A business starts with an idea of how to generate value for a customer. So, if a customer is looking for a table, you can produce a table, market it, ship it, and receive payment for it — and that's your business model. The total amount of money earned — in other words, revenue — is the coal that keeps your train running. Depending on the business model’s complexity, revenue will cover manufacturing, distribution, marketing, and other costs.

Besides simple transactions, there are many ways to generate revenue. That’s even truer for software companies: Web distribution and the nature of software create various possibilities to monetize code. Think of licensed/freemium apps, service subscriptions, and others. All of these represent a certain mechanism that specifies how a business generates revenue. The structure of this mechanism is called a revenue model.

Here's our video breakdown of revenue models

For those exploring the world of business strategy planning, we’ll elaborate on the definition of the revenue model, and the correlation between business models and revenue streams. We’ll also analyze different types of revenue models and look at some examples to scrutinize the pros and cons of each approach. Finally, we’ll reflect on how to choose or develop a model for your business.

What is a revenue model?

A revenue model is a plan for earning revenue from a business or project. It explains different mechanisms of revenue generation and its sources. Since selling software products is an online business, a plan for making money from it is also called an eCommerce revenue model.

The simplest example of a revenue model is a high-traffic blog that places ads to make money. Web resources that present content, e.g., news (value), to the public will make use of its traffic (audience) to place ads. The ads in turn will generate revenue that a website will use to cover its maintenance costs and staff salaries, leaving the profit.

Revenue models are often confused with business models and revenue streams. To avoid any misinterpretations, let’s quickly define these three terms that form a business strategy.

Revenue model vs business model

A business model (BM) is a broad term outlining everything concerning the main aspects of the business, all of which are contained in the answers to the following questions.

- What value will we create?

- How will we deliver it?

- How will we bring in revenue?

- How will we earn profit?

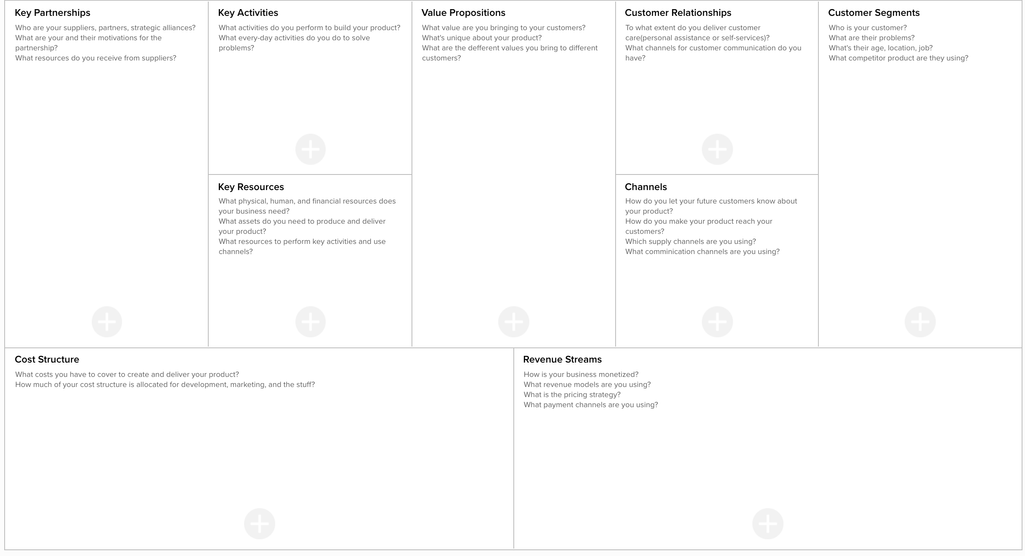

Numerous forms of business models can’t be classified in a single list because each part is highly individual to the industry, type of product/service, audience, or profitability. Business models are often depicted strategically on a business model canvas. This is a compound representation of all the key elements of a BM.

