The MICE tourism market is a dynamic segment of the travel industry. It was valued at $782.80 billion in 2023, and given a CAGR of 5.5 percent, its value in 2033 is expected to reach $1,337.14 billion. Since the entire travel market is estimated to be valued at around $11.39 trillion, MICE comprises around 7 percent of it.

MICE tourism market overview

The WTM Global Travel Report unveiled in November 2024 at WTM London stated that business travel grew at a faster pace than leisure tourism (19 vs 11 percent). MICE events keep attracting corporate travelers who tend to stay longer for leisure purposes and spend more at the destinations. In this post, we’ll discuss these and other trends in the MICE tourism market, so let’s jump right in.

What is MICE tourism?

MICE tourism is a type of business travel where people take trips for professional or educational events. MICE is an acronym that stands for meetings, incentives, conferences, and exhibitions.

So MICE is mainly about business travel. Although leisure activities can also be included in the program to better engage attendees, events like concerts, festivals, or sports belong to a different category.

Let’s discuss each type separately.

Learn about event management software and how it helps with planning and executing mice tourism activities.

Meetings

Meetings are smaller gatherings at which people discuss specific business matters, such as product launches, agreement terms, or strategy settings. Comprising 45 percent of the entire MICE market, meetings are its biggest component.

In line with this, the 2024 Deloitte corporate travel study showed that meetings are among the most popular reasons for frequent business travelers: 21 percent of respondents travel at least once a month for sales meetings and client relationship building, and 14 percent travel for team meetings. For the sake of comparison, only 13 percent of business travelers said they take frequent trips to conferences or exhibitions.

Incentives

Incentives are travel experiences companies organize to reward employees or partners, recognize their achievements, or motivate performance. These trips are often designed as luxurious, exciting getaways where attendees can relax and connect with others in an informal setting.

The 2024 Incentive Travel Index survey revealed that finance and insurance is a primary industry for incentive travel programs, followed by technology, and pharmaceuticals and healthcare.

According to the survey, the average incentive travel spend per person is $4,900 and respondents expect this number to grow in 2025-2026.

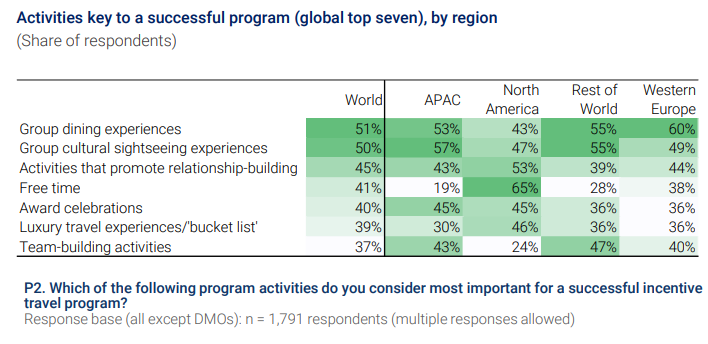

When asked about the most appreciated activity, most respondents mentioned group dining and group cultural experiences. However, interestingly, the priorities varied across geographical regions. For travelers from North America, free time was the most important, followed by activities that promote relationship-building. Europeans chose group dining as their top priority, while Asians opted for group sightseeing.

Most appreciated activities. Source: 2024 Incentive Travel Index

Many companies are known for their incentive travel programs including Google, IBM, Salesforce, Amway, Marriott, etc.

Conferences

Conferences are large, often multiday gatherings that bring together people from similar industries or interests, providing a space for sharing knowledge, networking, and professional development.

The 2024 Deloitte corporate travel study showed that 63 percent of people expected to have at least one business trip to a conference or exhibition in 2024.

Conferences usually involve various activities, typically including keynote speeches, panel discussions, and networking sessions. As we mentioned previously, leisure activities are also often arranged to engage visitors and foster communication.

Many conferences are held on a regular periodic basis, such as annually, biannually (twice per year), or biennially (every other year). Every industry sector has conference events to exchange knowledge and communicate, and in most cases, conferences are combined with exhibitions to showcase the latest developments. That’s why we’ll discuss the biggest events in the next section.

