In the hospitality industry, choosing the right metrics and carefully tracking them can help you, as the hotelier or hotel manager, to understand how your hotel is performing, compare it with your competitors, and possibly find the weak points and opportunities for improvement.

So, the aim of this article is to describe the main KPIs typically adopted by hotels to support their business analysis. To make it as clear as possible, we’ll demonstrate all the calculations through examples using the same numbers of a hypothetical hotel.

How to calculate ADR, occupancy rate, ALOS, and TAR: basic operational metrics

Let's start with the simple measurements that give the broadest overview of your hotel.

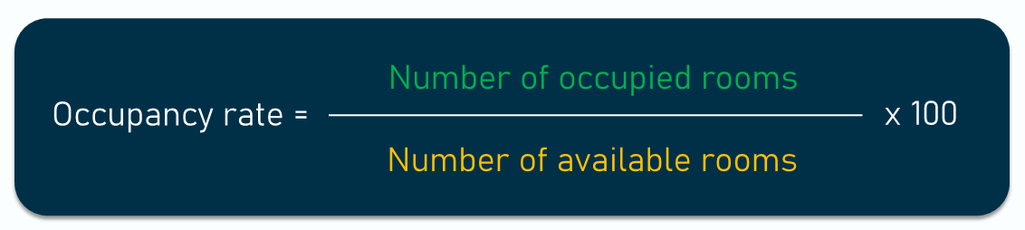

Occupancy rate/occupancy percentage

Occupancy rate formula

What does it show? An occupancy rate is measured by dividing the number of occupied rooms by the number of available rooms and multiplying by 100, showing the percentage of rooms occupied at a specific moment.

For example, if you have a 10-room hotel and last night you sold 5 rooms, then the occupancy rate would be 50 percent. In further calculations, we will use 0.5, which is equivalent to 50 percent.

Why use it? Despite its simplicity, the occupancy rate is an important KPI that shows how full your hotel is. Monitoring it over time lets you understand how your hotel is performing in different periods. It might show you that your property is most popular on the weekends or during the holiday season, or when some sporting events take place nearby. In any case, you will know better what to focus your marketing efforts on to get that desired “No vacancy!” sign on your door.

Important to understand. Many hoteliers prioritize the occupancy rate and focus on increasing its value, forgetting that the ultimate goal is to maximize revenue, not fill up the rooms. There are cases when higher occupancy doesn’t lead to bigger profit (for example, when you lower rates), so you have to use it carefully in combination with other measurements to get a fuller picture.

Also note that only the rooms that are in service and ready to be rented out are meant by available rooms, excluding the ones that are under maintenance or occupied by staff members.

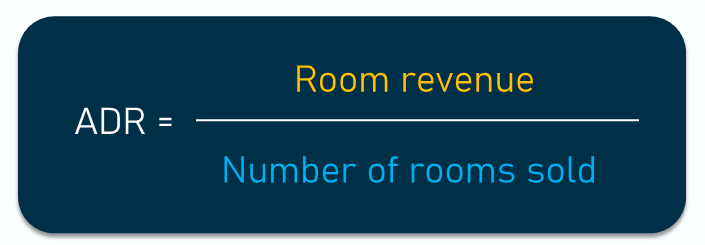

ADR (Average Daily Rate)/ARR (Average Room Rate)

ADR formula

What does it show? ADR also called ARR is used to calculate the average rental revenue per occupied room at a given time. To find ADR, divide your total room revenue by the number of rooms sold.

For example, if you sold 5 rooms out of your 10-room hotel and your total revenue was $2,000, then ADR would be $400. Obviously, it makes sense to calculate the metric only if you have different room rates; otherwise, its value is pretty evident.

Why use it? ADR is one of the essential performance indicators that basically shows how much money each room brings you. You can monitor it over time (it’s great if its value increases) and compare it to your competitors to make decisions about your pricing strategy.

Important to understand. ADR can be deceiving as it only tells you one part of the story. It takes into account neither your unsold rooms, nor the revenue that comes from other sources (bar, spa, restaurant, tours, etc.), nor the associated costs. So, it’s a useful performance metric by itself, displaying the room-specific revenue, but it won’t show you the complete picture of your property’s financial results.

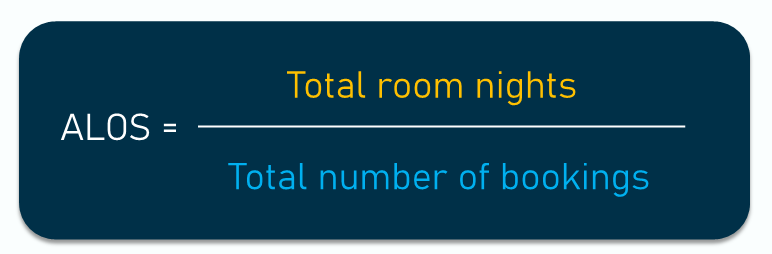

ALOS (Average Length of Stay)

ALOS formula

What does it show? ALOS identifies the average number of nights your guests spend at your hotel and is calculated by dividing the total room nights by the total number of bookings.

For example, in April, the number of room nights was 200 (out of maximum of 300 for a 10-room hotel), with a total of 50 bookings. Then, ALOS is 4 days.

Why use it? It’s better if ALOS is higher since shorter stays mean increased guest turnover, resulting in larger labor costs. You can influence ALOS by adjusting your revenue management strategy and offering discounts for longer bookings or increasing your one-night rate. A more aggressive approach can be applied during a busy season when high demand is expected, such as setting a minimum length of-stay to reduce short-term bookings.

Important to understand. ALOS can vary widely depending on your hotel's focus. For example, if you have a property in Las Vegas and you mostly accept guests coming for a weekend getaway, or a B&B in downtown Chicago welcoming business travelers, your hotel ALOS would probably be shorter than for a resort in Cancun aimed at vacation tourists.

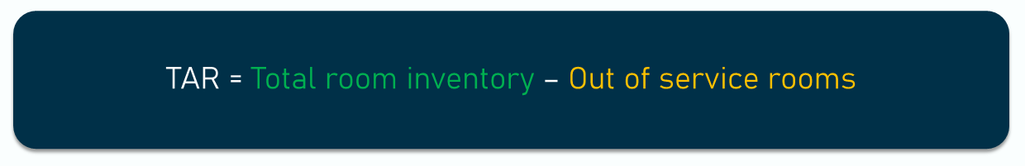

TAR (Total Available Rooms)

TAR formula

What does it show? TAR reflects the number of operational rooms within a hotel, excluding those temporarily out of service due to maintenance, refurbishment, or other issues. This metric is essential for calculating revenue and occupancy metrics accurately, as it provides a clear count of rooms available for guests.

