Where are airlines on their journey to NDC implementation? To evaluate the progress, IATA introduced the Airline Retailing Maturity (ARM) index, which looks into three parameters

- technical capabilities;

- partnerships taking into account connectivity, reach, volumes of transactions, and partner feedback; and

- the potential value captured; to measure it, airlines use a self-assessment survey.

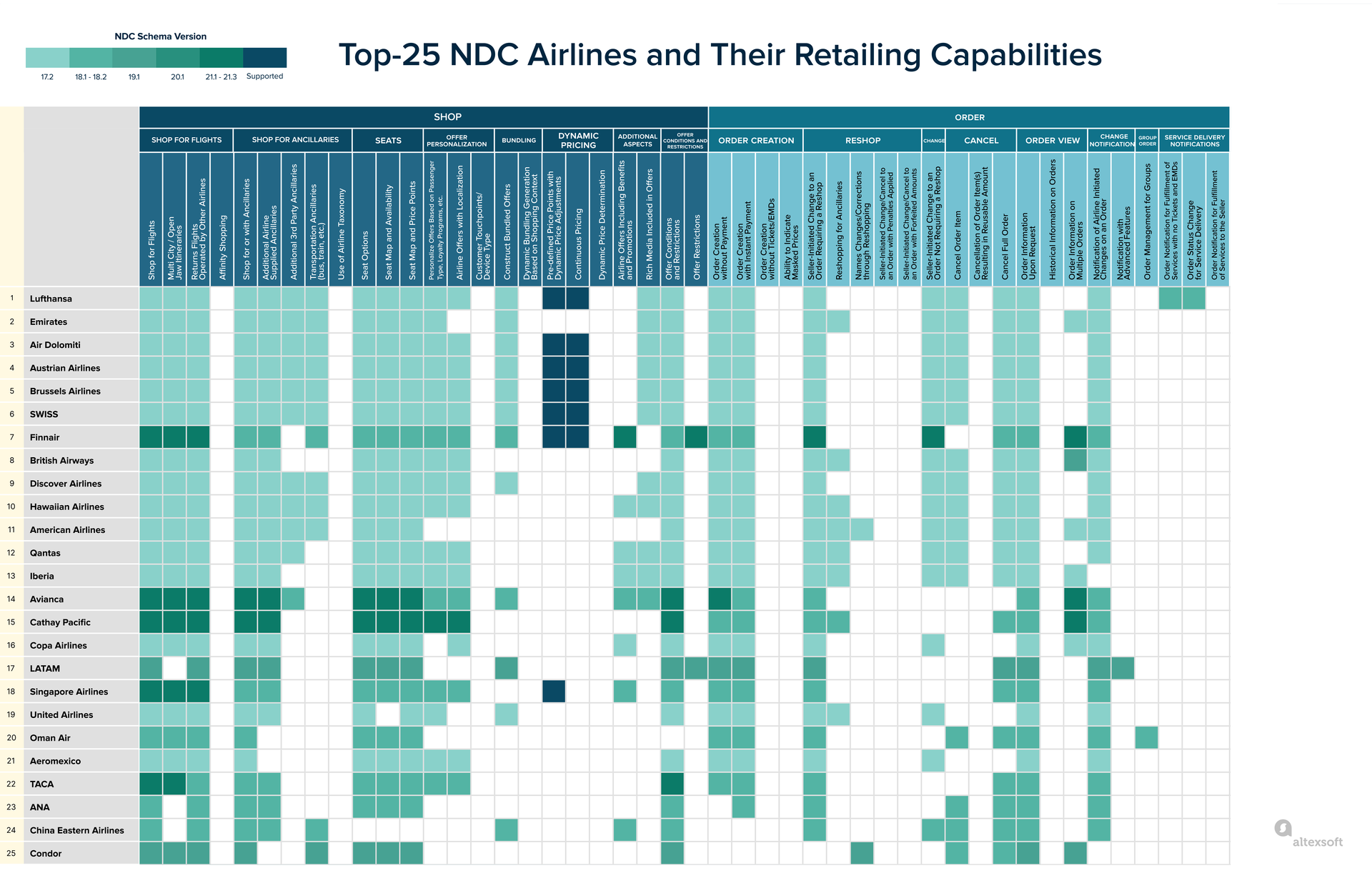