But conferences aren’t only about specific industry-related professional meet-ups. There are political, sports, educational events – and also a number of unusual ones that break the mold. Here are some examples to name but a few:

- the International UFO Congress Convention attracts researchers, academics, and enthusiasts in the field of UFOlogy;

- the Mars Society Convention focuses on Mars colonization;

- the World Toilet Summit is all about improving worldwide toilet and sanitation conditions;

- the World Clown Association Convention gathers clowns from many countries to share their skills and experience.

Not to mention all sorts of non-professional conventions and wacky events, such as Xena: Warrior Princess Convention, Irish Redhead Convention, and National Hobo Convention. Well, that’s where you might find attendees networking in ninja costumes or debating the future of space travel over lunch… But let's circle back to something a bit more grounded.

Exhibitions

Exhibitions (also called trade shows or expos) are events that allow businesses to showcase their products or services, network with clients, and keep up with industry trends.

The Global Association of the Exhibition Industry estimated that the total indoor exhibition space reaches 42.1 million sqm across 1,425 venues globally. Europe leads in terms of both the number of venues and capacity, followed by Asia-Pacific and North America.

These are some of the largest events from different industries.

CES (Consumer Electronics Show) is one of the largest tech conferences globally, drawing up to 182,000 attendees pre-pandemic. Held annually in Las Vegas, it showcases new products and technologies in the consumer electronics industry from around the world.

Mobile World Congress (MWC) held in Barcelona is the largest exhibition for the mobile industry, attracting more than 100,000 participants at its peak.

The automobile industry boasts several annual massive events in different destinations. The biggest ones are:

- the Detroit Auto Show (formerly known as the North American International Auto Show) has a record attendance of over 800,000 people;

- the Paris Motor Show brought together 1.25 million auto lovers in 2016;

- the International Motor Show Germany gathered over 900,000 attendees in 2015; and

- the Japan Mobility Show (or Tokyo Motor Show) tops the list with a whopping 1.3 million visitors.

Trade shows dedicated to agriculture, books, video games, construction machinery, furniture, pet supplies, makeup, and numerous other topics regularly attract hundreds of thousands of visitors from around the world.

So where do all these enthusiasts flock to share knowledge and talk to peers?

Top MICE destinations

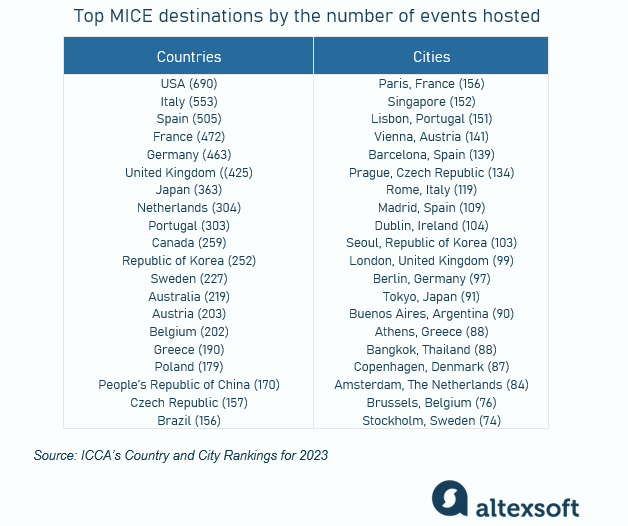

Each year, ICCA (International Congress and Convention Association) compiles a report of the most popular destinations worldwide that hosted the greatest number of meetings and industry events. In 2024, it released the ICCA’s Country and City Rankings for 2023. You can see the results below.

Top MICE destinations by the number of events hosted. Source: ICCA’s Country and City Rankings for 2023

As you can see, the US is most active in hosting meetings and industry events, but they are scattered around the country. At the same time, many European cities made it to the list, which only proves that Europe is the leading MICE geographical region with a 38 percent share.