For example, if 4 of the rooms in your 10-room hotel are under maintenance, the total available rooms would be 6.

Why use it? Knowing your total available rooms allows you to calculate other occupancy and revenue metrics accurately. It’s particularly valuable for understanding how room inventory affects revenue performance and adjusting marketing or pricing strategies based on room availability.

Important to understand. While the number of available rooms sets the base for other calculations, it’s essential to keep your inventory updated regularly. Rooms that are not ready for guests due to maintenance or staffing should be excluded, as they may affect metrics like occupancy rate.

How to calculate RevPAR, GOPPAR, CPOR, NOI, and other financial metrics for revenue management

In short, hotel revenue management is a combination of distribution and pricing strategies aimed at maximizing income.

Revenue Management - the science of ultimate hotel success

Check our video on how revenue management works in hospitality

Revenue management, among other things, is based on careful tracking of certain KPIs and adjusting a hotel’s revenue strategy according to changes that took place or are predicted and expected. Let’s take a look at those metrics.

RevPAR formula (Revenue per Available Room)

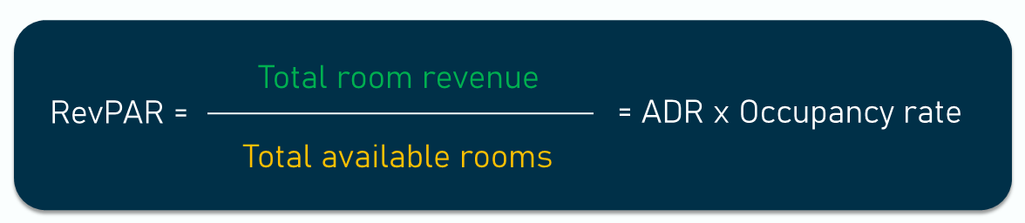

RevPAR formula

What does it show? RevPAR shows the amount of revenue generated by one room, whether booked or not. There are two ways to calculate it. You can either divide your total room revenue by the total number of available rooms OR multiply ADR by the occupancy rate.

For example, selling 5 rooms out of 10 brought you $2,000, so your RevPAR equals $200 (you’re getting the same result by multiplying your ADR of $400 by the occupancy rate of 0.5).

Why use it? RevPAR is one of the most popular metrics in hospitality. It’s similar to ADR but takes unsold rooms into account, giving a more accurate picture. Needless to say, hoteliers have to aim at increasing their RevPAR since it reflects both the pricing for rooms and the ability to fill them.

Important to understand. Just like ADR, RevPAR doesn’t include additional revenue from other sources, so it only shows the inventory performance. It also doesn’t take into account any operational costs and other expenses and can’t be used to measure profitability. Besides, the calculation is on a per-room basis, so sometimes large hotels have a smaller RevPAR, but still generate higher total revenue. Read on to learn about more demonstrative indicators.

TRevPAR (Total Revenue per Available Room)

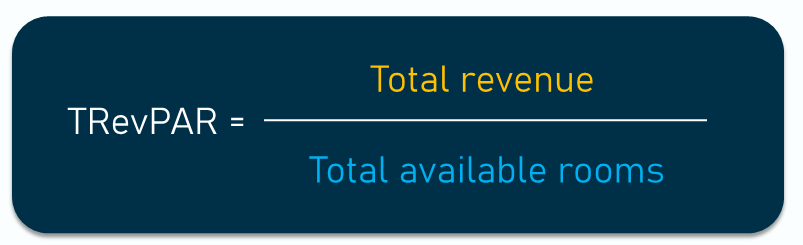

TRevPAR formula

What does it show? TRevPAR is measured by dividing your total revenue (from room rental and other sources) by the total number of available rooms. This metric shows the total revenue of the hotel per room.

For example, you have a revenue of $2,000 from the 5 booked rooms out of ten available rooms. The revenue of the restaurant is $1,000, and the revenue of the spa is $500. With the total gross revenue of $3,500, TRevPAR equals $350.

Why use it? TRevPAR solves one of the problems of RevPAR as it includes the additional revenue streams in the calculation. It might not be significant for smaller properties that only rely on rental payments, but it becomes an important indicator for hotels managing multiple points of sale. Revenue managers must focus on this KPI to maximize the revenue potential of all hotel departments and adjust package offers, as well as the entire upselling strategy.

Important to understand. Like RevPAR, this KPI doesn’t account for input costs, so it can’t reflect the ultimate profit.

RevPAG (Revenue per Available Guest)/ RevPAC (Revenue per Available Customer)

RevPAG formula

What does it show? RevPAG (RevPAC)is a metric that calculates the total revenue generated by each guest/customer during their stay, considering all spending, such as room rate, dining, spa services, and other amenities. This guest-centric measure shifts the focus from room occupancy to guest spending patterns, providing a more comprehensive view of revenue performance. You can also make the calculation including customers who do not stay at the hotel, but only come to use amenities, if you have such an option for visitors.

For example, imagine your 10-room hotel was fully booked, with each guest spending an average of $300 on their stay, $100 in the hotel restaurant, and $50 at the spa. This totals $4,500 in revenue for the 10 guests. Dividing $4,500 by the 10 guests results in a RevPAG of $450.

Why use it? RevPAG demonstrates how much value each guest brings to your property. It’s particularly useful for hotels that emphasize ancillary services open to non-sleeping guests, such as a bar or restaurant, spa, shops, car rental, casino, water or amusement park, etc. This metric also helps hotel managers identify opportunities to increase revenue through upselling, cross-selling, and personalized guest experiences. By understanding and enhancing the value of each guest’s stay, hotels can better align their strategies with guest satisfaction and overall profitability.

Important to understand. RevPAG is typically lower than RevPAR because multiple guests may stay in one room, spreading total revenue across more individuals. This metric gives a more granular view of individual guest spending, which is especially helpful for properties aiming to maximize ancillary revenue per guest through amenities like dining, spa services, and experiences.