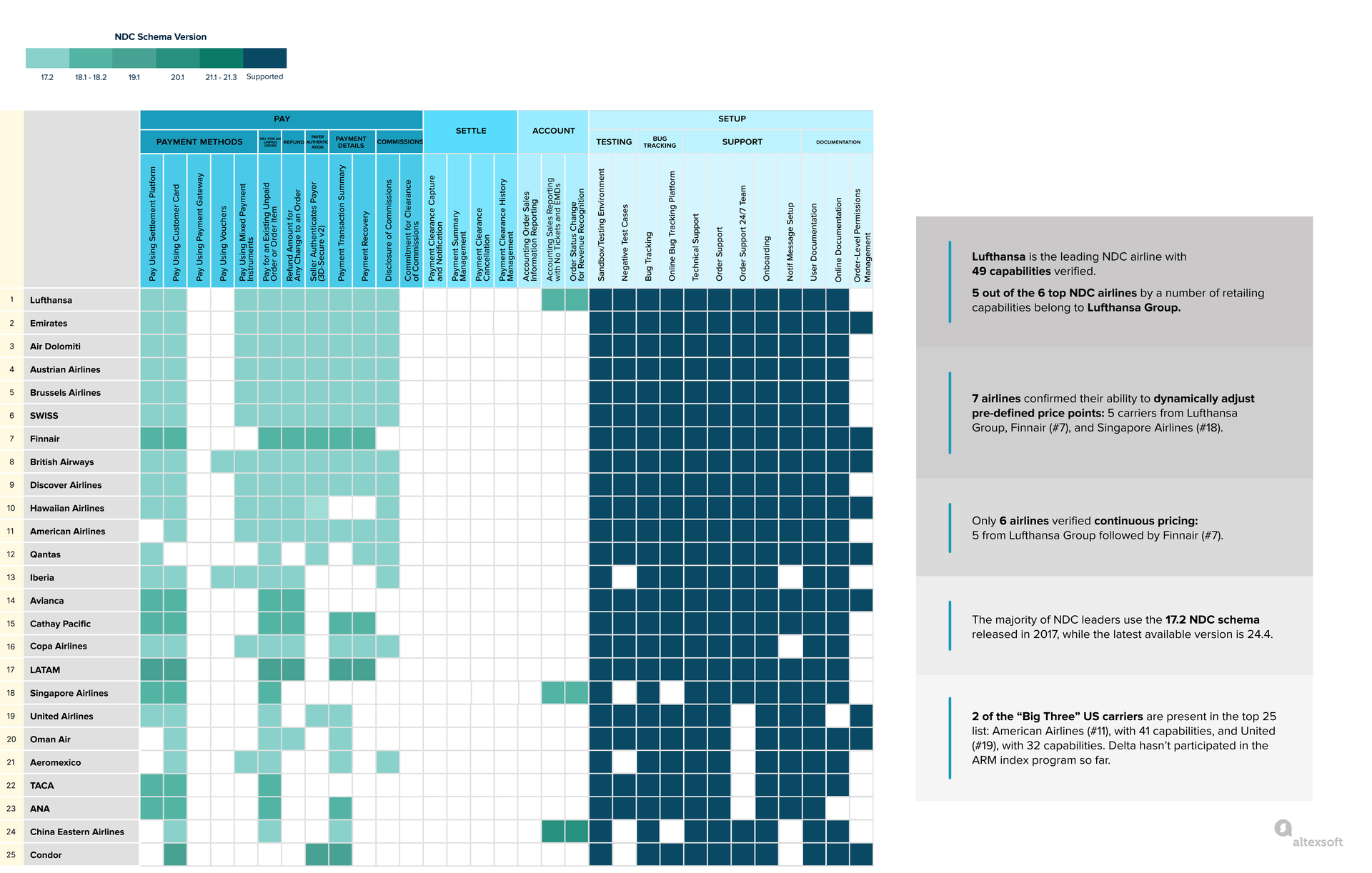

Of the three parameters, only information on technical capabilities is public. Accessible on the ARM Index Registry, it replaced the former 4-level NDC certification, offering a more detailed overview of what airlines can and can’t do in terms of modern retailing. To better see the big picture, we created a data sheet that mirrors the state of modern retailing adoption across airlines at the beginning of 2025.

