Everybody in the hospitality business encounters the concept of rate parity. Its initial aim was to make things fair and square for all the industry players, but that's not always the way it works.

To cooperate successfully with OTAs without losing control over their own pricing, hoteliers need to grasp the idea and develop a strategy that will allow them to apply rate parity to their advantage.

What is price parity, and why it’s important

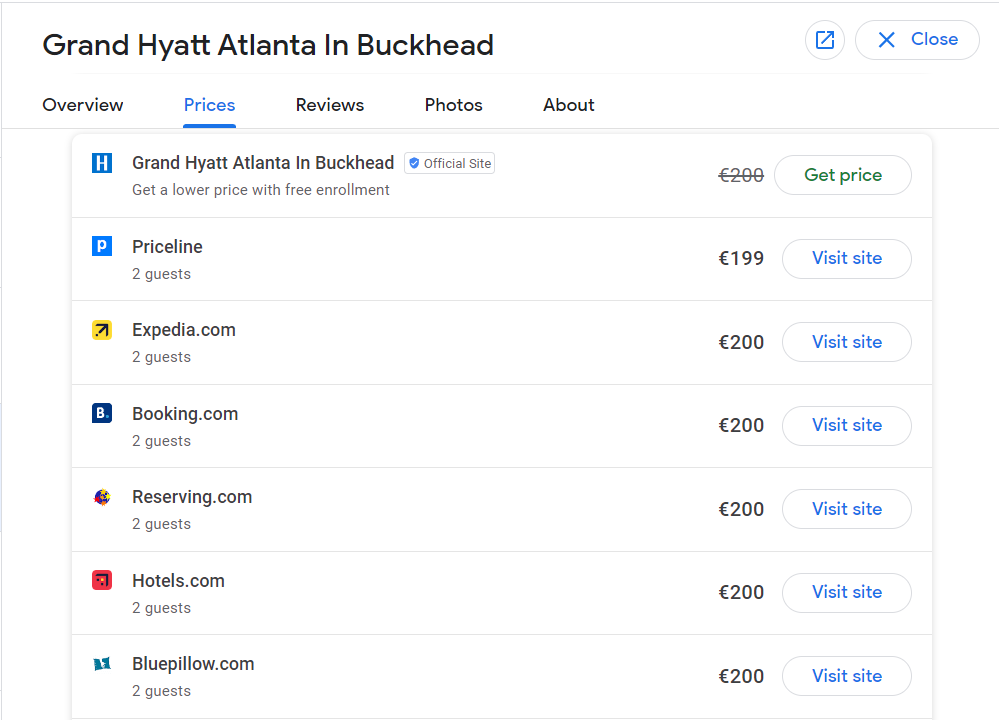

Rate parity (sometimes also called price parity) in the hotel business means maintaining the same price for the same room type across all public distribution channels, such as the hotel's own website, OTAs, and GDSs.

Rate parity in action. Source: Google Hotels

Rate parity is usually negotiated in a contract between an OTA and a supplier— a hotel chain, independent hotel, or B&B. Having set a price for the OTA for a particular room type, the hotel can no longer sell the same inventory for less on other publicly available online platforms.

Hotel rate parity types

The conditions of a rate parity agreement can be more or less stringent. Specialists sometimes use the terms wide and narrow rate parity.

Wide rate parity is the most rigid type of parity. Let's say Desert Rose Hotel has a contract with Booking.com under wide parity; this means that Desert Rose is required to always offer the best room prices and best room availability to Booking.com

The hotel is not allowed to sell its rooms on any channel, including its own website, cheaper or on more favorable terms than on the OTA partner's channel.

Narrow rate parity permits more favorable prices on other online reservation portals but not on the hotel's own website. In this case, our Desert Rose, which has a contract with Booking.com, would be able to offer cheaper deals on Expedia and other OTAs as long as the rate displayed on Booking.com is not higher than that on Desert Rose’s own website.

However, the hotel has the right to offer reduced prices, discounts, and other perks to the loyalty or reward program members, as well as to customers who book via email, phone, or social networks. The main thing is that these favorable offers should not be reflected in metasearch engines (such as Google Hotel Search, Trivago, Kayak, TripAdvisor, etc.).

