During these times, when the number of flights has drastically dropped, every penny counts. Even before the pandemic, the aviation industry was going through a crisis, so airlines fought hard to track down and close every loophole. There are, unfortunately, a lot of them, one being the revenue leakage. Often created by travel agents and customers (both accidentally and not), these holes account for about 3 percent of an airline’s revenue. Though it doesn’t seem like a lot, it’s a hefty sum for a large company. In this article, we explain when revenue leakage happens in airlines and how revenue managers can seal these holes. Couldn’t be more relevant, right?

Airline revenue leakage

Revenue leakage is the mismatch between the expected revenue from the bookings that were made and the amount that airlines eventually receive. Identification of the areas of your revenue loss will enable you to minimize them. This includes discrepancies in fares sold by sales agents, intense competition on the market, refunds and cancellations of tickets, changes in foreign exchange rates, improper calculation of penalty charges, etc.

Leakage plugging strategy is called revenue integrity (RI). This involves making sure that the right passengers fly on the right plane, at the right time, at the right fare. Due to numerous problems, this is not always possible.

Sources of airline revenue leakage

Not always intentionally, travel agents as well as passengers themselves can cause a bunch of revenue integrity problems for airlines. First, let’s see at what stages of the flight booking process leakages appear. And in the next sections we’ll talk about solutions.

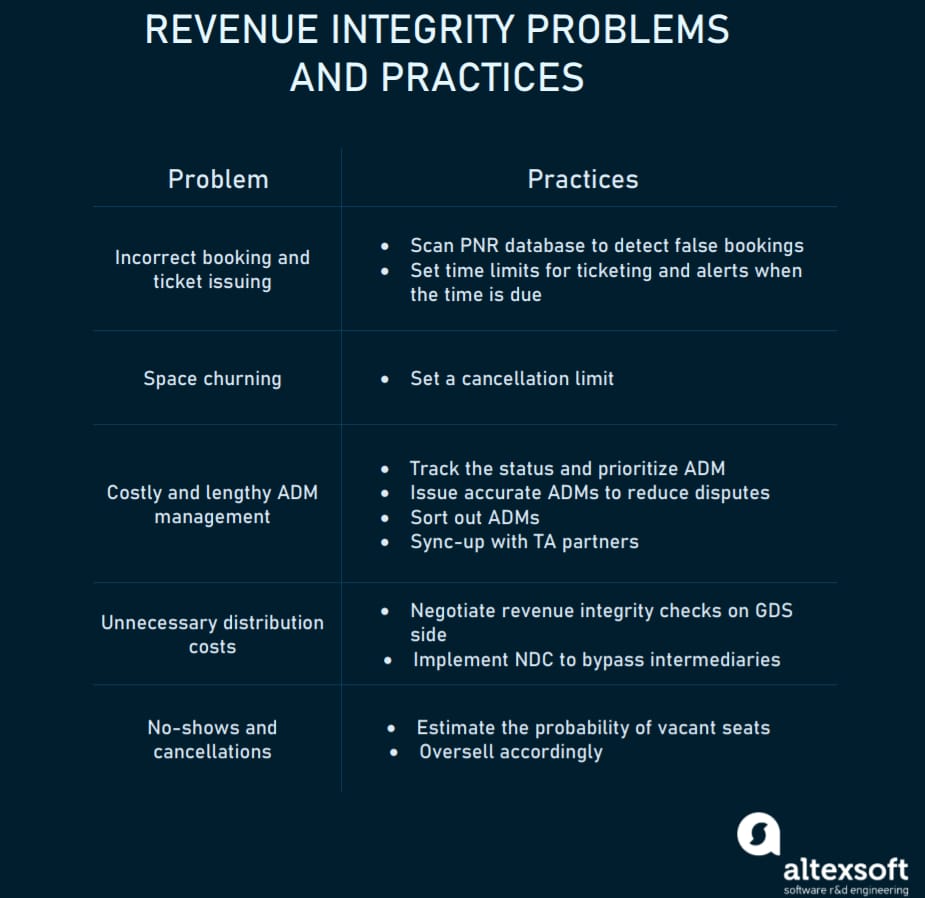

Root causes of revenue leakage and practices to mitigate them

Reservation stage

Unticketed booking. It happens when the booking is completed but passenger’s ticketing details are missing. For instance, when a travel agent wants to give a customer the exact price of a tour, they often hold a seat to do that. But no passenger name record (PNR) has been created. As a result, this test booking activated a hold but no one is going to travel by that ticket. So, airlines can be left with an empty seat and no payment. Besides, Global Distribution Systems still charge airlines for such passive bookings. And it can amount to a sizable sum if used frequently. Some airlines forbid creating bookings for testing or training purposes. If identified, a carrier cancels such a booking and issues a fine for the travel agency.