A business model canvas template by AltexSoft

So the BM describes how a business will work from the standpoint of value generation. Revenue models, on the other hand, are a part of the business model used to describe how the company gets gross sales.

Revenue model vs revenue stream

A revenue model is used to manage a company’s revenue streams, predict income, and modify revenue strategy. The revenue itself is one of the main KPIs for a business. Measuring it annually or quarterly allows you to understand how your business operates in general and whether you should change the way you sell the products or charge for them.

But what are revenue streams?

A revenue stream is a single source of revenue that a business has. There can be many of them. Streams are often divided by customer segments that bring revenue via a given method. The two terms – revenue stream and revenue model – are often used interchangeably, since, from a business perspective, the subscription revenue model will have a revenue stream coming from subscriptions. However, models can name multiple streams divided into customer segments, while the principle of revenue generation (subscription) will remain the same.

Revenue model types

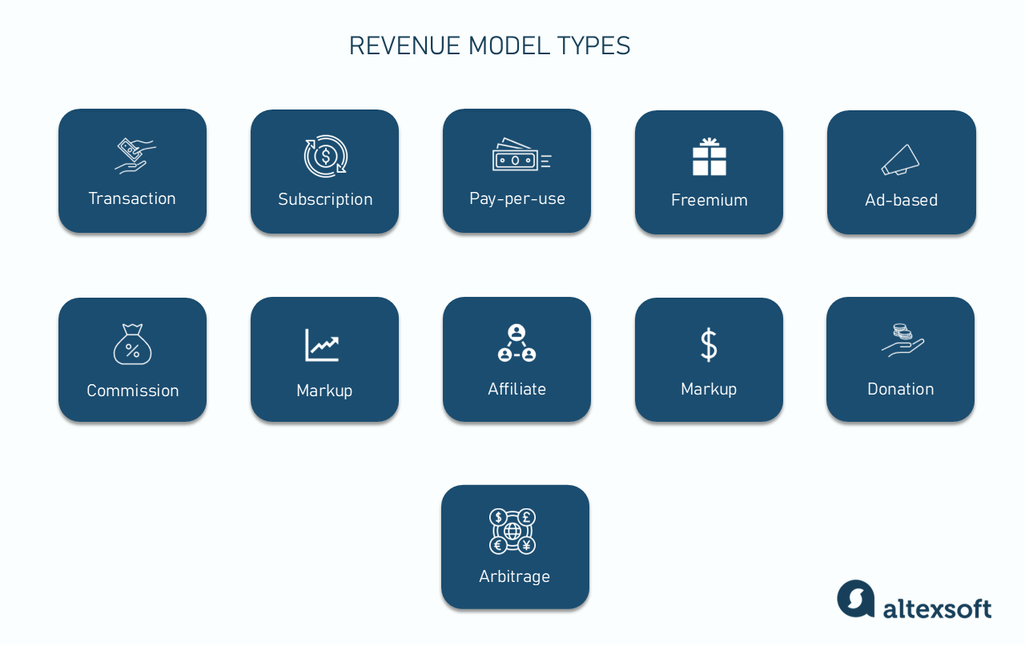

Any start-up, tech company, or digital business may combine different revenue models. The revenue model will look different depending on the industry and the product/service type.

Here we will pay more attention to the most common revenue models used in the software industry and online business.

Revenue model types

Transaction-based revenue model

A transaction-based revenue model is a classic and one of the most straightforward methods of generating income, where businesses earn revenue each time a customer completes a transaction. The customer can be another company (B2B) or a consumer (B2C).

This model is commonly used by companies that sell software licenses, one-time services, or digital products. Revenue is directly tied to the volume of transactions, meaning that businesses that use this model must continuously attract and retain customers to sustain their income.

Nearly any company that produces and sells its products uses this type of revenue model. Examples include Samsung, Rolls Royce, Nike, Microsoft, Apple, Boeing, and McDonald’s.