GOPPAR (Gross Operating Profit per Available Room)

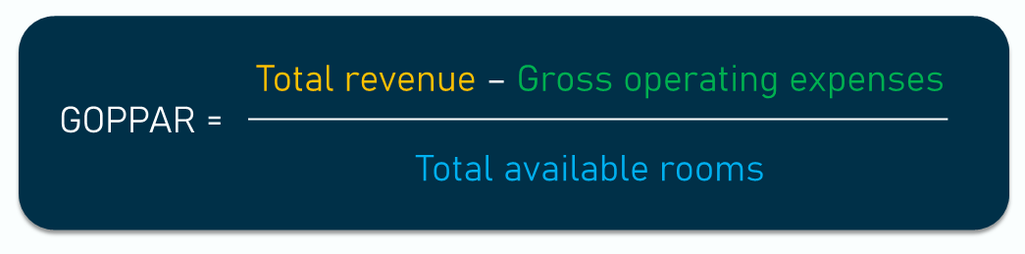

GOPPAR formula

What does it show? GOPPAR demonstrates how much gross operating profit comes from each room. Gross operating profit is your total revenue minus gross operating expenses — the total day-to-day costs required to run a business before loan interest and taxes are considered. If you divide the result by the total number of available rooms, you’ll obtain your GOPPAR.

To calculate yearly GOPPAR, use annual revenue and expense figures and divide the resulting GOP by the number of rooms multiplied by 365.

For example, your total net revenue is $3,500, and your gross expenses are $1,700. So gross operating profit would be $1800. Divided by the 10 rooms, GOPPAR equals $180. Why use it? GOPPAR is a strong performance indicator, as it goes beyond revenue-related KPIs and incorporates operational expenses. So, this advanced metric reflects how much money your hotel actually makes, allows you to understand its actual value, and measures its bottom line.

Important to understand. There are variances in calculating GOPPAR depending on the costs taken into account. Generally speaking, there are two main groups of expenses:

- variable costs, or any operational expenses that change depending on the number of rooms sold, i.e., breakfast, supplies, cost to clean the room, incremental energy, etc.; and

- fixed costs that are paid on a monthly basis to maintain property, such as rent, payroll, Internet bills, etc.

So, you can include only variable, room-related expenses to measure GOPPAR. However, it’s worth considering both variable and fixed costs to better understand how well you manage.

Monitoring GOPPAR through both peak and low seasons will show you if your expenses are balanced. Besides, if you’re developing your business, adding new services, or just changing the structure of your expenditure, GOPPAR will show you if your efforts pay off.

CPOR (Cost per Occupied Room)

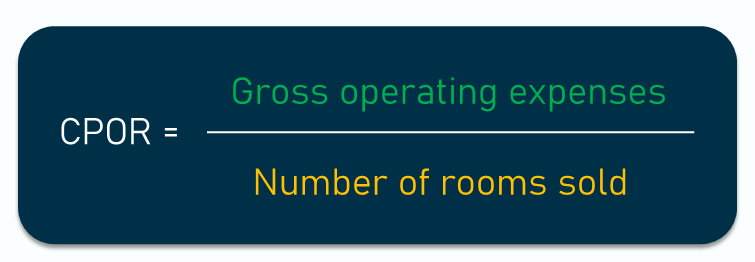

CPOR formula

What does it show? CPOR is measured by simply dividing gross operating expenses by the number of rooms sold to show how much every sold room costs you.

For example, you have 5 rooms occupied and your total operating expenses are $1,700. The CPOR would be $340.

Why use it? CPOR is a crucial KPI that allows you to monitor your expenses. It’s often used to calculate the minimum rate per room since you obviously shouldn’t charge less than you spend.

Important to understand. Here again, different ways of calculation exist, as sometimes only room-related costs are considered. In this way, you can find the average variable expenses per room, which is also good to know. However, if you want to define your minimum room rate, we advise including both variable and fixed costs to avoid losses.

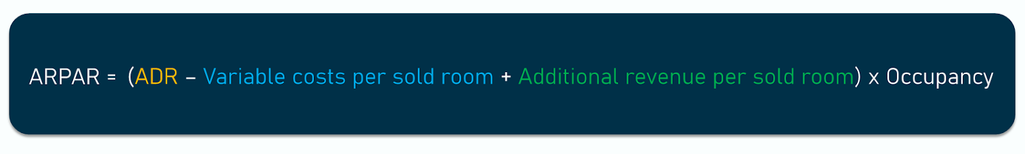

ARPAR or Adjusted RevPAR (Adjusted Revenue per Available Room)

ARPAR formula

What does it show? ARPAR shows how much profit each room brings you, considering variable costs (we’ve explained this figure in the GOPPAR section) and additional revenue. To calculate ARPAR, first subtract variable costs per sold room from your ADR, add the amount of additional revenue per sold room, and then multiply the result by your occupancy rate.

For example, your ADR is $400, and your occupancy is 50 percent with 5 rooms sold out of 10. Let’s say your variable costs are $750 ($150 per room) and the additional revenue is $1,500 ($300 per room). Then, your ARPAR would be $275.

Why use it? Developed and introduced in 2015 by industry expert Ira Vouk as a new index for profit maximization, ARPAR proved to be way more accurate and useful than RevPAR as it accounts for variable expenses and also considers ancillary revenue-generating POS. In this way, it gives a better picture of inventory profitability, showing the net revenue created by each occupied room.

Important to understand. ARPAR doesn’t include fixed costs, which can be quite significant, so it still can’t be used for measuring your property’s overall profitability. Also, it’s hard to use it for benchmarking purposes since variable costs and additional amenities often differ across hospitality businesses.

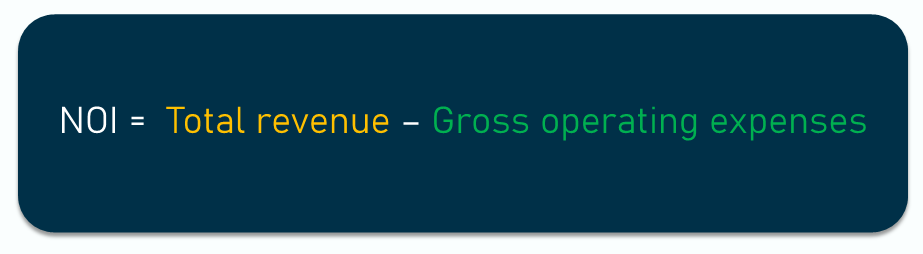

NOI (Net Operating Income)

NOI formula

What does it show? NOI shows whether your property is making a profit or loss. To find it, you subtract your gross operating expenses from your total revenue.