Space churning. Another case is when agents are trying to simply retain a seat or circumvent the ticketing time limit. Iteratively canceling and rebooking the same ticket, agents practice churning. It results in such negative events as PNR corruption and excessive GDS costs. So, it’s critical to take measures against it. We’ll provide the remedy later on.

Seat blocking. Also, agents may temporarily block airline seats for possible future bookings. However, they may not be used and the agency will simply let go of spaces they couldn’t sell. Meanwhile, the blockings have hindered valid bookings and the airline has lost potential passengers.

Duplicate booking. When the same person holds two or more confirmed reservations for a similar itinerary it can also turn into a blocked but unpaid seat. Shopping around for the best deal, passengers may accidentally make a duplicate unpaid booking. In the best-case scenario, the airline’s passenger service system (PSS) promptly spots dupes and cancels one of them. But the system can fall victim to different misunderstandings, for example, when the same or similar names are on the same flight. A program may mistakenly take them for duplicates while they are different passengers. Of course, there may be misprints, too.

Payment and ticketing stage

Booking classes and fare rule violations. If a customer fails to purchase a flight, say, two weeks in advance, the minimum fare remaining will get considerably higher for the same service class, whether it’s economy, business, or first class. So, some customers may grab the ticket at an advance purchase fare by backdating the validation date. Airlines must prevent backdating. An issue with booking classes may occur on the travel agency’s side. While reserving an outbound flight for an advance purchase fare, they can book the return ticket available only at a higher class with an equal fare, causing the airline to lose the difference between the advance purchase fare and the higher-priced fare.

Funds settlement

Unnecessary distribution costs. GDSs charge airlines distribution costs for every booking, even if it was incorrect and didn’t produce a real customer. Unnecessary booking costs can add up to four percent of an airline's GDS bill. However, these costs aren’t under the carrier’s direct control because they come from agents using the GDS.

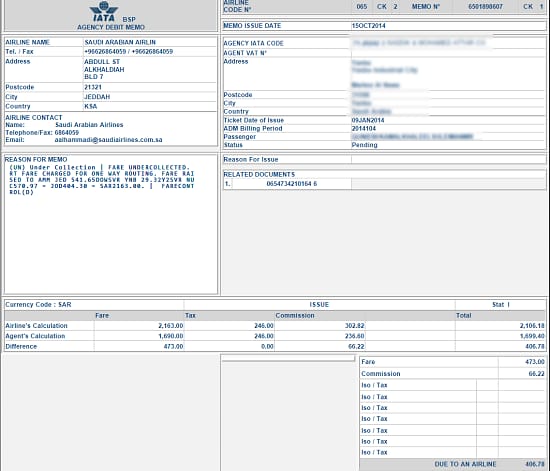

ADM management costs. Discovering an agency’s misbehavior, an airline notifies them they've done something wrong and asks them to pay back a certain amount of money. This notification is called an Agency Debit Memo or ADM. Carriers send ADMs via intermediaries - Airlines Reporting Corporation (ARC) for US agents and IATA for those outside the US.

Agency Debit Memo, Source: Steph Lee

Annually, the industry spends about $150 million on ADM management. However, the majority of parties involved seem to ignore the impact of ADM management as well as the related cost.

ADM dispute processing can span up to three weeks. But the issue is time sensitive as airlines are losing due to expired ADMs. Parties involved in the ticketing distribution chain have experienced challenges with managing ADMs. The complexity of ADM reason codes contributes to that. Each code defines a reason for issuing a debit memo. After being standardized, the number of codes was reduced to over a hundred but it’s still a lot.

Post-booking stage

Refundable no-shows and last-minute cancellations. The airline is at risk of losing money when someone cancels and there’s no one to buy that vacant seat. But even if the airline owes no money back (the seat is non refundable), fares are time-dependent. So, chances are the passenger bought the ticket beforehand at a much lower fare than it would cost if purchased closer to the departure date. Besides, seeing a convenient seat idling, passengers don’t understand why they had fewer options in the first place. Sometimes the reason for no-shows is that a passenger is late for the connecting flight because he or she booked journeys below minimum connection time.