The pros. You have full control over the pricing strategy.

The cons. The cons will depend on the industry/product type and pricing tactics, as the model itself imposes a constant generation of sales with the help of advertising and marketing strategies. The only con we might mention here is the financial burden connected with sales you will carry on your own.

Subscription revenue model

A subscription revenue model involves charging customers a recurring fee — usually monthly or annually — for ongoing access to a product or service. This model is popular among SaaS companies, streaming services, and digital content providers. The steady revenue stream allows companies to plan for long-term growth and continuously invest in product development.

Subscription models provide predictable, recurring revenue streams. Businesses that adopt this model usually offer different tiers of service to cater to various customer needs and budgets.

Software companies, ranging from streaming services like YouTube and Netflix and cloud storage platforms to healthcare solutions and digital newspapers, use this model.

The pros. This model provides businesses with a predictable and stable revenue stream. It also encourages long-term customer relationships and makes it easy to forecast future revenue.

The cons. This model is plagued by high customer acquisition and retention costs.

Pay-per-use revenue model

A pay-per-use model charges customers based on their usage of a product or service. This model is particularly effective for cloud computing services, where users are billed for the resources they consume, such as data storage or processing power. It aligns costs with usage, making it attractive to customers who prefer to pay only for what they use.

Cloud computing providers like Amazon Web Services and Google Cloud Platform deploy this model. Twilio also adopts usage-based pricing for its services.

The pros. This model appeals to cost-conscious customers by aligning costs directly with usage. There’s also the potential for higher revenues from power users.

The cons. Revenue can be inconsistent and difficult to predict and it requires robust tracking and billing systems. Also, high usage can lead to unexpectedly high costs for customers.

Freemium/hybrid revenue model

Have you ever downloaded a mobile app riddled with ads and seen popups asking you to buy the premium version to eliminate them? Or maybe your favorite mobile game wants you to pay for more hearts. These are classic examples of the freemium revenue model in action.

A freemium revenue model is a type of app monetization in which users can access the main product for free but are charged for additional functions, services, bonuses, plugins, or extensions.

Freemium models are hybrid in nature, as they are always combined with other revenue models. For example, Dropbox starts as a free product. However, once users exceed the free 2GB storage, they are promoted to subscribe to one of Dropbox’s plans. LinkedIn, Duolingo, video games, and other widely known businesses have also adopted the freemium/hybrid revenue model.

The pros. This model provides a low barrier to entry since the free version attracts users and allows them to experience the product in hopes of upselling or converting them into paying customers.

The cons. A major downside of this revenue model is the cost of supporting free users. Take Duolingo, for example. It has around 34 million active users, but only a tiny percentage — 8.6 percent — are paying customers. Overall, the freemium/hybrid model requires tenacity and patience, as conversion rates are low, and users who do convert take time to do so.

Advertisement-based revenue model

The advertisement-based revenue model is a plan with which businesses make money by selling ad spaces. It is one of the most standard methods of producing top-line growth, and it’s valid both for online and offline businesses. It’s often used by websites/applications/marketplaces or any other web resource that attracts huge amounts of traffic.

YouTube, Instagram, Facebook, and Google are just a few prominent examples. All these platforms generate revenue by displaying advertisements to users and charging businesses for exposure. In addition to promotion, these platforms may also generate revenue through other sources, such as premium subscriptions or licensing agreements.

The pros. Having a high-traffic resource allows you to monetize the ad space nearly instantly. Often, there is a strong demand for advertising space, especially with organic traffic and platforms with the target audience.

The cons. Running advertising campaigns to gain web visibility on various platforms like social networks is a standard marketing activity with targeting instruments more precise than ever. However, advertisements are everywhere, so you might think twice about whether you want to distract a user by placing an ad in your app – even if it is a secondary revenue stream.

