers selling perishable goods like flowers or produce is usually higher (meaning that you sell and replenish your merchandise more often to avoid its spoilage) and can be 10+ compared to, say, businesses selling heavy machinery or luxury items where ITR can be 1 or 2.

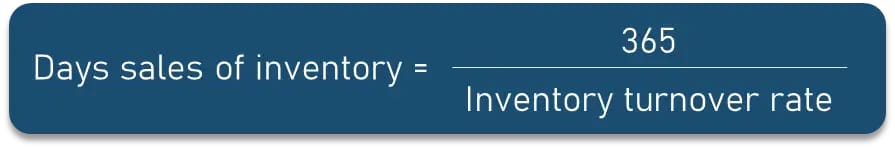

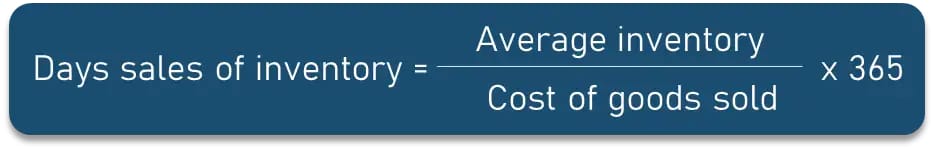

Days sales in inventory (DSI) / Inventory days on hand (DOH)

or

Days sales of inventory or inventory days on hand is how many days it takes to sell your inventory. To calculate it, you can either divide 365 by ITR or divide average inventory by COGS and multiply the result by 365.

It can also be measured in weeks instead of days (the KPI will be referred to as weeks-on-hand and have 52 instead of 365 in the formula) or be calculated for any period other than a year (change 365 to the period duration in days in the formula).

What does it show? DSI shows the efficiency of your sales and inventory management activities. Being inversely proportional to ITR, the lower DSI is generally better than the higher one.

How to approach it? A lower DSI indicates that you don’t keep stock on the shelves for too long. And if it takes fewer days to sell your goods, you have a better cash flow and lower carrying costs. A high DSI is usually a sign of excessive inventory, low sales volume, and poor stock management.

Important to understand. Just like with ITR, there’s no one DSI value that all businesses have to strive for. The optimal range varies greatly across industries. So you have to benchmark your DSI to your own historic measurements (striving to decrease its value) and to those of your direct competitors.

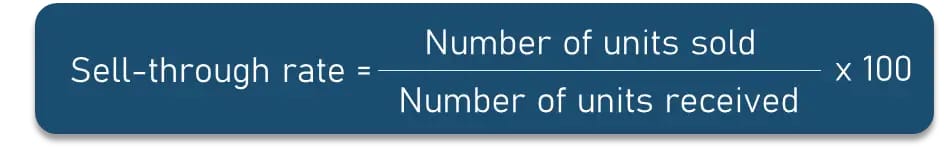

Sell-through rate

A sell-through rate measures the percentage of stock sold in your total inventory volume. To calculate it, divide the number of units sold by the number of units received and multiply the result by 100.

What does it show? A sell-through rate evaluates the selling performance of stock items in a certain period of time (usually one month). It can also give you insights into current trends and demand fluctuations.

How to approach it? A sell-through rate is often calculated for separate goods or groups of items to get a more granular understanding of sales trends. A high or increasing sell-through rate is an indicator that the item is popular, so you might want to adjust your procurement schedule to buy more of it. A low sell-through rate will highlight low-selling items that you might want to stop replenishing – or promote to your customers to increase sales volume.

Important to understand. The sell-through rate can show performance or demand fluctuations in almost real time, so it’s worth monitoring it closely and regularly to be able to make timely adjustments to your inventory and sales strategies.