Tariff abuse. Another instance is a customer buying a ticket with no intention completing the whole itinerary. Carriers often sell connecting flights for less than the cost of one individual flight component. They undertake this practice to fill space that would otherwise be flown empty. However, some passengers book a round trip ticket to avoid paying the higher one-way cost. Wanting to bring down the price, they add an extra leg and then get off midway. It’s classified as a tariff abuse, so some airlines have a no-show policy. It involves canceling subsequent flights on the same itinerary and/or even charging a flyer the higher fare they tried to avoid.

Timely notice of speculative bookings is key in the prevention of inventory spoilage. Otherwise, it’s an obvious revenue leakage. An airline sacrifices the price of one or more legs for the whole itinerary to work. But if it was for nothing, then an airline should end such activity.

Best practices for developing your revenue integrity plan

Assuming that most airlines start with defining clear-cut booking policies and fixed penalties for violations, now they must make sure agents adhere to them. How should they go about it?

- They can detect inaccuracies by analyzing PNRs.

- Auditing ticket lifecycles can also help keep track of abuses.

- Now if an error was found, airlines act upon it by issuing ADMs against agents.

- On the other hand, airlines can also enforce policies through GDSs.

- In addition, tricks such as overbooking and dynamic ticket pricing can counter revenue leakage.

Read on to find out the details of each practice and pick the ones that will help you tackle your revenue integrity state.

Integrate a PNR database analyzer

Solved problems: incorrect booking and/or ticket issuing, e.g. unticketed, passives, duplicates, and misprints detection.

Instead of manually validating all your PNRs, run a revenue integrity robot. Integrated into a Central Reservation System where PNRs are generated, the robot exercises automatic flight firming processes against the PNR database to trace poor quality bookings. A robot carefully examines new bookings, captures any modification of or within the existing PNRs, and reacts when a booking reaches a certain date or time stamp.

Setting time limits by which reservations must be ticketed, the robot sends reminders to an agent in due time. It also notifies the airline of all PNRs pending revalidation or reissue after a change of reservation on passenger request.

The robot hunts down non-productive bookings that aren’t likely to yield revenue like invalid or suspicious PNRs and duplicate e-tickets. It also reports if there’s a discrepancy between e-tickets and fare restrictions. It also identifies sophisticated and unique fuzzy name matching, such as alternative spellings, to minimize unnecessary creation of alternate travel plans within and across multiple PNRs.

An example of an RI robot is the SITA Revenue Integrity solution. Maintaining PNRs in an integrated shadow database, it automatically runs logical processes isolating problem PNRs.