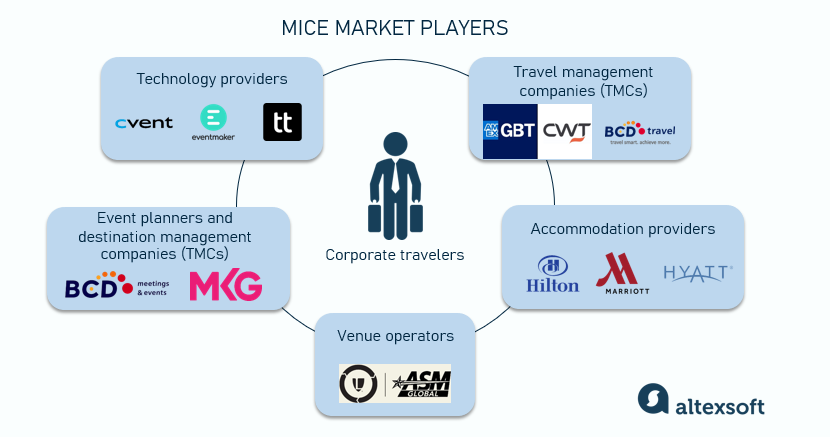

Key players in MICE travel

Organizing events at scale isn’t easy and often requires collaboration between multiple service providers. So let’s talk about the key players involved in the MICE sector.

Key players in the MICE market

Travel management companies (TMCs)

Travel management companies or TMCs are basically travel agencies that help businesses organize corporate travel.

Check our expert who explains the ins and outs of corporate travel

Depending on the agreement, these companies can provide end-to-end organization, from logistics planning to on-site support to expense management. They work closely with corporate clients to ensure efficient travel arrangements and may offer support with group travel coordination, visa assistance, travel policy compliance, etc.

Some well-known names in this category are American Express Global Business Travel (Amex GBT), BCD Group, Carlson Wagonlit Travel (soon to be acquired by Amex GBT), TravelPerk, etc.

Accommodation providers

For many hotels, MICE is a crucial revenue stream. Corporate travelers are generally thought to spend more than leisure tourists, so no wonder properties strive to attract this segment.

Not only does business travel fill up rooms, it also generates revenue from

- renting event spaces, such as conference and meeting rooms, ballrooms, breakout areas, etc.;

- food and beverage sales;

- dedicated event services (catering, audiovisual support) and staff, etc.

Business hotels often create conference or meeting packages that typically include event space, snacks, drinks, use of conference technology (e.g., projectors), Wi-Fi, etc.

There’s another advantage for hotels. MICE events are held all year round and mainly on weekdays, while leisure guests typically prefer weekends. All that keeps the hotel booked regardless of the season, ensuring a steady demand level and consistent revenue inflow.

In their revenue management, MICE-oriented business hotels must monitor RevPAM (Revenue per available square meter) in addition to common room-specific metrics like RevPAR. Learn more about essential hotel KPIs from the posts linked below.

Big chains like Marriott, Hilton, Hyatt, and IHG are best known for their business hotels with MICE-oriented facilities and amenities.

Venue operators

Venue operators manage the spaces where MICE events take place, offering facilities tailored for meetings, conventions, and exhibitions. They ensure the venue meets technical, logistical, and comfort needs, often offering amenities, technical support, and adaptable spaces to accommodate different event formats.

Most major convention centers are owned and run by the state or government entities. The largest private-sector venue operator, ASM Global, was recently acquired by Legends, the event solutions provider, to form a major live events company.

Event/destination management companies

These companies handle the planning and execution of events, from logistics and scheduling to marketing and attendee engagement. They coordinate between clients and suppliers, managing all aspects of event production and ensuring everything runs smoothly.

Some recognized corporate event planners are GoGather, BCD Meetings & Events, MKG Events, and Maritz Global Events.

Destination management companies (DMCs) are local experts that can offer experiences tailored to a specific destination. They can act both as travel agents and event managers, organizing turnkey MICE tourism for corporate clients.

The MICE Magazine highlights some standout DMCs that specialize in different markets, such as Agenda: USA in Kansas City, US; Spectra in London, UK; Arabian Adventures in UAE; etc.