Rate parity benefits for hotels

The main advantage of rate parity is that compliance with it allows the accommodation provider to enter into a contract with the OTA and thus reach a wider audience. But there are other benefits as well.

Customer trust and confidence. Guests who find a lower price on one channel after booking through another may feel cheated. If the result of a metasearch shows the same rate for the same room type, it reassures the customer that the deal is fair.

Brand reinforcement. By adhering to a unified and transparent pricing strategy, the hotel improves its reputation and strengthens its value proposition.

Promoting fair competition. Rate parity ensures that hotels of the same price category compete based on factors such as location, amenities, service mix, and quality rather than through price wars.

Simple tariff management. A uniform pricing scheme is easy to monitor and update. This improves operational efficiency and reduces the risk of mistakes.

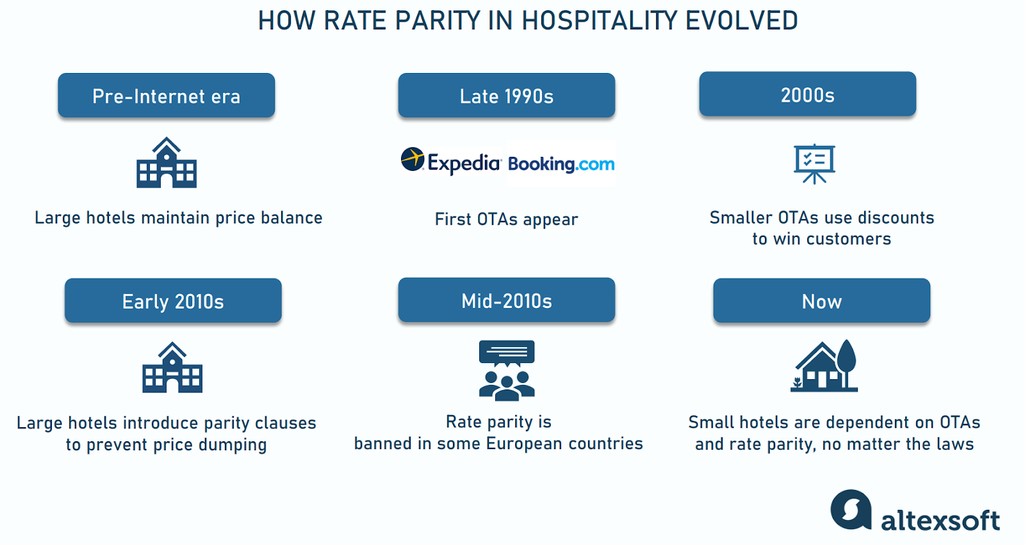

History of rate parity in hospitality

Price parity is not a new invention, and OTAs certainly do not have a patent on it. Even before Internet technologies started to dominate hospitality, large hotels followed this tactic when selling through then-existing distribution channels: walk-ins, direct phone reservations, emails, brick-and-mortar travel agencies, and GDSs. Price parity puts everybody on an equal footing.

Price parity evolution

At the end of the 1990s, the first OTAs were created, in particular European Booking.com and American Expedia, and the most advanced hoteliers were the first to test the waters. Cooperation with OTAs reduced marketing costs: The imaginary Desert Rose Hotel profited enough to pay commission for getting guests from another continent.

Technology was rapidly developing. In a few years, online booking became available to people all over the world, and hotels, of course, benefited greatly from this. But, as it happens, the explosive growth led to chaos: New OTAs were dumping, trying to snatch a piece of the market from the existing players. As a result, the big players had to cut prices to retain customers.

To get the situation under control, major hotel chains started to introduce a rate parity clause in their agreements with OTAs, and then the rest of the market actors followed suit.

However, over time, the balance of the power shifted. Booking through Booking.com, Eхpedia, and similar platforms is easy and convenient. Besides, OTAs, especially large ones, tend to invest heavily in advertising. So it is unsurprising that the share of direct bookings through hotel websites has been falling, while the OTAs' share has been growing rapidly.