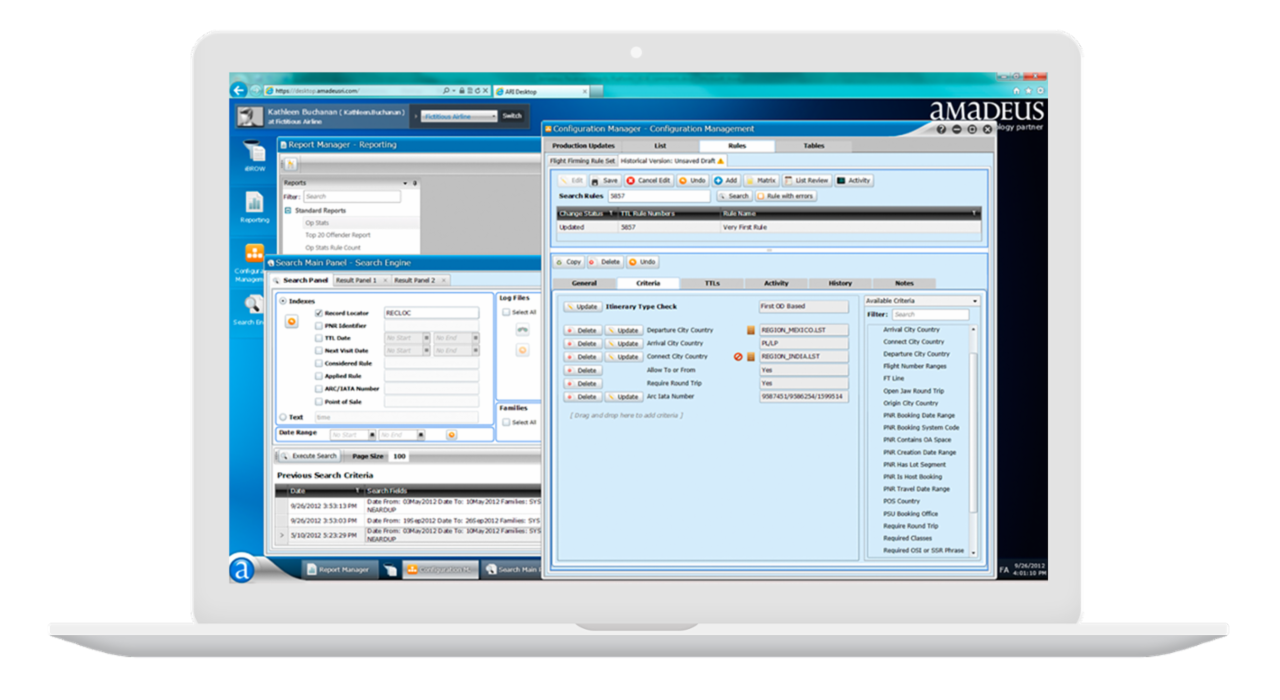

Another RI solution, Amadeus Revenue Integrity, resolves duplicated, non chronological, overlapping, and mirrored itineraries, any e-ticket mismatches, and also controls the deadlines for deposit, names, and ticketing fulfilment.

Amadeus Revenue Integrity Desktop allows for performing multiple functions, switching between tasks (defining rules, searching logs, reviewing reporting and analytics, and referencing documentation)

Uncover problematic travel agency behavior

Solved problems: Booking classes and fare rule violations, space churning, seat blocking, contravention of rules.

Airlines should educate the agent community on adherence to booking rules. They also should keep track of how their partners are handling bookings and whether they are complying with airline ticketing, booking, and revalidation policies. It requires a more profound analysis across the entire booking lifecycle.

Complete the ticket lifecycle audit. This will allow an airline to identify the markets and routes most affected and figure out what personalized RI checks should be implemented in the future.

Set up a cancellation limit. An example of controlling measures is setting up a cancellation limit. If there are attempts that exceed the cancellation limit for a travel agency, the airline can bill back to agents the incurred costs or initiate some other form of penalty.

Limit access. Once you’ve identified agents violating the policies, inform them of corrective measures and the consequences of non-compliance. However, if a travel agency keeps exercising non-compliant booking practices, an airline reserves the right to restrict an abusive TA’s access to their inventory through their GDS.

The same Amadeus RI also has a feature named Sales Watcher. It keeps an eye on financial losses resulting from agencies, controls the rate of sales at any agency, and alerts in case of any burst ticketing situations or when sales quotas have been reached.

Streamline Agency Debit Memo

Solved problems: ADM management: reduced costs and effective processing, timely dispute resolution with agencies.

Currently, a dedicated ADM Working Group including airlines, agents, travel agents associations, and GDSs is working towards ADM reduction and management improvements.

Watch how ADM Working Group is addressing revenue leakage

But the progress is slow. Here’s what an airline can do to optimize ADM processing on its side.

Improve business relationships with travel agents. It directly affects your ADM costs so it’s important to improve understanding between you and your partners.

Create a leaner and more efficient ADM process. Optimizing the process from your side, you can’t ignore the other parties involved. You’ll be able to create a leaner and more efficient process only by synergizing the workload with the parties involved.

Prioritize ADMs. Most common ADMs have to do with fares and taxes, commissions, and costly chargebacks. There’s a part of ADMs that are disputed by travel agents. Their processing has a high chance of dragging on. So, it makes sense to handle them with special care. In general, airlines should aim at reducing disputes with the agency community by providing them with accurate ADMs.

Tracking the status of ADMs (issued, pending, disputed, or canceled), airlines can prioritize those that are about to expire. Having filtering features to sort out ADMs by agency or by BSP also contributes to the accuracy of the ADM database. Accelya ADM Vision, a web-based platform for managing ADM data, allows users to drill down from BSP to agent to ADM. Integrated with all BSP countries, it provides information on the number and age of pending ADMs, prioritizing settlement of critical disputes. It generates the history of all ADMs and updates that data three times a day.

Build stronger relationships with GDSs and implement NDC distribution

Solved problems: unnecessary booking costs, more accurate data for auditing the booking transactions.

Basically all communication with TAs is facilitated by Global Distribution Systems. With a vast network of routes, flights, countries, and agents, it is extremely difficult for airlines to identify the exact source of GDS cost or leakage. So, they must work with the GDSs, incentivizing them to encourage more revenue integrity checks at the source.

However, if GDS systems are too unwieldy or not cooperative enough, airlines can bypass them by leveraging the New Distribution Capability (NDC) standard. This way they get the chance to work directly with travel agencies. Read more on how to approach the NDC implementation in our article.