Technology providers

Though not as obvious, this category of service suppliers is also an essential piece of the MICE puzzle. Technology providers offer solutions to event organizers to support event planning and execution including such processes as

- venue sourcing,

- event registration,

- ticketing and online payments,

- check-ins,

- virtual interactions,

- audience engagement,

- marketing,

- data analytics, etc.

For example, companies such as Cvent, Eventmaker, and Eventtia offer specialized event management tech solutions. They include registration, event apps, analytics, and other handy features that streamline event planning and enhance the attendee experience.

Read more about event management software in our dedicated post.

The economic impact of MICE travel

As we mentioned in the beginning, MICE is a high-value, steadily growing industry segment. Just for the sake of comparison: Peak Super Bowl attendance was around 104,000, and the largest crowd for a Taylor Swift concert was 96,000.

Well, auto shows and book fairs attract millions of visitors, all of whom spend money at the event destination. Of course, not all of them are corporate travelers, so let’s stay the course and focus on business travel expenses.

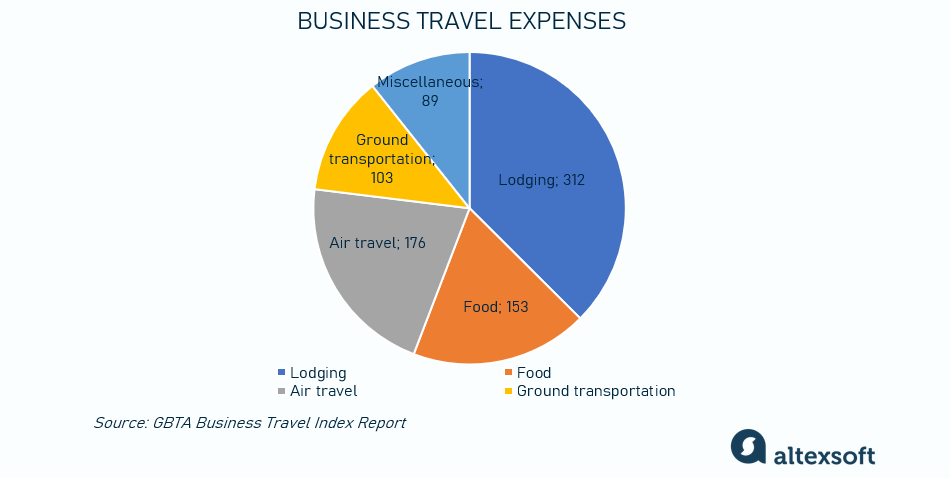

According to the latest GBTA report, business traveler spending, on average, amounts to $834 per person. Here’s the approximate breakdown:

- lodging accounts for $312,

- food and beverage is $153,

- air travel averages $176

- ground transportation is $103, and

- miscellaneous expenses of $89 round out the total.

Business travel costs breakdown. Source: GBTA report

All this spending affects the local economies at the event destination in several ways.

Direct impact includes spending on accommodation, transportation, food, venue, etc., accounting for $1.2 trillion globally. So all businesses working in these sectors benefit from MICE events directly. The estimated direct impact of business events on GDP is $662.6 billion.

Indirect impact is about purchasing products and services that aren’t directly related to the event, such as entertainment, tickets to local attractions, souvenirs, etc. MICE events generate many jobs for locals (an estimated 10.9 million jobs globally) and boost supply chains, creating a ripple effect for the local economy.

Induced impact includes increased tax revenues at the MICE event destinations and also further economic activity of local vendors.

The impact of event tourism

The key trends of the MICE tourism sector

Okay, so now we get to the juiciest part. We said that MICE tourism is a high-value sector with a broad economic impact. Seeing its benefits, governments worldwide have been increasingly investing in MICE-related infrastructure to attract visitors and strengthen their economies.

But what is driving this market today? What are the main trends and innovations that support its evolution – and what can market players do to keep moving with the times?

Bleisure

The bleisure trend of combining work travel with entertainment isn’t new but it keeps gaining traction. The WTM Global Travel Report actually named bleisure the top tourism growth driver.