Commission-based revenue models

A commission-based revenue model is one of the most common ways businesses make money today. A commission is a sum of money a retailer adds to the total cost of a product or service.

A commission may be charged per marketplace or transaction and can be assigned as a

- flat rate, a fixed sum of money for any type of transaction, e.g., a $450/300/1500 transaction is charged with a $20 commission;

- percent of transaction size, e.g., a $100 transaction is charged with a 10 percent commission – $10; or

- tiered commission, a percent or flat rate that grows based on the transaction volume, e.g., 50,000 transactions are charged a 4 percent commission, 150,000 transactions a 7 percent commission.

Marketplaces and eCommerce platforms, in particular, utilize commissions the most. Another large category includes businesses that connect service providers/renters with consumers. Think of any ride-hailing company, food delivery, online travel agency (OTA), or alternative accommodation services.

Airbnb is a platform that allows individuals to list and rent their homes or apartments as short-term rentals. It generates revenue by charging a commission on each booking made through its platform. The commission is typically a percentage of the total booking cost and is paid by the host (property owner). Other examples are Booking.com, Uber, Lyft, Ticketmaster, Priceline, and Upwork.

The pros. Revenue is easily predictable because of the sheer fee.

The cons. There are many problems bound to the concept of a commission, but the major one goes to the scalability of a business that’s attached to a transaction size or volume. In general, dependency on the product supplier’s sales makes generating revenue require upfront investments and competitive superiority.

Markup revenue model

Markup is the type of revenue model with which you buy a product at a certain cost and then sell it for a higher price: The difference between the two is your profit margin. This model is often used by wholesale, retail, and service-based businesses.

For example, a wholesaler may be a bed bank — a B2B company that purchases rooms from accommodation providers in bulk at a discounted, static price for specific dates, and sells them to OTAs, travel agents, destination management companies, airlines, or tour operators.

In addition to bed banks, airline consolidators leverage a markup model to earn revenue: They are brokers that book flight seats in bulk at discount rates and then resell them to travel agencies. Examples are Mondee, Picasso Travel, and Centrav.

Pros. Markup revenue models are straightforward, allowing businesses to easily calculate their profit margins on each sale. With this approach, businesses can be flexible with their pricing by adjusting the markup to reflect changes in the cost of goods or changes in market conditions.

Cons. While markups provide a great deal of flexibility, some organizations may not have enough resources to manage revenue and apply changes to their markup strategy based on the market state. So, they set a uniform markup for all of their products or services. This may lead to prices being too low or too high and businesses may not be able to fully capitalize on the value of certain products.

Affiliate revenue model

The affiliate model is similar to the commission-based model. The main difference is that, with the affiliate model, you do not sell the product or service on your own platform, but rather redirect the customer to the original provider's platform to make the purchase and earn a commission on any resulting sales. An affiliate model is a contract between a supplier of a product/service and a promoter. A promoter can be another business/media resource/blogger who recommends a supplier’s product. The earnings will come as a percentage of sales or fees for the number of registrations done via referral links.

Businesses utilizing the affiliate model include metasearch engines as a unique example. Metasearch tools can be found almost everywhere. Their main difference with retailers is that they don’t sell products directly but offer comparison and search as a value. Advertising and affiliate programs are the main revenue models used to get earnings in this case.

Blogging and event-promoting platforms like Broadway.com or TheaterMania generate revenue using this model. Among other examples are Amazon affiliate websites, e.g., Cloud Living and ThisIsWhyImBroke.

The pros. Just like the advertisement-based revenue model, once you have a huge traffic resource, you might apply for an affiliate program to earn money. This will bring you income without any investments because you will basically generate traffic and leads for the affiliate program provider.

The cons. Unfortunately, the percentage of affiliate programs promised to the promoter is quite low. Sometimes, it fluctuates between 1-2 percent and requires a high volume of sales generated through your links.