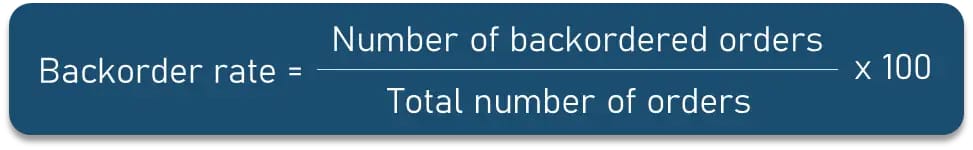

Backorder rate

The backorder rate is the percentage of orders delayed due to items on backorder. To calculate it, divide the number of backordered orders by the total number of orders and multiply the result by 100.

What does it show? The backorder rate shows how many orders you can’t fulfill immediately because you don’t have it in stock. It may happen due to supply chain disruptions, inefficient inventory management, or poor demand forecasting. A high backorder rate indicates that the buyers’ demand isn’t serviced properly, which can result in customer churn.

How to approach it? A high or increasing backorder rate is usually a negative sign that signals procurement issues or glitches in your supply chain performance. However, it can also be a sign of growing demand. In any case, it’s worth exploring the reasons behind this KPI’s fluctuations to see if you have to adjust your replenishment strategy, review your demand forecasts, and/or examine your logistics partners’ performance.

Important to understand. Backorder is not the same as out of stock. The former means that the inventory item isn’t available at the moment but will be received and shipped to the buyer in the foreseeable future, while the latter doesn’t imply any forecasts. So if you still have a certain percentage of backorders, be clear with your buyers about shipment ETA.

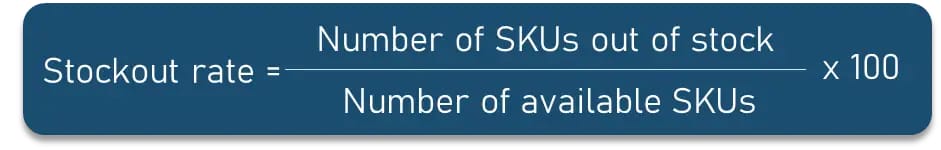

Stockout rate or Out of stock (OOS) rate

A stockout rate (or out of stock rate) defines the percentage of inventory unavailable for sale in the total stock amount. A stockout rate is calculated by dividing the number of stock keeping units (SKUs) out of stock by the number of available SKUs and then multiplying the quotient by 100.

What does it show? A high stockout rate usually highlights inventory management inefficiencies and indicates missed sales opportunities and potential dissatisfaction among customers.

How to approach it? Just like with the backorder rate, you don’t want a high or growing OOS rate. Some of the ways to prevent stockouts are forecasting demand more accurately, adjusting reorder schedules, and maintaining an adequate amount of safety stock.

Important to understand. Even though stockouts are sometimes caused by unpredictable factors (remember the toilet paper rush during the pandemic?), regular stockouts can erode brand trust and lead customers to competitors.

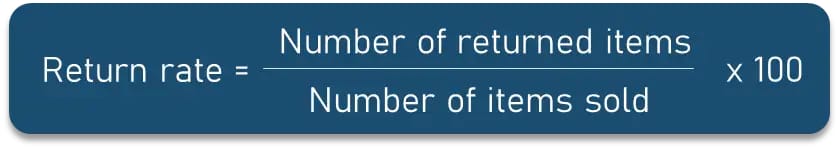

Return rate

The return rate is the percentage of goods or shipments that customers return. To calculate it, divide the number of returned items by the total number of items sold and multiply the result by 100.

What does it show? The return rate shows how many orders are sent back to you because of damage, defects, dissatisfaction, change of mind, or other reasons. It’s crucial to investigate the causes of returns because this KPI can be an important indicator of your merchandise quality, customer satisfaction, or shipping efficiency.

How to approach it? Managing returns is expensive, so you definitely want your return rate to be minimal (if not zero!). But the measures that you need to take to reduce the return rate greatly depend on the reasons: For example, if customers are unhappy with what they get, pay attention to the quality of goods, consider offering testing samples, and/or be clear with product descriptions to set the right expectations.

Important to understand. It’s crucial that you address the reasons behind returns while still providing customers with return options and a clear return policy.