Now, depending on the country and hotel, 25-75 percent of total online bookings are made via OTA. Therefore, travel agencies can safely dictate their terms to hotels, increasing commissions and, at the same time, demanding price parity so that neither the hotel nor third-party distribution channels are dumping.

Online travel agencies themselves widely use loyalty or reward programs such as Expedia One Key or Booking Genius, offering participants favorable booking conditions and best prices while leaving little reason to bother going to hotel websites.

In this video, you will learn more about the complex love-hate relationship between hotels and OTAs.

Consequently, price parity has become an instrument of influence and dominance of OTAs in the hospitality market and has also become a topic of heated professional discussions.

Price parity laws: is it obligatory at all?

Rate parity clauses are typically included in contracts between hotels and their distribution partners. But many hotelier associations and antitrust authorities in some countries believe that parity clauses are anti-competitive. They stop consumers from getting different prices on competing online platforms and limit accommodation providers in their ability to meet their commercial interests best. Let's get into the geography of rate parity.

Regulations related to price parity

There is no such thing as an international rate parity law that is applied globally. Each region or country may have its own regulations.

The European Union declared rate parity clauses anti-competitive in 2015 following an investigation by the European Commission. As a result, Booking.com and Expedia ceased using wide price parity clauses throughout the European Economic Area.

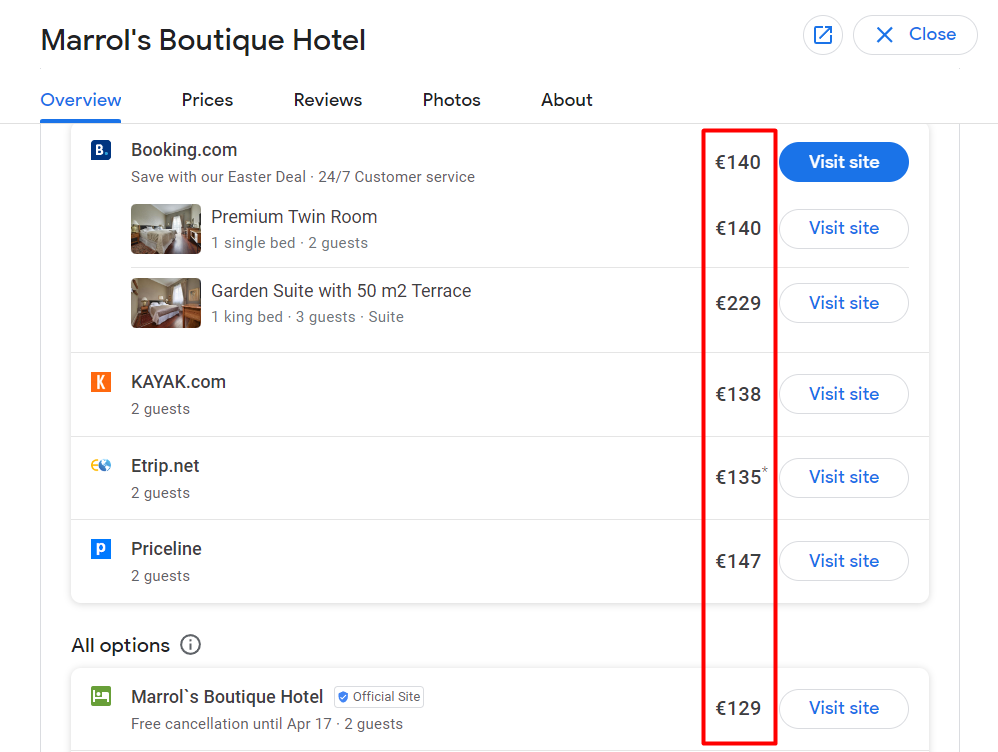

An example of rate disparity: the small European hotel’s website has the lowest price. Source: Google Hotels

France, Austria, Germany, Italy, and Belgium adopted laws banning the use of wide and narrow price parity clauses by any OTA.

Germany and Sweden ordered IHG, Booking.com, and Expedia to remove all rate parity clauses from their contracts with hotels.

Australia and New Zealand forced Booking.com and Expedia to use only narrow parity clauses in contracts with accommodation providers.

The US, UK, and Latin America don’t regulate rate parity.