How to use the datasheet:

- Right-click on images to open them in a new tab and explore the capabilities of the top 25 NDC airlines.

- Left-click on the Download Infographic button in the upper right corner to access the full version of the datasheet with 75 NDC airlines.

- Go to the spreadsheet at the very end of the article, which contains the same information as the full datasheet.

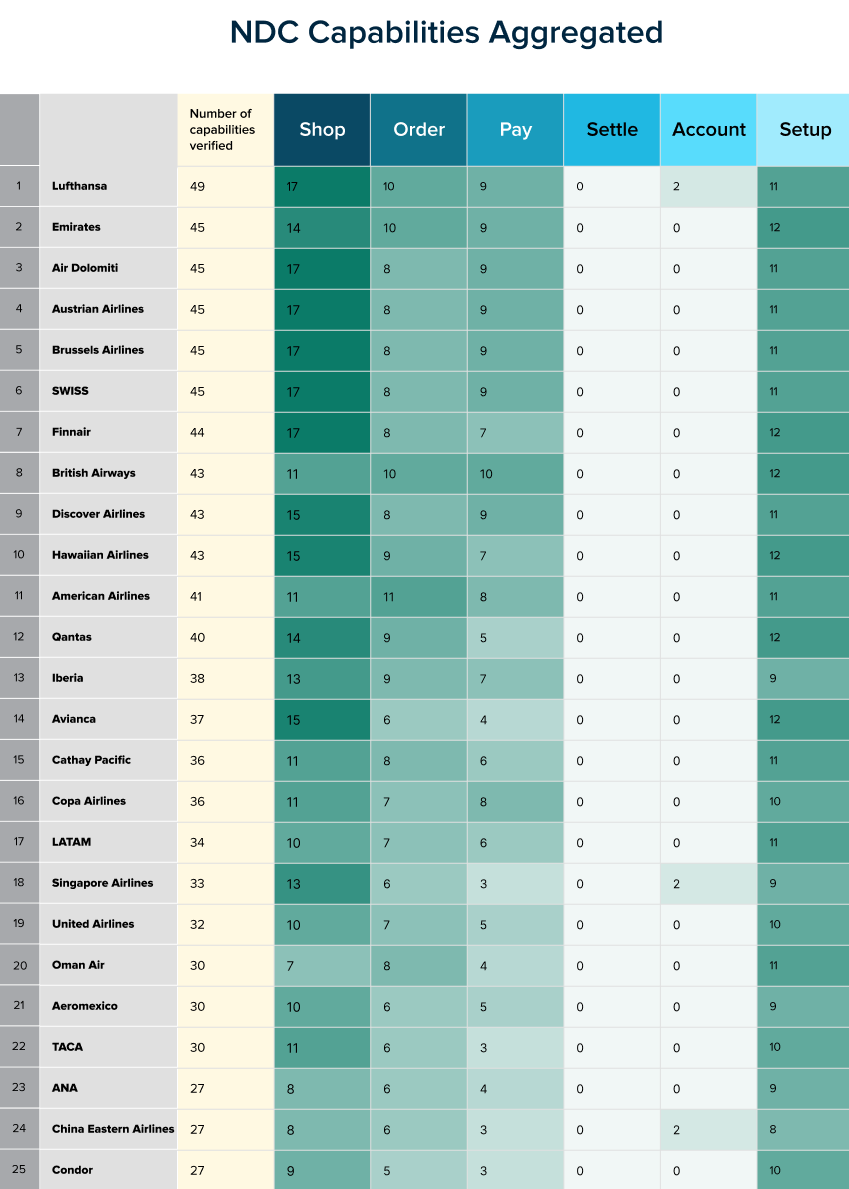

Aggregated NDC capabilities of the top 25 airlines

The full datasheet covers 75 airlines participating in the ARM program, the NDC schema versions they use, the verified NDC functionality, and stats that inform the retailing maturity across carriers.