Also, don’t confuse the return rate with the rate of return, which shows the percentage of gain or loss on investment over a period of time.

You can read more about reverse logistics and returns management in our dedicated post.

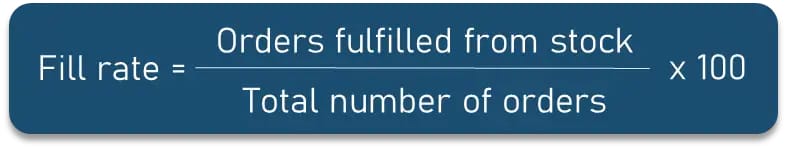

Fill rate or Fulfillment rate

The fill rate (also called fulfillment rate) measures the percentage of customer demand that is met through immediate stock availability, without stockouts or backorders. To calculate it, divide the number of orders that can be fulfilled from stock by the total number of orders placed and then multiply the quotient by 100.

What does it show? The fill rate shows how effectively the inventory meets the customer demand. A fill rate of less than 100 percent suggests room for improvement in inventory management.

How to approach it? Some of the reasons behind the low fill rate are inaccurate demand predictions and a nonoptimal procurement schedule. Improving demand forecasting accuracy and inventory replenishment processes can enhance the fill rate.

Important to understand. While a high fill rate is ideal, overstocking to achieve this can increase holding costs, so balance is crucial.

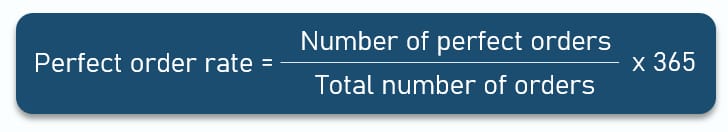

Perfect order rate

The perfect order rate is the percentage of orders that meet all of the critical customer requirements like the right product, quantity, on-time delivery, and proper invoicing. To calculate it, divide the number of perfectly fulfilled orders by the total number of orders placed and then multiply the quotient by 100.

What does it show? The perfect order rate evaluates the efficiency and effectiveness of the supply chain from procurement to delivery. A high perfect order rate signifies that a business is meeting its customer expectations consistently.

How to approach it? You definitely want your perfect order rate to be as close to 100 percent as possible. If you see this metric declining, define the root causes of imperfect orders and make improvements in those areas. In your analysis, you can also refer to other metrics, such as the return rate, to highlight the weak points.

Important to understand. It's a holistic metric combining various facets of order fulfillment and gives an understanding of cross-functional alignment.

Order cycle time (OCT)

Order cycle time is the total time from when a customer places an order to when they receive the product. It encompasses the duration of processing the order, picking, packing, and delivering the item.

To calculate the average OCT for a period of time (e.g., a month, a quarter, or a year), sum up the OCTs of all the orders completed in that period and divide by the number of orders.

What does it show? It reflects the efficiency of your order fulfillment process and is closely related to customer satisfaction.

How to approach it? A shorter OCT improves customer experience and can lead to competitive advantage, while a prolonged cycle time can deter customers and affect brand reputation. By monitoring and seeking to reduce the OCT, businesses can enhance customer satisfaction and potentially boost repeat business.

Important to understand. If you see that your OCT increases, scrutinize your order management processes to identify bottlenecks or inefficiencies and find ways to address them. Some possible reasons for prolonged fulfillment can be manual order processing, poor communication between teams, nonoptimal picking and packing, or delayed delivery.

Other sales-related KPIs that are often tracked are stock-to-sales ratio, lost sales ratio, average time to sell, on-shelf availability, and so on.

Operational KPIs: inventory carrying cost, GMROI, shrinkage, demand forecast accuracy, and others

Operational KPIs include a lot of diverse metrics that evaluate your business processes from different perspectives and show you how well your company performs. Many of them are related to financial measurements – after all, that’s what matters most to business owners.