For example, you made $3,500 from room sales, the restaurant, and the spa. Your gross expenses are $1,700, making that day's NOI $1,800. To calculate your weekly, monthly, or yearly NOI, you have to take the corresponding total figures.

Why use it? Income is what’s left after you paid your expenses. So, NOI is the KPI that finally defines the bottom line, or absolute financial result of your activity. It’s the most important metric for owners and investors as it clearly shows your property’s ability to generate profit.

Important to understand. The NOI is income before tax and doesn’t consider some expenses, such as loan interest and amortization. In other industries, it’s referred to as EBIT—earnings before interest and taxes.

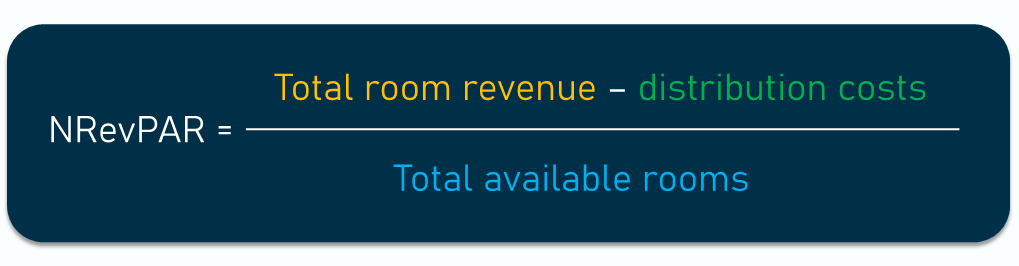

NRevPAR (Net Revenue per Available Room)

NRevPAR formula

What does it show? NRevPAR is similar to RevPAR but provides a more precise picture of room revenue by deducting distribution costs (such as OTA commissions). This metric shows the net revenue generated per available room.

For example, suppose you sold 5 out of 10 rooms at an ADR of $400, making your total room revenue $2,000. If your distribution costs are $100, your net revenue is $1,900. Dividing this by the total 10 rooms, your NRevPAR would be $190.

Why use it? NRevPAR helps assess the profitability of different booking channels and the effectiveness of direct bookings. It’s useful for evaluating how much revenue remains after distribution costs. Just one example: HotStats’ 2025 data shows that global RevPAR grew 19 percent since 2019, but distribution costs per available room surged by 25 percent during the same period.

Important to understand. While NRevPAR provides a clearer view of net room revenue by excluding distribution costs, accurately calculating these costs can be challenging. Different channels (e.g., OTAs, direct bookings, and partnerships) may have varying fee structures, making it difficult to capture all costs precisely. This metric is most effective when distribution costs are consistently tracked, allowing you to better assess the profitability of each channel and optimize your distribution strategy accordingly.

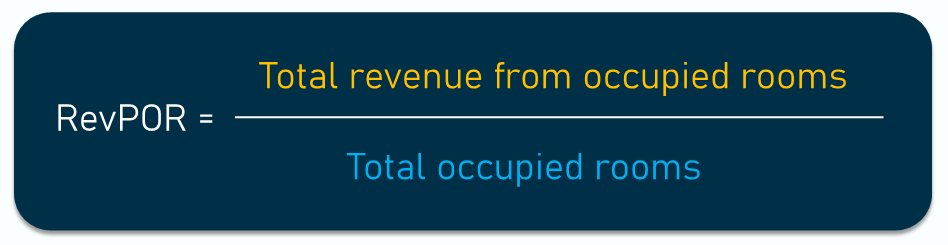

RevPOR (Revenue per Occupied Room)

RevPOR formula

What does it show? RevPOR calculates the total revenue earned per occupied room, considering all income sources associated with a guest stay, such as room rate, food and beverage, and other in-room services.

For example, if your hotel’s total revenue from 5 occupied rooms is $2,000 from room sales, plus $500 from food and beverages, your total revenue is $2,500. Dividing this by the 5 occupied rooms, the RevPOR is $500.

Why use it? RevPOR is valuable for analyzing how much each occupied room contributes to overall revenue, not just from room rates but from additional guest spending. It’s especially useful for understanding the revenue impact of upselling or cross-selling within your hotel.

Important to understand. While RevPOR provides insight into revenue per occupied room, it doesn’t account for unoccupied rooms, so it’s best used alongside metrics like RevPAR for a complete picture of your revenue performance.

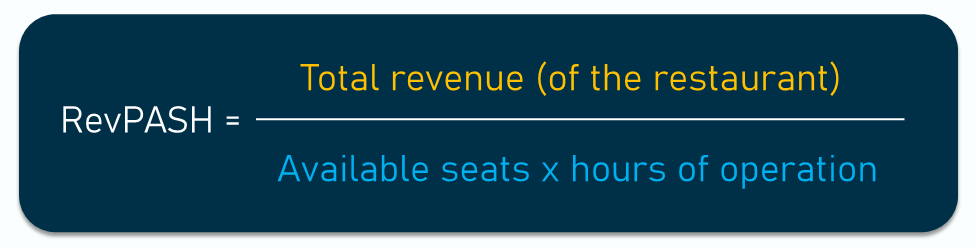

RevPASH (Revenue per Available Seat Hour)

RevPASH formula

What does it show? RevPASH is often used in restaurants, bars, or hotel event spaces to measure revenue per available seat per hour. It’s calculated by dividing the total revenue of a given outlet by the available seat hours, providing a granular view of space utilization.

For example, imagine your hotel’s restaurant has 20 seats and operates for 5 hours per day, giving you 100 available seat hours. If the restaurant earns $1,000 in revenue during this time, your RevPASH is $10.

Why use it? RevPASH is ideal for optimizing the revenue potential of your dining or event spaces. By tracking how well seating capacity is used during peak and off-peak hours, hotel managers can adjust reservation policies, pricing, and promotional efforts to maximize revenue.

Important to understand. RevPASH is specific to spaces with limited seating and doesn’t apply to room revenue. It’s particularly effective for restaurants or event venues within hotels where maximizing seating can significantly impact revenue.