India, in 2022, ordered the two largest OTAs in the local market, MakeMyTrip and Goibibo, to remove price parity and exclusivity obligations from their contracts with hotels.

Why regulations don’t work as expected

It would seem that laws banning rate parity allow hoteliers to relax. They can charge any price and compete freely with large OTAs, expecting to attract direct bookers and therefore increase revenue.

However, a study initiated by the European Commission in 2020 showed no significant change in the situation compared to 2016, when Booking.com and Expedia implemented the switch to narrow parity clauses EU-wide. Moreover, no noteworthy difference was spotted between countries banning rate parity completely and those allowing for narrow parity.

Ironically, it is independent hotels that are the most dependent on large OTAs, whether rate parity is banned or not. Indeed, in Europe, the chain hotel room share is only 45 percent. Many of the rest are just small mom-and-pop guest houses and B&Bs. For the latter, it might be tempting to offer their inventory to third-party dealers at a lower rate, but they often choose not to do so regardless of the regulation. Small hotels fear possible sanctions from the partner OTA, i.e., lowering them in ranking results.

That's why in the US, where 73 percent of hotel rooms belong to big players, price parity has not turned into an industry scarecrow. Branded hotels have learned to work effectively with this instrument, turning it to their advantage.

A hotel with a big share of direct booking is interested in making sure that no distribution partner is dumping. If a room costs $200 on Hilton's website, and imaginary Cheaphotel.com prices the same room at $180, guests will prefer to pay less. The hotel will fill its rooms, but it will devour its own revenue by doing so. Price disparity is unacceptable for branded hotels, as well as for large OTAs. On the other hand, small OTAs and small hotels are dumping to get traffic and buyers to their sites. Those endeavoring to catch up with competitors will always try to get around price parity.

Imagine a large chain hotel with a huge advertising budget, high brand awareness, a modern website, an extensive loyalty program, and millions of satisfied guests. When cooperating with OTAs, it only needs one thing — to make sure that no distribution channel tries to undercut the prices indicated on the hotel's website. In this case, the wide rate parity clause is the hotel's best weapon, and its main challenge is to be able to track down the attempts of dumping from outside and stop them in time.

OTA price parity manipulations: how travel agencies bypass regulations

OTAs have two options for collaborating with hotels: the agency model and the merchant model. In the former case, OTAs don’t process payments or have any control over prices. They only showcase final rates set by hotels and collect commissions for their services (usually 10-30 percent of the rate) after a guest’s checkout. In the latter case, the hotel passes the negotiated net price to the OTA, which acts as a merchant — meaning it can accept payments from travelers and markup prices at its discretion.

In the first case, it is difficult for OTAs to violate rate parity. In the second case, they are able to do so by setting a lower markup.

Let's get back to our imaginary Desert Rose Hotel. This time, it has a contract with Expedia and three smaller travel agencies. The price for a standard room across all platforms is $100, and this perfect harmony is reflected in Google Hotel Ads. But suddenly, a disgruntled Expedia manager contacts Desert Rose, claiming the parity rate violation.

It turns out that some third-party OTA, with which Desert Rose does not have a contract, bought rooms in bulk from a bed bank at $80 and put them on sale with a $10 markup, resulting in a price of $90 in Google Hotel. Clear disparity appears. Since Expedia has no way to influence third-party OTAs, the blame will fall on the hotel’s head. The partner OTA may well downgrade Desert Rose as a penalty, even though the hotel also has no tool to influence the offender.

This problem exists and, at the moment, has no universal solution. But this example shows how important it is for a hotel to ensure price parity and maintain strong long-term relationships with partner OTAs.

Apart from the obvious unscrupulous violation of price parity, there are other ways for OTAs to bypass this market regulation.

Combining hotel rooms into a package with flights and other services. In such a configuration, it is impossible to track whether the price parity for a particular room type has been violated.

Closed User Groups. This is a special type of OTA that requires any user to join a closed member program. In this case, the discounted rates simply do not appear in the metasearch engines.

Opaque rate. This approach involves selling a service to a consumer without disclosing the brand of the provider until payment is made. A traveler can choose only the city/region and the hotel's star rating. Still, the exact name remains hidden, which allows OTAs to offer substantial discounts without formally violating the parity rate clause.