Inventory carrying cost or Holding cost

Inventory carrying cost (also holding cost or the cost of carrying inventory) is the percentage of inventory value that you have to spend on owning, storing, and holding it. It includes expenses related to direct purchases, inventory shrinkage, warehouse rent, utilities, insurance, etc.

To calculate it, first sum up inventory capital costs, risk costs, storage costs, and service costs, then divide the sum by the total inventory value and multiply the quotient by 100.

What does it show? Inventory carrying cost represents all the overhead costs that you incur by holding inventory in stock.

How to approach it? You definitely want to minimize inventory carrying costs, just like any other category of expenses, while still covering all bases. In general, it’s not uncommon for holding costs to account for 20 to 30 percent of the total inventory value.

Important to understand. Unless you operate on a drop-shipping model, your holding costs will comprise a significant amount. Some of the ways you can cut them are managing and reducing shrinkage, redesigning/optimizing your warehouse space, and getting rid of dead stock.

Cost per unit

The cost per unit is the total cost associated with producing, receiving, storing, and distributing one unit of a product. To calculate it, first sum up all the fixed and variable costs associated with the product and then divide the result by the total number of units produced.

What does it show? Cost per unit provides insight into production efficiency and the cost-effectiveness of inventory. It is a fundamental metric for pricing strategies, profit calculations, and overall business profitability.

How to approach it? Businesses always strive to keep costs low. To reduce cost per unit, analyze your expenditure to identify potential for savings or efficiency improvements.

Important to understand. Cost per unit can be very unstable because of various market fluctuations (e.g., seasonal changes in demand, fuel price, labor costs, etc.).

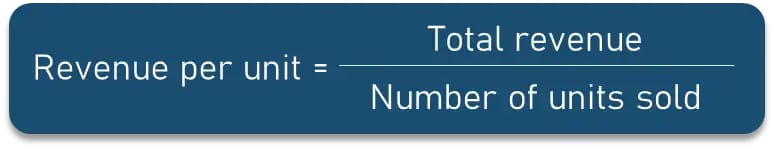

Revenue per unit

Revenue per unit (also called Average revenue per unit or ARPU) is the amount of revenue generated by selling one unit of a product. To calculate it, divide the total revenue obtained from sales by the number of units sold.

What does it show? Since, in most cases, revenue per unit is measured for separate SKUs or product groups, it gives a granular view of the profitability of individual items.

How to approach it? It’s obvious that the higher the revenue, the better. However, you always have to compare revenue per unit with cost per unit to determine product profitability and develop optimal pricing strategies.

Important to understand. When adjusting your pricing based on revenue per unit, remember to take into account the customer's willingness to pay and competition prices.

Gross margin return on investment (GMROI)

Gross margin return on investment (GMROI) is the share of profit in your overall inventory value. To calculate it, divide gross profit by the average inventory value.

To calculate gross profit, subtract the cost of goods sold from your total revenue.

Gross profit = Revenue - Cost of goods sold (COGS)

What does it show? As it basically compares profit versus investment, GMROI shows how effectively your inventory generates cash flow.

How to approach it? GMROI more than 1 means that you are above the breakeven point; however, you should always be looking for ways to increase it. The average GMROI varies across industries; for example, in retail, it’s usually higher than in wholesale.

GMROI can give you a most granular view into how well different SKUs are performing, so it makes sense to calculate it for separate items. This way, you’ll be able to see your most profitable goods and tailor your sales, replenishment, and marketing strategies accordingly.

Important to understand. Low-margin products can still generate high cash flow if they turn quickly, so don’t hurry to get rid of them. Take a more holistic view of other KPIs, such as the ITR we described above.

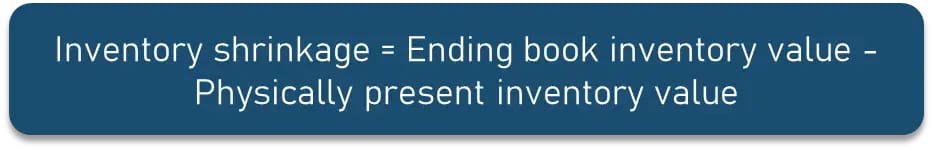

Inventory shrinkage

Inventory shrinkage is the difference between the amount of inventory you actually have on hand and the amount recorded in the balance sheet. To calculate it, subtract the physically present inventory value from the ending book inventory value.