Airlines. The datasheet ranks airlines by the number of realized capabilities. Lufthansa (49 capabilities) is the distinct leader here, followed by Emirates, Air Dolomiti, Austrian Airlines, Brussels Airlines, and SWISS (45 capabilities each), four of which belong to the Lufthansa Group.

The last on the list are three airlines—Binter Canarias, Hahn Air Lines, and Royal Jordanian—that implemented only one capability: Shop for Flights.

Among participating airlines are five low-cost carriers: Spirit (25 capabilities), Vueling (22 capabilities), Pegasus (13 capabilities), Scoot, owned by Singapore Airlines (6 capabilities), and Jeju Air (3 capabilities).

NDC schema versions. Airlines verify the functionality against the most recent schema version available. At the time of writing, IATA updated its NDC API standard to 24.4. Yet, the latest release utilized by carriers so far is 21.3. Among other things, it has better support for payments and interlining—namely, it includes separate interline offer and order messages (still, NDC standards for interlining are evolving and far from mature).

In total, airline NDC features are accessible via eight schema versions, with the earliest, 17.2, prevailing over others. Some carriers implemented the same capability with two different releases, but in our datasheet, we specified only the most recent one.

Some capabilities—such as dynamic bundling and pricing and all setup features—don’t require API calls to be confirmed. Instead, an airline must provide documentation describing how it realizes certain functionality.

Capabilities. IATA verifies 77 capabilities in six categories: Shop, Order, Pay, Settle, Account, and Setup. So far, the majority of airlines support only the most essential steps in the NDC booking flow, such as shopping for flights and ancillaries, order creation, and payment acceptance.

At the same time, only a few carriers verified advanced features that NDC brought to indirect distribution—like continuous pricing, bundling, or providing rich content. Post-booking servicing (changes to an order, cancelations, refunds, etc.) also leaves a lot to be desired. Besides that, the fact that functionality is verified does not always mean that it works efficiently or is used at all in real booking scenarios.

Below, we’ll examine each group presented in the datasheet in more detail.

NDC Airlines List and Their Retailing Capabilities Verified by IATA

Shop capabilities

The Shop group makes possible crafting offers based on various factors, from desired dates and destinations to journey distance, passenger type, loyalty program, and other factors. It creates preconditions for selling a wide range of ancillaries, product bundling, applying dynamic pricing, adding rich content, and more.

Shop for Flights is the most popular capability across all categories. Vetted by 71 airlines, it lets them provide offers based on origin/destination, dates, and passenger type (adult, child, or government travel.) The two other most used capabilities in the category are Shop for or with Ancillaries and Seat Options.

Shop for or with Ancillaries (54 implementations) is for sending a list of services related to seats and bags. Besides that, 35 airlines confirmed their ability to offer extra add-ons. Yet, in reality, a range of products beyond seats and bags is limited to just a few items — for example

- lounge access, onboard WiFi, and a fixed-price upgrade by Lufthansa;

- lounge access, onboard WiFi, and meals by Finnair;

- the same-day upgrades and flight changes, meals, and carbon offsets by American Airlines; and

- meals and SAF (sustainable aviation fuel) climate products by British Airways.