How to manage rate parity effectively

Price parity poses a serious problem for smaller hotels. They do not have marketing budgets even close to what OTAs have. The best strategy for such hotels is, on the one hand, to adhere carefully to price parity and not clash with OTAs and, on the other hand, to take steps to maximize direct bookings. Here are some practical tips.

Put the Best Price Guarantee statement on your website. And scrupulously make sure that no dealer tries to undercut your prices. If, after researching online, potential customers find that no one is offering a better price, you’ll gain their trust.

Optimize website speed, performance, and overall user experience. Turn it into a conversion machine. Make sure the booking process is as smooth as possible for potential guests. Integrate a chatbot so that customers can easily get answers and give feedback.

Read our article on website speed optimization to get practical recommendations on the matter.

Offer direct bookers more value. Instead of lowering prices, provide direct bookers with more value than OTAs can offer. It can be flexible cancellation terms, free transfers, late check-out, included drinks, tickets to an event nearby, the ability to choose a window view right at the time of booking on the hotel website, and more.

Run a loyalty program. Encourage new visitors to provide their email before booking and sign up for the loyalty program so that they can access lower prices, special deals, and additional value. Furthermore, collecting the customer's data opens opportunities for future marketing efforts.

Promote your hotel on social media. There is a great opportunity to segment the audience and reach different target groups. Besides, you are free to provide discounted rates to guests who follow your hotel on Facebook or X (Twitter) without breaking the sacred rule.

Contract directly with metasearch platforms. They use a pay-per-click bidding model, and it's less than the commission paid to online travel agencies.

Contract directly with more OTAs. And establish solid relationships with your distribution partners — so they don't try to buy your inventory from wholesalers.

Use technology to manage price parity effectively. Software products enable effortless monitoring and synchronization of hotel room availability and pricing across multiple distribution channels. Technology solutions are equally important for branded hotels, with their mountains of diverse data, and small B&Bs, with their perpetual staff shortages and the need for automation.

Technology solutions for price parity management

The main software product that can help a hotel solve the parity rate problem is the rate shopping tool.

A rate shopping tool is specifically designed for monitoring and comparing prices. This software checks rates on all available online platforms, displays data conveniently and signals disparity immediately. Rate shoppers can also track competitors' prices in real time, helping hotels to respond to market changes.

There are many tools for comparing tariffs with different functionality. The best option depends primarily on the size of your business and its needs: how often and on which distribution channels you need to monitor prices.

Rate shopping providers compared

In addition to the basic functions of a rate shopper (real-time rate shopping and rate parity monitoring), the features can include, for example, collecting demand and availability data, rank and review tracking, local events monitoring, etc.

Some channel managers and revenue management systems (RMSs) have a built-in rate shopper. However, if the software you already use lacks such an option, or if the embedded module does not meet your requirements, then you should consider acquiring an independent tool. When choosing a standalone rate shopper, pay attention to the following characteristics.

Data accuracy and completeness. Make sure that the data is regularly updated and that the software uses reliable methods to maintain data integrity.

Broad comparison options. Assess whether the functionality allows you to compare different room parameters, such as room type, length of stay, number of guests, and food conditions. It is important to choose a tool that allows you to compare prices with all other parameters being equal. Otherwise, the comparison becomes meaningless.

Diversity of data sources. The tool should have access to a variety of distribution channels, including hotel websites, online travel agencies, metasearch engines, and global distribution systems. A variety of sources will help you gain a better understanding of current market conditions and competitor strategies.

For the hotels, it is important to realize that OTAs are not going anywhere in the foreseeable future and will definitely not give up price parity. Therefore, as a hotelier, you have to learn how to innovate for effective price parity management. And as a first step, ensure you have the right tools to implement your distribution approach.

Olga is a tech journalist at AltexSoft, specializing in travel technologies. With over 25 years of experience in journalism, she began her career writing travel articles for glossy magazines before advancing to editor-in-chief of a specialized media outlet focused on science and travel. Her diverse background also includes roles as a QA specialist and tech writer.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.