What does it show? Shrinkage is the dreaded though inevitable value of inventory lost due to shoplifting, employee theft, damage, administrative or cashier errors, vendor fraud, etc.

How to approach it? Obviously, all businesses strive to minimize shrinkage. If you see it increasing, you have to find out the reasons behind it and decide how to reduce your future losses. In general, there are two main directions of action:

- prevent it by, for example, investing in additional security or employee training or

- compensate for financial loss by increasing prices.

Important to understand. You have to be careful with both of the above solutions to avoid overinvesting on the one hand and losing price-sensitive customers on the other.

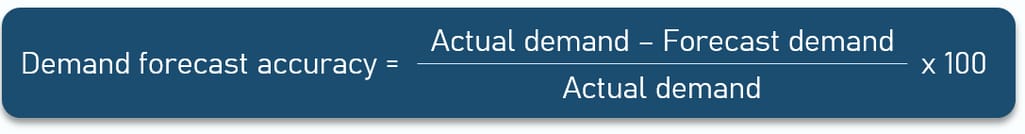

Demand forecast accuracy

Demand forecast accuracy compares the actual numbers of sold, ordered, and/or produced goods with the forecast. To calculate it, subtract forecast demand from actual demand, divide the result by actual demand, and then multiply the quotient by 100.

What does it show? Demand forecast accuracy is one of the main inventory management KPIs, and it’s just what it sounds like – the measure of how precisely you predict customer demand. Since this KPI shows the deviation from the forecast, the lower the percentile, the better.

How to approach it? Though it’s rarely possible, aim at a 0 percent gap (which would mean a 100 percent forecast accuracy). It’s always desirable to predict customer demand as precisely as possible since it impacts your entire inventory strategy and guides your decisions about which items and in what quantity you must restock.

Important to understand. If demand is higher than you forecasted, it’s almost as bad as poor demand since you risk running out of stock, failing to satisfy your customers, and losing profit.

Be sure to read our article about demand forecasting and watch our expert video below about the role of AI and ML in forecasting demand and sales.

Demand and sales forecasting

Average inventory

The average inventory that we’ve already mentioned above is the mean stock level maintained over a specific period. As we said, it’s usually calculated as the sum of the beginning and ending inventory divided by two. You can also calculate it by averaging daily inventories over a month or a quarter.

What does it show? Average inventory offers a clearer view of how much stock you hold on average, helping businesses gauge their inventory efficiency and identify potential storage or stock turnover issues.

How to approach it? By comparing the average inventory with sales data, businesses can discern if they are overstocking or understocking. Adjustments can be made accordingly to ensure optimal inventory levels and reduce carrying costs.

Important to understand. Awareness of average inventory levels aids in striking a vital balance between excess stock, which increases costs, and insufficient stock, which risks lost sales.

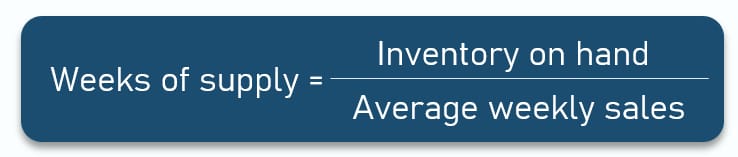

Weeks of supply (WoS)

Weeks of supply (WoS) is how many weeks' worth of inventory is currently on hand based on the historical sales rate.

To find WoS, divide the on-hand inventory by the average weekly sales (usually, the calculation is done in the number of items). However, it can often be trickier than it seems, so you have to come up with your own method of calculating WoS (for example, decide if you include the goods in transit or on order into inventory on hand) and stay consistent.