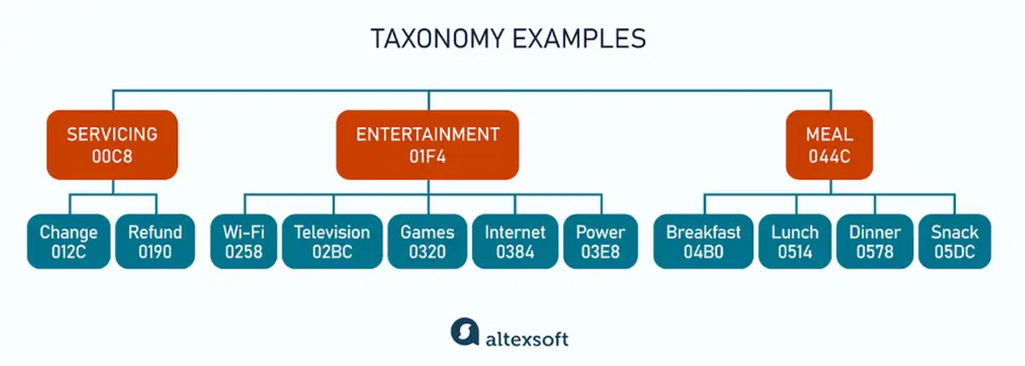

11 carriers can technically deliver add-ons from third parties, and 12 have paved the way for including ground transportation—such as train or bus—in their propositions. For instance, Cathay Pacific already has intermodal options among its available NDC features. The only carrier that confirmed the readiness to use taxonomy—a special codeset to expose flight products and services more efficiently—is Shandong Airlines.

Examples of taxonomy for servicing, entertainment, and meals. Source: IATA Standards Development

Seat Options (51 implementations) is verified if an airline can return details of cabin configuration so that a seller can construct a seat map and display it to travelers. Yet, most airlines also specify availability and pricing information, completing this basic capability with Seat Map and Availability (48 implementations) and Seat Map and Price Points (47 implementations).

So far, 4 capabilities in the Shop category see zero adoption — namely, they’re

- affinity shopping, allowing for recommending products based on flight duration, budget, travel purpose, and other additional parameters;

- offer personalization regarding a customer touchpoint or device type. Using geolocation and other technical details, an airline might construct an offer in a specific language, propose flights from the nearest airport, or return compressed videos to better fit on a smartphone screen;

- dynamic bundling generation based on shopping context. At the same time, 13 airlines have proved their ability to construct static bundles;

- dynamic price determination, which is about pricing an offer in real-time, using AI and the shopping context rather than pre-filed fares and rules.

Only 7 airlines have verified that they can make adjustments on top of existing price points, while 6 of them (Lufthansa group carriers and Finnair) can also do continuous pricing or generate infinite price points.

Order capabilities

The category reflects an airline’s ability to manage orders and handle post-booking servicing, such as adding and deleting ancillaries, rebooking and canceling flights, and more.

The majority of airlines (51) implemented Order Creation without Payment (a booking is confirmed before money collection) or with Instant Payment, and 28 of them support both flows. Many more (62) confirmed their readiness to provide the latest order version using Order Information Upon Request.

At the same time, no carrier has adopted the Order Creation without Tickets/EMDs, which is available from the 18.2 API version and later. This capability proves the readiness for ONE Order, or using a single commercial document instead of three — e-ticket, EMD, and PNR (passenger name record) — to manage flight sales. Though the initiative holds a lot of promise for both airlines and travelers, it requires a lot of transformation across the entire industry. Currently, ONE Order is more discussed than really adopted, and the transition from legacy documents will take years at best to complete.

Another unrealized feature in the Order Creation group is the Ability to Indicate Masked Prices. How does it work? When a seller adds margins to an offer price, an airline can generate an order for the initial amount but hide it from travelers if they request information about their flight directly from the carrier. This scenario is possible if the seller acts as a merchant of record and the airline allows the middleman to markup a particular product (for example, it can be a bulk fare.) Also, it’s only available from the 19.2 schema and later.

Agency vs merchant model in travel

As for booking servicing, the majority of participating carriers (40) support the core Order Reshop flow when a set of new offers is generated in response to the seller’s request for alterations. Also, 37 carriers do Full Order Cancellation (which involves a reshop flow).

Additionally, 18 airlines allow for order changes that don’t involve product replacements (like updating passenger details). Yet, this doesn’t cover editing names, which can be made only with the Names Changes/Corrections Through Reshopping capability, currently verified only by Condor and American Airlines.

With schema 24.1, IATA allowed for adding information on penalties and forfeited (non-refundable) amounts to orders when a reshop or cancelation occurs. Also, airlines can retain the value of canceled items to be used by travelers for purchasing other services (this is possible in scenarios not triggering an instant refund.). Yet, as we said, the most recent API version implemented by carriers is 21.3, so none of them have enjoyed these innovations so far.