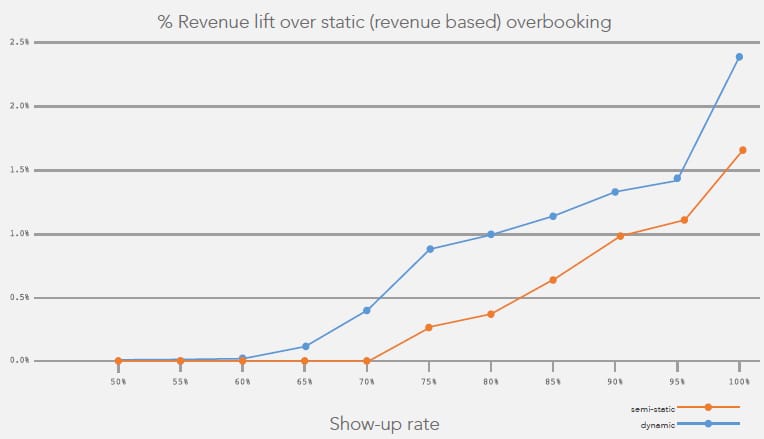

Exploit the no-shows with overbooking

Solved problems: Tariff abuse, refundable no-shows, and last-minute cancellations.

By looking at historical trends, Revenue Managers can estimate the number of people who will and will not board a flight. Major clues include:

- Missed connections - inbound flights are delayed past connecting departure time.

- Nonrefundable tickets leave passengers to no show instead of canceling when they have a change of plans.

- Last minute changes - some changes are known, just not until close to departure date or time. Think business travelers who change cities at the last minute, or meetings end early and they want a different flight.

Based on that data, RMs can estimate no-shows and last-minute cancellations and exploit them to increase the revenue. That’s especially critical if the ticket was refundable.

That’s why airlines resort to overbooking tricks. Trying to profit from empty seats, they intentionally sell more tickets than there are seats on the plane. Think the no-show rate is five percent, for example, so it’s safe to oversell by two which is about three extra seats. Applied regularly, overselling represents a serious income stream. Additionally, they determined that even if there is a miscalculation and they have to ask some passenger to give up the seat, the reaccommodation cost will be lower than the average last-minute fare. So, they consider this gamble worth taking.

The increase of show-ups leads to an increase in revenue if applying overbooking, Source: Pros

Overbookings are very important for an airline’s revenue. Juggling between cheap and expensive seaters, airlines can offer more discount seats.

So how to efficiently estimate no-shows and late cancellations to boost your overbooking strategy?

As for the overbooking predictions, their accuracy varies on each route. Some routes are highly predictable, while others have a lot of variables. The RM team learns these and uses this information to make informed pricing decisions. Using complex algorithms that forecast inventory load and no-show certainty, airlines get to maximize the profitability of any given flight - assuming a certain degree of overbooking.

Although overbooking is a common practice that pays off when buyers don’t show up, it may well lead to offloads or downgrades if based on distorted booking statistics. Such cases entail denied boarding costs, and even serious conflicts if passengers refuse to give up their seats. That’s not mentioning overall customer satisfaction. That’s why to be on the safe side, some airlines raise the reaccommodation costs to make overbooking less appealing. Other airlines like JetBlue alter policies to oversell flights only in extreme circumstances.

Implement dynamic pricing

Solved problems: optimal fare price differentiation.

An airline’s Revenue Management team sets prices on every flight and route in the system. Since airline schedules are fixed months in advance, revenue management seeks to maximize the money brought in on every flight. Calculating the average fare in a market, they figure out how much people are willing to pay at various times. Some people booked months in advance and others booked only days before the departure. And depending on when a seat was purchased, its price could be as little as $200 or as much as $5000.

Finding the optimal customer mix helps airlines achieve higher revenue possible. And that’s why they implement dynamic pricing that allocates the resource among the different fare classes. They have to decide how many seats to sell to discount passengers, and how many to save for future ones, who’ll be willing to pay the full fare.

See our video on how revenue managers at airlines determine the pricing

Be forward-looking in your revenue integrity strategy

Developing a comprehensive revenue integrity program requires an in-house RI software that will automate your revenue leakage traceability. Be ready to initiate an RI department and support another IT overhead or outsource this solution to an external provider.

If you’re looking to fix a single problem, like adjust ADM management or fix booking/ticketing problems, use one of the ready-made solutions, like those offered by SITA, Accelya, or Amadeus.

For any complex revenue leakage analysis or dynamic pricing, be prepared to build a bespoke solution with a tech consultant.