What does it show? Weeks of supply indicates the duration for which the current inventory will last without any additional replenishment, assuming the sales continue at the same average rate. A higher WoS suggests overstocking, which may lead to increased holding costs and risk of obsolescence, while a lower WoS may indicate potential stockouts and lost sales opportunities.

How to approach it? Aim to maintain an optimal balance for the WoS, considering the nature of your products, industry trends, and seasonality when determining the optimal WoS for your business.

Important to understand. If you deal with seasonal products, be prepared to manage WoS closely. Also, remember that WoS doesn’t account for consumer behavior changes.

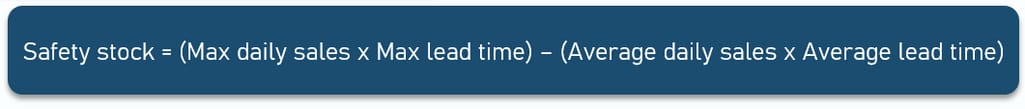

Safety stock

Safety stock is the extra inventory kept on hand to protect against stockouts due to uncertainties in demand or supply chain disruptions.

There are several ways to calculate safety stock suitable for different scenarios. One of the simple formulas is multiplying the maximum daily sales volume by the maximum lead time, then multiplying the average daily sales volume in a period by the average lead time, and subtracting the second product from the first.

Lead time is the number of days it takes to complete the order from the moment it's received.

What does it show? Closely related to WoS, the level of safety stock indicates how risk-averse a company is to potential stockouts. But if WoS reflects historical demand, safety stock is more about predicting future sales and preparing for them.

How to approach it? Your safety stock estimation serves as a basis for your replenishment strategy. Determine the optimal level of safety stock based on historical sales data, level of forecasted demand, lead times, and acceptable risk levels.

Important to understand. While safety stock acts as a buffer, over-relying on it can increase holding costs and tie up capital. Also, you have to be extra careful when defining safety stock for perishable items so as not to lose on the unsold inventory past the expiration date.

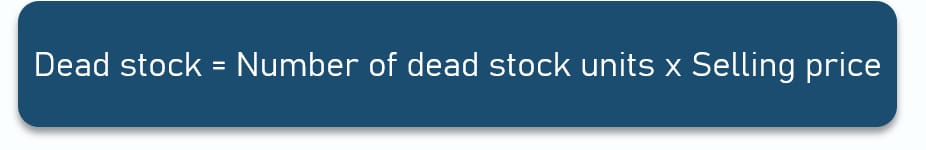

Dead stock

Dead stock (or obsolete inventory) refers to the inventory that has not been sold or used for a long time and is unlikely to be sold in the future.

There are several ways to identify the dead stock value. The simplest approach is to multiply the number of dead stock units by their selling price. Another one is to include all the related holding costs associated with owning dead stock.

However, there's no single approach as to which inventory to treat as dead stock, since it varies greatly depending on the industry and the type of product. So you'll have to define the storage duration after which the item can be referred to as read stock for each SKU separately. For example, it's typical for apparel items that are left in stock at the end of the season or, say, digital devices after the new version is launched.

What does it show? Dead stock indicates products that have failed to attract customer interest or are no longer relevant to the market. These items tie up capital and occupy warehouse space without generating revenue.

How to approach it? Dead stock represents wasted investment and potential loss. Regularly reviewing inventory and identifying dead stock can help you minimize carrying costs and free up space. Once identified, strategies like discounts, promotions, or bundle offers can be employed to clear out dead stock.

Important to understand. Often, you won't be able to return dead stock to your supplier. In this case, consider donating, recycling, or disposing of these items.

Other noteworthy operational KPIs are inventory accuracy, cost per order, etc. It’s also useful to track customer-related KPIs like net promoter score and employee-related metrics like labor cost per item.

Receiving KPIs: time to receive, receiving efficiency

Receiving inventory is an essential part of the stock replenishment process – and one of the most important warehousing activities. So this group of KPIs is basically about evaluating your warehousing team's performance.