Interest revenue model

An interest or investment revenue model relates to any type of business that generates revenue in the form of interest on their loans or deposit payments. These are most often banking or electronic wallet companies that work with financial operations.

The revenue is generated by making a loan to a customer or by a customer depositing or investing money (or other resources) into the business. At the end of a return period, a percentage of the loan sum will return as revenue. Debit/credit money provided with the bank accounts also relates to this model. That’s just one of the ways financial companies can make money, combining it with transaction fees for using their e-wallet/bank account.

Many banks, credit card companies, and other financial institutions use the interest revenue model. For example, peer-to-peer lending platforms, such as LendingClub and Prosper, generate revenue by charging interest on loans funded by investors.

The pros. The interest rate provides a clear view of what revenue a business will generate, as the percentage stays unchanged until the return period is over.

The cons. The regulations of an interest rate impact both the customer and the business. Sometimes, it depends on the economic environment. Think of currency rate changes that influence potential and existing borrowers.

Donation-based or pay-what-you-want revenue models

This is a revenue model based on investments made by businesses or customers on a voluntary basis. The product or service itself is free to use by default, so that’s the primary value a company brings to the customer. The revenue is generated in the form of donations, or sometimes in the form of “pay-what-you-want.”

It’s important to mention that there is a difference between a donation-based business and a charity organization. A donation-based company is still required to pay taxes.

For example, AdBlock generates revenue through donations from users who support the development and maintenance of the software. At the same time, AdBlock offers a premium version of the software for a fee, which includes additional features and support. Among other examples is Wikipedia which relies on donations as a significant source of revenue. Additionally, the platform makes money through grants and partnerships.

The pros. Because of the free access to the product, some companies manage to get increasingly popular, resulting in donations becoming a major part of their revenue.

The cons. The model is never used on its own and the revenue generated by it remains a secondary source because of its random/unstable nature.

Arbitrage model

An arbitrage revenue model involves buying products or assets at a low price in one market and selling them in another market at a higher price, capitalizing on price differences. This model is common in finance, trading, and some eCommerce businesses. Its success relies on the ability to identify and exploit price discrepancies quickly.

An example is Airbnb arbitrage, where individuals rent properties long-term and then sublet them as short-term rentals on platforms like Airbnb. Someone might rent an apartment for $1,500 monthly and list it on Airbnb for $100 per night. If they can keep it occupied for 20 nights a month, they'd earn $2,000 and make a $500 profit. This practice is not how Airbnb itself makes money but a method users deploy to generate income through the platform.

The pros. If done correctly, you can generate high profits with minimal risk using this model. Also, significant capital investment is not required to deploy this model.

The cons. Arbitrage requires expertise and constant market monitoring. It may involve using sophisticated algorithms and fast processing capabilities to identify opportunities.

There are many other revenue models, and a business or project may use more than one revenue model. It is important for businesses and projects to carefully consider their revenue model as it can have a significant impact on the overall success of the venture.