The Howdy survey reports that almost half of business travelers planned a bleisure trip in 2024.

So market players look for ways to adapt to the new format. Event planners look for destinations that offer entertainment options, TMCs include leisure activities in itineraries, and hotels offer bleisure packages and amenities that support both remote work and recreation.

Read our post dedicated to the bleisure trend to learn how you can capitalize on it.

Virtual and hybrid events

We all remember the shift to remote caused by the pandemic. Since physical events weren't possible, the need for digital communication channels and powerful streaming tools became critical.

As travel restrictions eased, businesses started to get back to face-to-face events.

Live meetings are still a preferred way of communication – and definitely the best way to network. Actually, surveys showed that 72 percent of professionals prefer in-person conferences over virtual ones. And according to the 2023 The State of In-Person B2B Conferences report, 4 in 5 organizers say in-person events are the most impactful marketing channel, while 77.7 percent of attendees say in-person B2B conferences are best for networking.

However, the efficiency of virtual and hybrid formats is undeniable as they allow for reaching a broader audience, are (arguably) cheaper to arrange, and are better for the environment. While heavily reliant on technology, virtual events don’t have the organizational limitations of in-person ones.

So they remain as part of the overall event mix. Skift calculated that in 2023, 47 percent of events were virtual or hybrid. And AmEx GBT, in their 2025 Global Meetings and Events Forecast, expects the share of these formats to drop to around 41 percent of all business meetings.

According to the Market Data Forecast, the current virtual events market size is $166 billion and is expected to grow at around 21.89 percent in the next decade.

Besides streaming technologies, virtual event organizers rely on other digital solutions, such as

- mobile event apps that allow attendees to register, view agendas, communicate, engage in various activities, etc.;

- data analytics solutions to dig into event performance, understand attendee preferences, and find opportunities for improvement;

- CRM systems to gather attendee data and enable personalization, and so on.

Speaking of personalization, that’s another big trend shaping the MICE market.

Personalization and attendee experience

Personalization has been around for most service and customer-facing industries. As we said, event organizers use CRM and data analytics technologies for more accurate guest profiling and the creation of tailored experiences and customized content.

And it’s not only about targeted marketing campaigns. Skift’s Event Technology Report states that 61 percent of software vendors offer at least one AI-powered feature to enhance the attendee experience.

The most common one is matchmaking (almost 40 percent). Having complete attendee profiles, apps like Grip or b2match analyze data such as job roles, industries, and interests to suggest potential networking matches. Event participants can look through profiles, search for people based on similar interests, or trust the app recommendations – and schedule the meeting, either in-person or virtual.

Most event apps also use attendee profiles to help visitors create customized agendas. They provide information about ongoing and planned activities, allowing guests to add them to the calendar, view and chat with other attendees, get navigation directions, etc. Some platforms (e.g., Eventbase) even offer personalized recommendations to help users choose sessions, content, and activities that best match user interests and preferences.

Real-time translating apps such as Worldly or Interprefy make content accessible to multinational visitors with AI-translated speech and live captions.

As for experiences, organizers strive to make the event memorable for attendees, so they create a mix of formats. To increase engagement and foster networking, they incorporate interactive elements (real-time polling, gamification, etc.) and various activities, both industry-specific (hackathons, barcamps, debates, roundtable discussions, etc.) and leisure (trivia, scavenger hunts, etc.).

Creating an unforgettable event experience might also mean choosing an unusual venue type (an art gallery, a historic castle, etc.) or alternative accommodation options (villas, glamping cabins, etc.). It might also mean offering a personalized swag, for example, with the attendee's name and company logo or providing several options to choose from.

Sustainability and wellness

As environmental consciousness grows, many MICE events now prioritize eco-friendly practices. This includes choosing sustainable venues, going paperless, reducing waste, and partnering with hotels that offset carbon emissions.

There’s also a global trend toward a healthier lifestyle. So event planners must ensure that attendees have opportunities to support their physical, mental, and emotional well-being. It can include providing diverse catering options, wellness breaks, quiet zones, stress management workshops, etc.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.