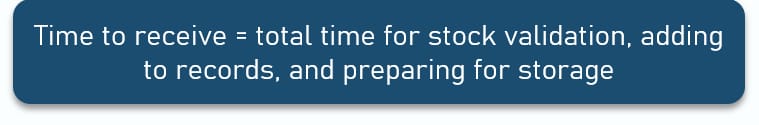

Time to receive

Time to receive is the total time it takes to process received items, including accounting, sorting, and putaway (though often putaway time is not included and is calculated as a separate metric).

What does it show? Time to receive shows how fast your warehouse team processes incoming stock.

How to approach it? Tracking the time to receive is important because if you notice the receiving rate going down, you’ll have to deal with inefficiencies in your warehousing operations. Some of the reasons may be the growing volume of incoming inventory and insufficient staff, lack of training, equipment issues, or flawed workflows.

Important to understand. Optimizing and speeding up warehousing operations is crucial as it’s a big part of inventory flow along the supply chain that greatly impacts your overall fulfillment efficiency.

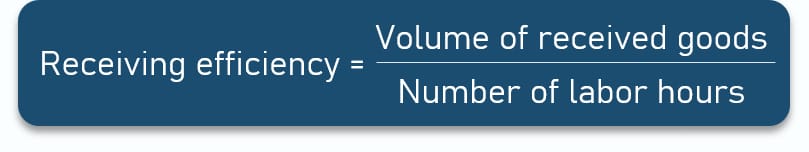

Receiving efficiency

Receiving efficiency compares the amount of incoming inventory (usually the number of items) and the number of working hours per certain period of time (day, week, month). To calculate it, divide the volume of received goods by the number of labor hours.

What does it show? Receiving efficiency shows how many stock items your warehousing staff processes in a certain time frame.

How to approach it? Like the previous KPI, the decrease in receiving efficiency indicates a drop in productivity.

Important to understand. Receiving efficiency is another actionable KPI that can help you uncover issues and bottlenecks in your warehousing workflows.

Other receiving KPIs worth monitoring are the cost of receiving per line, receiving cycle time, and receiving accuracy.

How to approach inventory metrics: practical recommendations

Here are several actionable ideas on how to harness data and get useful insights out of inventory KPIs.

Identify key objectives. Before selecting KPIs, you should clearly understand the specific objectives of your business. Are you looking to improve cash flow, reduce stockouts, or decrease holding costs? The objectives set the direction for which KPIs to track.

Choose the KPIs to track. There are numerous inventory metrics, but you might not need all of them. Select those that are relevant to your industry and align with your business objectives. For example, you don’t need to track the return rate if you sell, say, pharmaceuticals, and your policy doesn’t allow returns. On the other hand, if you work with produce or other perishable goods, then the percentage of inventory sold within the freshness date would be one of the most important metrics.

Set benchmarks. Determine what a good, acceptable, or poor performance looks like for each KPI. These can be based on your industry standards, past performance, or target objectives.

Implement software. Consider employing inventory management software or other specialized tool to consistently measure and track these KPIs. Automating this process will save time, reduce human error, and ensure deeper analytics.

Analyze trends and changes. On a regular basis (monthly, quarterly, annually), review the KPIs to see if you're meeting, exceeding, or falling short of your benchmarks.

React. If performance is lacking or you notice new market trends, identify root causes and adjust strategies or processes accordingly.

Review KPIs periodically. As your business evolves, so may your objectives. Once in a while, it’s worth reviewing the list of KPIs you track to ensure they remain relevant to your current business goals.

Inventory KPIs help business owners and inventory managers measure and improve the effectiveness of stock-related processes and other operations. If you regularly monitor and adjust your strategy based on these metrics, you can get better control over your business and meet your operational and financial goals.

As a further reading suggestion, check out our comprehensive overview of supply chain analytics, a list of essential eCommerce metrics to track, and a detailed guide to analytics in procurement.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.