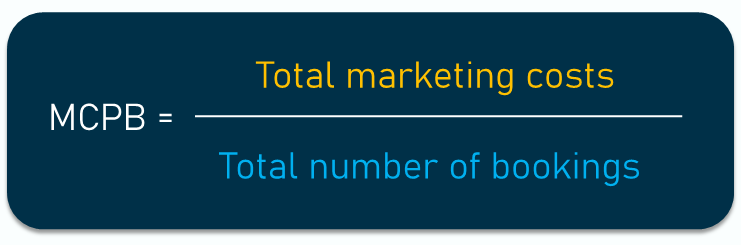

MCPB (Marketing Cost per Booking)

MCPB formula

What does it show? MCPB indicates the cost-effectiveness of marketing campaigns by measuring the marketing spend required to generate each booking. It’s calculated by dividing total marketing costs by the number of bookings, showing how much it costs to acquire each reservation.

For example, suppose your hotel spent $500 on a marketing campaign that resulted in 10 bookings. Dividing the marketing cost by the number of bookings, your MCPB is $50.

Why use it? Understanding MCPB helps assess the return on investment for marketing initiatives. Lowering MCPB is often a goal, as it implies more efficient marketing spending that leads to higher bookings, thereby improving overall profitability.

Important to understand. MCPB can vary based on seasonality or promotional campaigns. To get a complete view, consider analyzing MCPB over different periods and comparing it with metrics like DRR to see if direct bookings are more cost-effective.

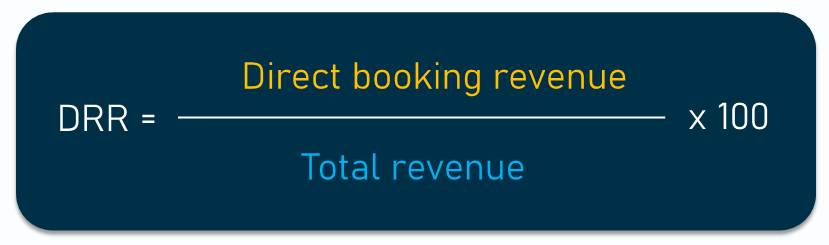

DRR (Direct Revenue Ratio)

DRR formula

What does it show? DRR calculates the percentage of hotel revenue generated from direct bookings compared to third-party channels. It’s determined by dividing revenue from direct bookings by total revenue, offering insight into the effectiveness of direct booking strategies.

For example, if your total revenue is $3,000, and $1,800 of that comes from direct bookings, the DRR is calculated as $1,800 divided by $3,000 and multiplied by 100, resulting in a DRR of 60 percent.

Why use it? Increasing DRR often means reduced dependency on OTAs or other channels that charge high commissions. A higher DRR indicates that direct marketing strategies, such as loyalty programs or exclusive website offers, are successful in attracting guests.

Important to understand. While DRR highlights the effectiveness of direct bookings, it’s only one piece of the puzzle. Consider both direct and third-party contributions to revenue and balance them based on occupancy targets and channel cost efficiency, which we can get from MCPB.

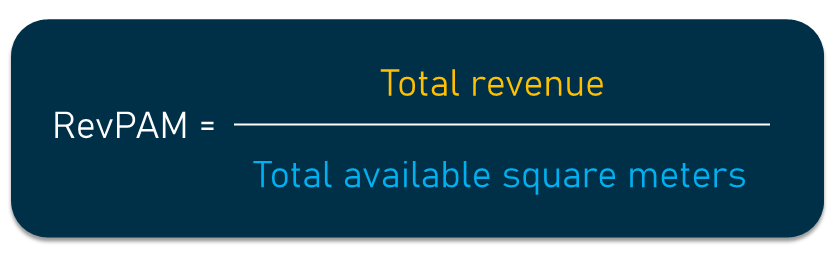

RevPAM (Revenue per Available Square Meter)

RevPAM formula

What does it show? RevPAM measures the revenue generated by each square meter of a hotel’s property. Unlike room-specific metrics, RevPAM accounts for the total usable space throughout a property, including guest rooms, conference rooms, dining areas, and other revenue-generating spaces. It’s an ideal metric for hotels that need to maximize revenue across various parts of the property, particularly those with a focus on multiple amenities or MICE/leisure events.

For example, suppose your hotel has 1,000 square meters of total usable space and generates $50,000 in total revenue over a certain period. To calculate RevPAM, divide the total revenue by the total square meters. In this case, $50,000 divided by 1,000 gives a RevPAM of $50 per square meter.

Why use it? For hotels with diverse revenue streams, such as F&B outlets, spas, or conference areas, RevPAM provides insight into how effectively space is monetized beyond room occupancy alone. This metric is invaluable for identifying underutilized spaces that could be optimized to generate additional revenue.

Important to understand. RevPAM provides a high-level view of revenue efficiency by area, but it doesn’t break down revenue by specific sources. For a more detailed analysis, it’s helpful to use RevPAM alongside other metrics like RevPASH or RevPOR, which focus on revenue from specific areas, such as dining or room occupancy.

How to calculate MPI, ARI, RGI, and LBR: benchmarking metrics to understand the position among competitors

Looking at your reports in isolation can’t tell you whether those numbers are cause for concern or celebration. Comparing your performance against your competitors is an important activity that should be conducted regularly, as it allows you to identify potential areas for improvement. Knowing industry standards or analyzing how industry leaders perform can help you determine your own weaknesses and adjust your strategy accordingly.

For more effective benchmarking, you first have to create your own competitive set of hotels that share the same market segment and are similar in main criteria such as location, size, range of services, etc.

Once you come up with such a set, you’ll have to do a bit of research to find out what your competitors’ KPIs are. A common way of getting that kind of information is through a STR Report that provides data on 67,000 hotels in 180 countries.

With the necessary numbers, you can perform the competitive analysis. Note that all the indexes described below can be calculated by a simple division or can be turned into a percentage by multiplying the result by 100. Besides, you can compare your metrics to the market average, to market leaders, or any specific hotel which you might have a rivalry with.

MPI (Market Penetration Index)

MPI formula

What does it show? MPI (also known as occupancy index) compares your hotel’s occupancy to that of your competitors. It’s calculated by dividing your hotel occupancy by the market/other hotel occupancy.

For example, your occupancy rate is 50 percent, and the market average is 80 percent. The MPI would be 0.625, which is less than 1, meaning that your rate is lower.