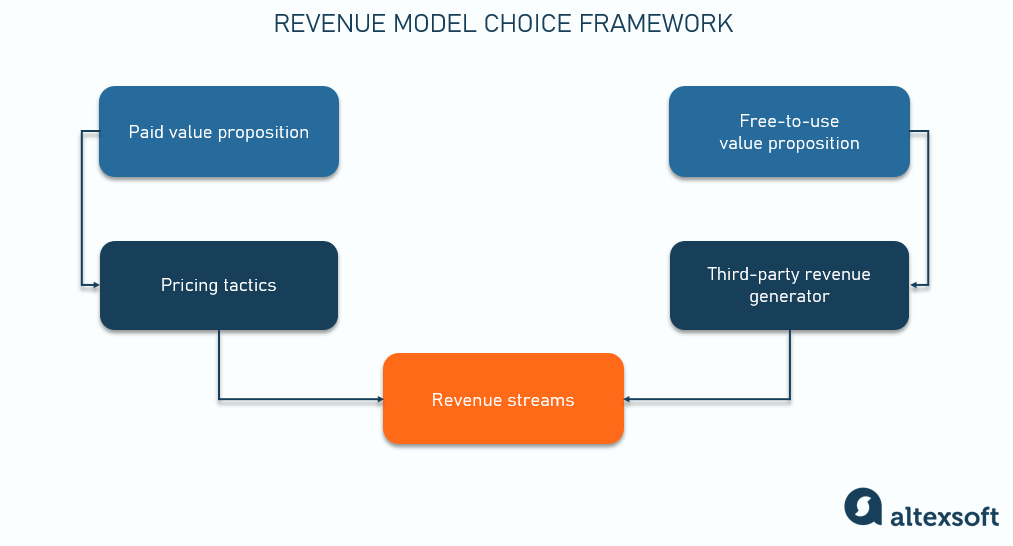

How to choose a revenue model framework

Depending on your business model, the product or service you’re presenting to the user is a subject of exchange. This is your value proposition on the market, so you are in charge of choosing what you want to get back based on the market factors, target audience, etc.

Paid value proposition. In most cases, your value proposition costs money to use. Whether it’s a service or a software product, a customer will need to pay in some form to gain access to your value. Your revenue model in this case will be based on transactions. So develop pricing tactics that will depend on the nature of the product, the type of audience you’re trying to reach, the type of deployment, specifics of product usage, etc.

Free-to-use value proposition. If the value proposition doesn’t require money to use or you choose it to be free, then you need a third party to generate revenue for you. This could be anything based on the previously mentioned types, whether it’s ad space, donations, affiliate programs, or reselling.

The combination of the two will basically present you with the revenue streams that will focus on each of the customer segments. In the case of the paid value proposition, each pricing plan will be a separate revenue stream.

Revenue model examples

Let's explore in more detail how companies use some of the revenue models to succeed in business.

Transaction-based revenue model: Affinity

Affinity, known for its suite of design and creative software, employs a transaction-based revenue model and offers its products through a one-time payment option. Affinity Designer, Photo, and Publisher are available for both macOS and Windows at a one-off cost. There’s also an option to purchase all three products under a universal license. This allows users to avoid recurring subscription fees, a model that sets Affinity apart from competitors like Adobe, which has shifted to subscription-based pricing.

Subscription revenue model: Netflix

Netflix has mastered the subscription-based revenue model, offering users unlimited access to its vast library of TV shows, movies, and original content for a recurring monthly fee. The subscription model has been fundamental to Netflix’s global success, providing the company with a predictable and stable revenue stream. This allows the tech giant to invest heavily in content creation, producing exclusive series and films that attract new subscribers and retain existing ones.

Pay-per-use revenue Model: Amazon Web Services (AWS)

Amazon Web Services operates on a pay-per-use model, where customers are billed based on their consumption of computing resources, storage, and data transfer. With this model, companies only pay for the services they use rather than committing to large upfront investments in hardware.

The pay-per-use model is particularly attractive to startups and small businesses that need flexible, scalable cloud solutions. AWS allows them to adjust their usage as needed, ensuring they only pay for the resources they consume. This flexibility also benefits large enterprises with fluctuating demands, as they can scale up or down without being locked into fixed pricing models.

Donation-based revenue model: Wikipedia

One would think that with the high traffic volumes Wikipedia enjoys, it would run ads on its website to earn big bucks. However, it doesn’t. Instead, Wikipedia’s business model relies completely on donations and grants to the non-profit Wikimedia Foundation — its parent organization.

Every year, Wikipedia conducts fundraising campaigns, asking its users to contribute a small amount to keep the site running. While this model might seem risky, it has proven successful, as the Wikimedia Foundation generated revenue of about $180 million in 2023’s fiscal year.

The donation-based model allows Wikipedia to remain independent and ad-free, which is an essential aspect of its identity and mission.