Among other least popular Order functionalities are

- historical information on orders;

- airline notifications on changes with advanced features — such as order versioning, indicating reasons, and more. Only LATAM confirmed this feature, while 51 airlines, including LATAM use notifications without extra details to inform sellers of order changes;

- order management for groups. No carrier except for Oman Air proved the ability to create and service group bookings; and

- service delivery notifications.

Lufthansa, China Southern Airlines, and Xiamen Air are three airlines that confirmed their ability to exchange information on service statuses with lounge operators, car rentals, and other delivery providers. However, no one has verified the ability to send such updates to a seller.

Pay, settle, account, and setup capabilities of the top 25 NDC airlines. To explore all 75 NDC airlines, download infographics or go to a spreadsheet at the end of the article

Pay capabilities

While most recent NDC schemas support a wide variety of payment methods, most participating airlines stick with traditional forms — Pay Using Settlement Platform (35 implementations) and Pay Using Customer Cards (40 implementations). In the former case, a seller collects money from a traveler and then remits the value of the offer to a carrier via IATA’s Billing and Settlement Plan (BSP) or Airline Reporting Corporation (ARC). The latter scenario implies that a seller redirects card information to a carrier that acts as a merchant of record and charges the customer’s card.

How IATA BSP and ARC work

Three airlines—British Airways, Copa Airlines, and SunExpress—accept vouchers holding the value of paid services that a carrier didn’t deliver and refund to a customer. Currently, EMD is an industry standard for providing vouchers. Also, as mentioned above, 24.1 schema allows for keeping the value of unused services in the order for future payments.

Since the 19.2 schema and later, the Pay Using Payment Gateway capability has been available. This means a traveler can be redirected to the airline’s website to complete a purchase via any method the carrier has implemented (including, for example, a digital wallet). However, no supplier has verified it with IATA to date.

No matter the method, only 19 airlines automated full or partial refunds to the original form of payment with the Refund Amount for Any Change to an Order capability.

One more unused capability in the Pay segment is Commitment for Clearance of Commissions when an airline communicates that it will take care of funds it owes to a seller and no other actions will be needed. On the other hand, 14 airlines already support Disclosure of Commissions—namely, they can provide a seller with information about the size of commissions applied to the offer.

Settle capabilities

This capability group aims to streamline the exchange of clearance, remittance, and settlement information between airlines and sellers via the IATA Clearance Manager. It covers all types of NDC transactions, including refunds and commissions. However, today, China Southern Airlines is the only carrier that implemented one of four existing setup features: Payment Clearance Capture and Notification.

So far, no carrier supports three other settle capabilities: summary management, cancelations, and history management.

Account capabilities

The smallest category has three capabilities and four participating carriers. Lufthansa, Singapore Airlines, China Eastern Airlines, and China Southern Airlines proved their ability to send sales information without tickets and EMD and order status updates to their accounting system providers.

At the same time, no carrier uses Accounting Order Sales Information Reporting, which combines order information and service delivery status into a single notification.

Setup capabilities

The setup category mirrors the efforts an airline takes to develop its NDC channels. The more capabilities the carrier has, the simpler it is for third parties to integrate with NDC content. Over 40 airlines provide a Sandbox to test capabilities, Bug Tracking (an API consumer can raise an issue to an API provider by email), Technical Support, and User Documentation.

Over 30 goes beyond that and allows developers to submit defects and track statuses via an Online Bug Tracking Platform (for example, Jira), offers Onboarding services and additional Order Support to resolve non-technical issues, and maintains Online Documentation.

Over 20 help with Notification Message Setup for order changes, have an Order Support 24/7 Team to service non-technical problems, and enable developers to create Negative Test Cases, such as flight disruptions, payment failures, incorrect parameter entries, etc.

With 25 years of experience, Liudmyla is a seasoned editor and IT journalist. Over the last five years, she has focused on travel tech, travel payments, and the advancements in NDC implementation.

Want to write an article for our blog? Read our requirements and guidelines to become a contributor.