Why use it? As obvious as it may seem, it’s an important indicator to track. Basically, it shows if customers choose your hotel over others.

Important to understand. As we’ve already mentioned, occupancy is not the best indicator of success as it doesn’t account for revenue (dropping rates can raise occupancy and the MPI but lead to financial losses). So, MPI is useful for knowing how your hotel stands in the market, but it can’t be used to evaluate its performance.

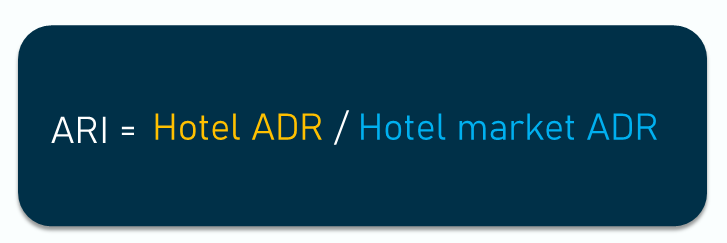

ARI (Average Rate Index)

ARI formula

What does it show? An ARI is found by dividing your hotel’s ADR by the market ADR. It measures how your average rates compare to other hotels in your competitive set.

For example, your ADR is $400, and your leading competitor has $500. So, ARI equals 0.8.

Why use it? ARI provides an idea of average market prices and helps you adjust your pricing strategy. If it’s less than 1, you are undercharging and possibly losing revenue due to lower rates.

Important to understand. ARI has to be tracked together with occupancy and, again, with other revenue-focused KPIs. Even though low value of ARI is considered a sign of poor performance, it can be a result of your marketing strategy and intentionally dropped rates to attract more guests and boost occupancy.

RGI (Revenue Generation Index)

RGI formula

What does it show? RGI (also called RevPAR index) compares your RevPAR to that of your competitors and is obtained by dividing your hotel’s RevPAR by that of a market or another hotel.

For example, your RevPAR is $200, and the neighboring property gets $160. RGI comes to 1.25, which is a good result as it's more than 1.

Why use it? As we said, RevPAR is one traditional metric used to measure performance, blending occupancy and rates. So, RGI can show whether you’re getting a fair share of the market compared to your competitors.

Important to understand. Remember the disadvantages of RevPAR we mentioned above, and don’t consider it the ultimate focus of your strategy.

CSAT, NPS, CES: customer-related metrics to support marketing

The next group of metrics we’ll briefly discuss is not specific to hotels but still important to monitor since understanding customers and their experience is essential for any service-focused business.

Customer satisfaction metrics

Guest satisfaction is not always easy to measure, and you often have to deal with qualitative feedback data extracted from post-stay surveys and online reviews (read our post about sentiment analysis to know how to extract insights from such review data). However, there are certain metrics that you can easily obtain and monitor.

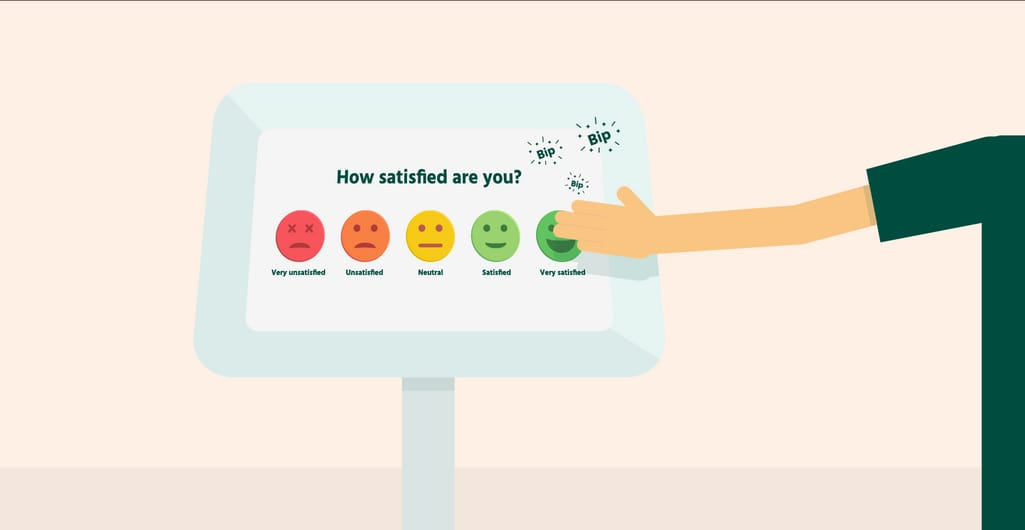

CSAT (Customer Satisfaction Score). Asking a simple, straightforward question like “How satisfied were you with your experience/our services?” with easy-to-choose scale options, say, from 0 to 10, can provide you with a measurable and trackable result. You can include such a question in your surveys or add it at the end of chatbot interaction.

Simple customer opinion collection, source: helphouse

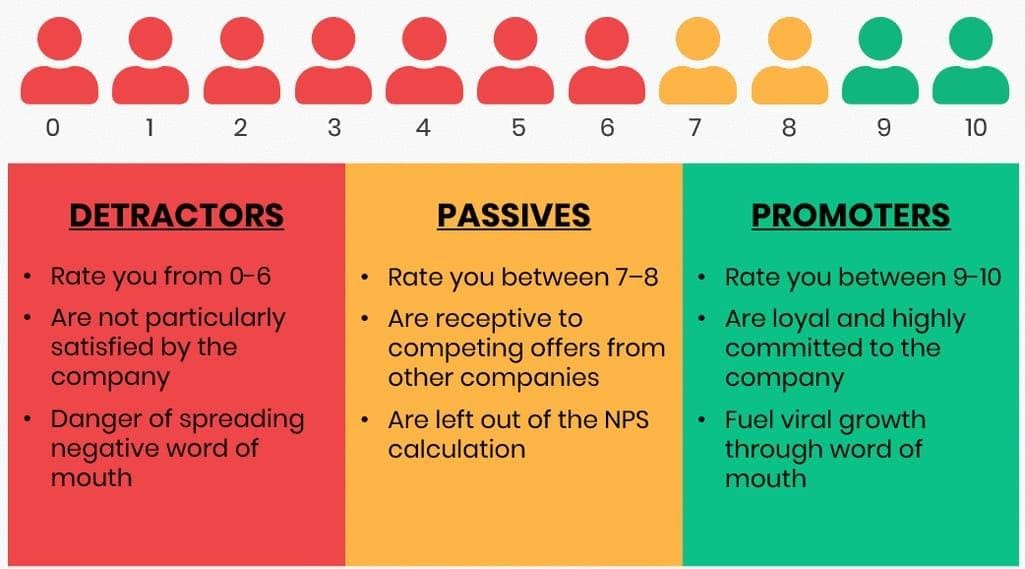

NPS (Net Promoter Score). NPS is a good way to measure your customers’ loyalty. NPS surveys typically consist of a rating question, e.g., “How likely are you to recommend our company to a friend or colleague?”, and an open-ended question that prompts respondents to explain their choice. Read our article dedicated to the Net Promoter Score for more information.

What is a good NPS? Source: Netigate

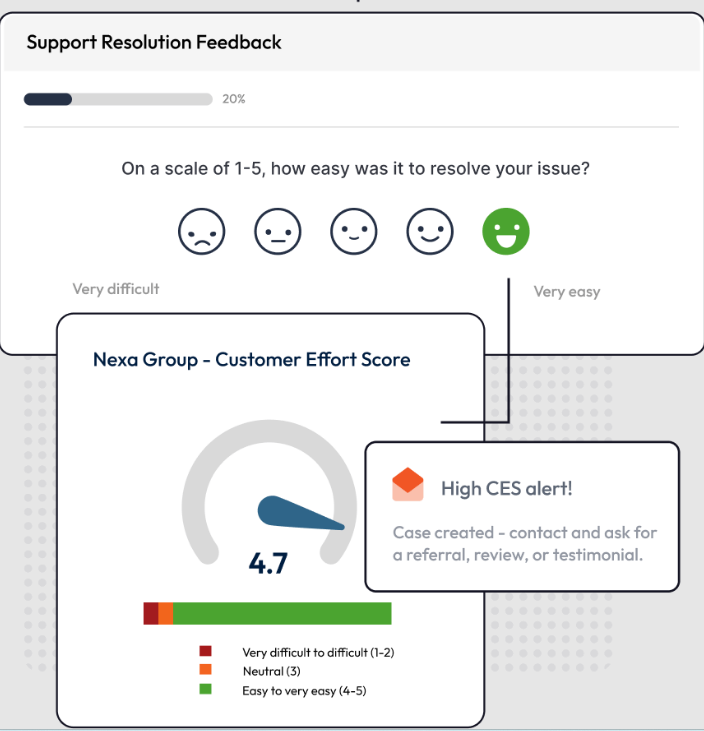

CES (Customer Effort Score). CES can be used to measure how easy and comfortable it was for your customers to interact with your brand, whether they booked a room on your website, received assistance from your support team, or used your mobile app.

Sample CES dashboard, source: SmartSurvey

Customer segmentation

Segmentation is not actually about the metrics, but rather about better understanding who your main customers are. It’s an extremely important marketing practice because once you have that knowledge, you can create effective marketing strategies aimed at different segments to provide a personalized experience for every guest.

Typically, the 4 main types of segmentation are

- demographic segmentation -- grouping by age, gender, ethnicity, occupation, income, religion, etc.;

- psychographic segmentation -- grouping by lifestyle, interests, values, etc.;

- geographic segmentation -- grouping by geographic location, city vs rural origin, etc.; and

- behavioral segmentation -- grouping based on the previous customer behavior with your brand, i.e., purchase patterns, preferred payment methods, preferred types of communication, sales channels, etc.

Some data necessary for the segmentation process is easier to collect (like personal information entered during the booking process or tracking previous purchases), while other types require more effort (like creating questionnaires, conducting personal interviews, researching published information, or social media, etc.).

Website metrics to measure online engagement

This group of metrics is also not industry-specific, but it’s obvious that global digitization gives websites a huge role. According to a study by TravelBooml, 81.2 percent of leisure travelers visit a hotel’s website before booking. So, analyzing user behavior to understand your website performance is a must to ensuring a pleasant online experience for your guests.

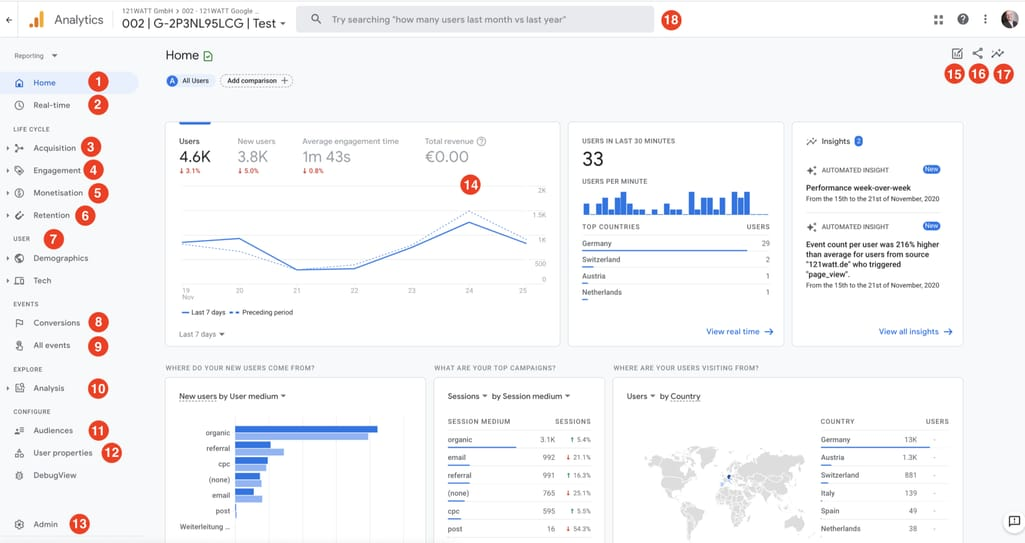

Website metrics from analytics tools

The information for tracking these metrics can be obtained directly from the Google Analytics tool or an alternative instrument that allows you to track customer online behavior.

Google Analytics interface, source: B2C

Here, we’ll just briefly go over a few of the metrics to give you an idea of the value they can bring.

Bounce rate shows the percentage of visitors who leave your website quickly without doing anything. A high bounce rate means your content isn’t interesting or engaging enough.

CTR, or click-through rate, is the percentage of users who actually clicked on your link after seeing it in the search results or an online ad. If your CTR is low, it’s worth changing your meta title or description to make it more appealing.

New visitors vs. returning visitors shows the ratio of first-time visitors to returning visitors. If you have many returning visitors, it’s a good sign, as it might mean that you have a lot of loyal customers. If not, it’s a reason for working on your customer retention strategy.

Conversion rate is the most important measurement of success as it shows the share of people who actually made a booking through your site, making it close to the LBR metric.

Time on site or Average session duration is how much time visitors spend on your website. If you get a lot of traffic but the session duration is low, it might be a sign to optimize your content.

Link sharing when the link to your website is shared on social media, blog post, or other sites, is the ultimate stage of engagement and is a sign that you’re doing a good job! Unless, of course, it’s the negative reference, but we’re sure it’s not your case.

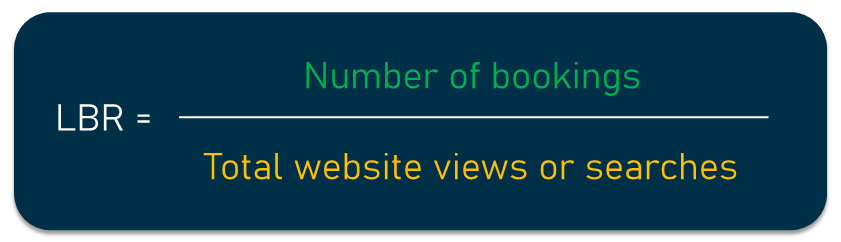

LBR (Look-to-Book/L2B Ratio)

You can’t calculate this important metric using Google Analytics alone. GA captures search and view activity, but it must be combined with booking data from the booking engine and Property Management System (PMS).

LBR formula

The L2B ratio measures how often views or searches on your booking platform convert into actual purchases. It’s calculated by dividing the number of reservations by the number of searches or views, providing insights into conversion efficiency.

For example, if your website receives 1,000 views and results in 50 bookings, then the LBR is calculated by dividing 50 by 1,000, giving a ratio of 0.05, or 5 percent.

A high LBR suggests effective website design, pricing, or promotional offers that appeal to potential guests. It’s particularly useful for identifying where conversion efforts can be improved, especially if many visitors aren’t completing bookings.

A low LBR can point to issues in the booking process, such as complicated navigation or non-competitive pricing. Use this metric in tandem with website analytics to pinpoint areas for improvement, like simplifying checkout or enhancing mobile accessibility.

Key hotel metrics compared

Let’s take a closer look at some of these metrics and how they stack up against each other.

RevPAR vs ADR vs occupancy rate

RevPAR. While RevPAR is useful, it only considers room revenue and ignores other revenue sources like dining or amenities. It’s most valuable for room-centric analysis and should be combined with broader metrics for a complete view of hotel performance.

ADR. ADR is ideal for evaluating pricing strategy and helps you see how much guests are willing to pay, on average, for a room. However, since ADR doesn’t account for occupancy, it may give an incomplete picture of performance. For instance, a high ADR could result from selling fewer rooms at higher rates, which might not indicate peak performance if many rooms remain unsold.

Occupancy rate. This metric is valuable for tracking demand trends, especially for planning peak and off-peak season strategies. However, occupancy rate alone doesn’t account for revenue generated, meaning it’s possible to achieve high occupancy with low rates, which may not be profitable. Therefore, it’s most informative when paired with metrics such as ADR or RevPAR.

While each metric has its strengths, they are most effective when paired together.

TRevPAR vs ARPAR vs GOPPAR

TRevPAR. TRevPAR is valuable for properties with various amenities, as it gives you a fuller perspective on revenue. It helps identify potential revenue gaps across departments and shows you how each room contributes to revenue beyond occupancy rates. However, it doesn’t account for operating costs, so it doesn’t provide insights into profitability. This means you should pair TRevPAR with cost-related metrics, such as GOPPAR, to get a more accurate picture of your hotel’s financial health.

ARPAR. ARPAR is a more precise measure of profitability per room as it adjusts total revenue by deducting discounts and costs associated with revenue generation. However, it requires detailed tracking of variable costs and discounts, which may complicate the reporting process.

GOPPAR. GOPPAR is a comprehensive measure of a hotel’s profitability, as it accounts for all operating expenses, including fixed costs like utilities, salaries, and maintenance. Unlike TRevPAR and ARPAR, which focus on revenue, GOPPAR directly indicates a property’s operational efficiency and financial health. However, note that since GOPPAR includes both variable and fixed costs, it may fluctuate based on seasonal expenses or changes in operational costs.

Looking ahead: from room metrics to profit intelligence

Nowadays, traditional KPIs such as occupancy rate, ADR, and RevPAR remain essential, but the industry is moving beyond these room-centric metrics toward guest-centric and profit-focused performance indicators. Now, RevPOR, capturing total guest spend across rooms, food and beverage, and ancillary services, and GOPPAR, revealing true operational efficiency and profitability, come to the forefront. For example, selling fewer rooms at better margins, encouraging direct bookings, or increasing high-margin ancillary spend can improve GOPPAR even if RevPAR stays flat.

Besides these classic KPIs, the hospitality industry is adopting new metrics.

ReRTI (RevPAR Room Type Index) evaluates RevPAR performance at the room type level. It compares the RevPAR of a specific room category against a defined benchmark (such as the property average or a competitive set equivalent). This metric highlights which room types are over- or under-performing, enabling more accurate pricing, inventory allocation, and upgrade strategies.

Upgrade Capture Rate measures how effectively a property converts upgrade opportunities into revenue. It tracks the proportion of guests who move from a booked room type to a higher category. A high rate indicates strong upsell processes and clear value communication to guests.

Attribute-Based Pricing Yield assesses how well individual room attributes—such as view, floor level, bed configuration, or balcony—are monetized. It reveals which features guests truly value and how effectively those preferences are translated into yield.

To learn more, read our comprehensive article about attribute-based shopping in hospitality.

Together, emerging metrics reflect a broader shift: from measuring how well rooms are sold to understanding how effectively the hotel maximizes guest value and profit. Properties that adopt this holistic approach are better positioned to make informed pricing decisions and sustain long-term performance.

Maria is a curious researcher, passionate about discovering how technologies change the world. She started her career in logistics but has dedicated the last five years to exploring travel tech, large travel businesses, and product management best practices.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.